Our AI-driven classification system for interpreting Confirmation and Contrarian signals offers clarity and support for your trading decisions. This guide explores the functionalities and strategic implications of this feature and how it aids you in harnessing the full potential of these signals.

Understanding Confirmation and Contrarian Signals

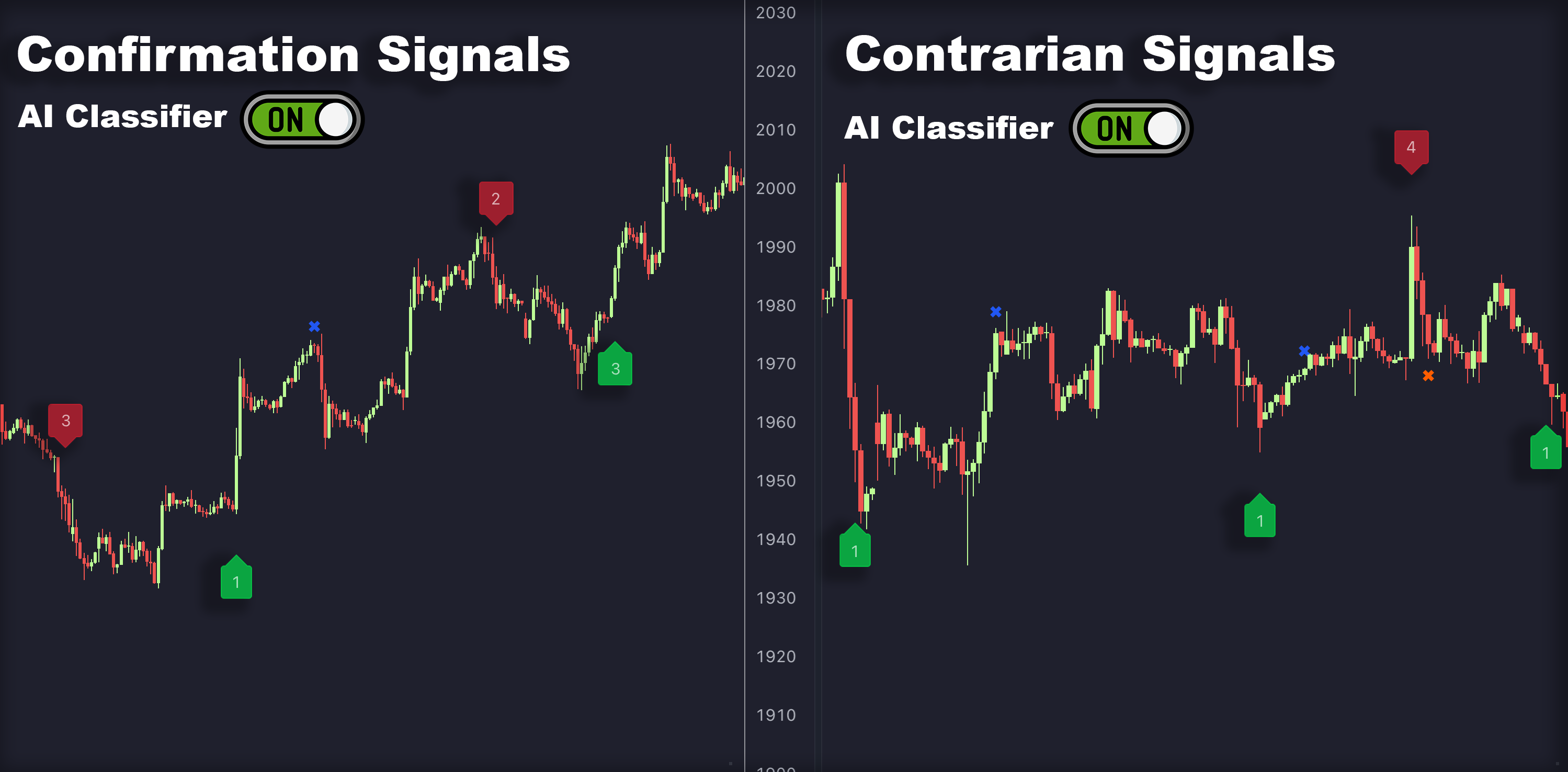

Confirmation signals employ a performance adaptive trend-following approach. They are designed to validate possible actions a trader may consider and work best when combined with other tools such as our indicator overlays.

