In this article we are going to do a deep dive exposing what makes a bad vendor, going through the history of indicator vendors, and outlining how vendors can actually have an overall positive impact for the community.

In this article we are going to do a deep dive exposing what makes a bad vendor, going through the history of indicator vendors, and outlining how vendors can actually have an overall positive impact for the community.

With a rather odd & convoluted history, the industry of selling access to technical indicators goes back further in time than most traders & investors are aware of.

A rather large majority of investors perceive the act of selling access to technical indicators as being in most relation to selling 'snake-oil'.

While this is true for many vendors who unfortunately market indicators as a 'get rich quick' scheme for trading, it's not true for every vendor.

Disclaimer: LuxAlgo is a provider of technical indicators (mostly free, but some paid), however, we will try to be as un-biased as possible in this piece. This article is purely for informational & educational purposes for the greater community.

Four Things That Make a Good Vendor

We could summarize this as a vendor who first & foremost follow TradingView vendor requirements, develops quality products, cares about the community, truly acknowledges that past performance is not necessarily indicative of future results, and has good business practices.

A step by step ruleset to follow of how to be a good vendor could be as follows:

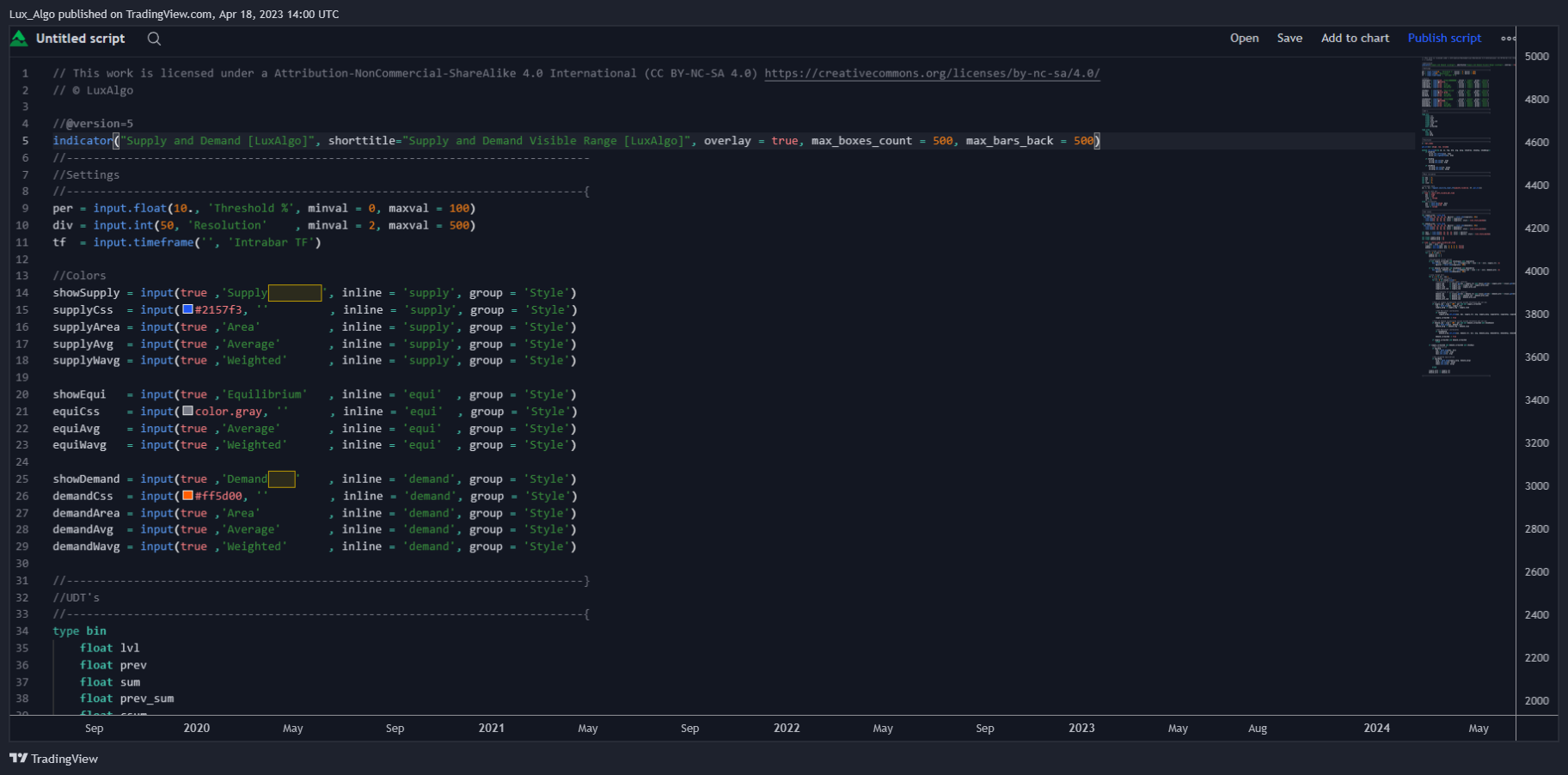

1. Publishes open-source scripts

Aside from the paid scripts, vendors should be easily able to contribute other publications with open-source code for the greater community.

Come on, let the world see that code! There shouldn't be any hesitation to contribute open-source scripts if a vendor is deeming themselves good enough to sell private indicators, right?

Well, there's not many other ways to immediately tell if their products are "quality" if a vendor has no open-source publications to show for themselves as a developer.

If someone is going to sell indicators, we believe in our opinion that they should be able to contribute to the community with open-source work as well in a notable way. This can also be a vendor's way of "giving back" or at least just a way to show they care about the community.

Many vendors completely disregard publishing open source as a means to building a community & also being contributive to the great platform with a userbase they're building a business on top of, while in fact, it does all of this in an extremely productive way.

A possible reason why many vendors do not prioritize publishing open-source scripts could be that they don't know how to do so in any case, so they stick to private script publications mostly (or entirely) to avoid having to be in the public eye of the broader TradingView / Pine Script community.

2. Doesn't use misleading marketing practices

Indicators can be marketed as quality, efficient, comprehensive, educational, and supportive tools for traders / investors.

