Explore the Hanging Man candlestick pattern, its key characteristics, market context, and how to effectively trade reversals.

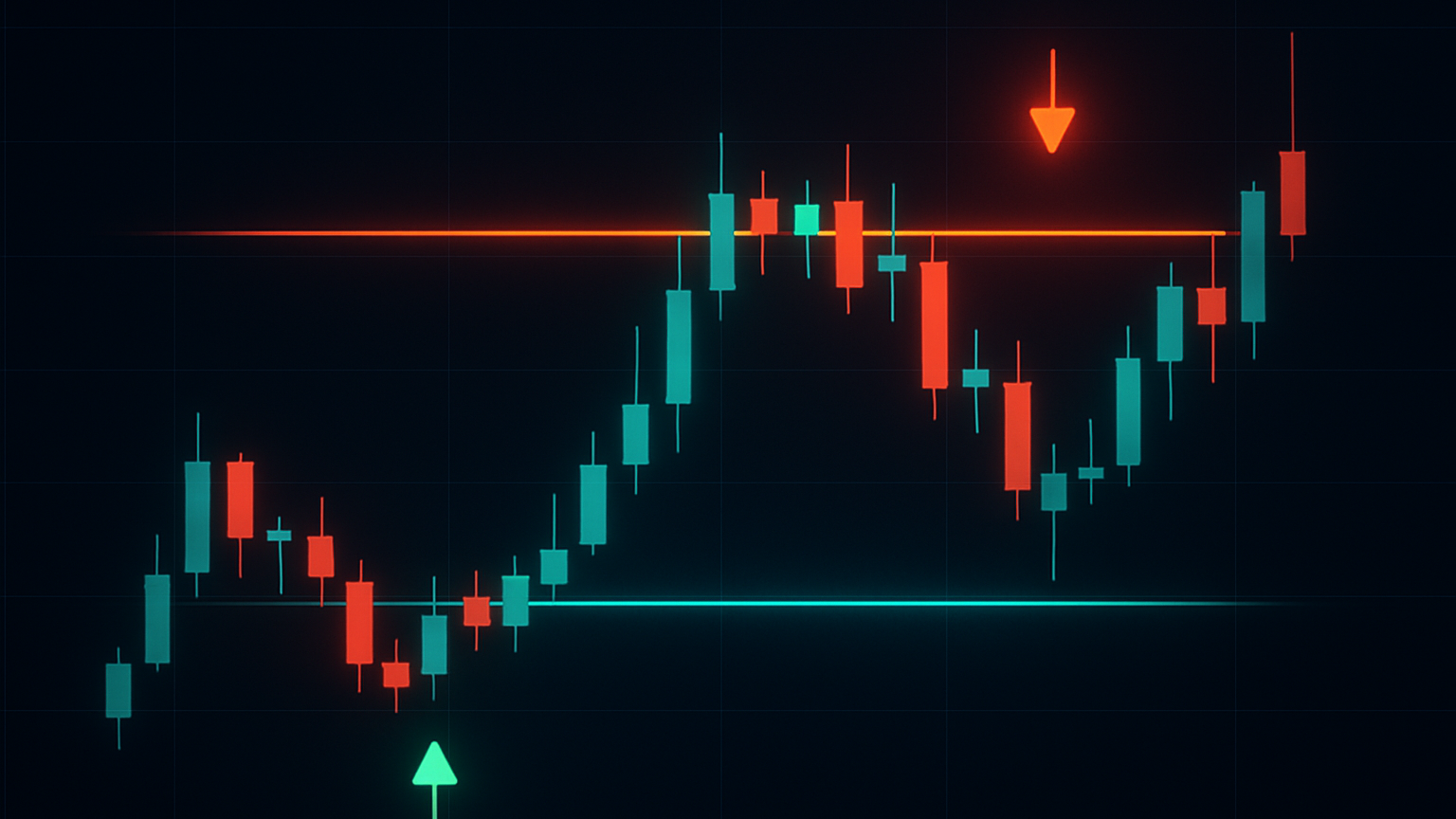

The Hanging Man candlestick pattern is a single-candle formation that signals potential market reversals after an uptrend. It features a small body near the top and a long lower shadow (at least twice the body’s length). Traders use it to identify bearish reversals when confirmed by a bearish candle in the next session.

