Explore the top CFD prop trading firms for retail traders in 2025, offering various funding options, profit splits, and evaluation structures.

- DNA Funded: Offers funding up to $600,000, profit splits of 80%-90%, and flexible challenges starting at $49.

- Funded Trading Plus prop firm: Scale accounts to $2.5M with profit splits up to 100%. Fees start at $119, and instant funding options are available.

- ThinkCapital: Budget-friendly with fees starting at $39. Offers funding up to $1.5M and multiple evaluation paths.

- FTMO prop firm challenge: Trusted by 240,000+ traders. Start with $200,000 funding, scale to $2M, and enjoy profit splits up to 90%.

- FundedNext: Industry-leading funding up to $4M with profit splits as high as 95%. Entry fees start at $32.

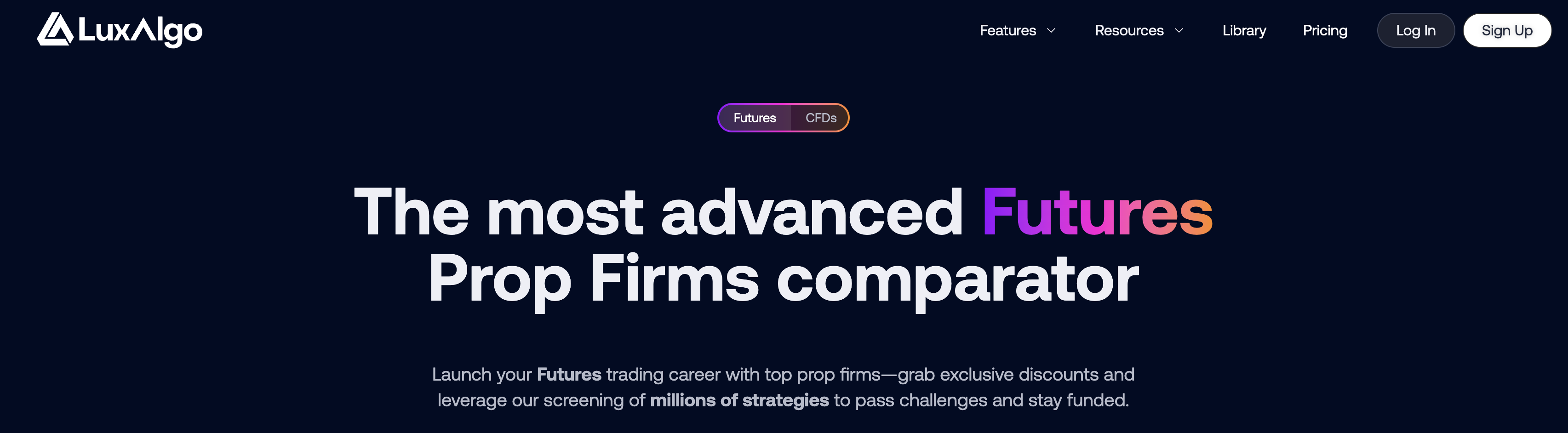

Passing Prop Firm Challenges With Ready-to-Use Strategies

Prop firm evaluations can feel deceptively simple: hit a profit target, respect drawdown rules, and stay consistent. In reality, most traders fail because they’re forced to prove performance under pressure, with strict limits on daily loss, overall drawdown, and sometimes minimum trading days.

If your goal is to pass more challenges with fewer resets, the most practical edge is trading a plan that has already been pressure-tested. That’s why LuxAlgo makes it easy to access ready-to-use prop firm strategies you can run as a structured approach for evaluations. You can explore them directly on the LuxAlgo prop firm strategies page.

These strategies are built to help you trade the evaluation the way it’s designed:

- Proven to work in the past by demonstrating performance across historical market conditions.

- Would have passed historical challenges based on rule-sets similar to real prop firm evaluation constraints.

- Higher probability of passing current challenges because they’re designed around repeatable execution and risk controls—exactly what prop firms reward.