There is a balance a vendor must have when it comes to marketing a technical indicator as a product.

To be clear, of course, it is only logical & common sense to display a product as 'good', and there's nothing wrong with that.

However, if a vendor goes too far, such as saying, "Our indicator has an 89% win rate!" or "How to turn $1k into $100k!" or even "Revealing the game-changing secret weapon that made trader $1M on 1 trade!" - then a vendor is simply using bad practices to acquire customers.

A great analogy can be an advertisement for a food company such as Pizza Hut. Of course, they want to make the pizza look great with excellent visuals, good lighting, & shiny cheese, however, they don't tell you by eating the pizza it will get you a 6-pack rock hard abs.

The same can be applied to marketing technical indicators as products. Of course, a vendor can display their product functioning well in good market conditions primarily, however, by claiming it has any sort of "win-rate" or guaranteed profits, a vendor is being misleading.

The only difference between the Pizza Hut ad & the technical indicator ad being it pertains to the analysis of financial markets, so, in general there should also be proper disclaimers where fit to address consumer expectations using such products.

3. Isn't misleading or overpromising in branding

This goes hand-in-hand with the point made above on marketing.

If a brand itself is in relation to generating profits like "Profit-Bot" or a product / feature is called "10x-Gains-Moving-Average"... the vendor is likely en-route to problems in the long run with the business (bad reviews, business disputes, poor community, etc).

A great business is made on transparency, providing value, caring about customers, and making a difference within an industry for the better.

The more a business does good by customers, the healthier the business will be, & the longer the business will last.

Within the space of technical indicators as products, no matter how transparent the marketing / website is, many customers will still have the impression that they will use these products to help themselves 'make profits'.

While this is of course mostly everyone's goal being involved in financial markets in the first place, it calls for a good balance in the presentation of the indicators as well as setting expectations clear by communicating realistic expectations to customers as best as possible.

One thing vendors can easily do to be transparent, honest, & an overall good actor in the industry is to provide a generous refund policy to ensure consumers who may still have the wrong idea about the intended usage have the opportuntiy to move on with a full refund.

Executing on a good refund policy tends to be the most successful strategy for vendors opposed to free trials even for managing expectations because free trials can attract even less experienced traders who don't want to take the time to learn the product itself no matter how many times they have directed to not follow indicators blindly.

There are many instances of where this is seen as similarly true within digital products in general such as plug-ins, educational programs, etc.