Key Points:

- Structure: Small body, long lower shadow, little to no upper shadow.

- Market Context: Appears after an uptrend, often near resistance levels.

- Confirmation: A bearish close below the Hanging Man strengthens the signal.

- Volume: Higher volume increases reliability.

- Success Rate: Historical accuracy is around 59%, improving with proper validation.

For best results, combine this pattern with tools like RSI, MACD, and volume analysis, and always use risk management strategies like stop-loss orders.

Pattern Recognition

Key Characteristics of the Hanging Man

The Hanging Man is recognized by its small upper body and a long lower shadow, with little to no upper shadow. The body can be either green (bullish) or red (bearish), but red bodies often point to a stronger chance of reversal. According to Thomas Bulkowski's research, longer shadows tend to improve the pattern's success rate. These features help identify the pattern and its potential impact.

Market Conditions to Watch For

For the Hanging Man to be valid, certain market conditions need to align:

- Prior Trend: It should appear after a clear uptrend.

- Volume: Higher trading volume during its formation adds credibility.

- Position: Most impactful when near key resistance levels.

- Confirmation: A bearish session following the pattern strengthens the reversal signal.

Bulkowski's findings suggest that if a confirmation candle forms the day after the Hanging Man, it can predict further price declines with up to 70% accuracy. The presence of strong trading volume enhances the pattern's reliability.

How It Differs from Similar Patterns

To better understand the Hanging Man, it's useful to compare it with other candlestick patterns:

- Hammer: Found in downtrends, signaling potential bullish reversals.

- Shooting Star: Appears in uptrends, with a long upper shadow indicating bearish reversals.

- Doji: Represents market indecision, with little to no body.

The Hanging Man stands out for its bearish signals, especially when it forms after a strong price rally. Its message becomes clearer when the next trading sessions close below its body, confirming the reversal.

Signal Analysis

Bearish Signal Validation

To confirm the Hanging Man pattern as a bearish reversal signal, look for a close below the pattern's body in the next trading session. This close strengthens the bearish outlook by validating the pattern.

Here are the key elements to watch:

- Shadow Length: The lower shadow should be at least twice the length of the body.

- Volume Profile: Higher trading volume adds credibility to the pattern.

- Price Location: Patterns forming near resistance or supply zones carry more weight.

"A higher volume on the day this pattern appears strengthens its validity, indicating a substantial change in market sentiment." - WritoFinance.com

These factors help assess the pattern's reliability and reduce the chances of misinterpreting market signals.

Reliability Factors

Certain factors can help distinguish between strong and weak signals, improving the chances of success.

| Reliability Factor | Strong Signal | Weak Signal |

|---|---|---|

| Prior Trend | Strong uptrend | Choppy uptrend |

| Volume | High volume | Low volume |

| Confirmation | Closes below pattern | No follow-through |

| Shadow Length | 2–3× body length | Less than 2× body |

| Market Context | Near resistance | Mid-range |

For better accuracy, consider these factors across multiple timeframes and technical indicators.

To refine your approach:

- Analyze Multiple Timeframes: Look for pattern alignment on daily and 4-hour charts to confirm a potential reversal.

- Use Technical Indicators: Check RSI and MACD for signs of overbought conditions.

- Assess Market Structure: Focus on strong, stable uptrends instead of sideways price action.

"Confirmation is crucial because the Hanging Man pattern alone doesn't guarantee a reversal. It could be a false signal in a strong uptrend." - XS.com

To manage risk, set stop-loss orders just above the pattern's high. These steps can strengthen the Hanging Man's role as a reliable reversal indicator.

Trading Methods

Trade Entry and Exit Rules

To act on a Hanging Man pattern effectively, wait for a bearish confirmation candle after the pattern forms at the top of an uptrend.

Here’s what to look for:

- The Hanging Man must appear at the top of an uptrend.

- Enter the trade only when the next candle closes bearish.

- Confirm the move by ensuring the volume is above average.

Set your profit targets at key technical levels. For example, if trading USDJPY, aim for the next support level. Always combine these steps with strict risk management practices.

