Turn AI-built strategies into live, automated signals with LuxAlgo’s AI Strategy Alerts. Discover, stress-test, and “Dive Deeper” into any strategy, then stream precise entry/exit alerts to your screen, inbox, or bots. All synced with TradingView and your existing LuxAlgo workflow.

The next step for our AI Platform

Markets aren’t getting easier. Institutional models are getting faster, retail tools are more automated, and the edge now belongs to traders who can combine human intelligence with machine-level execution.

Over the last year, our AI platform has grown from a simple strategy finder into a full backtesting engine: it understands the majority of technical analysis concepts traders use every day (yes, even order blocks, mean reversion, market structure, etc), it searches through millions of backtested strategies across every market, and it lets you save those strategies to your account & do further analysis on-platform or even on TradingView too.

Today’s update is about what happens next.

With AI Strategy Alerts, you’re no longer just discovering & analyzing strategies, you’re deploying them. Any strategy you pull from the LuxAlgo AI can now fire live alerts: to your screen, your inbox, or as webhooks to route orders to your broker, exchange, or prop firm.

This is the missing bridge between “that backtest looks great” and “this setup is actually firing on my account right now.”

From millions of strategies to the one you actually trade

The foundation of AI Strategy Alerts is the existing LuxAlgo AI backtesting engine.

When you open the AI, you don’t write code. You just describe what you trade and how you like to trade it:

- “Show me GBPUSD strategies on the 1H using breakouts and trend filters.”

- “Give me a mean-reversion strategy for ES futures on the 15-minute chart.”

- “Find a BTC strategy that keeps drawdown under 20% and trades a few times per week.”

Behind the scenes, the AI is searching a massive database of strategies built on top of automated technical analysis trading concepts we've coded over the years and market data — tens of millions of combinations across more than 90 assets, including stocks, ETFs, crypto, forex, commodities, and futures.

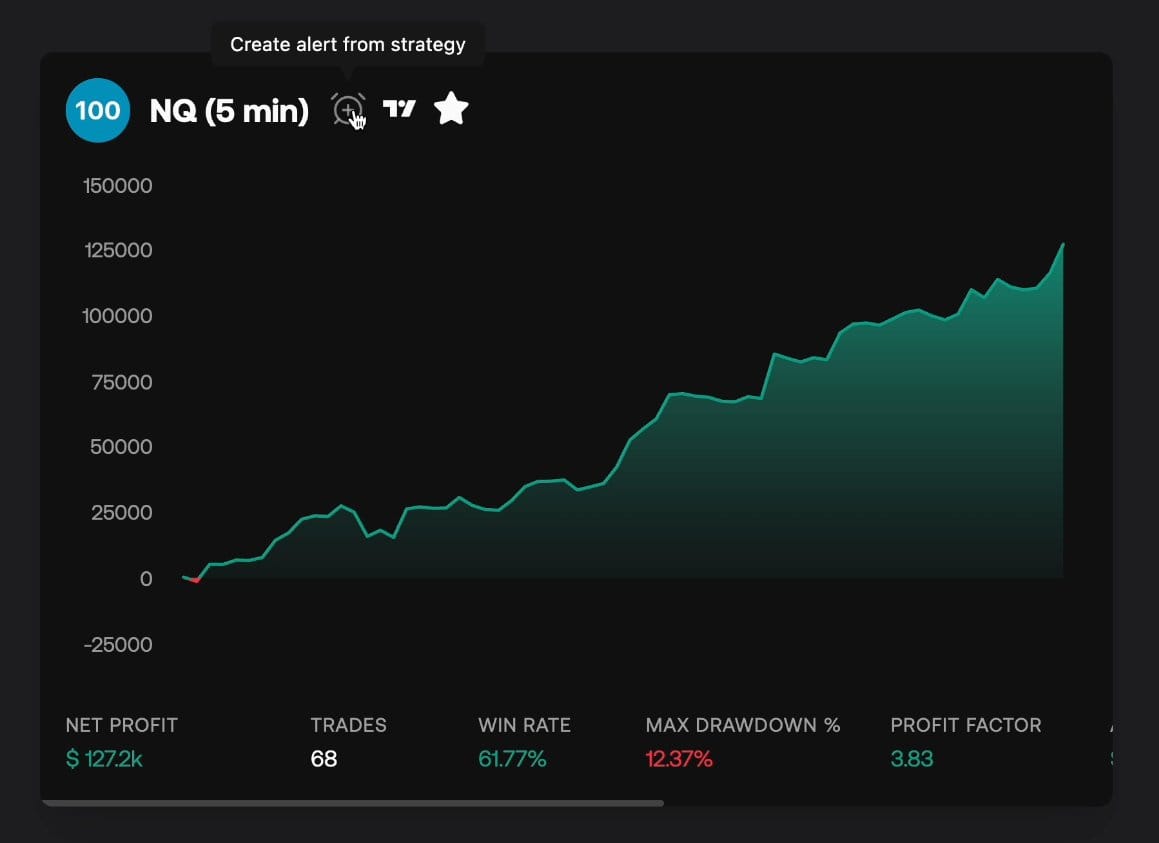

You can easily get back ranked strategy candidates with:

