In this series about chart patterns we previously discussed narrowing wedges patterns, explaining their identification rules, the measure rule associated with them, and various observations.

In this series about chart patterns we previously discussed narrowing wedges patterns, explaining their identification rules, the measure rule associated with them, and various observations.

In this series about chart patterns we previously discussed narrowing wedges patterns, explaining their identification rules, the measure rule associated with them, and various observations.

In this post, we will cover head & shoulders , inverse head & shoulders , and their complex counterpart. We will cover their identification rules, measure rules, and share some observations regarding these unique yet popular patterns.

The topics covered in this post are mostly based on the work of Bulkowski on chart patterns (1).

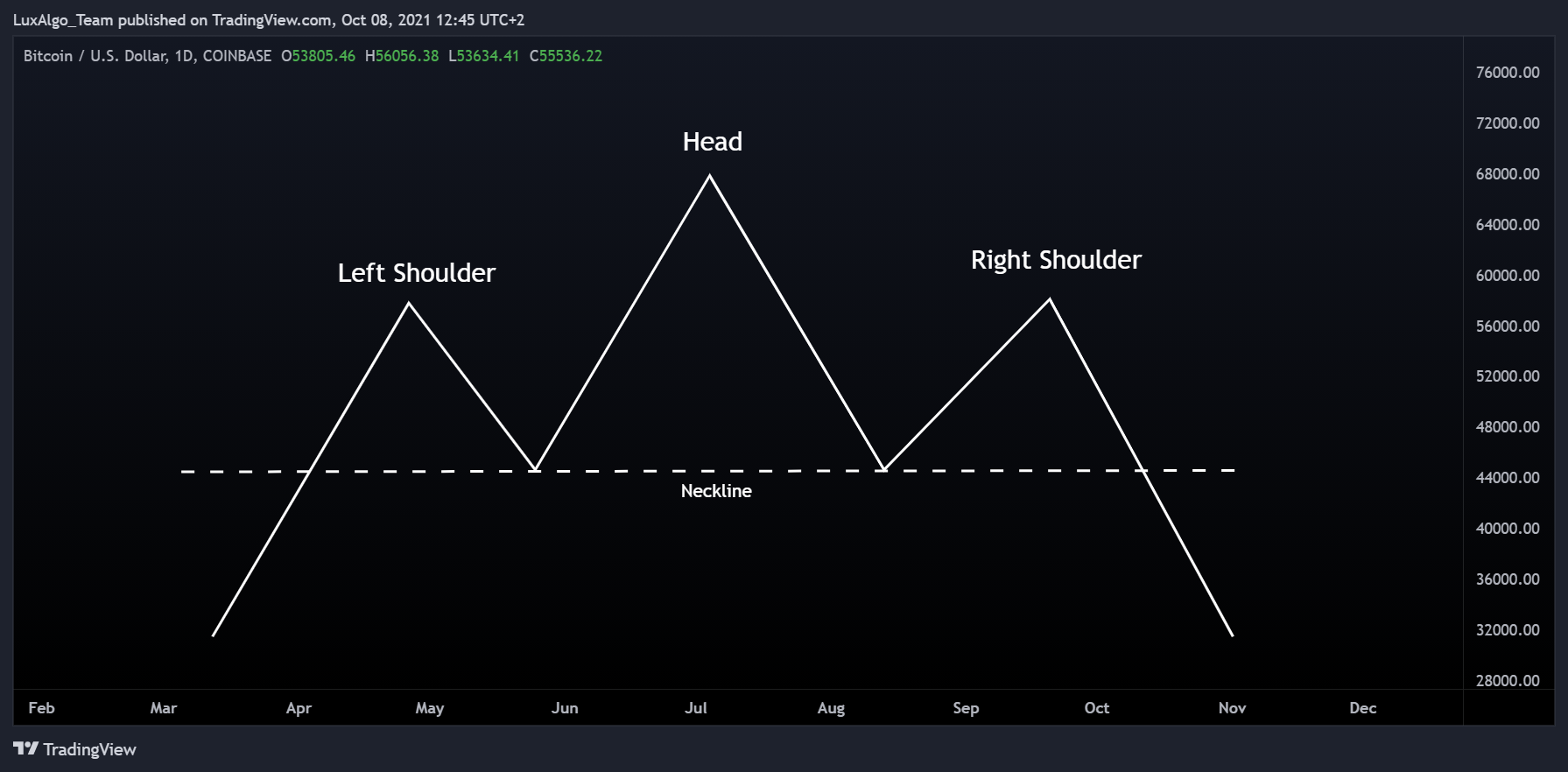

