Learn how to leverage market seasonality for trading success by identifying patterns, using analysis tools, and implementing solid risk management.

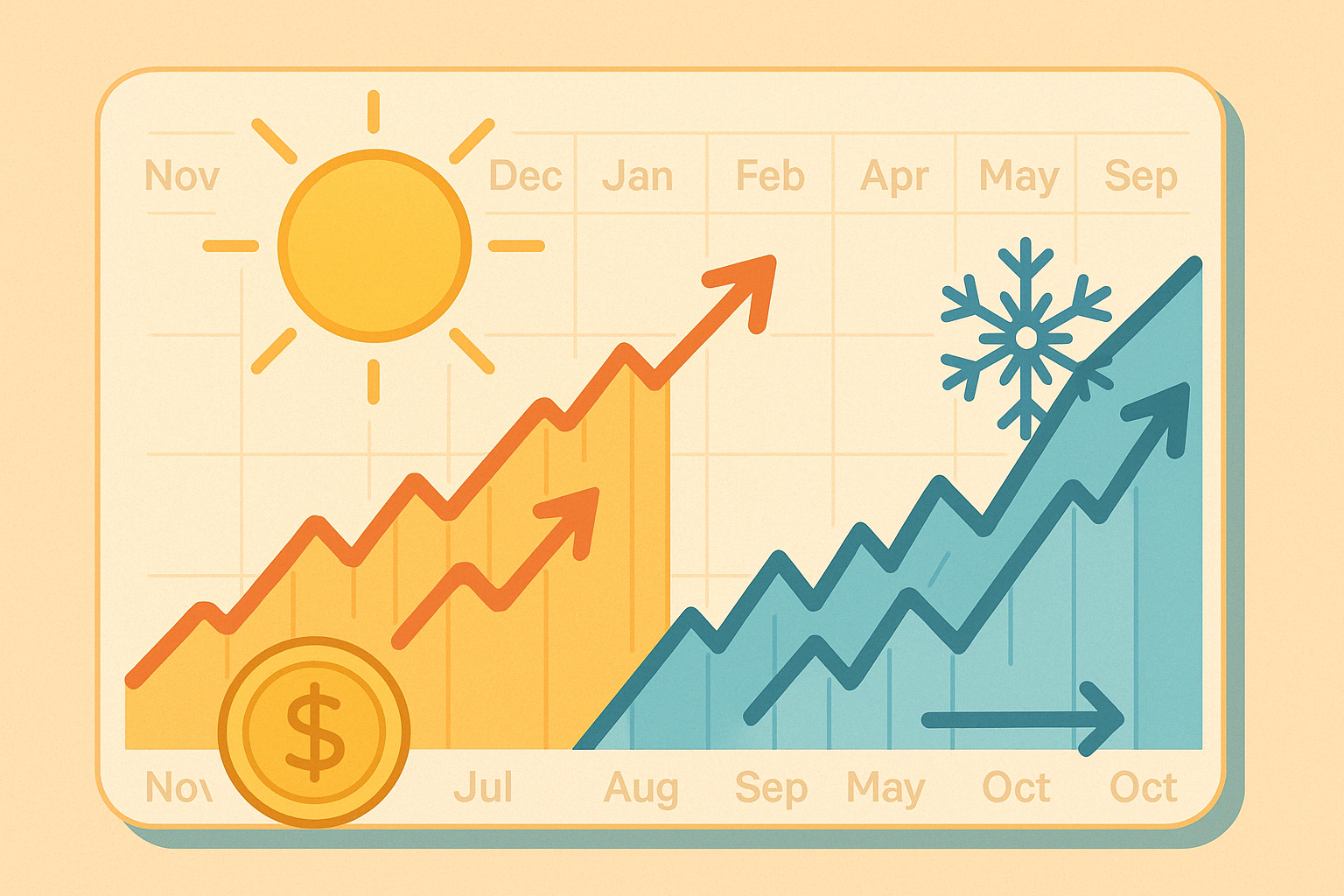

Market seasonality is all about recognizing recurring patterns in financial markets to time your trades effectively. These patterns, influenced by economic cycles and investor behavior, can guide when to enter or exit positions across stocks, forex, and commodities. Here's a quick summary:

- Key Insight: Historical data shows the S&P 500 often performs better from November to April (7.5% average return) than May to October (1.5% average return).

- Tools & Techniques: Use TradingView with LuxAlgo’s exclusive toolkits on TradingView—Signals & Overlays for real‑time scans, Price Action Concepts for automated pattern analysis, and Oscillator Matrix for multi‑timeframe indicators—to view seasonal charts, detect patterns, and backtest strategies.

- Risk Management: Stick to disciplined position sizing, clear risk‑reward ratios, and strategic stop‑loss placements.

- Sector Rotation: Focus on cyclical sectors during growth phases and defensive sectors during slower months.

Charting and Trading Seasonality: Tutorial

Finding Seasonal Patterns

Spotting seasonal patterns involves using advanced tools and analyzing historical data. Traders combine statistical techniques with modern technology to uncover actionable trends.

Seasonal Analysis Tools

TradingView, with access to LuxAlgo’s toolkits on TradingView, provides everything you need:

| Feature | Purpose | Application |

|---|---|---|

| Seasonal Charts | Visualize recurring patterns | Track historical price moves over calendar periods |

| Pattern Detection | Highlight statistically relevant trends | Automatically flag seasonal setups |

| Backtesting Tools | Validate strategy effectiveness | Test seasonal entries/exits on past data |

The Oscillator Matrix toolkit on TradingView includes a money flow indicator for detecting trend strength and divergences, helping confirm seasonal opportunities.

