Automate your trading strategies effortlessly with a platform that executes orders based on signals, supporting various assets and brokers.

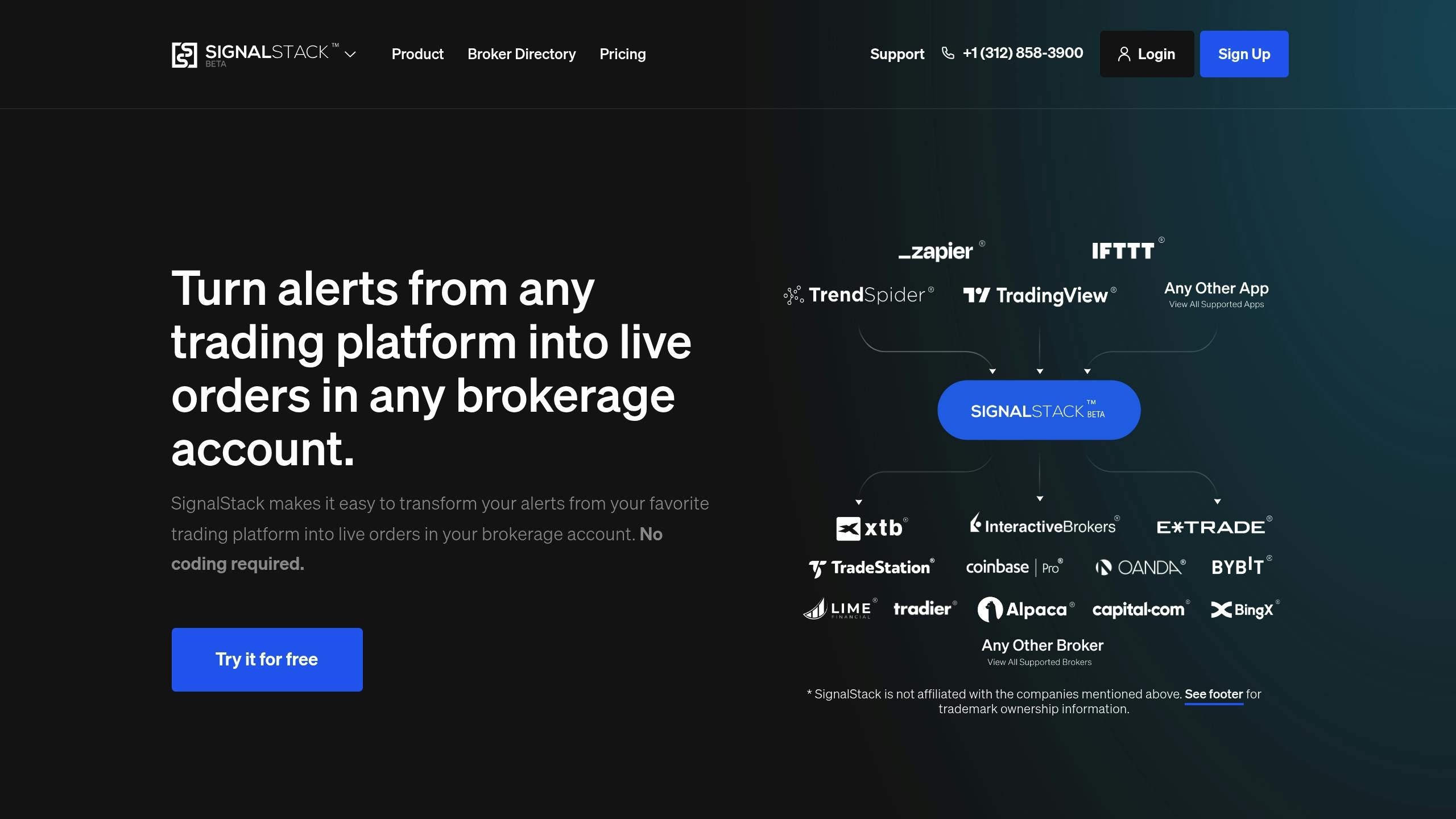

SignalStack is a platform that automates trading by turning signals from charting tools into executed orders at brokers – no coding required. It supports stocks, crypto, forex, and more, with features like fast execution (0.45 seconds), 99.99% uptime, and integration with 33+ brokers.

Key Features:

- Order Types: Market, Limit, Stop, Stop-Limit

- Asset Classes: Stocks, Crypto, Forex, Futures, CFDs

- Pricing: First 25 signals free, then $1.49 to $0.59 per signal

- Broker Integrations: Alpaca, Coinbase Pro, Oanda, and more

- Execution Speed: Under 0.45 seconds

Why Use SignalStack:

- Automates trading strategies without coding.