- Clear performance metrics (net profit, win rate, drawdown, profit factor).

- A clean equity curve.

- The core rules the AI is using: when to enter, when to exit, and what it’s looking at.

From there, you can further refine & learn more about the strategies, save promising strategies to your LuxAlgo profile, or even use our existing tools to copy and paste them into TradingView in 2 clicks.

That’s where things used to stop. Now, with the recent addition of advanced alerts for automated trading, things get much more serious for active traders.

Introducing AI Strategy Alerts

AI Strategy Alerts turn any AI-generated strategy into a live signal source for efficient automated trading. We've designed the alerts to compete with the flexibility & efficiency of TradingView's own alerts.

From the same screen where you review a strategy’s performance, you can now:

- Create an Alert from the strategy

- Attach Long, Short, and Exit alerts directly to that strategy’s conditions.

- Choose how you want those alerts delivered:

- In-app notifications

- Email alerts

- Create Webhooks for automation platforms and custom infrastructure

- Route signals into bot platforms like TradersPost (code "LUX" for a discount) which can forward orders to supported brokers or prop firm accounts, or others like Alpaca, Binance, 3Commas, etc.

The key detail: you’re not hand-wiring logic or rebuilding rules. The alert logic is tied to the exact conditions the AI used to generate the backtest. The equity curve you saw is the logic you’re now monitoring in real time.

You decide how hands-on you want to be:

- Semi-automated – get alerts when conditions line up so you can manually confirm and execute (also can send to Discord, Telegram, email, etc).

- Fully automated – push webhooks into any bot platform, exchange, broker, etc that allows webhooks (any automation stack) and let the system manage execution within the risk limits you define.

Either way, the AI is doing the scanning; you’re deciding how the signal gets expressed in your actual trading.

A workflow that matches how traders actually work

Here’s what a real session with AI Strategy Alerts feels like, start to finish:

- Prompt the AI

- You tell the AI what you trade, the timeframe, and any concepts you care about.

- Example: “Find a long/short BTCUSD strategy on the 1H that uses trend signals and volume to filter chop.”

- Review your candidates

- The AI returns multiple strategies with performance stats, rules, and equity curves.

- You skim for what matches your style: trade frequency, drawdown, and how the equity curve behaves in recent regimes.

- Pick and save the strategy

- When you find something that fits, you save it to your strategy portfolio inside the AI so you can revisit and refine it later.

- Create AI Strategy Alerts

- From that same strategy view, you click to create alerts.

- You choose which events you care about: Long entry, Short entry, Exit, or a combination.

- You define your alert message template, and optionally add a webhook URL if you’re connecting to a bot platform or custom system.

- For implementation details, you can refer to the Creating Alerts and Webhooks sections inside the AI Strategy Alerts docs.

- Let the platform watch the chart

- Once the alerts are live, LuxAlgo’s infrastructure watches the market for you.

- When your conditions are met, you get pinged — or your automation stack receives the signal in milliseconds.

Instead of juggling multiple tools and manually re-creating rules, you get one continuous loop: discover → validate → alert.

Deep Strategy Analysis, Chart Context & TradingView Integration

AI Strategy Alerts can plug into a much deeper layer inside the LuxAlgo AI platform: full strategy analysis on any saved strategy, directly on LuxAlgo.com/chat.

