Explore how the Fisher Transform indicator enhances market analysis by pinpointing turning points and filtering out noise for effective trading.

The Fisher Transform indicator, created by John F. Ehlers, helps traders identify market turning points by converting price data into a Gaussian (normal) distribution. Unlike traditional oscillators, it delivers sharp, precise signals by amplifying price peaks and troughs. Key features include:

- Clear Entry and Exit Signals: Line crossovers and extreme values (+2.0/-2.0) highlight potential market reversals.

- Noise Reduction: Filters out minor price fluctuations to focus on significant movements.

- Trend and Momentum Analysis: Indicates bullish or bearish trends with readings above or below zero.

LuxAlgo enhances the Fisher Transform by integrating it with TradingView, real-time alerts, AI Backtesting, and customization options, making it adaptable to different trading styles. Gaussian normalization sharpens signals, making it effective across various assets and timeframes. This indicator is a valuable tool for traders aiming to improve decision-making and risk management.

Mastering the Fisher Transform Indicator: Spot Market Reversals with Precision

Mathematical Foundation and How the Indicator Works

The Fisher Transform uses a mathematical approach to turn unpredictable price movements into clear, actionable signals. This precision is why it stands out compared to traditional oscillators. By understanding the math behind it, traders can see how this indicator delivers sharp turning points, offering clarity in even the most volatile markets. Let’s break it down further.