More detail about the LuxAlgo prop firm strategies page: it’s built for speed and clarity—so you can quickly find strategies tailored to the type of prop firm you’re targeting, then apply them without starting from scratch. Instead of guessing what might work, you can filter down to practical approaches that align with common challenge rules (targets, drawdown limits, and consistency requirements).

How users can access strategies quickly: visit the LuxAlgo prop-firms portal, choose a firm (or compare multiple), then jump straight into the strategies designed to fit typical evaluation constraints. This helps you spend less time researching and more time executing a clear plan.

How users can receive high discounts: when relevant promotions are available, users can often unlock the highest available discounts through LuxAlgo offers and partner campaigns—helping reduce the cost of tools and strategy access while you prepare for an evaluation (or retry a challenge).

Suggested Strategies

Below, you’ll see firms with different rules, costs, and account scaling options. As you compare them, consider pairing your preferred firm with a strategy that has already demonstrated historical viability—so you can focus on consistency, rule compliance, and execution quality during the challenge.

Quick Comparison Table

| Firm Name | Max Funding | Profit Split | Starting Fee | Key Feature |

|---|---|---|---|---|

| DNA Funded | $600,000 | 80%-90% | $49 | Flexible challenges, low fees |

| Funded Trading Plus prop firm | $2.5M (scaling) | 80%-100% | $119 | Instant funding, scaling options |

| ThinkCapital | $1.5M (scaling) | 80%-90% | $39 | Affordable entry, multiple paths |

| FTMO prop firm challenge | $2M (scaling) | 80%-90% | $155 | Advanced analytics, trusted brand |

| FundedNext | $4M (scaling) | Up to 95% | $32 | High funding potential, low fees |

These firms cater to different trading styles, budgets, and goals. Whether you're a beginner or an experienced trader, there's an option for you. Ready to dive deeper? Keep reading for detailed insights on each firm.

Best Prop Firms in Terms of Trading Conditions in 2026 – Forex, Metals, Indices and Crypto

