LuxAlgo’s Smart Money Concepts (SMC) script became TradingView’s most-liked indicator in just two years—discover why traders are switching to price-action tools.

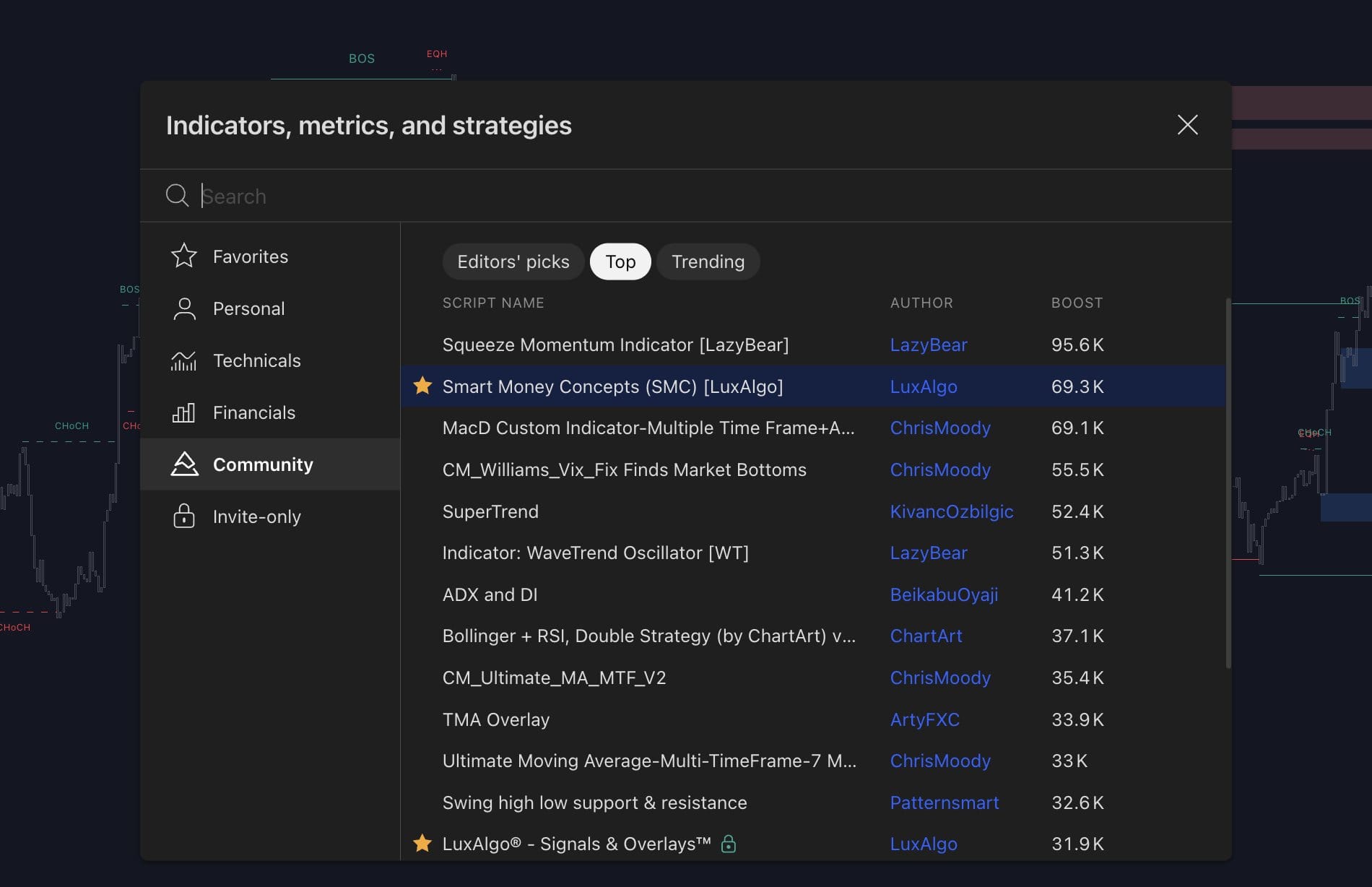

LuxAlgo released the Smart Money Concepts (SMC) indicator in late 2022 on the TradingView platform and it has already nearly overtaken every publication in the TradingView Community Scripts. Recently passing SuperTrend by KivancOzbilgic, ChrisMoody's custom indicators, and now it is closing in on LazyBear’s 2014 classic 'Squeeze Momentum Indicator', proof that modern price-action analytics now outshine legacy technical indicators.

| Indicator | Author | Year Published |

|---|---|---|

| Smart Money Concepts (SMC) | LuxAlgo | 2022 |

| MACD Custom MTF | ChrisMoody | 2014 |

| Squeeze Momentum | LazyBear | 2014 |

Why Traders Are Using SMC More

Shift Toward ICT-Style Price Action

In the last few years, ICT (Inner Circle Trader) has reshaped retail trading by turning the spotlight onto institutional order flow. His YouTube deep-dives on Break of Structure (BOS), Change of Character (CHoCH), and liquidity grabs inspired an entire generation of forex traders to abandon lagging oscillators for pure price-action models.

