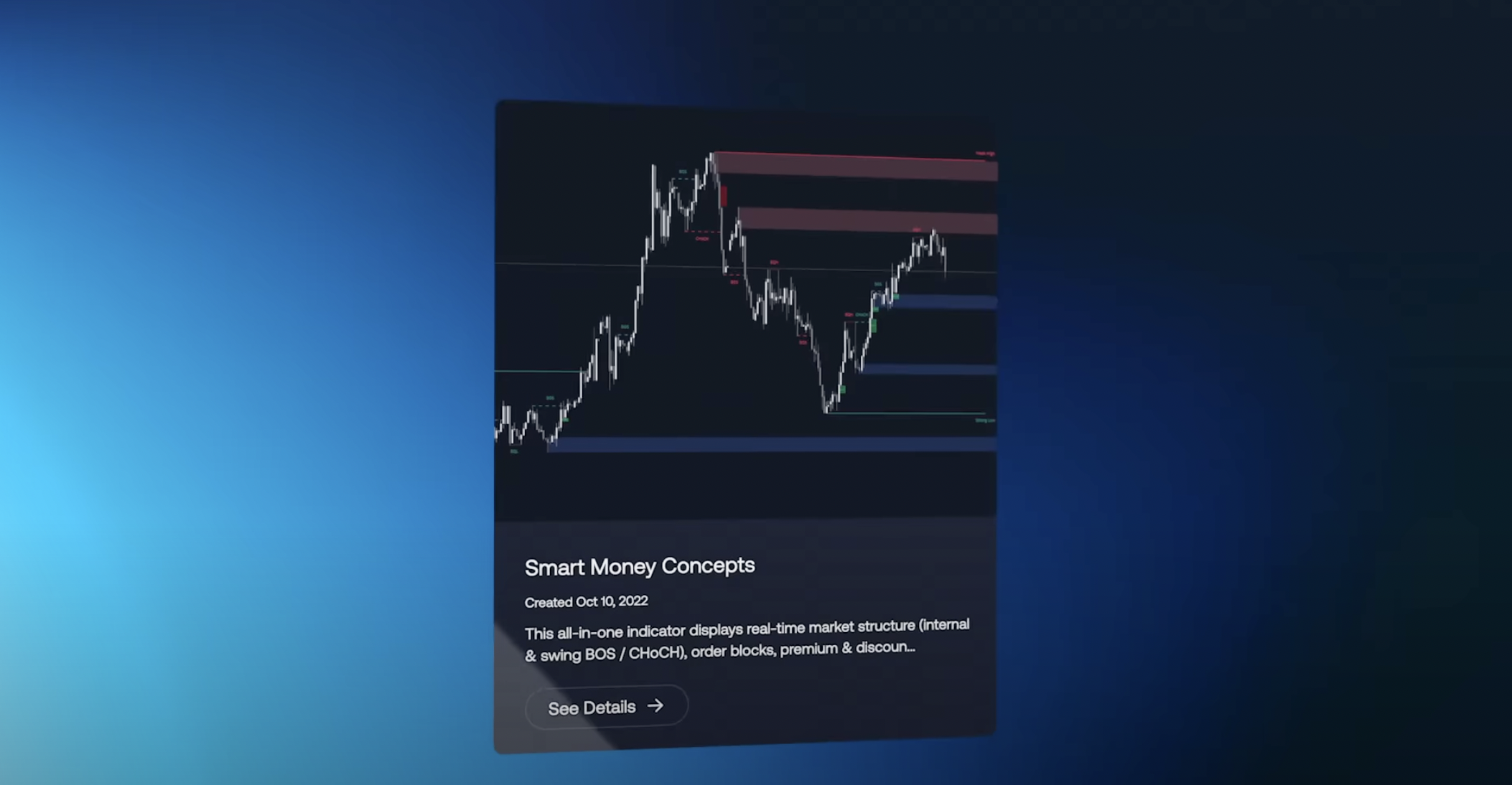

Smart Money Concepts (also known as SMC) is the most popular ICT trading methodology and strategy. LuxAlgo's Smart Money Concept indicator is the most advanced and available on TradingView, MetaTrader (MT4 & MT5), and Ninjatrader on the LuxAlgo Library,

