The next step for LuxAlgo backtesting

We’ve spent the last few months rethinking how traders build and test ideas. The result is a sweeping update to our backtesting suite that combines three major improvements:

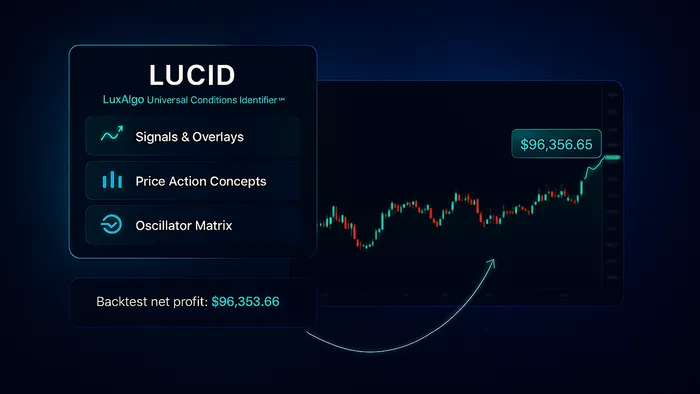

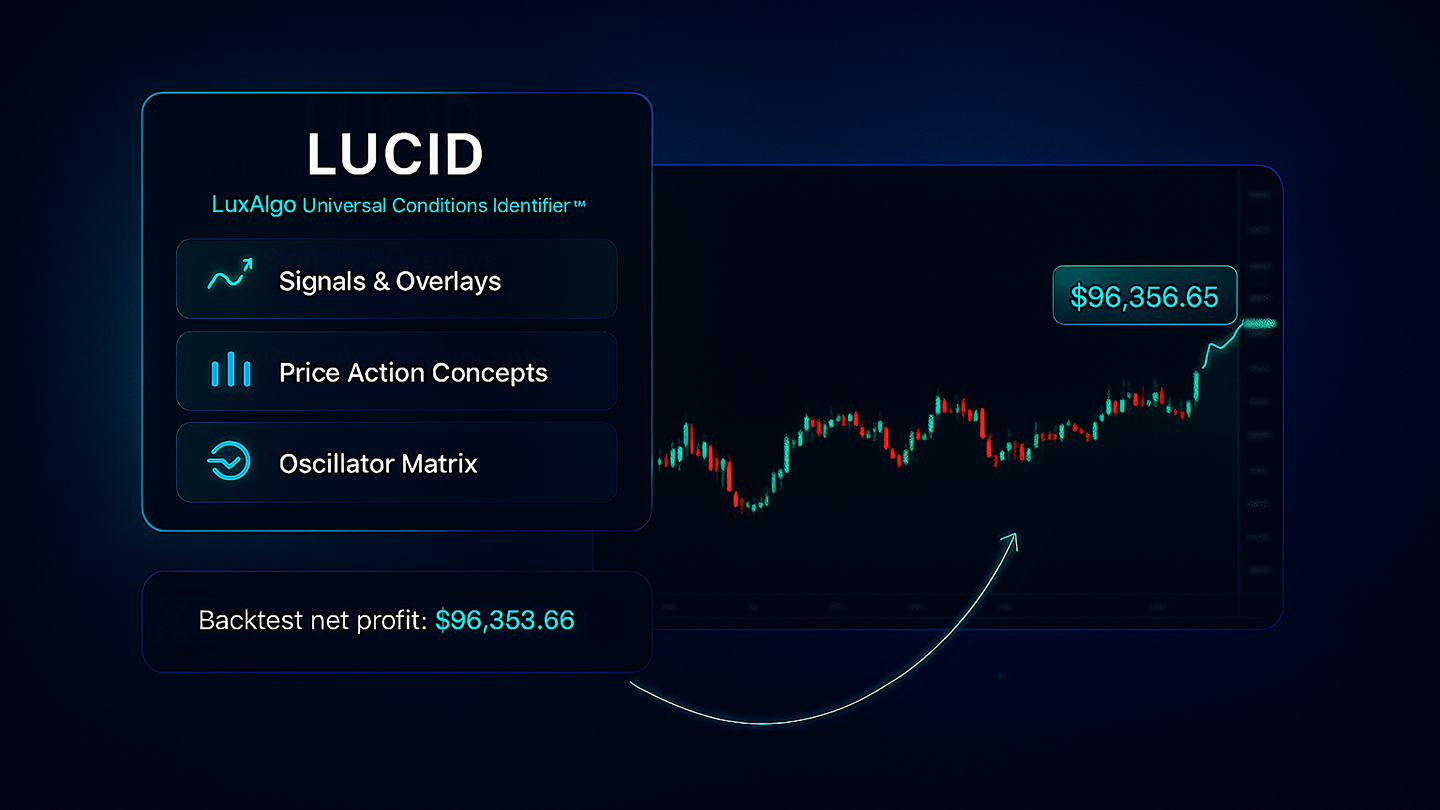

- LUCID – the LuxAlgo Universal Conditions Identifier – a new way to unify triggers and filters from all of our toolkits into a single strategy.