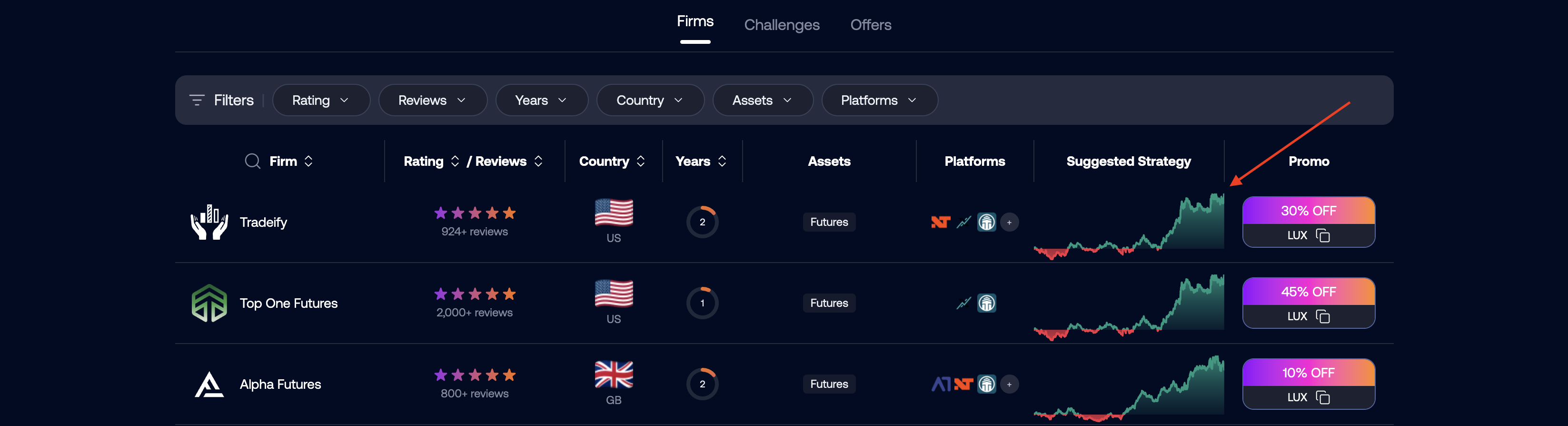

1. DNA Funded

DNA Funded is a well-regarded proprietary trading firm supported by an ASIC-regulated broker [1]. The firm stands out for its systematic approach to trading and provides access to over 800 CFD instruments across various markets [1][4].

Maximum Funding

DNA Funded offers traders funding of up to $600,000, positioning it in the mid-range among prop trading firms [4]. While this cap is lower than competitors like FundedNext ($4,000,000) or FTMO prop firm challenge ($2,000,000), it is comparable to firms such as Alpicap and surpasses others like iFunds, which caps at $500,000 [5]. Traders can choose from a variety of account sizes, starting at $5,000 and going up to $200,000 [4].

Profit Split

The firm's profit-sharing model starts at 80%, with an option to increase it to 90% through an add-on [1][2]. This allows traders to retain a substantial portion – between 80% and 90% – of their earnings. DNA Funded also provides a clear evaluation process to guide traders toward success.

Evaluation Structure

DNA Funded offers three different challenge types to suit varying trader preferences [1][6]:

| Challenge Type | Fee Range | Account Sizes | Profit Target | Max Daily Drawdown | Max Total Drawdown | Time Limit |

|---|---|---|---|---|---|---|

| Single Helix (1-Step) | $59 – $1,209 | $5,000 – $200,000 | 10% | 5% | 10% | Unlimited |

| Double Helix (2-Step) | $49 – $1,079 | $5,000 – $200,000 | 10%, 5% | 6%, 5% | 10% | Unlimited |

| Pro Challenge (2-Step) | $99 – $549 | $10,000 – $100,000 | 5% | 4% | 5% | 10 Calendar Days |

The Pro Challenge is designed for seasoned traders who prefer a faster evaluation process, with a 10-calendar-day limit [6]. A minimum of three trading days is required for all challenges [7].

Trading Restrictions

To enforce sound risk management, DNA Funded sets daily drawdown limits between 4% and 6%, depending on the challenge type [6]. The total drawdown limits range from 5% to 10%. Most challenges come with no time constraints, giving traders the freedom to develop their strategies at their own pace – except for the Pro Challenge, which has a strict 10-day limit [7].

Fees

DNA Funded’s fees range from $49 to $1,209, accommodating traders with different budget levels [1][6]. The Double Helix challenge is the most budget-friendly option, starting at $49 for a $5,000 account. On the other hand, the Single Helix offers the highest funding potential, with a $1,209 fee for a $200,000 account [6]. The Pro Challenge falls in the middle, with fees ranging from $99 to $549, offering a balance between cost and the speed of evaluation [6].

2. Funded Trading Plus prop firm

Funded Trading Plus has earned recognition from International Business Magazine [10] for its transparency and strong trader support. Based on its Trustpilot listing, it currently holds a 4.0/5 rating from about 2,600 reviews [8], and traders frequently highlight fast payouts and responsive customer service.

3. ThinkCapital

4. FTMO prop firm challenge

5. FundedNext

Pros and Cons Comparison

Using LuxAlgo to Pass Prop Firm Challenges

Passing prop firm challenges isn't just about luck, it demands precise signals, disciplined risk management, and strategies that consistently perform across different market conditions. LuxAlgo provides trading tools that work on TradingView, helping traders approach evaluations with a clearer plan and more consistent execution. Let’s dive into how each feature of LuxAlgo can sharpen your trading game for prop firm evaluations.

