Learn the differences between static and dynamic support in trading, and how to effectively use both for better market strategies.

Trading success often hinges on knowing when to use static or dynamic support and resistance levels. These levels help predict where prices may reverse or stall, guiding better trade decisions. Here's a quick breakdown:

-

Static Support/Resistance:

Fixed price points based on historical data (e.g., previous highs/lows). Best for long-term strategies and range-bound markets.

Fixed price points based on historical data (e.g., previous highs/lows). Best for long-term strategies and range-bound markets.

-

Dynamic Support/Resistance:

Shifting levels that adapt to market changes using indicators like Moving Averages or Bollinger Bands. Ideal for short-term trades and trending markets.

Shifting levels that adapt to market changes using indicators like Moving Averages or Bollinger Bands. Ideal for short-term trades and trending markets.

Quick Comparison

| Feature | Static Support/Resistance | Dynamic Support/Resistance |

|---|---|---|

| Flexibility | Fixed | Adjusts with market changes |

| Best For | Long-term, range-bound markets | Short-term, trending markets |

| Tools Used | Historical data, Fibonacci | MAs, Bollinger Bands, Ichimoku |

| Reaction Speed | Slower | Faster |

To maximize results, combine both methods. Use static levels for overall trends and dynamic levels for precise trade entries or exits. This dual approach strengthens strategies across varying market conditions.

Static Support and Resistance: What It Is and When to Use It

Defining Static Support and Resistance

Static support and resistance levels are fixed price points based on historical data. These levels don’t change and are derived from key historical highs, lows, or price levels where significant trading activity occurred. Traders rely on them as consistent reference points.

How to Spot Static Levels on Charts

To identify static levels, focus on historical price movements. Traders often use these methods:

| Method | Description | Best Used For |

|---|---|---|

| Historical Highs/Lows | Marking major peaks and troughs | Long-term trend analysis |

| Fibonacci Retracements | Using ratios to analyze price moves | Finding potential reversal zones |

| Price Action Analysis | Studying repeated price reversals | Pinpointing strong support/resistance zones |

Tools like LuxAlgo can simplify this process by offering advanced price action analysis and allowing you to examine multiple timeframes at once.

Strengths and Weaknesses of Static Levels

Static support and resistance levels have their advantages but also come with limitations depending on market conditions.

Key Strengths:

- Clear and consistent reference points for traders

- Work well in stable, sideways-moving markets

- Easy to identify for long-term analysis

- Useful for planning extended positions

Notable Limitations:

- Don’t adjust to sudden market changes

- Can lose relevance in shifting conditions

- Less effective in highly volatile markets

- Require regular re-evaluation

Static levels are most effective in stable markets with defined trading ranges. For example, during consolidation phases, prices often bounce between these levels, making them reliable for planning trades. However, they can break during major market events or trend shifts, so they require ongoing validation.

While static levels provide consistency in predictable markets, dynamic support and resistance can adapt to changing conditions - more on that in the next section.

Dynamic Support and Resistance: How It Works and Its Uses

What Are Dynamic Support and Resistance Levels?

Dynamic support and resistance levels change as prices move, adjusting to ongoing market conditions. These levels are formed when prices interact with moving indicators, creating flexible boundaries that evolve with recent price action. Unlike static levels, which remain fixed, dynamic levels shift automatically, making them especially useful in trending markets.

Indicators for Identifying Dynamic Support

Certain technical indicators are commonly used to spot dynamic support and resistance levels:

| Indicator Type | How It's Used |

|---|---|

| 20 EMA | Tracks short-term trends in active markets |

| Bollinger Bands | Sets volatility-based boundaries for both trends and ranges |