When hedge funds, banks, and other so‑called smart money players move, the market pays attention. Smart Money Concepts (SMC) give retail traders a framework for tracking that flow of institutional liquidity, pinpointing where price is most likely to react. LuxAlgo’s Smart Money Concept Indicator brings those insights directly onto your TradingView charts in real time—for free—so you can locate high‑probability trade setups without spending hours on manual markup.

What Are Smart Money Concepts?

“Smart money” refers to capital controlled by experienced institutional investors with the resources to influence price.

SMC trading distills that idea into a clear blueprint: watch structural breaks, liquidity pools, and value gaps that institutions leave behind as they accumulate or distribute positions.

Key pillars include:

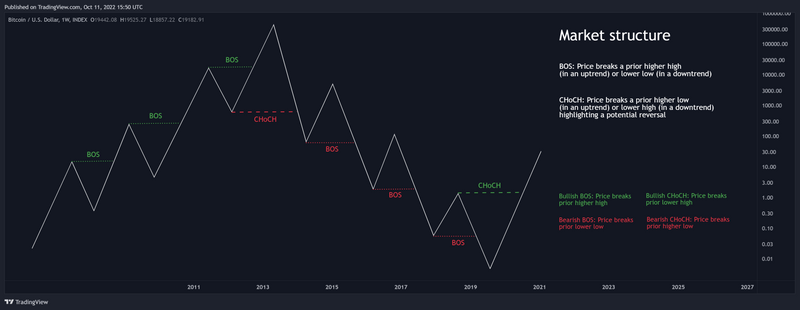

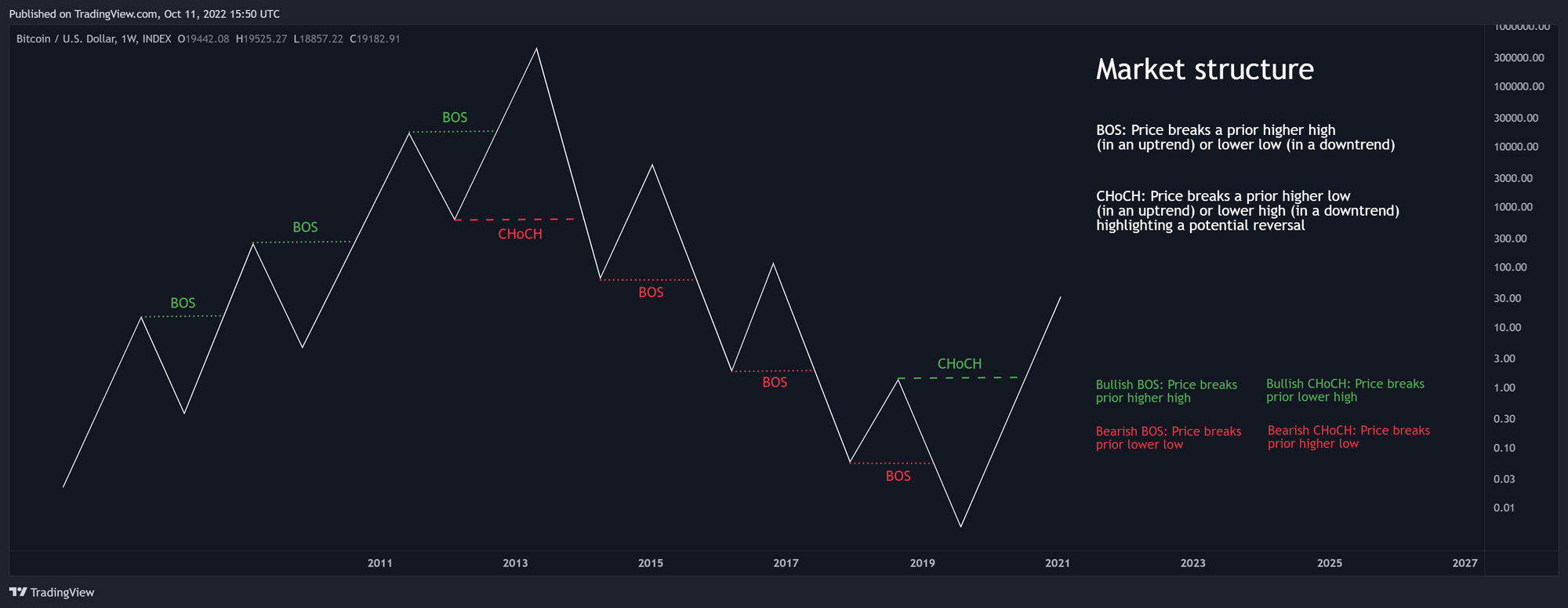

- Market Structure Shifts – Break of Structure (BOS) and Change‑of‑Character (CHoCH) reveal trend reversals.

- Order Blocks – Price zones where large players initiated trades, often acting as magnets for liquidity.

- Fair Value Gaps (FVGs) – Imbalance areas institutions may revisit to “fill” before continuing a move.

- Premium & Discount Zones – Relative value areas inside a price range, useful for identifying optimal entries.

Mastering these elements manually is tedious; the indicator automates every step.

Why Trade with an SMC Indicator on TradingView?

- Speed & Precision – Automatic labeling of BOS/CHoCH, order blocks, equal highs/lows, and FVGs means zero lost hours drawing boxes.

- Objective Entries – Clear on‑chart confluence (e.g., BOS + bullish order block inside a discount zone) removes guesswork.

- Multi‑Time‑Frame Context – Visual cues from daily, weekly, and monthly highs/lows help you trade with the larger trend.