The Fisher Transform Formula Explained

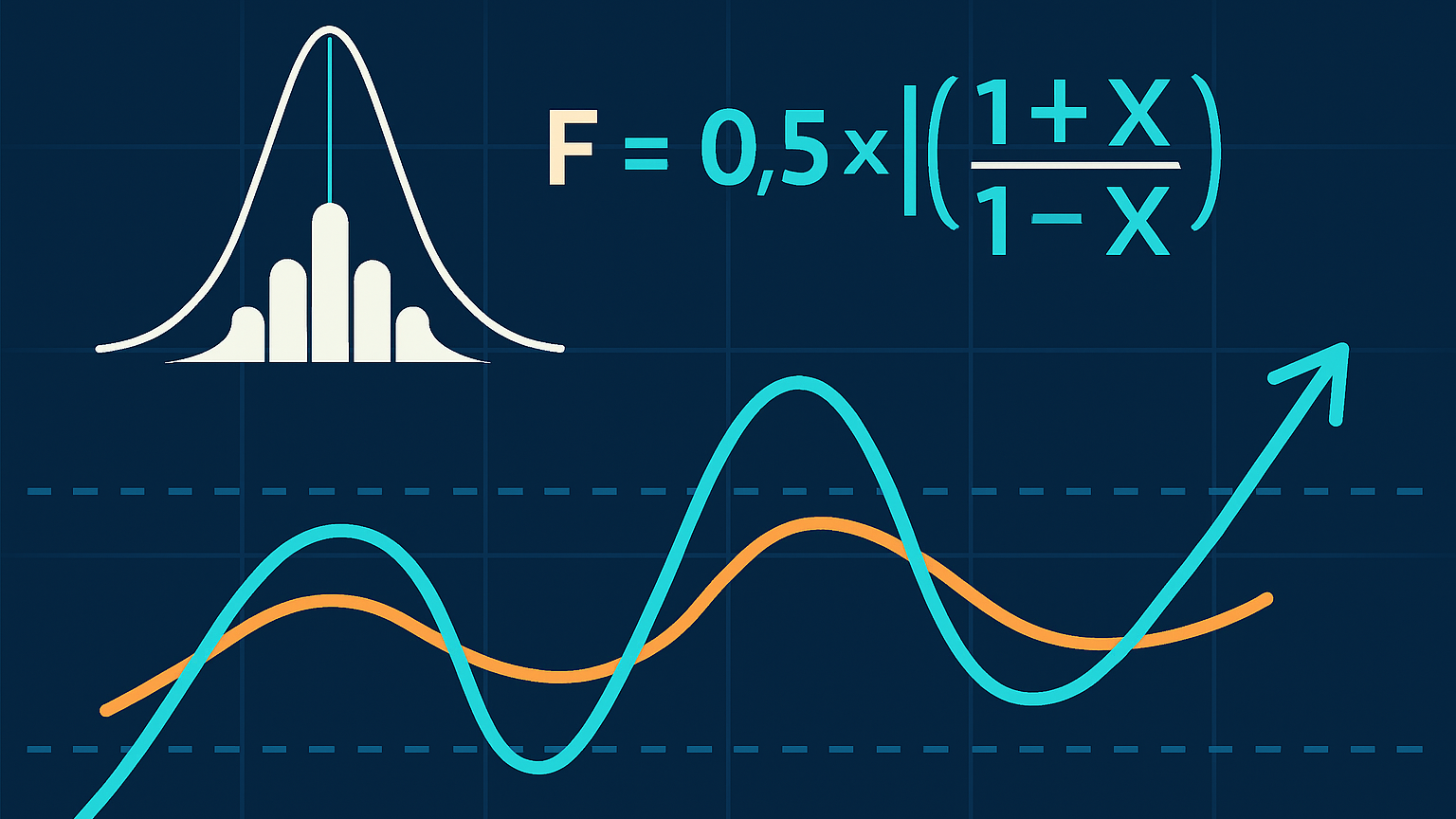

At the heart of the Fisher Transform is a formula designed to convert normalized price data into a Gaussian distribution:

F = 0.5 × ln((1 + X) / (1 - X))

Here’s what each part means:

- F: The Fisher Transform value.

- X: A normalized value derived from recent price ranges.

- ln: The natural logarithm function, which amplifies extreme price movements to highlight key turning points.

- 0.5: A scaling factor that keeps the output manageable while retaining sensitivity to price changes.

The inclusion of the scaling factor ensures that the indicator remains easy to interpret. Without it, values would double in size, making signals harder to read on standard oscillator charts.

Step-by-Step Calculation Process

To calculate the Fisher Transform, follow these steps:

- Step 1: Choose a lookback period. A common setting is 10 periods. Shorter periods (5–7) result in more reactive signals, while longer ones (14–20) create smoother, less frequent signals.

- Step 2: Determine the typical price. For each period, calculate the midpoint between the high and low prices: (High + Low) / 2.

- Step 3: Normalize the data. Use the formula:

X = 2 × ((Price - Lowest Low) / (Highest High - Lowest Low)) - 1

This ensures the result (X) stays within a range of -1 to +1. - Step 4: Apply the Fisher Transform formula. Plug the normalized value (X) into the main formula:

F = 0.5 × ln((1 + X) / (1 - X)) - Step 5: Create the trigger line. Smooth the Fisher Transform values by calculating a 1-period simple moving average. This trigger line helps confirm signals when it crosses the main Fisher line.

- Step 6: Plot the lines. Both the Fisher Transform and trigger lines are displayed on the same chart, typically with horizontal reference levels at +2.0 and -2.0 to indicate extremes.

Why Gaussian Normalization Improves Clarity

Gaussian normalization is a key step in refining the Fisher Transform’s signals. Price data naturally follows a skewed distribution, where values cluster with occasional extreme spikes. This makes it harder to distinguish normal fluctuations from meaningful turning points.

By converting price data into a Gaussian (bell curve) distribution, the Fisher Transform creates a more predictable framework. In a Gaussian distribution, about 95% of values fall within two standard deviations of the mean—so moves beyond +2.0 or below -2.0 can highlight statistically significant conditions that deserve attention. For more background, see an overview of the normal distribution.

This normalization process also minimizes noise. Random, minor price shifts that often trigger false signals in other indicators are smoothed out. Only sustained, meaningful price movements push the Fisher Transform toward its extreme levels, making its signals more reliable.

The result? The Fisher Transform produces sharp, unmistakable spikes and dips, unlike the gradual curves of other oscillators. This clarity allows traders to quickly identify market extremes and act confidently.

Another advantage of Gaussian normalization is its adaptability across different assets and timeframes. Whether you’re analyzing a $50 stock or a $50,000 cryptocurrency, the Fisher Transform adjusts proportionally to the asset’s typical price range. This versatility makes it a practical tool for traders in any market.

Key Features and Benefits of the Fisher Transform

The Fisher Transform, with its precise mathematical foundation, offers practical tools for traders aiming to make informed decisions. By normalizing price movements and amplifying signals, it provides distinct advantages in navigating the markets.

Detecting Market Turning Points

One of the standout features of the Fisher Transform is its ability to pinpoint potential market reversals. By emphasizing extreme price conditions, it produces sharp, noticeable moves that can act as early warnings of a shift in price direction. When the main line crosses extreme levels, a secondary signal line helps confirm these turning points, allowing traders to react quickly to potential changes. This is particularly helpful in volatile markets, where other indicators might struggle to provide clear insights. Besides identifying reversals, this tool also enhances trend analysis by offering a clearer view of price action.