- Strategy scripting – an intuitive scripting system for the backtesters that lets you describe complex logic using placeholders, operators, actions and LUCID connectors to create conditions for strategies never before possible.

- Enhanced AI backtesting replication – the AI Backtesting Assistant now provides ready‑to‑use script, letting you recreate strategies on TradingView with a single copy and paste.

These improvements mean you can go from concept to execution faster, whether you prefer to build strategies yourself or let our AI do the heavy lifting.

Meet LUCID – unifying signals across every toolkit

LUCID stands for LuxAlgo Universal Conditions Identifier. Previously, strategies created in our backtesters were confined to one toolkit at a time. If you wanted to combine a trend‑following signal from the Signals & Overlays toolkit with liquidity concepts from the Price Action Concepts algo, you had to rely on workarounds or external source connectors. LUCID removes this barrier by letting you access all trigger placeholders from our three core toolkits – Signals & Overlays, Price Action Concepts and Oscillator Matrix – at once.

With LUCID you can:

- Combine multiple algorithms in one strategy. Build logic that mixes momentum triggers, liquidity events and signal confirmations.

- Connect conditions with operators. Use logical operators (greater than, less than, crosses over etc.) to define exactly how triggers relate to each other.

- Trigger actions. Tell the backtester when to enter or exit trades, or when to fire alerts, using built‑in actions.

Reference any feature via placeholders. Just like Alert Scripting, strategy scripting uses curly‑braced placeholders to reference market data (open, high, volume etc.) and toolkit features

This unified approach makes it possible to design strategies that were previously impossible.

Strategy scripting: placeholders, operators and actions

Strategy scripting builds on the familiar syntax of our alert‑scripting language. It uses three simple building blocks:

| Component | Purpose | Example |

|---|---|---|

| Placeholders | Strings enclosed in curly brackets that refer to market data or toolkit features. | For instance {close} returns the closing price of each bar and {bullish_confirmation+} references a strong bullish confirmation signal. |

| Operators | Logical or mathematical connectors that compare two placeholders. | {bullish_confirmation+} and {bullish_overflow} checks if a strong bullish confirmation signal occurs within an overflow from the Oscillator Matrix. |

| Actions | Instructions executed when a condition is met, such as entering long or short, closing a trade or sending an alert. | @long() opens a long position when the preceding condition evaluates to true. |

A simple strategy script might look like this:

@only_scripted() = true

@long() = {bullish_confirmation+} and {bullish_overflow} and {unix_ts} >= 1737729000000

@short() = {bearish_confirmation+} and {bearish_overflow} and {unix_ts} >= 1737729000000

@exit_all() = {confirmation_exits}

You can write your own scripts directly in the Backtester (S&O), Backtester (PAC), Backtester (OSC) settings panels. The LuxAlgo documentation provides a complete reference of available placeholders, operators and actions for each toolkit, as well as examples to get you started (see the Strategy Scripting introduction and the backtester documentation)

AI Backtesting replication – copy strategies to TradingView in seconds

Our AI Backtesting Assistant already helps traders discover profitable ideas by searching through millions of strategies at luxalgo. But until now, recreating those strategies on TradingView required manually selecting the backtester, matching the time range and re‑entering each condition, With this update we have solved that pain point.

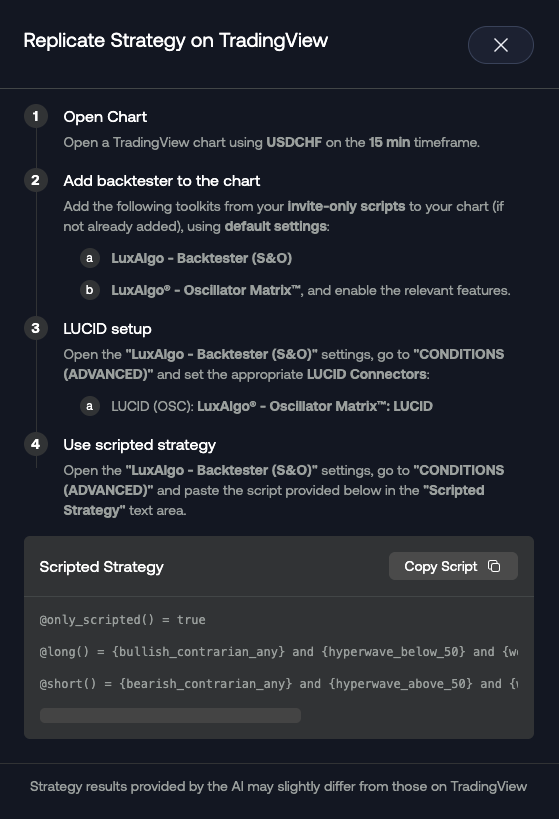

When you ask the AI for a strategy and like the result, simply click “Replicate Strategy on TradingView.” The platform will guide you through a step‑by‑step process:

This streamlined replication process means you no longer have to interpret strategy rules. The script is ready to use, and it can be further customised or combined with your own logic. The AI still supports saving strategies to your profile and viewing performance metrics as before, but now those strategies are portable.