Market History Analysis

Once trends are identified, review extensive historical data—ideally 15–25 years—to confirm reliability. For example, the S&P 500 rose during October–December in 68 out of 96 years from 1928 to 2024, highlighting the strength of this seasonal pattern.

Pattern Analysis Mistakes

- Insufficient Data: Use at least the last 5–10 years to ensure relevance.

- Ignoring Significance: Aim for hit rates above 60%; for example, Allianz SE saw a 76% win rate between October 25 and December 7 over 25 years with 6.57% average moves.

- Mixing Cyclical & Seasonal: Distinguish calendar‑based seasonality from longer economic cycles by cross‑referencing technical indicators.

Seasonal Trading Methods

Technical Analysis with Seasonality

Combine seasonal patterns with technical indicators to refine entries and exits:

| Indicator Type | Purpose | Best Use Case |

|---|---|---|

| MACD | Trend confirmation | Lagging but reliable signals |

| RSI & Stochastics | Momentum | Quick entries/exits within seasonal windows |

| Bullish Percent Index | Trend validation | Works well with a 15‑day moving average |

"Seasonality analysis is a useful tool when looking at a general time to enter and exit equity markets and sectors. However, seasonality analysis is not precise." – Equity Clock

Use the Oscillator Matrix toolkit’s divergence alerts to align technical signals with seasonal trends for stronger confirmations.

Market Rotation Tactics

Historical returns: S&P 500 delivered 6.8% annualized from November to April but only 1.2% from May to October. A seasonal rotation might look like:

- Growth Phase (Nov–Apr): Focus on cyclical sectors—Technology (XLK), Consumer Discretionary (XLY).

- Slower Months (May–Oct): Shift to defensive—Health Care (XLV), Utilities (XLU), Staples (XLP).

- Low‑Volume Summer: June–Aug trading volume drops ~12%; reduce exposure or position size.

Risk Control for Seasonal Trading

| Element | Implementation | Metric |

|---|---|---|

| Position Sizing | Max 1% risk per trade | 1% of account balance |

| Risk‑Reward | Set clear profit targets | ≥1:2 ratio |

| Stop‑Loss | Adjust for seasonal volatility | Tailored to current conditions |

Advanced Seasonal Trading

Market Correlations in Seasons

| Market Type | Seasonal Correlation | Best Period |

|---|---|---|

| Small Caps | Strong positive | Nov–Apr |

| Cyclical | High with growth | Nov–Apr |

| Defensive | Inverse to cyclical | May–Oct |

A 1999–2018 study showed a cyclical→defensive rotation achieved 19.8% annualized returns with –30% max drawdown, versus 3.2% and –60% drawdown in reverse.

Economic Cycles and Seasons

Since 1997, global markets have spent ~39% in expansion, 35% slowdown, 18% contraction, 8% recovery. Quality stocks hold up in all phases, while value stocks excel in recovery/expansion. Use PMI to gauge current phase.

"Seasonality is basically a technical signal generator with an essentially fundamental background... as an external factor it is independent of standard indicators." – Dimitri Speck

AI Tools for Seasonal Trading

AI enhances pattern recognition and execution. LuxAlgo’s AI Backtesting Assistant (Ultimate plan, $59.99/mo) optimizes seasonal strategies via historical analysis and automated signals. Other options include TrendSpider for AI‑driven patterns and Trade Ideas’ AI, which has outperformed the S&P 500.

"LuxAlgo exactly allows me to see the market faster and confirm entries/exits and it's amazing!" – Çağrı Güler

Creating a Seasonal Trading System

Daily Trading Process

- Morning Analysis: Check economic calendars and use SeasonAlgo (30 years of data) to spot seasonal setups.

- Pattern Validation: Confirm with RSI or Stochastics.

- Execution & Management: Monitor positions against your risk parameters; set alerts for shifts.

Trading Tools Guide

| Tool | Key Features | Use Case |

|---|---|---|

| SeasonAlgo | 30 years of data, pattern recognition | Identifying & backtesting seasonal setups |

| Seasonax | High win‑rate patterns, intraday focus | Short‑term seasonal trades |

| LuxAlgo AI Backtesting | Automated optimization, real‑time scanning | Refining seasonal strategies |

"Seasonax provides an unrivalled depth of data, often more than 30 years... The intraday optimization is a helpful tool." – Iain Brown, Insight Investment

Conclusion

Key Takeaways

Seasonal trading relies on long‑term data and repeating patterns. Erasmus University’s study across 68 markets over 217 years found seasonality to be highly effective. Core insights:

- Data‑Driven: Tools like Seasonax cover 30+ years.

- Blended Strategies: Seasonal + technical

- Risk Awareness: Combine with fundamental analysis

- Sector‑Specific: Retail often outperforms in Nov, Mar, Feb

Steps to Start

| Step | Action | Focus |

|---|---|---|

| Research | Use Seasonax & SeasonAlgo | 30+ year patterns |

| Validate | Confirm with RSI/Stochastics | Signal alignment |

| Execute | Documented trades | Winter–summer cycles |

| Monitor | Compare to historical avg | Adjust as needed |