If you’re building a prop-firm-ready workflow, it helps to combine structured analysis with repeatable execution. LuxAlgo supports that process through its TradingView-exclusive tools, including the Toolkits, Screeners, and Backtesters on TradingView, plus the AI Backtesting Assistant for strategy creation and validation. For traders starting out, the Library offers a free collection of indicators you can explore before upgrading, and you can review current plan details on the pricing page.

The Price Action Concepts (PAC) toolkit is your go-to for spotting high-probability setups. By automating pattern detection and identifying volumetric order blocks, PAC helps you navigate the strict requirements of prop firms, like drawdown limits and specific profit targets. It breaks down the market structure to highlight key support and resistance levels, revealing where price is likely to react.

With Signals & Overlays (S&O), you get customizable signal algorithms tailored to meet prop firm rules. Many firms prohibit strategies like Martingale or excessive scalping, but S&O helps you focus on clean, rules-compliant setups without relying on banned techniques. Its flexibility allows you to fine-tune signal settings, making it easier to adapt to varying market conditions.

The Oscillator Matrix (OSC) toolkit offers real-time divergence detection and insights into money flow, helping you align your trades with institutional momentum. Since prop firms evaluate consistency and risk-adjusted returns, OSC’s trend-following signals provide the confirmation you need to make confident, disciplined entries.

"LuxAlgo refines my trade entries and exits – it’s remarkable!" – Kevin Ortega

The AI Backtesting Assistant is a game-changer for preparing your strategies. Instead of risking real funds during evaluations, this lets you build and test your approach across multiple timeframes and market conditions, including out-of-sample checks that can help reduce overfitting. You can start here: AI Backtesting Assistant and review the platform documentation at Backtesting Assistant Docs.

What makes LuxAlgo effective for prop firm challenges is its ability to automate complex price action analysis and deliver clear, actionable signals. When trading with someone else’s capital under strict rules – like avoiding news trading, adhering to weekend restrictions, or managing maximum position sizes – consistent processes can reduce emotional stress and improve compliance.

"LuxAlgo exactly allows me to see the market faster and confirm entries/exits, and it’s amazing!" – Çağrı Güler

Beyond its TradingView tools, LuxAlgo offers 24/7 support and an active community of traders. Whether you’re optimizing settings to meet specific firm requirements or adjusting to changing market conditions, you’ll have access to guidance from traders who understand the unique demands of prop trading.

For US-based traders, LuxAlgo’s TradingView integration means you can use these tools on a familiar platform without the hassle of learning new software. Plus, the 30-day money-back guarantee gives you a risk-free opportunity to test whether LuxAlgo aligns with your trading style before making a long-term commitment.

At $39.99 per month for the Premium plan and $59.99 per month for the Ultimate plan (which includes the AI Backtesting platform), LuxAlgo can be a cost-effective option compared to the potential expenses of repeated prop firm challenge attempts.

Conclusion

Selecting the right CFD prop trading firm is all about finding the ideal match for your trading style, goals, and risk tolerance. Here's a quick rundown of some top options:

- DNA Funded: A great choice for beginners, offering a low $49 entry fee, flexible evaluations, and profit splits of up to 90% [1].

- Funded Trading Plus prop firm: Perfect for traders seeking instant funding and tailored programs that cut down evaluation time [1].

- ThinkCapital: A budget-friendly option with fees starting at $39, catering to those with limited starting capital [1].

- FTMO prop firm challenge: Designed for serious traders, featuring advanced analytics and a structured evaluation process [1].

- FundedNext: Ideal for those looking to scale, with account growth options up to $4M, low fees, and flexible conditions [1].

Each firm brings something unique to the table, so it's crucial to align your choice with your trading style. For instance, day traders might lean toward firms that support news trading and high-frequency strategies. Swing traders, on the other hand, could benefit from firms offering extended evaluations and strong risk management. Scalpers should look for setups tailored to high-frequency trading.

Your risk tolerance should also play a key role in the decision. Conservative traders might appreciate ThinkCapital's low-cost entry, while those with a more aggressive approach could find FundedNext's growth-focused structure more appealing.