Risk Control Guidelines

Managing risk is essential, as historical loss rates have ranged between 13–14% and 59%.

| Risk Component | Implementation Strategy | Why It Matters |

|---|---|---|

| Stop-Loss Placement | Place a stop-loss just above the pattern’s high | Limits losses if the uptrend continues unexpectedly. |

| Position Sizing | Adjust the trade size to control exposure | Reduces the impact of a single losing trade. |

| Market Volatility | Adapt position sizes based on market conditions | Accounts for fluctuations in price movement. |

Supporting Indicators

Pair your strategy with technical indicators to improve accuracy. Some helpful tools include:

- RSI: Confirms overbought conditions.

- MACD: Verifies bearish momentum divergence.

- Moving Averages: Identifies key support levels.

- Volume Analysis: Confirms the pattern’s strength.

Additionally, reversal signals can refine your approach. For example, LuxAlgo provides exclusive tools on TradingView that identify trend exhaustion using phases like the Momentum Phase and the Trend Exhaustion Phase. By combining these tools, you can improve the reliability of your reversal signals.

Advanced Analysis

Timeframe Analysis

The Hanging Man pattern's effectiveness can differ based on the timeframe being analyzed. A strong reversal signal on a daily chart might not hold the same importance on an intraday chart.

To get the best insights, evaluate the pattern across multiple timeframes:

| Timeframe | Key Considerations | Signal Strength |

|---|---|---|

| Daily | Best for identifying trend reversals | High reliability |

| 4-Hour | Works well for swing trades | Moderate reliability |

| 1-Hour | Useful for intraday trading | Needs further confirmation |

Higher timeframes help cut through short-term noise, providing clearer signals. Pairing this with volume analysis can further validate these insights.

Volume Analysis

Volume plays a critical role in validating the Hanging Man pattern. When trading volume increases during the pattern's formation, it indicates active market participation, strengthening the signal. To analyze volume effectively, compare the pattern's volume to its 20-period average. Look for volume spikes and confirm increased selling pressure in sessions that follow. While volume analysis can reinforce the signal, it’s equally important to understand when patterns fail.

Failed Patterns

Even with proper validation, the Hanging Man pattern can fail under certain conditions. The success rate for this pattern is around 59%, with failures often caused by specific market factors like weak context, low volume, or a lack of bearish confirmation.

| Failure Factor | Warning Signs | Mitigation Strategy |

|---|---|---|

| Weak Market Context | Forms in a sideways market | Wait for a clear uptrend before acting |

| Low Volume | Below-average trading activity | Ensure volume confirms the pattern |

| Lack of Confirmation | No bearish follow-through | Look for a confirming bearish candle |

| Strong Resistance | Price far from key levels | Check and respect major resistance zones |

To avoid false signals, combine timeframe analysis, volume confirmation, and a thorough review of market conditions. This comprehensive approach increases the reliability of the Hanging Man pattern as a trading indicator.

Hanging Man Candlestick Patterns - Complete Guide

Summary

The Hanging Man is a bearish reversal candlestick pattern characterized by a small body and a long lower shadow. Here’s what to focus on:

| Aspect | Key Requirements | Success Factors |

|---|---|---|

| Pattern Structure | Small real body; lower shadow at least twice the body length | Clear uptrend context |

| Volume Confirmation | High trading volume | Increased selling pressure |

| Risk Management | Stop-loss placed above the pattern high | Limit risk to no more than 2% per trade |

| Entry Timing | Wait for a bearish confirmation candle | Enter below the Hanging Man's low |

"The hanging man is a notable candlestick pattern in trading, signaling a possible shift from bullish to bearish market trends"

To get the most out of this pattern, traders should:

- Use it alongside other technical tools like RSI or MACD for extra confirmation.

- Focus on daily timeframes for better reliability.

- Pay attention to volume spikes for added validation.

- Set take-profit targets at previous support levels.

"The Hanging Man pattern is widely recognized, but relying solely on its signals can add uncertainty to the already unpredictable nature of financial markets"

For best results, look for the Hanging Man near key resistance levels and ensure there’s bearish follow-through. Stick to these guidelines and maintain strict risk management to incorporate this pattern effectively into your trading plan.