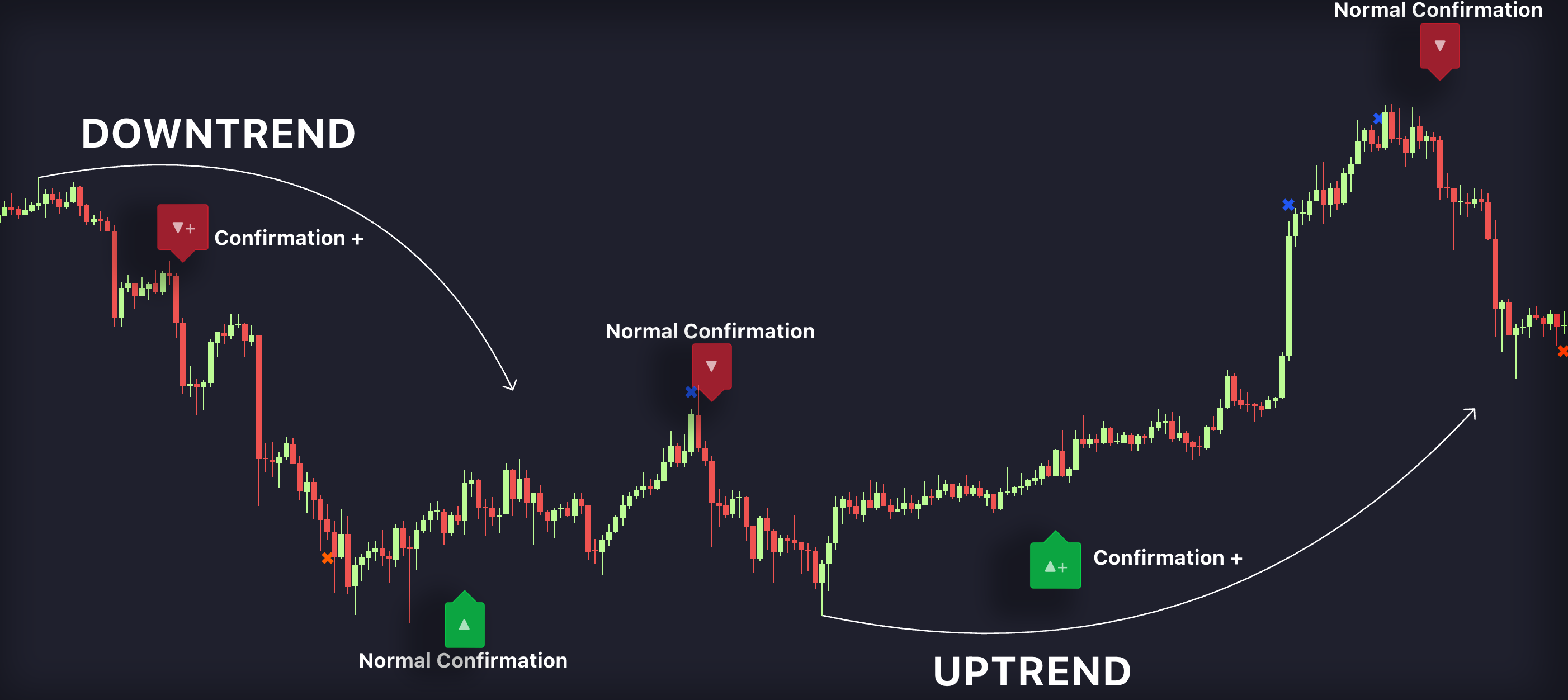

Confirmation signals come in two varieties: normal signals and strong (+) signals. Strong (+) signals align with the prevailing estimated trend, whereas normal signals may result from a retracement.

Contrarian Signals: Contrary to Confirmation signals, Contrarian signals hint at potential trend reversals. These signals are crucial for traders who capitalize on fluctuations and reversals. Perfect for trades who aim to spot potential tops and bottoms.

Similar to Confirmation signals, Contrarian signals can also be categorized as strong (+). These strong signals appear when the price is extremely overbought or oversold, increasing the likelihood of signaling a potential reversal.