4. Creates unique products

This should be a given, however, it's something we thought we should mention as many vendors tend to impersonate or completely mimic other products already existing in hopes of theirs attaining the same level of attention.

The reality is most technical indicators as products have already seen a high level of adoption from the broader community and it universally is known to them that there are knockoff products existing already.

Joining forces with the knockoffs is not a good bet in any endeavor and we believe that originality can go a long way in this industry as well.

What Makes A Bad Vendor?

This can be easily summed up in one image:

You know what they say, if something sounds too good to be true... it probably is.

If someone is standing in front of an exotic car, flashing cash, and telling you they got this rad lifestyle by using their trading indicator... it should immediately raise 1,000 red flags for you.

There's no such thing as getting rich quick, especially based on the functionality of a technical indicator. Period.

This type of malicious marketing is extremely harmful to people as it directly gives them false hopes, plays into desperation, and is from a common-sense perspective; a deceptive marketing tactic used by charlatans.

Bad vendors do not publish any open-source contributions and primarily just stick to marketing indicators in misleading ways that overall harm the community.

There are many potential reasons as to why vendors market indicators in misleading ways:

– They don't understand indicators & they are actually snake-oil salesmen (image above).

– They do understand indicators, maybe have something decent developed, but just don't know how else to market indicators other than promising profits.

– They may have tried marketing in non-misleading ways before, found that misleading marketing is producing the most sales for them, so they became fueled with greed & doubled-down on the misleading claims when marketing their product regardless. (Instead of trying to build a reputable business.)

How Vendors Can Benefit The Financial Community

Vendors have the power to reach more people, since at the end of the day, there is a business established behind them with marketing efforts.

We believe that people will buy indicators no matter what and that this is a real established market as products for traders, regardless of what the majority of investors think of it.

So, as long as there are good actors primarily at the top of the industry, this is what's best for the community overall, and possibly the overall perception of indicator vendors can change eventually.

Good acting vendors with the right practices as listed earlier in this article are able to educate more people through marketing their products, community growth, & open-source contributions that they publish as well.

All in turn, growing the broader interest in the scripting community which helps grow technical analysis further by having a larger number of users provide feedback to each other & further improve the space over time.

In the case of LuxAlgo as a provider for example, it would not have been possible to grow a TradingView following of 200,000+ without the marketing efforts outside of TradingView on platforms like YouTube, Instagram, and even TikTok for all indicators we have created (free & paid).

Which has certainly grown into a large community, which over time has meaningfully contributed to the interest in custom technical indicators & the scripting community overall in general.

In the case of a bad acting vendor, this is the exact opposite & bad for the community overall because they do not make any good contribution to the community and just merely exist to try & sell access to their private indicators.

Do Paid Indicators "Work" Better Than Free Indicators?

If you are defining the word "work" as "make more profits", then the answer is a hard no in all cases.

If you are defining the word "work" as in "being more useful", then it truly just depends on how comprehensive or unique the indicator is.

We believe that indicators are best used as supportive tools for decision making, so it's important to be asking this question in the right context & with this understanding when considering a product.

In the context of LuxAlgo Premium indicators specifically, we believe the answer is yes due to how the indicators were designed as all-in-one toolkits that include presets, filters, & various customization/optimization methods specifically designed to help traders embrace their trading style.

The position for paid indicators to exist under a subscription model is primarily done since indicators can be frequently updated / improved over time based on the user's feedback.

There are, however, other aspects of paid indicators which could be legitimately more useful than anything you can find for free in some other cases such as unique volume-based tools, extensive market scanner scripts, etc.

Although, it is quite limited when it comes to traditional technical indicators such as moving averages or signal-based indicators to make a strong argument that one is better than another in any meaningful way.

In most cases, you can take one indicator and overfit it to appear "better" or "more accurate" than another indicator by finding more specific market conditions or settings that has an advantage over another.

As a technical analyst, you begin to understand this once you have experimented with vast amounts of technical indicators with different use cases and have thoroughly reflected on its actual benefits to you. It's truly impossible to make an alternative argument in all cases, including debatably all paid technical indicators in existence right now.

The Real Value Proposition of Paid Technical Indicators

Since we can conclude in mostly all scenarios that paid indicators don't "work" better than free indicators in a technical sense when referring to its accuracy or direct visual aid to a trader, it begs to question what the actual value proposition can be for a vendor selling access to indicators.