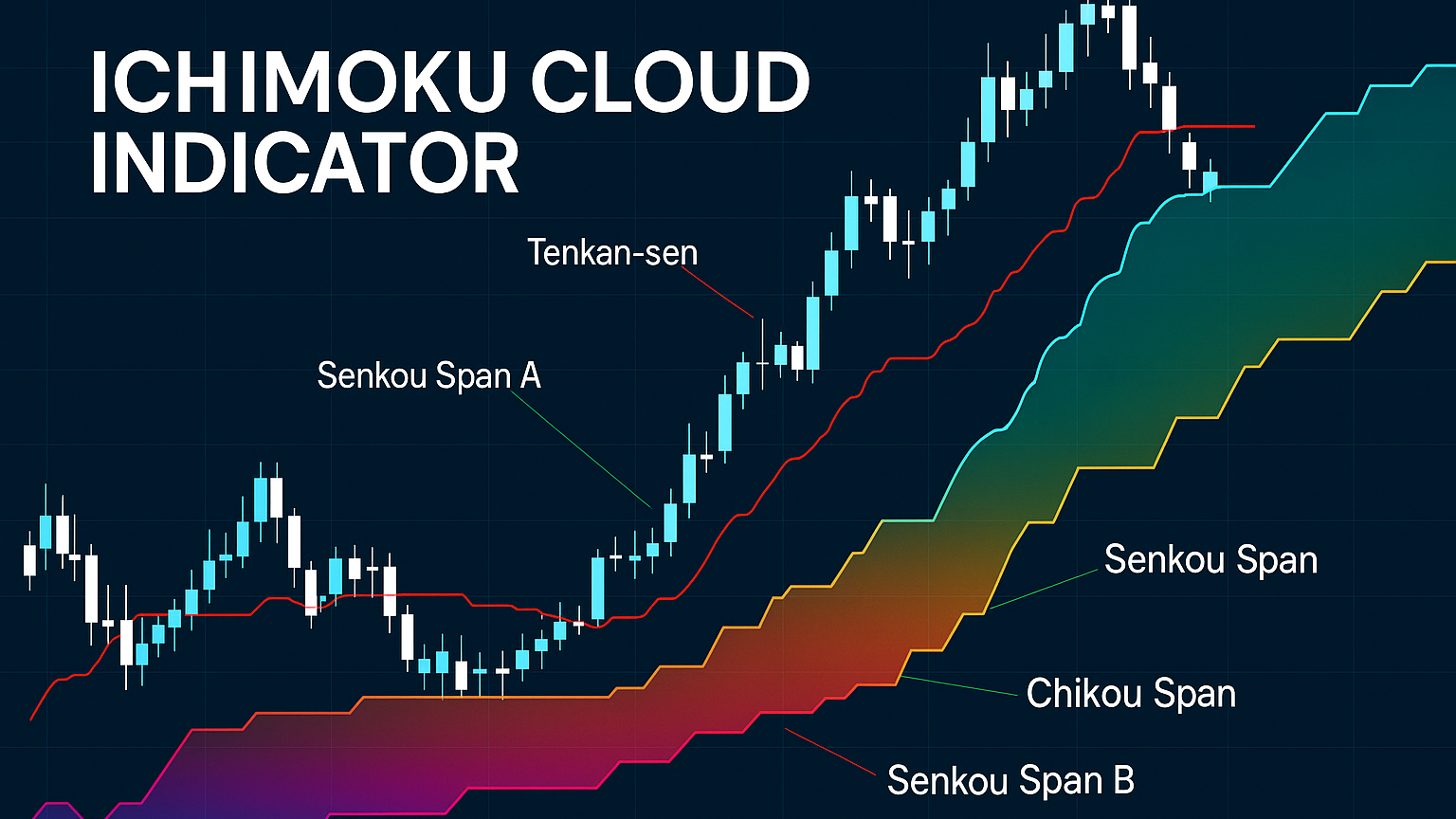

| Ichimoku Cloud | Projects future levels for medium to long-term analysis |

The 20 EMA, for example, highlights recent price trends over the last 20 periods, making it a go-to tool for identifying dynamic levels. Tools like LuxAlgo enhance this process by offering pattern recognition and insights into market structure.

Pros and Cons of Dynamic Support

Dynamic levels adjust as the market evolves, making them responsive to recent price movements and particularly effective in trending conditions. However, they come with challenges, especially in volatile or sideways markets.

Advantages:

- Automatically adapts to shifting market conditions.

- Reacts quickly to recent price trends.

- Works well in trending markets.

- Can help pinpoint potential reversal points in real-time.

Disadvantages:

- Prone to false signals during high volatility.

- May lag behind during rapid price changes.

- Requires more detailed analysis compared to static levels.

- Less reliable in range-bound markets.

Dynamic levels are most effective in trending phases, where tools like moving averages often provide reliable support or resistance. In choppy or sideways markets, traders should approach these levels with caution and consider pairing them with other indicators for confirmation.

While dynamic levels offer adaptability, combining them with static levels can strengthen your trading strategy, as we'll explore in the next section.

Static vs Dynamic: Comparing and Choosing the Right Approach

Static vs Dynamic: A Side-by-Side Comparison

To decide between static and dynamic support/resistance levels, it's essential to understand how they differ:

| Characteristic | Static Support/Resistance | Dynamic Support/Resistance |

|---|---|---|

| Fixed Price Levels | Stay constant over time | Shift with market movements |

| Time Frame Focus | Suited for long-term views | Better for short-term trades |

| Market Type | Best in range-bound markets | Ideal for trending markets |

| Complexity | Easy to spot and draw | Requires indicator setup |

When to Use Each Approach

Static support levels are perfect for range-bound markets, significant price points (like round numbers), and long-term analysis. They act as reliable reference points, holding their relevance over time and helping traders identify consistent price patterns. This makes them especially useful for position trading.

Dynamic levels, on the other hand, shine in trending markets, during periods of high volatility, and for short-term trades. Their ability to adjust to price changes is crucial in these scenarios. Tools such as LuxAlgo can help traders pinpoint patterns and market structures in real-time, making dynamic levels even more effective.

Here’s a quick breakdown:

Static Levels Are Ideal For:

- Range-bound markets with clear price boundaries

- Key psychological price points

- Long-term trend analysis and position trading

Dynamic Levels Work Best In:

- Strong trending markets

- Volatile market conditions

- Short-term trading setups

Both approaches have their strengths. Static levels offer consistency in stable markets, while dynamic levels adapt to changing trends. Many traders combine the two to build well-rounded strategies, which we’ll dive into further in the next section.