How to Utilize LuxAlgo Signals Effectively

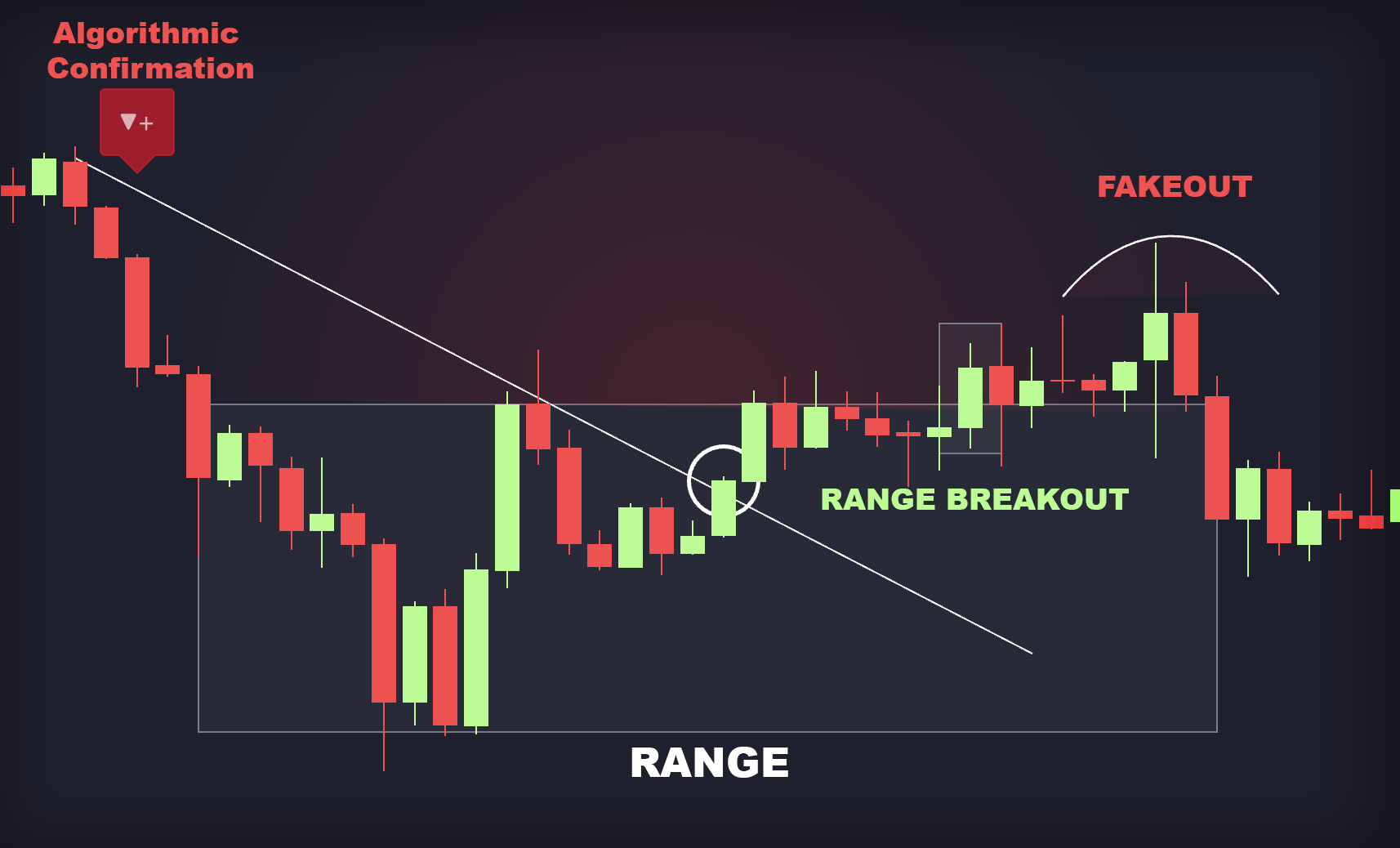

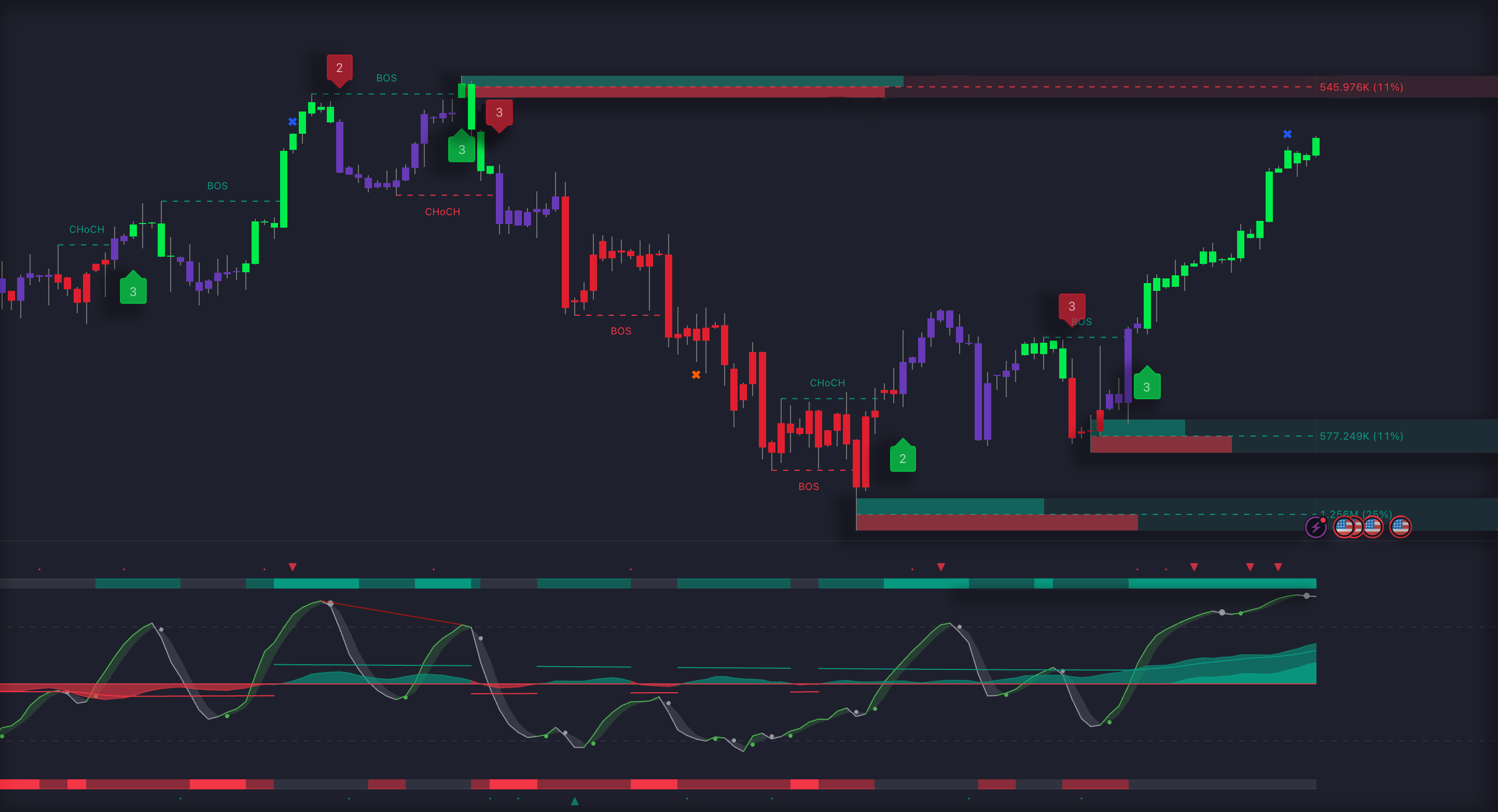

Whether using Confirmation or Contrarian signals, they should never be treated as standalone indicators for blindly taking buy and sell entries. Instead, they should be used in conjunction with your analysis to confirm or invalidate trends/setups. For example, if you have concluded from your analysis that the market should go bullish, you may want to enable signals to confirm the current trend in confluence with your analysis.

Note that this does not mean signals cannot be used as a trigger for entries. Just as mentioned above, you may find yourself in a situation where you want to wait for the signal to align with your analysis as well. In the example below we can see where a confirmation signal was used as an entry as it aligned with the analysis.