That wave spilled into the booming prop-firm challenge scene—FundedNext, MyForexFunds, FTMO—where passing an evaluation often hinges on keeping risk tight and strike-rate high. ICT’s minimalist, line-on-price approach fits that mandate perfectly, and traders wanted a tool that could mark up those concepts instantly. LuxAlgo’s Smart Money Concepts indicator became the first one-click automation of ICT’s workflow, letting challengers map liquidity pools, order blocks, and market structure in seconds instead of hours.

Inside the SMC Indicator — What It Actually Does

Full tutorial on YouTube how to use Smart Money Concepts indicator by LuxAlgo

| Module | Function | Trading Edge |

|---|---|---|

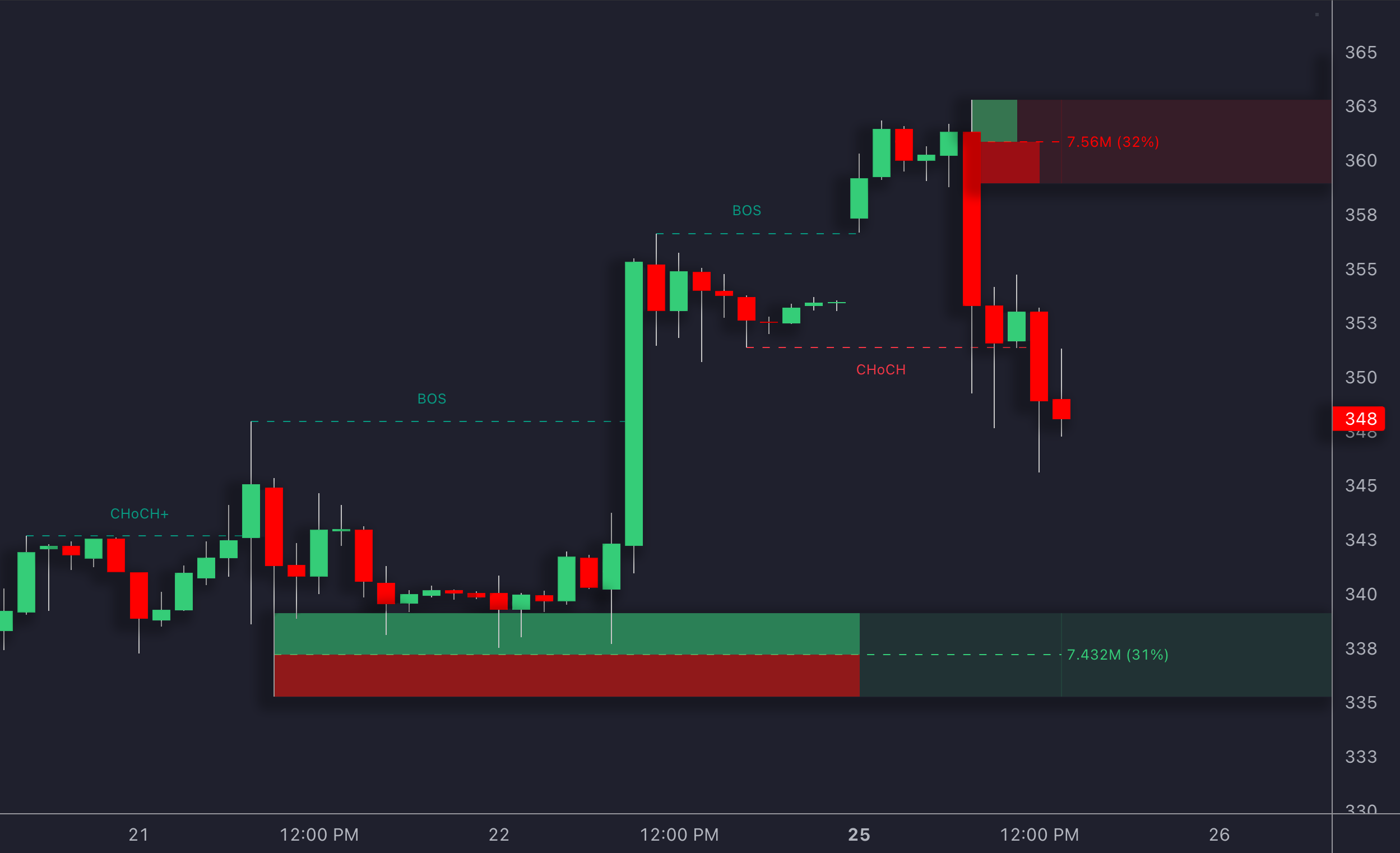

| Market-Structure Labels | Detects swing & internal Break of Structure (BOS) and Change of Character (CHoCH) in real time | Instantly spots trend continuations or flips |