More assets, more strategies and smarter AI

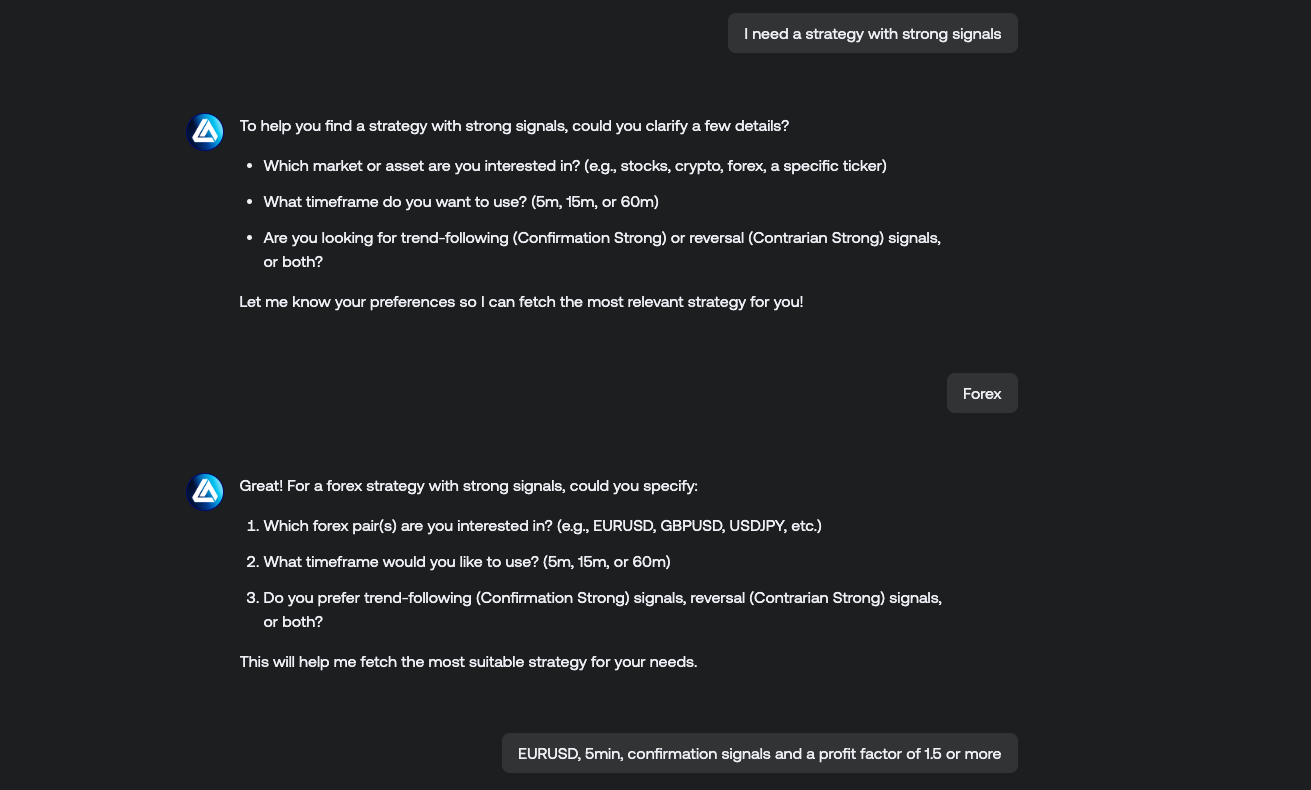

Alongside LUCID and strategy scripting, the AI Backtesting Assistant has gained a massive bump in coverage. The underlying database now holds tens of millions of strategies across more than 90 assets – including stocks, ETFs, cryptocurrencies, forex pairs, commodities and futures – giving you unparalleled variety. You can ask the AI to search across trend‑following, breakout or momentum approaches and instantly get ideas tailored to your criteria.

The AI also understands natural‑language prompts better than ever. It will ask clarifying questions if your request is vague and suggest ways to improve the search. You can still see the net profit, drawdown, equity curve and other statistics for every strategy before deciding to replicate it.

Get started with LUCID and the new AI backtesting tools

If you are already using LuxAlgo backtesters or the AI Backtesting Assistant within our ultimate plan, these updates are available now. To try LUCID and strategy scripting:

- Visit LuxAlgo.com, login to your account and open the AI Chat. Request a strategy that suits your goals – for example “Find a BTCUSD strategy using Confirmation signals and liquidity grabs.”

- Save or replicate the strategy. Use the star icon to save strategies for later, or click “Replicate Strategy on TradingView” to generate the Pine Script code and instantly copy it.

- Experiment with strategy scripting. Open your preferred backtester on TradingView, enable LUCID connectors and start writing your own scripts. Consult the documentation for a list of available placeholders and operators.

These improvements are part of our commitment to making advanced trading tools accessible to everyone. Whether you prefer to build strategies yourself or leverage AI‑generated ideas, LUCID and the enhanced AI replication flow remove friction and open up new possibilities.

Ready to experience a new era of backtesting? Explore LUCID and the improved AI Backtesting Assistant today, and let us know what you create.