Keep in mind, low fees aren’t the only factor to consider. Look at the complete cost structure, including spreads, commissions, and other charges, alongside your ability to meet the firm's criteria. LuxAlgo can be valuable for preparation by helping you standardize execution rules, pressure-test strategies, and practice consistent risk controls across different market conditions.

FAQs

What should I look for when choosing a CFD prop trading firm in 2026?

When choosing a CFD prop trading firm in 2026, the first step is to think about your trading style – whether you're into day trading, swing trading, or scalping. Each firm has its own set of rules about trade frequency, holding periods, and execution speed. Finding one that aligns with how you trade can make a big difference.

It's also crucial to look into the firm's risk management policies. Pay attention to things like daily drawdown limits, profit targets, and how long the evaluation periods last. Don't forget to review their rules for trading during news events and holding positions overnight to ensure they fit with your strategy.

Picking a firm that aligns with your trading approach and goals can make the entire process much smoother and more rewarding.

What are the differences in the evaluation processes of the top CFD prop trading firms featured in the article?

The way top CFD prop trading firms evaluate traders in 2026 varies depending on factors like the difficulty of their programs, the clarity of their rules, and the specific criteria they use to judge performance. Generally, traders are required to complete structured challenges or assessment phases to prove their trading abilities, consistency, and risk management skills before they can secure funding.

Some firms emphasize straightforward and fair evaluation processes, focusing on key metrics such as trading results and strict adherence to risk management rules. These variations show the industry's commitment to identifying talented traders while keeping the process approachable and transparent for retail participants.

What are the pros and cons of choosing a high maximum funding firm like FundedNext?

Choosing a firm with a high maximum funding limit, like FundedNext, offers some impressive advantages. For starters, traders can access larger virtual capital, giving them the ability to execute bigger trades and explore more opportunities. Add to that profit splits as high as 95% and quick payouts, and it’s clear how these features can enhance your trading potential and overall earnings. For seasoned traders, this setup is particularly appealing, as it allows them to scale their strategies more effectively.

That said, there are a few challenges to keep in mind. Firms offering high funding often come with stricter evaluation processes and tougher profit targets. This can create additional pressure, especially for traders who are still gaining experience. On top of that, the competitive nature of these firms means their challenges may be harder to pass compared to those with lower funding limits. It’s essential to honestly assess your trading skills and comfort with risk before deciding if this type of firm is the right fit for you.

References

LuxAlgo Resources

- LuxAlgo – Official Website

- LuxAlgo – Pricing

- LuxAlgo – Library

- LuxAlgo – Toolkits (TradingView)

- LuxAlgo – Screeners (TradingView)

- LuxAlgo – Backtesters (TradingView)

- LuxAlgo – AI Backtesting Assistant

- AI Backtesting Assistant Docs – Introduction

- Price Action Concepts Toolkit Docs – Introduction

- Price Action Concepts Docs – Order Blocks

- Oscillator Matrix Docs – Reversal Signals

- LuxAlgo Library – Pattern Detector

- LuxAlgo Library – Support & Resistance Dynamic

- Traditional Proprietary Trading – LuxAlgo Blog

- Top CFD Prop Trading Firms – LuxAlgo Blog

- LuxAlgo – Prop Firms Portal

- LuxAlgo – FTMO Prop Firm Page

- LuxAlgo – Funded Trading Plus Prop Firm Page

External Resources

- TradingView – Charting Platform

- Investopedia – Proprietary Trading

- Investopedia – Drawdown

- CME Group – Risk Management

- DNA Funded

- Funded Trading Plus

- ThinkCapital

- FTMO

- FundedNext

- ASIC – Australian Securities & Investments Commission

- Trustpilot – Funded Trading Plus Reviews

- CBS News – Best Prop Firms for US Traders

- Prop Firm Strategies Cover Image

- Suggested Strategies Cover Image