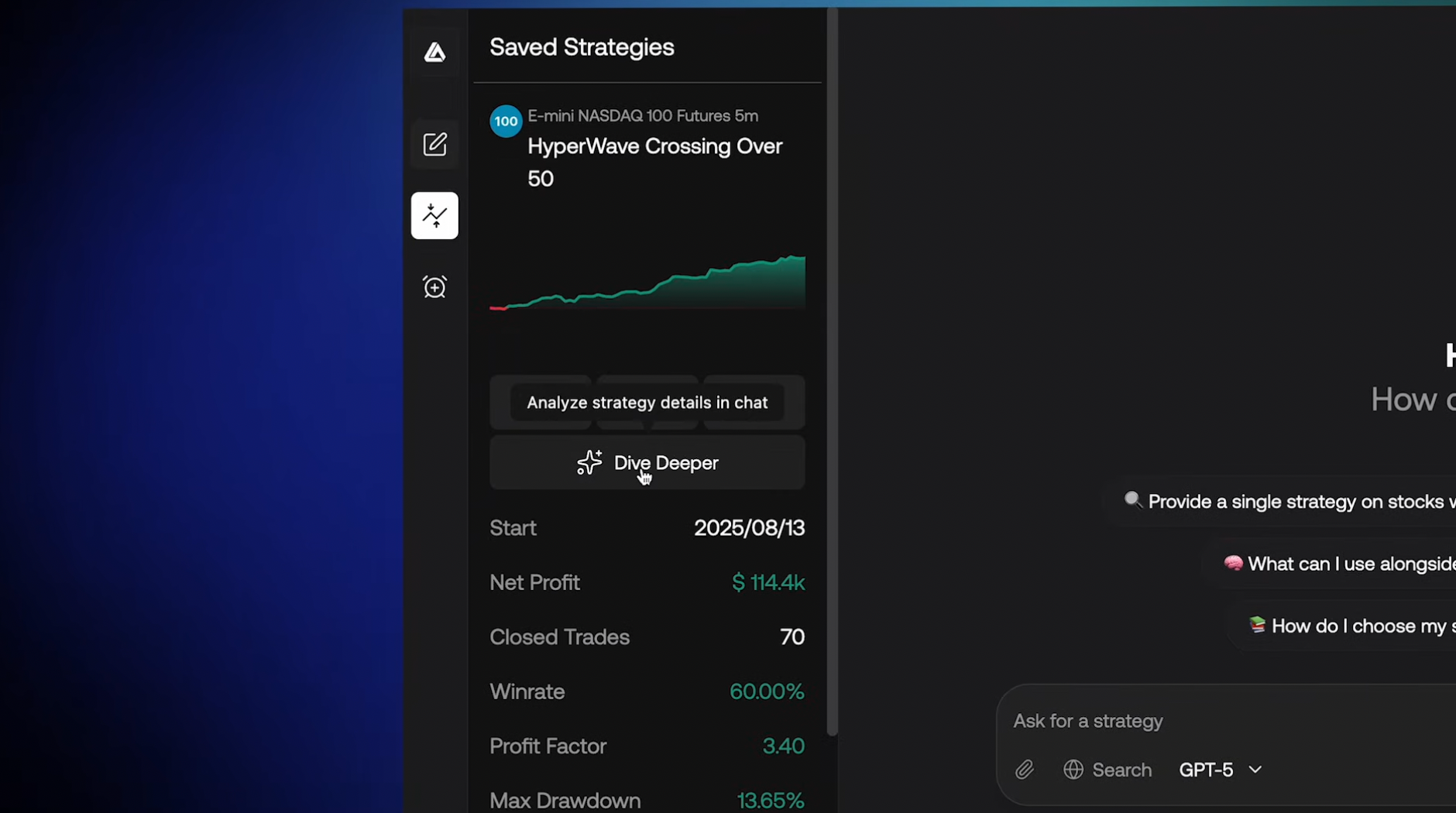

From your Saved Strategies, you can click Dive Deeper on any idea to open a detailed breakdown of how that strategy actually behaves. Instead of just looking at an equity curve, you can actually "talk to" the strategy to learn:

- The biggest winning and losing trades

- The longest duration of a winner or loser

- How often the strategy trades and how long it stays in positions

- Individual trades and sequences that made (or broke) the equity curve

- Really anything you want to know about the strategy

It’s a way to treat every strategy as something you can interrogate, not just “trust the chart.” Before you ever attach alerts, you can see exactly how a setup wins, how it loses, and whether the path to those results fits your own risk tolerance and style. All of this happens directly inside the LuxAlgo AI environment, without needing to jump between tools.