Improving Trend Identification

The Fisher Transform is also effective for gauging broader market trends. For instance, when the indicator stays above zero for an extended period, it signals bullish momentum, while prolonged readings below zero suggest bearish conditions. Crossovers around the zero line and changes in the indicator’s magnitude reveal shifts in trends and momentum. Additionally, divergences between the indicator and price movements can indicate that the current trend may be weakening—see an introduction to bullish and bearish divergence—offering traders an opportunity to reassess their strategies.

Reducing Market Noise

Random price fluctuations can often cloud decision-making, especially in choppy or sideways markets. The Fisher Transform addresses this by filtering out minor, short-lived price movements through Gaussian normalization. By focusing on sustained price moves, it minimizes distractions from market “noise”, giving traders a more straightforward view of the underlying trends. This makes it a reliable tool for identifying actionable signals, even in less predictable market conditions.

Practical Applications in Trading

The Fisher Transform becomes a powerful tool for generating actionable trading signals, especially when combined with complementary strategies and tools.

Using Line Crossovers for Entry and Exit Points

One effective way to trade with the Fisher Transform is by focusing on crossovers between its main and signal lines. When the Fisher line crosses above the signal line, it suggests a potential bullish entry. Conversely, a crossover below the signal line may indicate a bearish opportunity.

These crossovers are particularly effective when they occur near extreme levels. For example, bullish crossovers emerging from deeply negative levels tend to offer more reliable signals. Similarly, bearish crossovers following extended positive readings carry greater weight.

The steepness of the crossover also matters—sharper, more pronounced crossovers often indicate strong momentum. To maximize gains, many traders exit their positions near opposing extremes, locking in profits before momentum shifts.

Beyond crossovers, the indicator’s extreme values can also help define broader market conditions.

Identifying Overbought and Oversold Conditions

The Fisher Transform is useful for spotting overbought and oversold conditions. Values exceeding +2.0 suggest overbought levels, while readings below -2.0 point to oversold conditions. When these extremes persist, they often signal stronger momentum shifts. However, it’s important to note that these levels don’t guarantee immediate reversals—they serve more as warnings of potential changes ahead. For context on these terms, see overbought and oversold.

The distinction between brief spikes and sustained extremes is crucial. For instance, if the indicator briefly touches +2.1 and then quickly retreats, it could signal an impending reversal. On the other hand, if it climbs to +2.3 and remains elevated, it may suggest the trend still has room to run.

Divergences between the Fisher Transform and price action provide additional insights into market conditions. For example, if prices hit new highs but the Fisher Transform shows lower peaks, it could signal weakening momentum, even if the price trend appears strong. These divergences often precede significant reversals, offering traders a chance to anticipate shifts before they occur.

Integrating the Indicator with LuxAlgo Tools

Pairing the Fisher Transform with LuxAlgo’s exclusive tools can enhance its effectiveness by adding extra layers of confirmation. The Oscillator Matrix screener is particularly helpful, as it detects real-time divergences and provides insights into money flow, validating Fisher Transform signals.

For instance, if the Oscillator Matrix confirms bearish divergences alongside overbought Fisher Transform signals across multiple timeframes, the likelihood of a successful reversal trade increases significantly.

LuxAlgo’s Price Action Concepts toolkit offers additional confirmation by automatically detecting support and resistance levels, as well as volumetric order blocks. When a Fisher Transform crossover aligns with a key support or resistance level identified by this toolkit, it creates a strong setup that combines momentum analysis with structural price levels.

The Signals & Overlays toolkit is another valuable resource for filtering Fisher Transform signals. By leveraging its multiple algorithms, traders can determine whether a crossover truly reflects momentum or is merely market noise. This is particularly useful in choppy markets where false signals are more frequent.

LuxAlgo’s screeners streamline the process of identifying Fisher Transform setups across multiple assets. The Oscillator Matrix screener, for example, can quickly highlight stocks or forex pairs with extreme Fisher Transform readings, saving you the hassle of manually scanning charts.

Additionally, LuxAlgo’s real-time alerts ensure that you never miss critical signals. You can set alerts for specific crossover conditions or extreme readings, enabling you to act quickly on opportunities—even when you’re not actively monitoring the charts.

Advanced Usage with LuxAlgo’s Ecosystem

The Fisher Transform becomes a powerful tool when paired with LuxAlgo’s extensive set of features, creating a trading environment that offers more than just basic signal generation.

Real-Time Alerts and Signal Overlays

LuxAlgo’s alert system simplifies tracking Fisher Transform signals across various markets. With custom alerts, you can set notifications for specific conditions, like crossovers above +2.0 or below -2.0, and receive updates instantly on your mobile or desktop.

The Custom Alert Creator takes this further, enabling highly specific setups. For example, you can configure alerts to trigger only when the Fisher Transform crosses its signal line and breaks through extreme levels, helping you filter out weaker signals that often occur during market consolidation.

