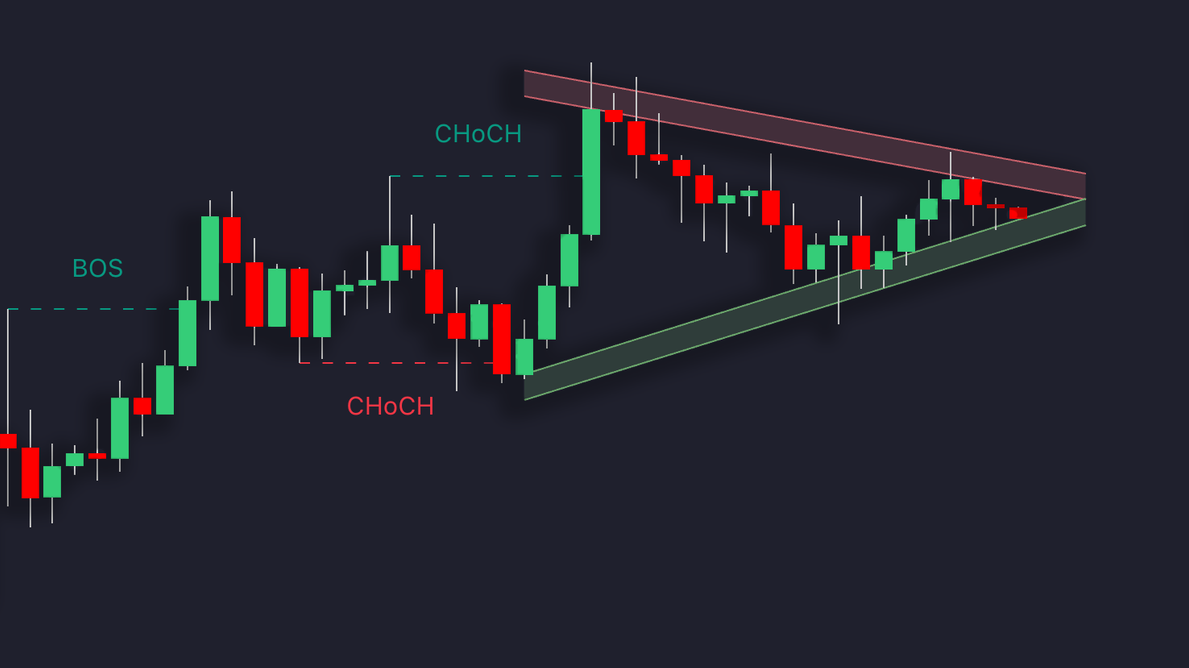

Explore triangle patterns in trading charts to identify price consolidations and predict future movements with actionable insights.

Triangles in trading charts help identify price consolidations and predict future movements. They form when trendlines converge over 1–3 months, signaling reduced volatility and market balance. There are three main types:

- Symmetrical Triangles: Equal Library Trend Lines indicator, reflecting trader indecision.

- Ascending Triangles: Flat top with rising bottom, showing increased buying pressure and bullish potential.

- Descending Triangles: Flat bottom with falling top, indicating growing selling pressure and bearish tendencies.

Key trading tips:

- Confirm breakouts with volume spikes and multiple price closes beyond trendlines.

- Use technical indicators like RSI and MACD for further validation.

- Manage risk with stop-loss orders near trendlines.

These patterns can signal trend continuations or reversals, offering clear entry and exit points when combined with volume analysis and broader market context.

| Pattern Type | Breakout Direction | Key Feature | Success Rate |

|---|---|---|---|

| Symmetrical | Up or down | Balanced trendline convergence | 54% upward |

| Ascending | Upward | Rising support line | 72.77% upward |

| Descending | Downward | Falling resistance line | 64% downward |

Triangle patterns provide actionable insights when analyzed with proper indicators and market trends.

Triangle Price Pattern Trading Strategy Guide

3 Main Triangle Pattern Types

Let’s break down the three main triangle patterns and what they mean for traders.

Symmetrical Triangles

Symmetrical triangles form when trendlines converge, connecting lower highs and higher lows. As Investopedia puts it:

"A symmetrical triangle is formed by trend lines connecting a series of sequentially lower peaks and higher troughs. This pattern is considered a continuation pattern, indicating a period of consolidation before the price breaks out."

These patterns are known for their reliability, with upward breakouts happening 54% of the time. For example, in 2021, Northwest Bancshares (NWBI) displayed a symmetrical triangle. The breakout occurred at $17.20, and the target was calculated at $19.40 by adding the triangle's $2.20 height to the breakout point.

Ascending Triangles

Ascending triangles stand out with a flat upper resistance line and a rising support line, signaling growing buying pressure. These patterns have a strong bullish bias, with a 72.77% success rate and a 77% chance of breaking upward.

Here’s a quick breakdown of their key traits:

| Component | Characteristic | Market Implication |

|---|---|---|

| Upper Trendline | Horizontal resistance | Reflects seller presence |

| Lower Trendline | Upward-sloping support | Indicates strong buying momentum |

On daily charts, ascending triangles typically show up 7–10 times a year, offering traders plenty of opportunities to act.

Descending Triangles

Descending triangles feature a flat lower support line and a declining upper resistance line, signaling increased selling pressure and a bearish outlook. These patterns have a 72.93% success rate, with around 64% breaking downward.