| Automatic Order Blocks | Highlights bullish & bearish OBs, tagging mitigation status | Identifies high-liquidity zones for entries, exits, or stop placement |

| Liquidity Levels | Plots Equal Highs/Lows, daily-to-monthly highs/lows | Maps where stops cluster—prime targets for smart money |

| Fair-Value Gap Scanner | Flags imbalances that often get “filled” before continuation | Fine-tunes retracement entries |

| Premium/Discount Zones | Shows relative value inside current range | Keeps you from buying tops or selling bottoms |

Add it to a chart and you’re handed an institutional-style markup—no boxes to draw, no trend lines to babysit.

How to Trade Smart Money Concepts

Smart Money Concepts work best when you combine three core ideas—direction, location, and confirmation—into a repeatable checklist. Here’s a field-tested blueprint you can overlay on any market or time-frame:

| Phase | What to Look For | Why It Matters | SMC Tools Involved |

|---|---|---|---|

| 1. Frame the Bias | A fresh swing-level BOS or CHoCH | Establishes bullish vs. bearish control | Market-Structure Engine |

| 2. Mark Liquidity | Nearby EQH/EQL clusters, daily–monthly highs/lows | Shows where stops sit and price may gravitate | Liquidity Pools |

| 3. Find Value | Price trading inside discount (for longs) or premium (for shorts) zones | Buying low / selling high within the range | Premium/Discount Bands |

| 4. Isolate a Zone | A recently printed order block or fair-value gap | Institutional entry zones or imbalance fills | Order-Block & FVG Scanner |

| 5. Wait for Confirmation | Internal BOS/CHoCH inside your chosen zone, OR a candle close rejecting the block | Filters false signals and tightens risk | Internal Structure + Alerts |

| 6. Execute & Manage | Enter on the confirmation; stop beyond the far side of the block; target the next opposing liquidity pool or OB | Keeps R-multiple favorable and emotions contained | Built-in Alerts & MTF Overlay |

Example Workflow (15 m → 4 h Confluence)

- 4-hour CHoCH down flips bias bearish.

- Price rallies into a premium band and tags a fresh bearish order block that aligns with the 4 h fair-value gap.

- Drop to 15 m: an internal BOS down prints inside that block—confirmation.

- Entry: Short at the close of the BOS candle.

- Stop: 5–10 pips (or 0.25 ATR) above the order block.

- Targets: First take-profit at the nearest bullish OB; runner to sweep the prior EQL cluster.

This rinse-and-repeat logic works whether you’re scalping BTC, swing-trading EURUSD, or executing positional plays on S&P minis.

Master these steps and the Smart Money Concepts indicator becomes more than a chart overlay—it’s a full trading framework that syncs you with institutional liquidity flows.

Beyond SMC: Price Action Concepts (Premium)

SMC’s meteoric rise underscores LuxAlgo’s expanding influence as the world’s largest provider of trading indicators. For those who need even deeper x-ray vision, LuxAlgo offers Price Action Concepts (PAC), the premium evolution of SMC that:

- Fuses volumetric order blocks and mitigation tracking for stronger confirmation

- Scans multi-time-frame liquidity dashboards up to daily automatically

- Adds trend-line and pattern liquidity detection, plus CHoCH+ extensions

- Provides an all-in-one screener that compresses hours of manual markup into seconds

PAC gives professionals the same SMC logic—turbo-charged with volume analytics and cross-TF confluence—for the fastest, most comprehensive view of price-action mechanics.

The Bottom Line

- SMC by LuxAlgo has become TradingView’s most-liked free indicator in record time, signaling a generational pivot toward automated price-action analysis.

- Its one-click combination of market structure, liquidity pools, and order blocks helps traders trade with institutional flow instead of against it.

- Price Action Concepts™ extends that edge by blending volume and multi-time-frame data into a single, ultra-efficient toolkit.

Ready to see why tens of thousands of traders have switched? Add Smart Money Concepts to your chart for free and try out the premium version when you're ready,

Smart Money Concepts indicator is free to install on all five major charting platforms via the LuxAlgo Library—TradingView, NinjaTrader, MetaTrader 4, MetaTrader 5, and Thinkorswim.