Using the Signals & Overlays toolkit, LuxAlgo enhances Fisher Transform analysis with visual confirmations from multiple overlay algorithms. When Fisher Transform crossovers align with these overlay signals, it creates a layered confirmation system, boosting the reliability of your trades.

These tools operate in real time, allowing you to act on Fisher Transform signals within moments of their occurrence. This speed is especially critical for short-term trading strategies where timing can determine success. Additionally, these real-time features integrate seamlessly with AI-driven backtesting for refining your strategies.

Backtesting and Optimization with AI

LuxAlgo’s AI Backtesting Assistant is a game-changer for validating and optimizing Fisher Transform strategies. It evaluates your setups against thousands of historical scenarios, identifying the most effective parameters for your trading approach.

The AI system provides detailed performance metrics, including win rates, average returns, and maximum drawdowns, across multiple assets. It also suggests parameter adjustments based on historical data, helping you fine-tune crossover thresholds and exit strategies for better results.

What sets this platform apart is its ability to test the Fisher Transform alongside other LuxAlgo indicators. The advanced optimization engine allows you to create hybrid strategies by combining the Fisher Transform’s turning-point detection with complementary signals from tools like the Price Action Concepts or Oscillator Matrix.

For Ultimate plan subscribers, LuxAlgo offers weekly backtests and strategy reports, showcasing the most effective Fisher Transform configurations across various asset classes. These insights ensure your trading strategies remain aligned with current market trends and integrate seamlessly with LuxAlgo’s toolkit for precise execution. (See the Backtesters overview.)

Conclusion

The Fisher Transform stands out as a tool that sharpens the ability to detect market shifts with precision. By transforming market data, it highlights potential turning points and filters out unnecessary noise, making it easier for traders to spot opportunities and act decisively when it matters most.

This method also provides early alerts at statistical extremes, helping traders fine-tune their entry and exit points. Its clear crossover signals make it versatile, supporting both trend-following and reversal strategies across different trading approaches and timeframes.

When paired with LuxAlgo’s Toolkits, the Fisher Transform becomes an even more powerful resource. It offers traders a straightforward, data-driven way to navigate complex markets and make informed decisions during critical moments.

FAQs

What makes the Fisher Transform Indicator more effective at identifying market turning points compared to traditional oscillators?

The Fisher Transform Indicator is unique because it converts price data into a Gaussian normal distribution, making market turning points more pronounced and easier to spot. This mathematical method minimizes noise, allowing traders to see reversals with greater accuracy.

While many traditional oscillators falter during low-volatility periods, the Fisher Transform excels by providing sharper and more dependable buy and sell signals. This heightened clarity makes it an effective tool for pinpointing trends and spotting potential market reversals.

How does Gaussian normalization improve the accuracy of the Fisher Transform Indicator?

Gaussian normalization improves the Fisher Transform by reshaping price data into a normal distribution. This adjustment emphasizes extreme price movements, helping traders pinpoint potential market turning points with greater clarity.

By zeroing in on these extremes, the Fisher Transform becomes more reliable for identifying reversals and delivering sharper signals. This, in turn, enhances the quality of insights for traders during technical analysis.

How can traders use the Fisher Transform Indicator with LuxAlgo tools to refine their trading strategies?

Traders can sharpen their strategies by pairing the Fisher Transform Indicator with LuxAlgo’s powerful tools to confirm market reversals and pinpoint turning points with greater precision. When combined with features like trendlines, moving averages, and divergence signals, the Fisher Transform helps cut through market noise, allowing traders to zero in on higher-probability setups.

LuxAlgo’s advanced pattern recognition and custom alerts work seamlessly with the Fisher Transform, improving signal clarity and supporting smarter decision-making. To get the most out of this approach, it’s crucial to use sound risk management practices—like setting stop-loss orders—and cross-check signals with multiple indicators. This layered approach can lead to more dependable entry and exit points.

References

LuxAlgo Resources

- LuxAlgo — Official Site

- Reversal Signals (Library)

- Moving Averages Proximity Oscillator (Library)

- Price Action Concepts — Introduction (Docs)

- Support & Resistance Dynamic (Library)

- Money Flow Profile (Library)

- Oscillator Matrix Screener (Docs)

- Signals & Overlays — Introduction (Docs)

- Custom Alert Creator (Docs)

- AI Backtesting Assistant

- Reversal Spotting Made Easy (Blog)

- Backtesters — Overview (Docs)

- PAC Screener (Docs)

- S&O Screener (Docs)

- LuxAlgo Toolkits (Features)