- Built‑in Alerts – Get notified the moment a structural break or fresh order block appears, even when you’re away from the screen.

What features are in LuxAlgo's SMC indicator?

| Feature | How It Gives You an Edge |

|---|---|

| Internal & Swing Market Structure | Tracks both micro and macro BOS/CHoCH so you see trend shifts early and confirm them later. |

| Order Blocks (Bullish & Bearish) | Highlights likely institutional entry zones; perfect for limit orders or stop placement. |

| Equal Highs & Lows | Flags liquidity pools retail traders often defend—prime spots for stop hunts and reversals. |

| Fair Value Gap Detection | Identifies imbalance areas where price may retrace, helping you fine‑tune entry targets. |

| Premium / Discount Bands | Visually separate expensive from cheap territory inside a trading range. |

| Daily‑to‑Monthly Highs & Lows | Adds higher‑time‑frame liquidity levels to your intraday chart. |

How to Add the Indicator to Your Chart (Step‑by‑Step)

- Open TradingView and log in.

- Click Indicators → Invite‑only scripts.

- Search “Smart Money Concepts (SMC) LuxAlgo”.

- Add to Favorites (the ★ icon) for one‑click access later.

- Press OK—the indicator appears instantly, pre‑configured with sensible defaults.

Pro tip: Turn on Color Candles in the settings to watch bullish and bearish structure flips without extra overlays.

Reading the Signals Like a Pro

- Trend Confirmation – Wait for a BOS/CHoCH on the swing level before treating a move as a new trend.

- Refined Entries – Enter inside a bullish order block that coincides with a discount zone for the lowest risk.

- Logical Exits – Target opposing order blocks, equal highs/lows, or a filled FVG.

- Context Matters – Layer the SMC indicator with LuxAlgo’s Signals & Overlays toolkit to validate momentum before you pull the trigger.