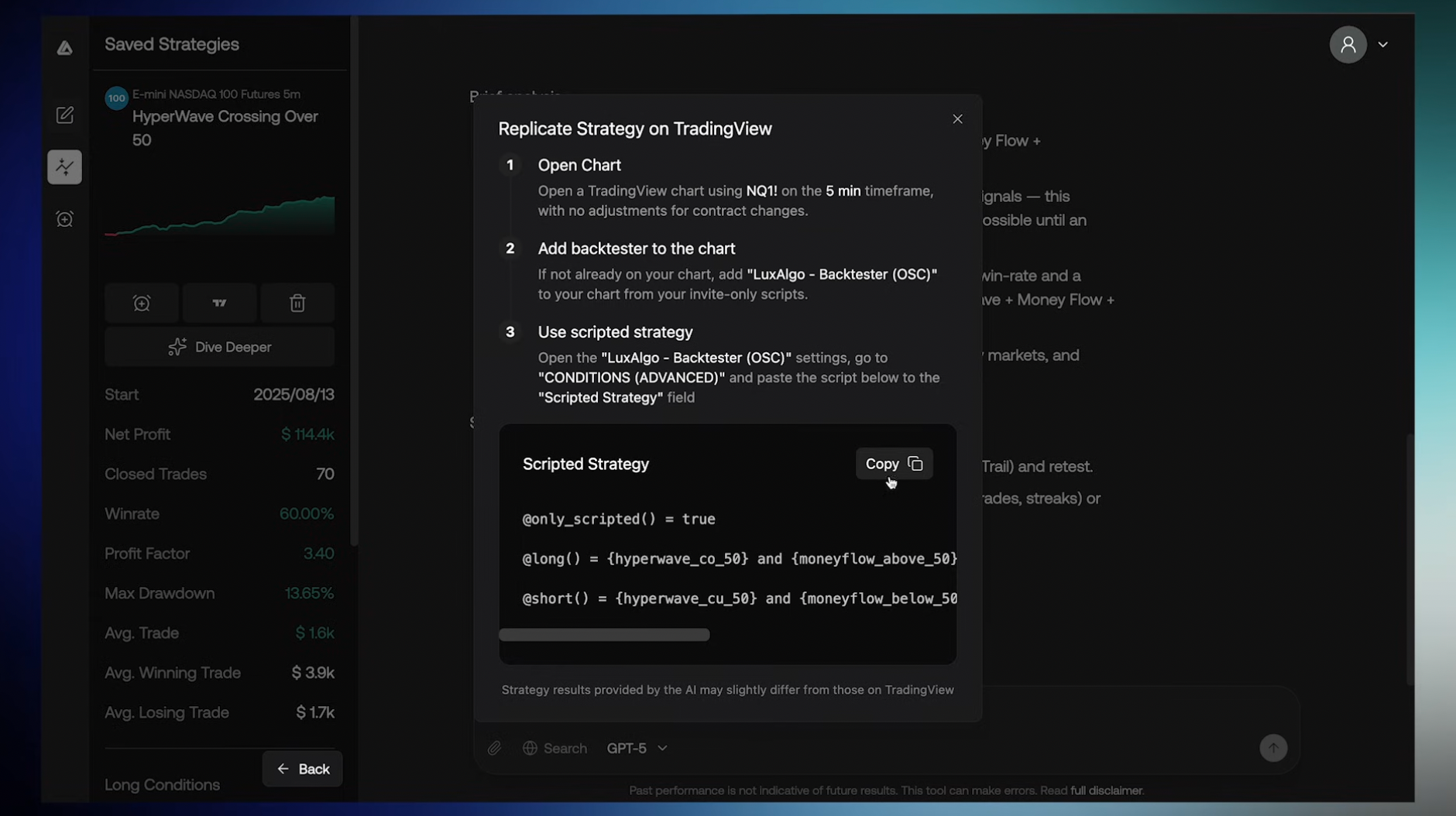

Optionally, if you want more visual control or prefer to work on TradingView, you can port any strategy over in 2-clicks using our Backtesters that host all of the automated technical analysis concepts:

- Replicate the logic into the TradingView Backtesters that host the technical concepts the AI used

- Further tweak & optimize entries, exits, filters in the settings

- Run visual backtests on your charts with the same improved data that now matches the equity curves you see inside the AI platform