- Supports multiple brokers and asset types.

- Reduces emotional decisions with consistent execution.

Comparison Table:

| Feature | SignalStack | TradersPost | Alertatron |

|---|---|---|---|

| Monthly Cost | $27 | $49.99 | $29 |

| Asset Coverage | Stocks, Crypto, Forex, Futures, CFDs | Stocks, Crypto, Futures, Options | Crypto only |

| Webhook Signals | 50/month | Unlimited | 150/day |

| Free Trial | 25 free signals | 7-day paper trading | 14-day paper trading (5 signals/day) |

| Execution Speed | 0.45 seconds | Not specified | Not specified |

| Broker Integrations | 33+ brokers | Limited | Limited |

SignalStack is ideal for traders seeking fast, reliable, and automated trading across various assets and brokers.

Setup Guide

Initial Setup Steps

SignalStack makes automating your trading strategies quick and easy with a simple five-step process.

Start by registering your account and selecting your signal source, such as TradingView or TrendSpider. The interface provides clear feedback – light green for success and red for errors.

| Setup Phase | Configuration Details |

|---|---|

| Account Creation | Verify email, set up password |

| Signal Source | Connect TradingView or TrendSpider |

| Order Config | Define trade parameters and sizing |

| Stack Activation | Set up alert endpoints |

| Validation | Test your configuration |

Once you’ve completed your account setup and signal configuration, the next step is linking your broker accounts.

Platform Connections

SignalStack supports order routing to over 33 brokers and exchanges. Its one-click integration system securely connects both live and paper trading accounts without hassle.

Supported platforms include:

- Stock Brokers: Alpaca, Tradier, Tradestation

- Crypto Exchanges: ByBit, Coinbase Pro

- Forex Platforms: Oanda

Here’s how to get started:

- Choose Signal Source: Select your preferred charting tool.

- Connect Broker: Use the secure one-click connection to link your brokerage account. You can connect multiple accounts without additional costs.

- Set Parameters: Configure and test your order parameters in real time before activating them.

Once everything is set up, your automated trading system will be ready to execute signals seamlessly through your configured stack.

Signal and Trade Automation

Alert to Trade Process

SignalStack simplifies trading by instantly turning alerts from charting platforms into actual trades. It processes incoming signals and typically executes orders in just 0.45 seconds.

Here’s how the process works:

| Stage | Action | Details |

|---|---|---|

| Signal Reception | Alert Capture | Captures webhook alerts from platforms like TradingView and TrendSpider |

| Processing | Order Generation | Converts alert data into a standardized order format |

| Execution | Trade Placement | Sends the order to the connected broker or exchange |

| Confirmation | Status Update | Delivers real-time feedback on the order’s execution |

This quick and efficient system enables a variety of trading possibilities.

Trading Options

SignalStack lets traders automate a broad range of strategies across different assets and order types.

Supported order types include:

- Market Orders: Execute instantly at the current price.

- Limit Orders: Execute only when the price hits a specific target.

- Stop Orders: Automatically trigger trades to manage risk.

You can automate trades for stocks, cryptocurrencies, futures, forex, and CFDs, each following its market’s rules and standards.

Advanced Tools

Strategy Builder

SignalStack enables traders to automate everything from simple alerts to complete strategies – no coding required. With broad asset coverage, the platform makes handling complex automated trading setups straightforward and efficient.

Here’s what the Strategy Builder brings to the table:

| Feature | Function | Benefit |

|---|---|---|

| Custom Alerts | Create personalized price and indicator alerts | Execute strategies tailored to your needs |

| Rule Configuration | Define entry/exit conditions and order parameters | Manage trades with precision |

| Testing Environment | Test strategies before deploying them live | Minimize risks |

| Performance Tracking | Track results with detailed logs | Fine-tune strategies for better results |

SignalStack offers over 1,000 pages of documentation to help traders make the most of the Strategy Builder. Beginners can start with basic price alerts and gradually add more advanced conditions like volume metrics or technical indicators.

While the Strategy Builder helps fine-tune your trading strategies, managing multiple broker accounts is just as seamless.

Multi-Broker Management

SignalStack simplifies trading for those juggling multiple accounts by offering a unified platform. Currently, it supports integrations with over 33 brokers.

Here’s why the multi-broker system stands out:

- Quick Integration: Connect multiple brokerage accounts instantly, with no extra setup costs.

- Centralized Dashboard: Oversee all trading activities in one place.

- Reliable Execution: Ensures fast and consistent trades across all connected brokers.