Order Blocks & Market Structure: Reading the “Smart Money” Roadmap

Smart‑Money trading begins and ends with understanding where price is likely to react. Two pillars make that possible: market structure (BOS & CHoCH) and order blocks. Together they form a GPS that shows both direction and destination.

1. Market Structure: BOS vs. CHoCH

- Break of Structure (BOS) marks the continuation of an existing trend. When bullish candles punch through the prior swing high, the indicator tags a green BOS label; when bearish pressure breaks the last swing low, you’ll see a red BOS.

- Change of Character (CHoCH) signals that control has flipped. A bearish CHoCH after a series of bullish BOS events hints at distribution, whereas a bullish CHoCH following consecutive bearish breaks suggests accumulation is underway.

- Internal vs. Swing Structure: The indicator tracks internal labels (micro‑structure) and swing labels (macro‑structure). This dual layer lets scalpers trade lower‑time‑frame reversals without losing sight of the higher‑time‑frame bias.

How to trade it:

- Stay aligned with the swing structure; fight the big trend and you fight liquidity.

- Use the internal structure to refine entry timing—wait for price to retrace into a discount (for longs) or premium (for shorts) before pulling the trigger.

2. Order Blocks: Institutional Footprints

Order blocks are price zones where large players filled sizeable orders, leaving behind obvious “footprints” of liquidity.

| Order‑Block Type | Typical Location | TradingView Display |

|---|---|---|

| Bullish OB | Forms after a down‑move that breaks upward (BOS/CHoCH) | Lime‑green box under price |

| Bearish OB | Forms after an up‑move that breaks downward | Salmon‑red box above price |

Key insights:

- Liquidity Magnets: Price often “checks back” to these blocks because resting orders remain unfilled.

- Confluence Zones: When an OB aligns with EQH/EQL or a Fair Value Gap, probability of reaction spikes.

- Risk Management: Stops naturally sit beyond the opposite side of the block, offering defined, tight risk.

Practical trading example:

- A bearish CHoCH flips bias short.

- Price rallies into a premium zone and taps a freshly printed bearish order block.

- Equal Highs (EQH) overhead add liquidity for a potential stop‑hunt; you enter short, placing your stop just above the EQH cluster.

- Target the next bullish order block or an EQH/EQL pair below for a 2‑to‑1 or better reward‑to‑risk.

3. Putting It All Together

- Trend Filter: Use swing‑level BOS/CHoCH to decide bullish vs. bearish bias.

- Entry Filter: Wait for price to reach a matching order block inside the correct premium/discount side.

- Exit Logic: Aim for opposing order blocks, liquidity pools, or completion of a Fair Value Gap.

- Alerts: Turn on BOS, CHoCH, and Order‑Block Filled alerts so you never miss institutional moves.

By marrying market‑structure shifts with order‑block liquidity, LuxAlgo’s Smart Money Concepts indicator translates the hidden language of banks and hedge funds into clear, actionable signals—whether you trade forex, crypto, or equities.

Frequently Asked Questions

Is this really free?

Yes. The core SMC indicator is 100 % free on TradingView, MT4, MT5 (MetaTrader), Ninjatrader, and ThinkorSwim on the LuxAlgo Library.

Does SMC work on crypto, stocks, or forex?

All three. Because it focuses on price structure and liquidity rather than asset class, it adapts to any liquid market.

Will it guarantee profits?

No indicator can. Think of SMC as a decision‑support system—combine it with sound risk management.

Take Your Analysis Further

- Explore the Library → Over 250 free indicators covering volume, volatility, sentiment, and more.

- Unlock Pro Toolkits → Signals & Overlays, Range Filter, Price Action Concepts, and the AI Backtesting Assistant for automated strategy discovery.

- Join 180 k+ Traders on Discord → Share charts, get feedback, and learn directly from LuxAlgo’s analysts.