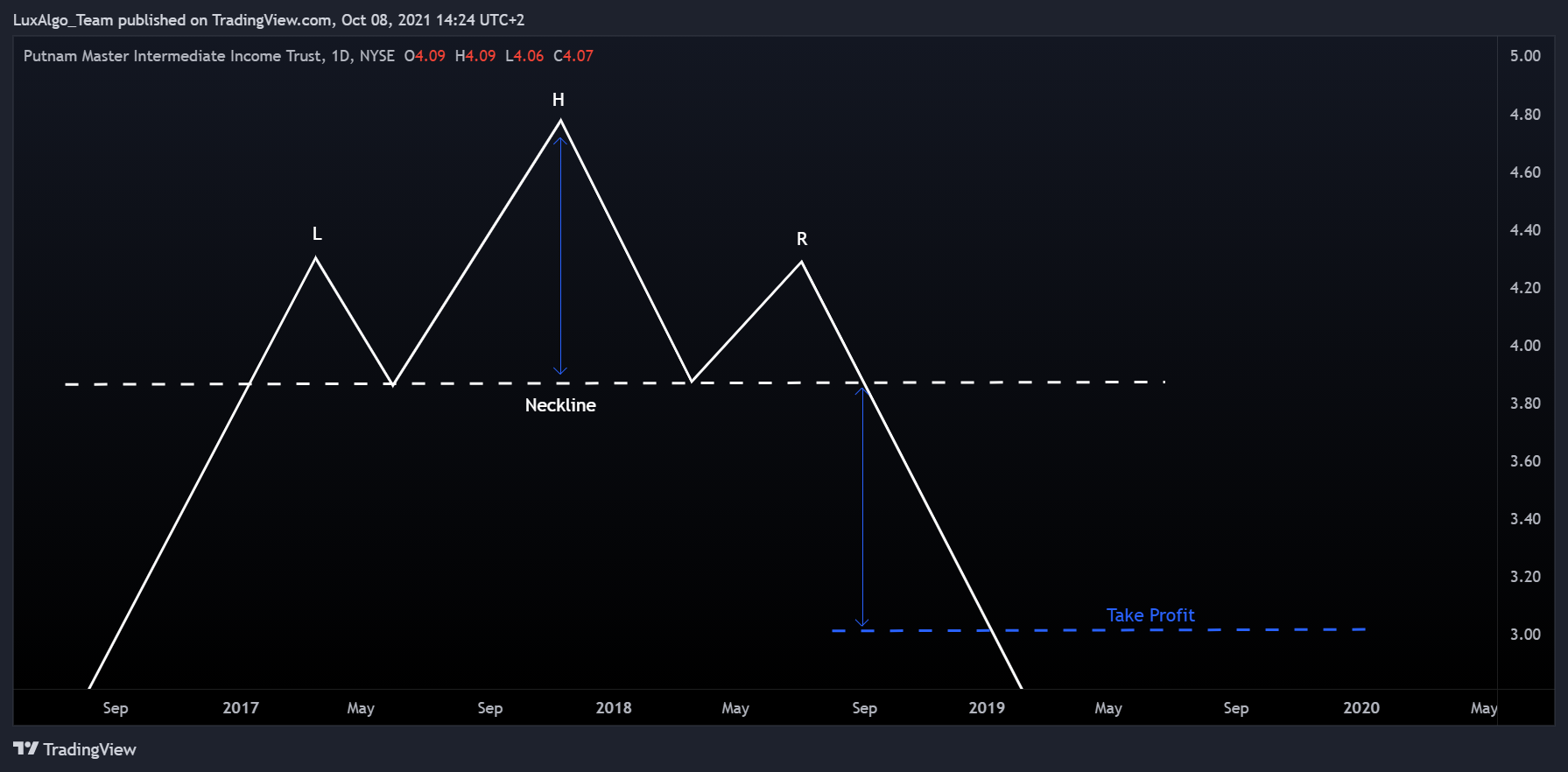

Head And Shoulders (HNS)

The head and shoulder pattern also referred to as Head-and-Shoulders Tops by Bulkowski, is a bearish reversal structure commonly found in uptrends, characterized by a series of three maxima with the center maxima higher than the other two.

The first maxima is denoted as "Left Shoulder", the second maxima (the highest one in the formation) is denoted as "Head", and the third maxima is denoted as "Right Shoulder". The volume on a head and shouldersformation should be decreasing over time.

Bulkwoski points out that symmetry can play an important role in the validity of an H&S pattern.

1: H&S = Left Shoulder < Head > Right Shoulder

2: Left Shoulder ≈ Right Shoulder

The first and second maxima are followed by two minima, the line connecting these two-point form the "neckline". Price breaking the neckline downward is a bearish signal (note that a low volume breakout is not indicative of a potential failure).