In a downtrend, traders often wait for the price to break below support before entering short positions. To manage risk, stop-loss orders are usually placed just above the upper trendline.

Understanding these patterns is key to recognizing and trading them effectively in real-world scenarios.

How to Verify Triangle Patterns

Once you understand the basics of triangle patterns, here’s how you can confirm them and improve your chances of successful trades.

Volume Analysis

Volume plays a key role in confirming triangle patterns. A strong breakout is usually backed by a noticeable increase in volume, signaling active market participation.

Here’s how to confirm a triangle breakout:

| Confirmation Step | What to Look For | Red Flags to Watch |

|---|---|---|

| Volume Check | A clear spike in volume during the breakout | Low or declining volume |

| Price Validation | Two consecutive closes beyond the trendline | Weak follow-through or just one close |

Best Timeframes to Use

Longer timeframes like daily and 4-hour charts are better for spotting triangle patterns. They help reduce market noise and give a clearer view of the trend.

| Timeframe | Reliability Level | Best Use |

|---|---|---|

| Daily | High | Confirming the main trend |

| 4-Hour | Moderate to High | Refining entry and exit points |

Technical Indicator Support

To strengthen your analysis, technical indicators can provide additional confirmation. Tools like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can offer helpful insights:

- RSI: In uptrends, readings over 70 confirm momentum; in downtrends, readings below 30 do the same. Divergences can signal potential reversals.

- MACD: Bullish crossovers above the zero line confirm upward breakouts, while bearish crossovers below it confirm downward ones.

For those seeking automated solutions, LuxAlgo’s Price Action Concepts (PAC) toolkit simplifies pattern detection. It integrates volume analysis and highlights triangle setups, making it easier to spot reliable trading opportunities.

Triangle Pattern Trading Methods

Entry and Exit Rules

Trading triangle patterns effectively requires clear entry and exit rules. The key is to act when the price breaks through critical trendlines, accompanied by a noticeable increase in volume.

| Pattern Type | Entry Signal | Target Calculation |

|---|---|---|

| Ascending Triangle | Price breaks above resistance with high volume | Add the triangle base height to the breakout point |

| Descending Triangle | Price drops below support with high volume | Subtract the triangle base height from the breakout point |

| Symmetrical Triangle | Price breaks in trend direction after two consecutive closes | Add the widest part of the triangle to the breakout point |

Risk Control Steps

Managing risk is essential in triangle pattern trading. For upward breakouts, place your stop-loss just below the most recent swing low.

- Confirm breakouts with multiple closes alongside volume spikes.

- Regularly monitor volume to ensure the breakout is reliable.

LuxAlgo Tools Integration

Once your entry, exit, and risk protocols are set, you can combine multiple exclusive toolkits on TradingView for enhanced precision. The Price Action Concepts (PAC) toolkit automates triangle detection and provides real-time alerts, while the Oscillator Matrix analyzes money flow and trend strength for additional confirmation. Set up custom alerts to notify you when prices approach key triangle boundaries or when volume surges align with technical signals.

Advanced Triangle Trading

Refining your triangle trading strategy involves tackling irregular patterns, avoiding false signals, and factoring in broader market conditions.

Non-Standard Triangle Types

Not all triangles are symmetrical. Some have uneven angles, reflecting an imbalance between buyers and sellers. These irregular shapes often lead to a surge in volume before a breakout. When the price breaks the steeper trendline, it could signal a shift in market sentiment. Recognizing these nuances is crucial for accurate breakout validation.

False Breakout Prevention

False breakouts can be tricky but offer learning opportunities. Trading expert Cory Mitchell, CMT, explains:

"False breakouts are a gift! Yes, there's often a losing trade associated with a false breakout, but it's not just you. Lots of people are losing on that false breakout!"

To reduce the chances of being misled by false breakouts, use the following methods:

| Verification Method | Key Indicators | Action Steps |

|---|---|---|

| Volume Analysis | Sudden volume spike | Confirm that the volume increase is sustained |

| Price Action | Timeframe alignment | Cross-check price movement across multiple timeframes |

| Technical Confirmation | Trend indicator alignment | Ensure multiple indicators agree on breakout direction |

Market Context Impact

The effectiveness of triangle patterns depends heavily on market conditions. Ben Clay, a strategist at Blueberry, highlights:

"Triangle patterns tend to be more reliable on longer timeframes (daily or 4-hour charts) compared to shorter time frames (1-minute or 5-minute charts). This is because longer timeframes offer a clearer picture of the underlying trend and price action."

Consider external factors like economic news, central bank policies, market sentiment, and key support and resistance levels. Combining these elements with technical analysis helps filter out noise and identify high-probability setups.

Conclusion

Triangle patterns can help traders spot market movements when used within the right context. Experts note that these patterns become more meaningful when analyzed alongside broader market trends and economic factors.

To trade triangles effectively, you need a well-rounded approach. Volume analysis confirms breakouts, while technical indicators validate trend direction. Triangles are particularly useful because they provide traders with valuable information about potential price breakouts, which can be used to make informed trading decisions.

Recognizing triangle patterns helps refine your entry, exit, and risk management strategies. Their reliability grows when they align with the current market trend and are backed by strong volume during breakouts. Adding context—such as economic updates, central bank actions, and market sentiment—further strengthens your trading decisions.

Combine these insights with exclusive toolkits on TradingView to improve your ability to spot patterns and execute trades with precision.