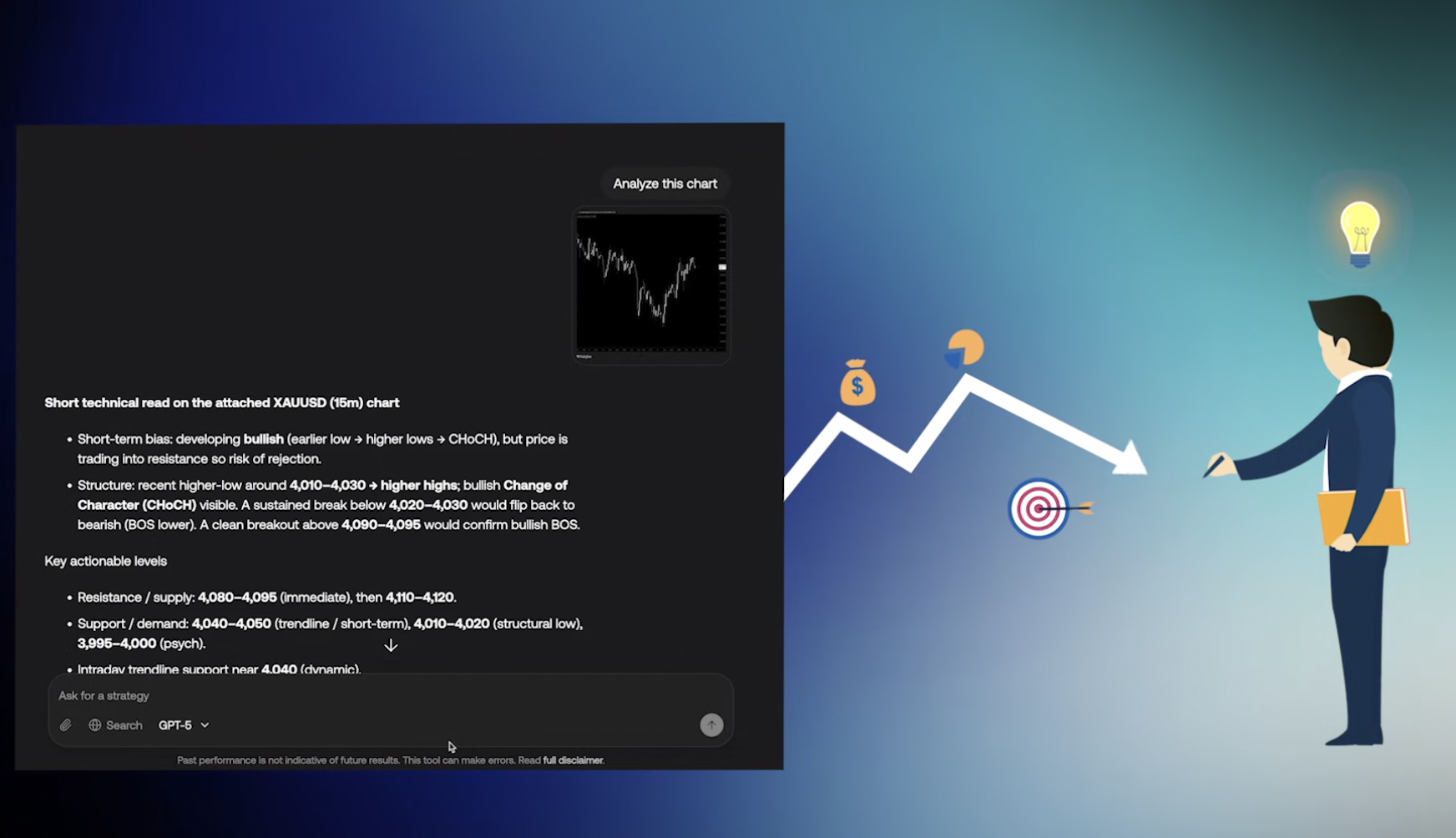

On top of strategy-level analysis, our AI now also supports chart analysis: you can bring in a chart and ask how to best apply LuxAlgo tools in that exact context.

The AI can highlight trend vs range behavior, suggest which overlays and oscillators to focus on, and propose ways to adapt your existing strategies to what’s happening on the screen. Those insights can then flow straight back into new or existing strategies that you can save, dive deeper into, and connect to alerts.

The result is a full loop traders can use: analyze a chart → generate or refine a strategy → dive deep into its behavior → wire it into live alerts — all inside one ecosystem, with the option to extend it into TradingView whenever you want more hands-on visualization.

Get started with AI Strategy Alerts

AI Strategy Alerts are part of the evolving LuxAlgo AI platform and are available on our Ultimate plan.

To try them out:

- Go to LuxAlgo.com/chat

- Request a strategy for the market and timeframe you care about.

- Save a candidate that fits your style, then dive deeper to learn more about it or create alerts from that strategy.

- Choose how alerts fire – in-app, email, or webhook to your automation stack.

LuxAlgo’s mission is to turn the world’s trading concepts into something you can act on today. The recent addition of AI Strategy Alerts are a major step in that direction — taking the strategies you discover with AI and making sure they can actually execute to take advantage of your edge.