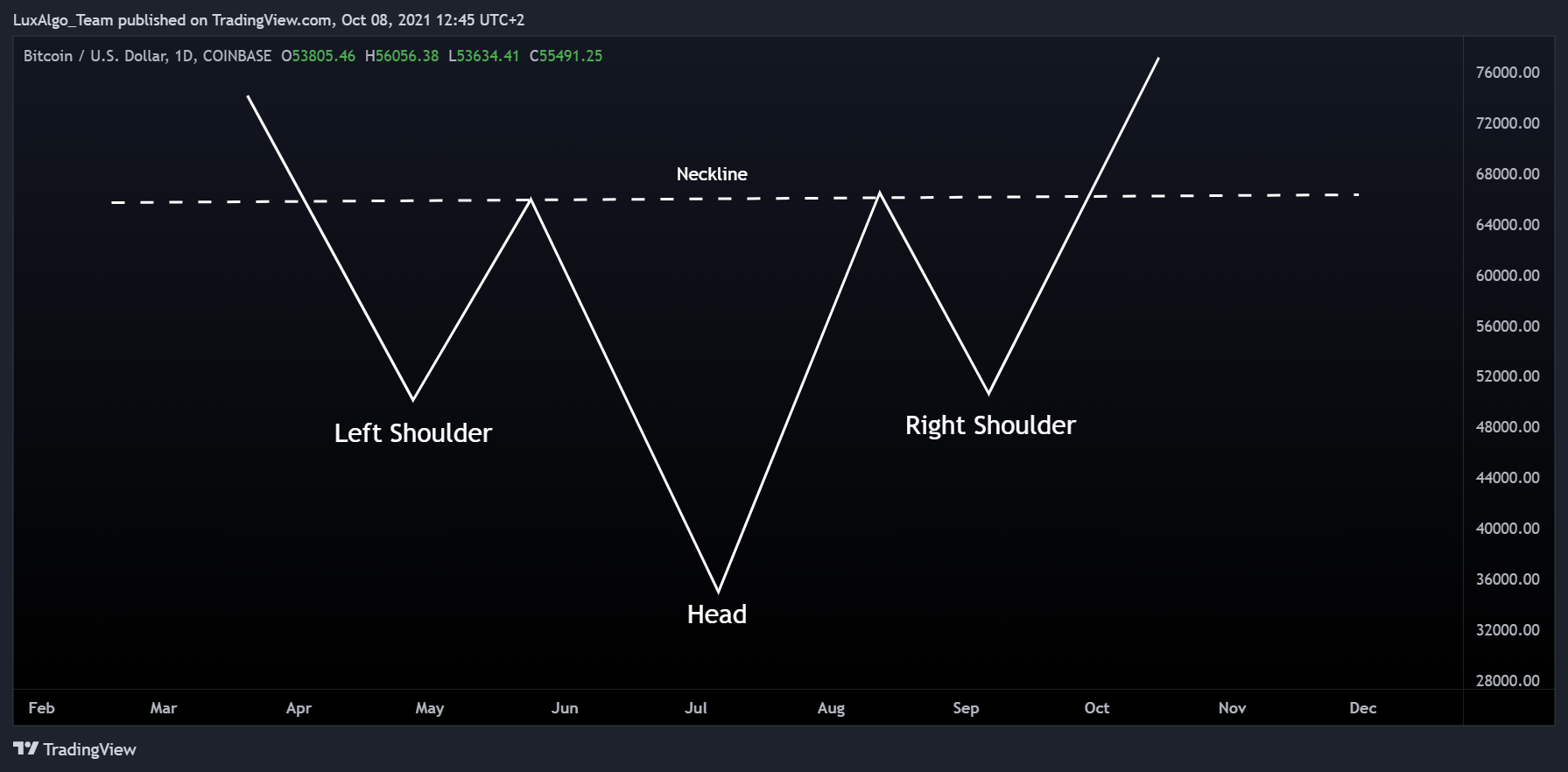

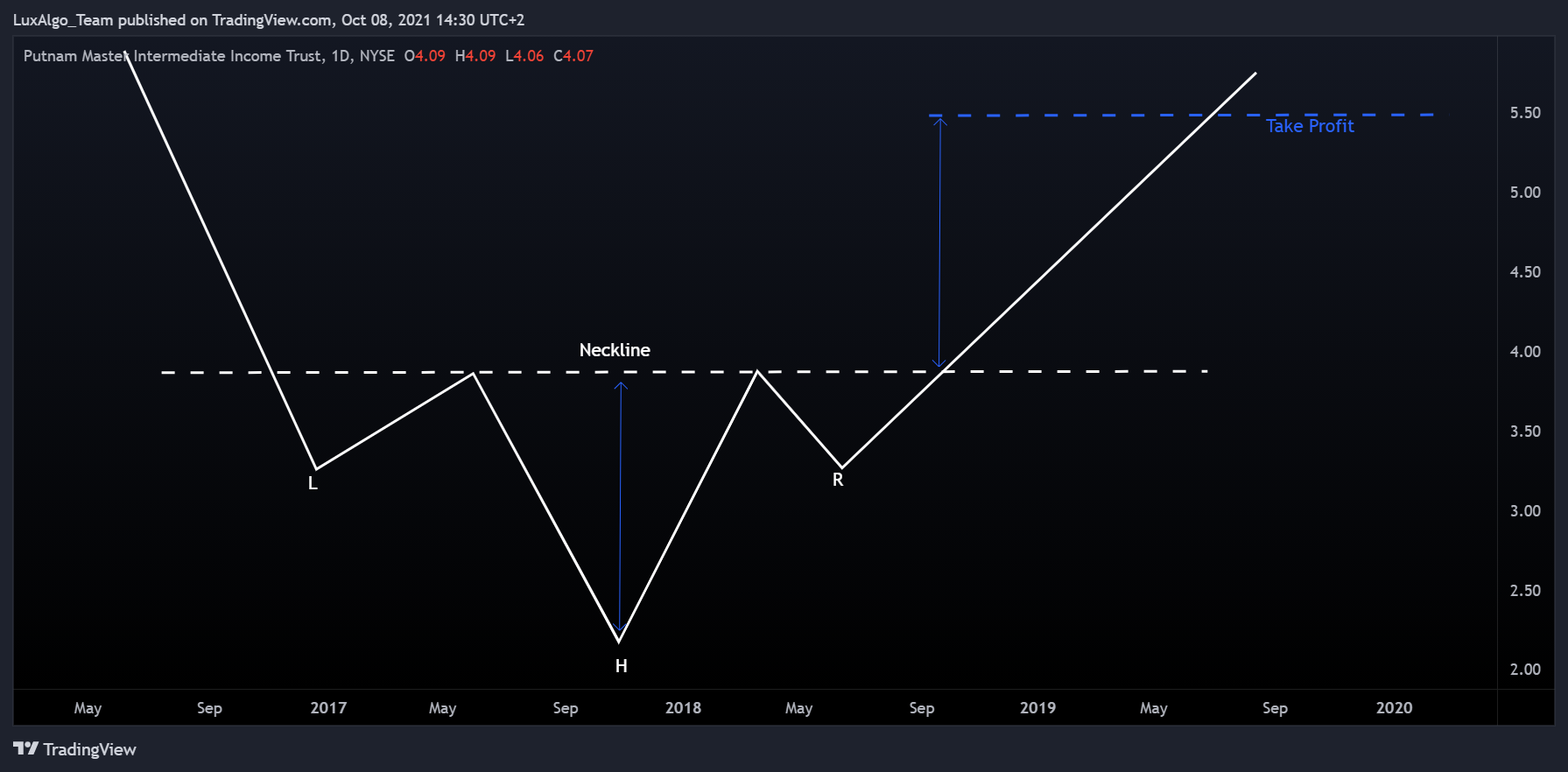

Inverted Head And Shoulders (IHS)

The inverted head and shoulder pattern also referred to as Head-and-Shoulders Bottoms by Bulkowski, is a bullish reversal structure commonly found in downtrends, characterized by a series of three minima with the centre minima lower than the previous two.

The first minima is denoted as "Left Shoulder", the second minima (the lowest one in the formation) is denoted as "Head", and the third minima is denoted as "Right Shoulder". Like with a regular H&S , the volumeshould be decreasing over time.

We can see it's simply a regular H&S pattern, but inverted.

1: Inverted H&S = Left Shoulder > Head < Right Shoulder

2: Left Shoulder ≈ Right Shoulder

The first and second minima are followed by two maxima, the line connecting these two-point form the "neckline". Price breaking the neckline upward is a bullish signal (note that a low volume breakout is not indicative of a potential failure).