AI Signal Classifier

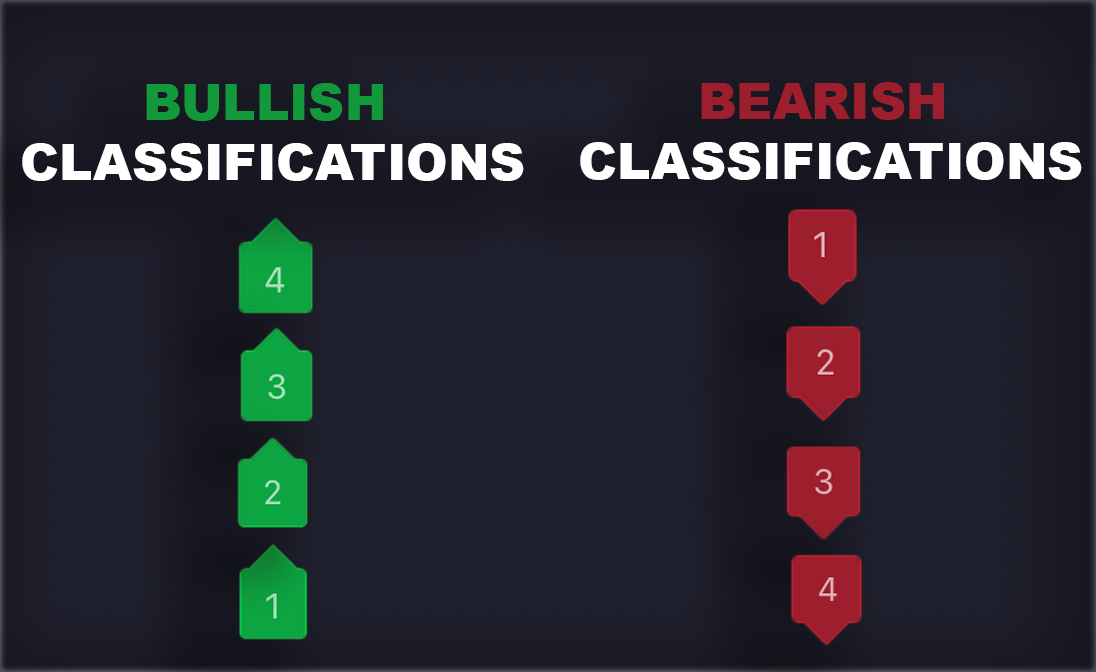

Users seeking a detailed understanding of signal nuances can utilize the AI Signal Classifier which uses an adaptive threshold classifier, available as an optional feature in the top settings menu. This tool automatically classifies both Confirmation and Contrarian signals on a scale from 1 to 4, providing clear labels to enhance interpretation.

This numerical scale gives insight into the signal strength, allowing for a deeper analysis that goes beyond merely distinguishing between normal and strong signals. It's worth noting that the default Confirmation Simple candle coloring mode continues to identify trends as normal or strong.

For Confirmation signals, lower values (1-2) may indicate a possible reversal or retracement, whereas higher values (3-4) suggest a likelihood of trend continuation.

In the case of Contrarian signals, lower numbers point to an emerging trend with a smaller chance of a significant reversal, while higher numbers (3-4) are generally associated with more established trends and a greater possibility of a major trend reversal.

How to Use AI Signal Classifier

- Strategy Formulation: Depending on your trading style—whether trend-following or reversal-centric—our signals guide you in crafting strategies that align with your goals and risk tolerance.

- Timing Entries and Exits: Our tools assist in precisely timing your market entries and exits, ensuring optimal trade execution based on current and anticipated market conditions.

These confirmation and contrarian signals are among the main aspects of the signals and overlays toolkit. They can be used alongside our other indicators, such as the price action concepts and the oscillator matrix. You can gain access to all of these tools by using the button below.

Our Confirmation and Contrarian signals provide a streamlined approach to navigating complex market data. By integrating these tools into your trading strategy, you gain a robust ally in the quest for market mastery. Whether you're a day trader seeking quick gains or a long-term investor focused on growth, our signals can significantly enhance your trading effectiveness.