A large part of the alternative value prop for a vendor may fall under the community & education that it provides under the brand, or additionally, the prospect of a vendor making paid indicators more interoperable with other applications such as large-scale alerts systems or cross-platform functionality.

Many vendors may try to create value propositions for their paid indicators by hosting a signal group where analysts callout trades using their paid indicators, however, this typically will be done in misleading ways over-hyping the usage and is not generally a good practice for vendors or users in our opinion.

With all of this mentioned, it may seem that the entire industry is full of charlatans at times, however, we do not believe the space will remain like this forever.

Should This Be A More Legitimized Industry?

The history of paid indicators goes all the way back to the 1980's with John Ehlhers & Mark Jurik being two notable figures providing paid tools through websites on various charting platforms.

There was also a rather strange ecosystem of products with generally 'awkward' branding existing on older charting platforms since the early 2,000's. Some of which on these platforms still exist to this day. While interestingly enough, practically none of these brands ever grew past being considered small plug-ins.

Some considerably large educational programs / memberships throughout the 2,000's (& some existing still to this day) have implemented indicators as a part of their offerings, although they typically tend to integrate indicators only to add on to their sales funnel styled websites in hopes to add unique value to their "life changing online course" positioning, so we won't mention any names.

Additionally, while most new traders are likely unaware, TradingView had an app-store marketplace themselves in the 2010's called "marketplace add-ons" where users could purchase indicators from various vendors within their indicators tab alongside the Public Library now called Community Scripts.

Likely as the TradingView platform & Pine Script was mass-adopted on a larger scale, this marketplace was discontinued for various reasons with the adoption of invite-only scripts, where anyone with a premium account can manage access on these types of script publications.

This pivotal shift leveled the playing field for the industry whereas it created a new ecosystem of vendors who all could leverage their ability to manage access to users without appearing as "just another marketplace add-on", but rather, actual brands themselves.

While keeping this piece as un-biased as possible, this is where LuxAlgo was born, & generally speaking, was primarily the inspiration for the hundreds of "Algo" brands popping up all over the internet trying to sell TradingView indicators due to our reputation in this environment.

In this current landscape, we believe there is an established ecosystem that has potential to mature further into a 'healthy' industry, so to speak... as mentioned earlier, just as long as there are more good actors leading it than bad.

We are also hopeful for platforms to recognize this evolution themselves & directly support the ecosystem to grow more efficiently with stronger operations over time while still allowing these brands their own independence as they have now.

It's very optimistic considering the realization of how popular the ecosystem has become & with the prospect of vendors within it to lead it in positive ways, which overall brings more people to TradingView & grows genuine interest in the Pine Script community from all over the internet very effectively.

Conclusion

We strongly believe indicator vendors will always exist in some capacity considering the 30–40-year history, the rise of digital products on the internet, as well as the growing popularity of indicator vendors in this current landscape. Considering this, it's important to ensure the brands leading the space are good actors so the space itself can mature long-term.

As a prominent figure in this industry, we hope from this article to have provided a lot of transparency for the broader community of traders & investors who may not have been aware of this space in such detail, as well as for any aspiring vendors to hopefully look to us and what we have outlined as a good role model / checklist for the sake of making this industry more legitimized in the future.

Thank you for reading!

- Sean Mackey (Founder @LuxAlgo)

We'd like to acknowledge...

Alex Pierrefeu (TradingView profile: @alexgrover) for being a massive leader at LuxAlgo since the beginning & going deep all the time creating theories with me about technical analysis & the industry with genuine fascination.

John Ehlers for being what we call the grandfather of this entire industry dating back to the 1980's with MESA Software.

Mark Jurik as a serious 'wave maker' with Jurik Research and for leading the way in the early 2,000's as a provider of unique tools.

@ChrisMoody for being a real "OG" in the TradingView community & for some cool discussions about the history of the industry early on.

All of the amazing users of LuxAlgo Premium since early 2020 and the entire community who provide us feedback to improve our indicators over time.

Everyone in the Pine Script community who follows us on TradingView & enjoys our contributions.

The @PineCoders team for being extremely helpful moderating the platform & for listening to our feedback / dealing with us throughout the years.

And lastly @TradingView for being the greatest platform for traders / investors and for making all of this possible in the first place.