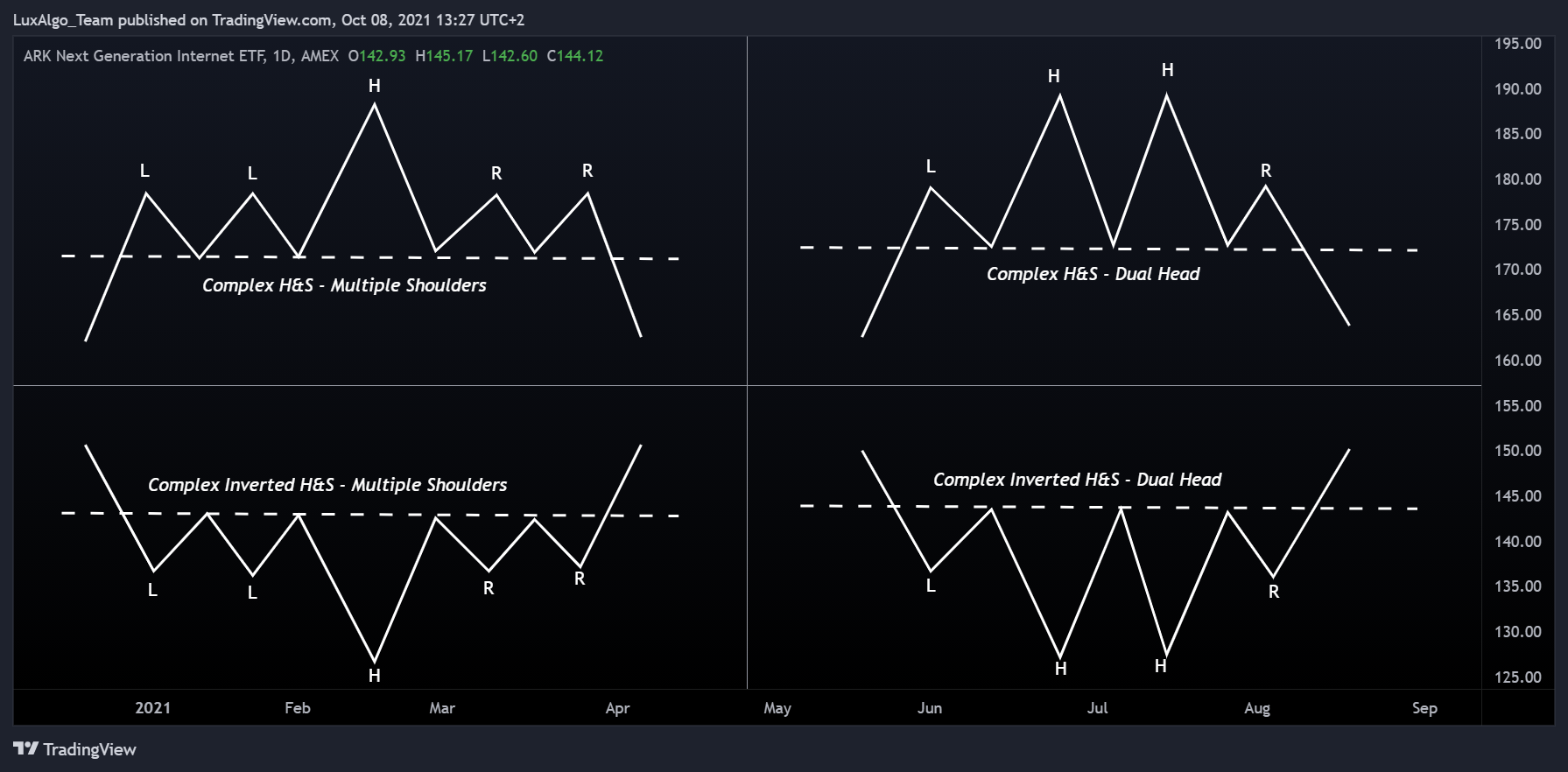

Complex Variations

Bulkowski presents two complex variations to the H&S and inverted H&Spatterns. These complex variations are similar to the regular ones but have the particularity of having multiple shoulders on each side or multiple heads.

Measure Rule

The measure rule for head and shoulders formations allows the determination for the level of taking profits and stop losses after a breakout of the neckline.

In the case of a regular H&S , the take profit should be set at the breakout point minus the height between the formation head value and the neckline value where the head is located.

The same applies to inverted H&S , the take profit should be set at the breakout point plus the height between the formation neckline value where the head is located and the formation head value.

In the case of a complex dual-head H&S formation, the head value that should be selected is the lowest one.

Observations

Head and shoulders formations can sometimes be encountered within diamonds formations.

Osler identifies head-and-shoulders trading as a type of noise trading and points out that the immediate price effect of head-and-shoulders trades disappears slowly but completely over the subsequent two weeks (2).

Caginalp and Balevonich found that head and shoulders patterns can be obtained as a consequence of a single group of investors with identical motivations and assessment of the value of the financial instrument (3).

References

(1) Bulkowski, T. N. (2021). Encyclopedia of chart patterns. John Wiley & Sons.

(2) Osler, C. (1998). Identifying Noise Traders: The Head-and-Shoulders Pattern in U.S. Equities. Federal Reserve Bank of New York Research Paper Series.

(3) Caginalp, G., & Balevonich, D. (2003). A Theoretical Foundation for Technical Analysis . Capital Markets: Market Microstructure eJournal.