For added flexibility, SignalStack integrates with Zapier, allowing traders to connect their strategies with unsupported apps or build intricate workflows. This is especially useful for institutional traders handling multiple accounts.

Platform Comparison

Feature Analysis

SignalStack stands out in the trading automation market with several standout features. Here’s how it compares to two major competitors:

| Feature | SignalStack | TradersPost | Alertatron |

|---|---|---|---|

| Monthly Cost | $27 | $49.99 | $29 |

| Asset Coverage | Stocks, Futures, Options, Crypto, Forex, CFDs | Stocks, Futures, Options, Crypto | Crypto only |

| Webhook Signals | 50/month | Unlimited | 150/day |

| Free Trial | 25 free signals | 7-day paper trading | 14-day paper trading (5 signals/day) |

| Order Execution Speed | 0.45 seconds | Not specified | Not specified |

| System Uptime | 99.99% | Not specified | Not specified |

| Broker Integrations | 33+ brokers | Limited selection | Limited selection |

This table highlights how SignalStack offers a mix of affordability, asset diversity, and strong technical performance.

Key Differences

SignalStack sets itself apart from competitors through several distinct advantages:

- Flexible Pricing: With a usage-based model and 25 free signals, SignalStack allows traders to scale their costs based on their needs, making it a budget-friendly option.

- Ease of Use: No coding skills are required. SignalStack automatically converts alerts from any trading platform into executed orders, making it accessible for traders without technical expertise.

- Wide Broker Support: Supporting over 33 brokers, SignalStack provides traders with more options compared to competitors, which often have fewer integrations.

While TradersPost offers unlimited webhook signals, SignalStack balances this with faster execution times and broader asset support. These features make it a strong choice for traders seeking reliability and flexibility across multiple asset types.

How to Connect SignalStack to Your Broker & Third-Party Trading Tool

Usage Tips

Streamline your trading process by blending automated tools with thoughtful risk management.

Strategy Tips

Boost your trading game with these practical strategies:

- Connect your charting platform to SignalStack’s webhook system for seamless multi-platform monitoring. For instance, when using TradingView alerts, take advantage of the dynamic order variable {{strategy.order.action}}. This allows you to set up alerts that automatically handle different order types.

- Use Zapier integration to build advanced automation workflows. This feature lets you link multiple signal sources, making your trading setup more dynamic and efficient.

- Keep a close eye on both your brokerage account and charting platform. SignalStack’s lightning-fast execution – just 0.45 seconds – ensures you can execute time-sensitive strategies with precision and confidence.

"SignalStack automatically converts any trading platform alert into an executed order in any brokerage account." – BuyStocks.ai

These tools and strategies are key to maintaining control while executing trades.

Risk Controls

Take a structured approach to manage risks effectively:

Order Type Configuration

| Order Type | Purpose | Tips for Implementation |

|---|---|---|

| Stop-Loss | Minimize potential losses | Set stops that align with your risk limits |

| Limit Orders | Secure profits | Place take-profit orders at target levels |

| Stop-Limit | Control entry prices | Ideal for handling volatile market scenarios |

System Safety Measures

Set up automated alerts to stay informed about any system exceptions.

For better risk management, consider these steps:

- Backtest your strategies to ensure they perform as expected.

- Set position size limits to avoid overexposure.

- Enable failure notifications to catch any issues early.

- Regularly monitor system uptime for uninterrupted performance.

When trying out new strategies, begin with smaller positions. Gradually increase your trade size as you confirm the reliability of your automation. This approach helps you stay in control while taking full advantage of SignalStack’s broad broker network.

Final Assessment

Let’s take a closer look at SignalStack’s current performance and what lies ahead.

Target Users

SignalStack simplifies automated trading by removing the need for coding. Its infrastructure is built to handle the needs of both individual and institutional traders.

| Trader Type | Primary Benefits | Best Use Cases |

|---|---|---|

| Retail Traders | Easy automation, multi-broker access | Basic trigger-based strategies |

| Active Traders | Quick execution, reliable platform | Time-sensitive trading strategies |

| Portfolio Managers | Support for multiple assets, custom alerts | Managing complex portfolios |

Performance Highlights

SignalStack enhances trading workflows by:

- Ensuring fast and reliable trade execution, which is critical for success.

- Reducing manual mistakes through automated processes.

- Providing flexible scaling options with its usage-based pricing model.

These features make it a strong contender for traders looking to improve efficiency.

What’s Next?

SignalStack’s roadmap includes plans to integrate more signal sources and expand its broker network. These updates aim to improve automation capabilities and increase broker options.