Combining Static and Dynamic Support for Better Results

How to Use Static and Dynamic Together

Using static and dynamic support levels together can take your trading strategies to the next level. By combining these approaches, traders can handle a variety of market conditions with more confidence and accuracy. When static and dynamic levels overlap, they create stronger trade signals, making it easier to decide when to enter or exit a trade. For example, if a 20 EMA lines up with a historical static support level, it can highlight a strong buying opportunity.

Static levels provide a big-picture view, while dynamic indicators help pinpoint precise entry and exit points. Together, they align long-term trends with short-term timing. Tools like LuxAlgo's Price Action Concepts (PAC) make this process easier by automatically identifying key levels and patterns.

Tips for Blending Static and Dynamic Approaches

Look for "convergence zones" where static levels meet dynamic indicators like moving averages or Bollinger Bands. These zones often signal high-probability setups, allowing for customized risk management. Use dynamic indicators to confirm static level breakouts, check for overlaps, and adjust your position size based on the strength of the signal.

Risk Management Considerations: Dynamic levels can help you fine-tune stop-loss orders as the market shifts. This flexible approach protects your profits while giving winning trades room to grow. Dynamic trailing stops are especially useful for managing risk while staying in line with trending moves.

Conclusion: Using the Right Tools for Market Conditions

Key Takeaways

Knowing when to rely on static versus dynamic support levels can make a big difference in your trading success. Static levels work well in steady, long-term markets, while dynamic levels are better suited for fast-changing, short-term scenarios. The trick is figuring out which method aligns with the current market environment and your specific trading goals.

Once you've grasped the strengths of each approach, the focus shifts to applying them effectively in your trades.

Steps to Sharpen Your Trading Skills

To improve your trading, start by practicing both methods separately. This will help you understand how each works in different situations. A paper trading account is a great way to experiment with static and dynamic strategies without putting your capital at risk. Tools like LuxAlgo can also assist you in spotting convergence zones, which often lead to stronger trade signals.

Here’s a simple guide to get started:

| Time Frame | Best Approach | Helpful Tools |

|---|---|---|

| Long-term (Weeks/Months) | Static Support | Historical price data |

| Medium-term (Days/Weeks) | Mixed Approach | Moving averages |

| Short-term (Intraday) | Dynamic Support | Real-time indicators |

The key to successful trading lies in using the right method at the right time. Whether you're focusing on long-term trends or navigating fast-moving markets, blending static and dynamic strategies with solid risk management can help you refine your trading game.

LuxAlgo Exclusive Features

LuxAlgo Exclusive offers a seamless blend of static and dynamic support and resistance analysis. Our platform integrates the Signals and Overlays toolkit for real-time dynamic analysis and the Price Action Concepts toolkit—which provides detailed insights into static levels—to give you the best of both worlds. With these cutting-edge tools, you can pinpoint key trade opportunities in any market condition.

By combining these advanced toolkits, LuxAlgo Exclusive ensures you’re equipped with robust analytics to navigate both trending and range-bound markets with confidence. Whether you’re planning long-term positions or executing short-term trades, our integrated approach helps you capture market nuances effectively.

FAQs

What are dynamic support and resistance levels?

Dynamic support and resistance refer to price zones that change in response to market activity, unlike static levels that remain fixed. These zones adjust based on recent price trends and are often identified using technical indicators. They are especially useful in trending or volatile markets, where static levels may not provide enough insight.

Here are some common indicators used to identify dynamic levels:

| Indicator Type | Common Usage | Best Market Conditions |

|---|---|---|

| Moving Averages | 20/50/200 EMA | Trending markets |

| Bollinger Bands | Upper/Lower bands | Volatile markets |

| Ichimoku Cloud | Cloud boundaries | Multiple timeframes |

For instance, in a downtrend, the 50 EMA often acts as dynamic resistance. If prices break above this level, it can switch roles and serve as dynamic support. This adaptability makes dynamic levels particularly helpful for short-term trades or when markets are experiencing high volatility.

"Dynamic support and resistance levels are areas where the market can pull back into and find support without needing to be at a horizontal support or resistance level." [1][2]

"Moving averages can also act as dynamic support and resistance levels." - Babypips.com [2]

References

- https://www.luxalgo.com/library/

- https://www.luxalgo.com/library/indicator/Support-Resistance-Dynamic-LuxAlgo/

- https://en.wikipedia.org/wiki/Bollinger_Bands

- https://www.luxalgo.com/library/indicator/Candle-Body-Support-Resistance/

- https://www.luxalgo.com/library/indicator/Previous-Highs-Lows/

- https://en.wikipedia.org/wiki/Fibonacci_retracement

- https://www.luxalgo.com/

- https://www.investopedia.com/terms/i/ichimoku-cloud.asp

- https://docs.luxalgo.com/docs/toolkits/price-action-concepts/market-structures

- https://www.luxalgo.com/blog/reversal-spotting-made-easy/

- https://www.luxalgo.com/library/indicator/Volume-Delta-Trailing-Stop/

- https://indicatorvault.com/support-and-resistance-levels/

- https://2ndskiesforex.com/trading-strategies/what-is-dynamic-support-and-resistance/