Explore a comprehensive review of an automation tool for traders, highlighting its features, pricing, and how it integrates with popular platforms.

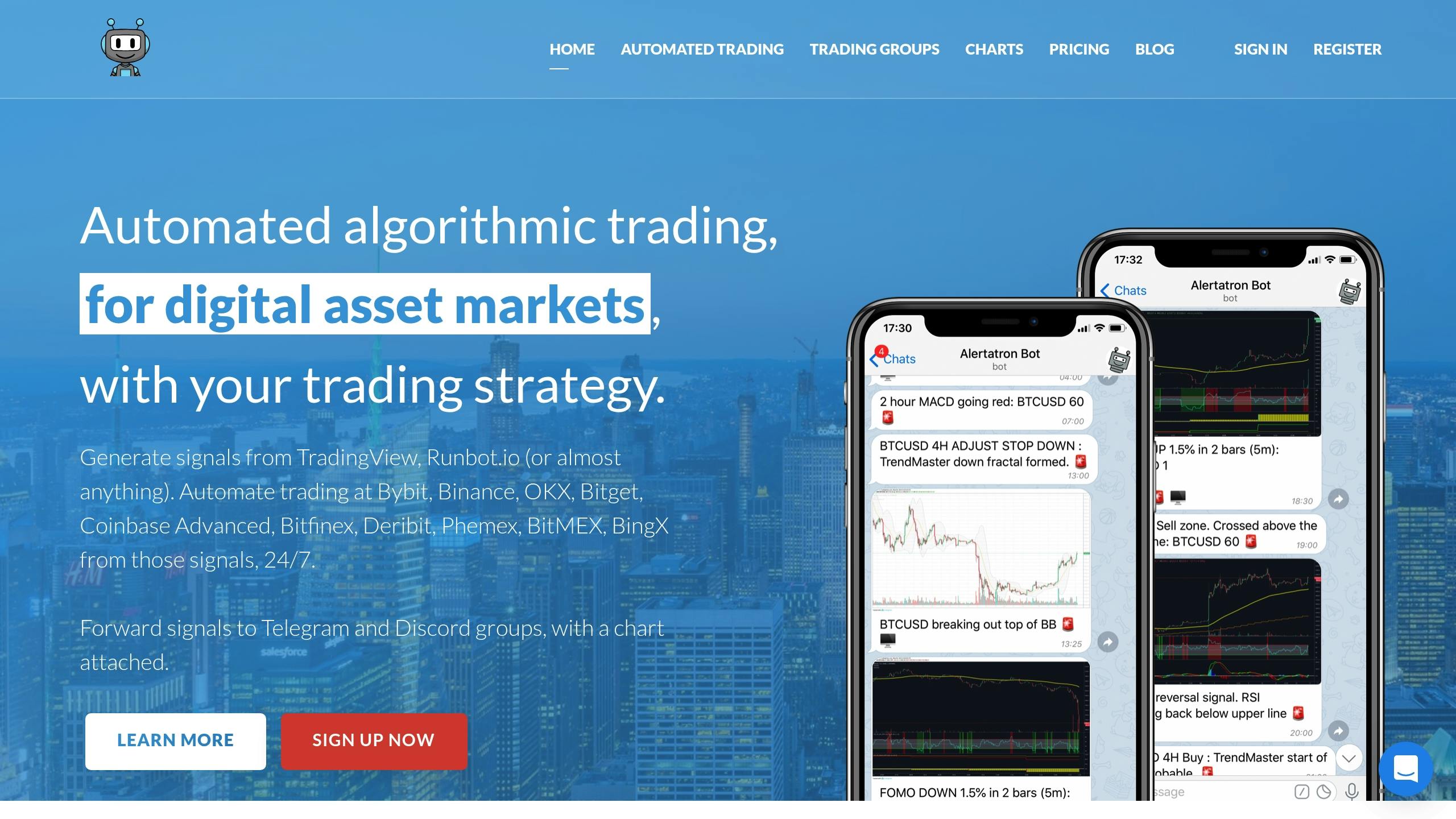

Alertatron helps traders automate their strategies with fast execution, advanced order management, and seamless integration with major cryptocurrency exchanges. It responds to TradingView alerts in under a second and supports complex order sequences, making it ideal for experienced traders.

Key Features:

- Execution Speed: Executes trades in less than one second.

- Advanced Orders: Includes stop-loss, take-profit, trailing orders, and multi-step sequences.

- Integration: Works with exchanges like Binance, Bybit, and BitMEX.

- Communication Tools: Sends alerts via Telegram, Discord, Slack, and more.

- Pricing: Plans typically range from $59–$199/month (see provider for latest tiers).

For traders focused on technical analysis, LuxAlgo provides advanced tools on TradingView and an AI Backtesting platform for creating and evaluating strategies, while TradingView offers powerful charting and alert systems. Together, these services can cover most trading needs.

Quick Comparison:

| Feature | Alertatron | LuxAlgo | TradingView |

|---|---|---|---|

| Execution | Automated trade execution | Requires third-party execution | Alert generation only |

| Focus | Order execution | Technical analysis & AI backtesting | Charting and alerts |

| Pricing | $59–$199/month | $0–$59.99/month | Free and premium tiers |

| Key Features | Fast execution, advanced orders | Toolkits & AI Backtesting | Alerts, custom indicators |

Recommendation:

- For Fast Execution: Use Alertatron.

- For Strategy Refinement: Try LuxAlgo.

- For Charting and Alerts: Start with TradingView.

Each platform has strengths, and combining them can optimize your trading workflow.

How to Automate Trading Signals with Alertatron Signals Lite

1. Alertatron Features

Alertatron is designed to execute trades automatically, responding to TradingView alerts in less than a second. This speed is crucial for strategies that rely on precise timing.

The platform connects with major cryptocurrency exchanges, including Bybit, Binance, OKX, BitMEX, Bitfinex, Deribit, and Bitget. Each user gets an isolated trading engine for reliability and performance.

Advanced Order Management

Alertatron provides a range of order management tools, giving traders the flexibility to implement various strategies. Here's a breakdown:

| Order Type | Description |

|---|---|

| Basic Orders | Market, limit, and conditional orders |

| Advanced Orders | Stop-loss, take-profit, and trailing orders |

| Complex Sequences | Multi-step order chains with custom delays |

| Scaled Orders | Non-linear scaled entries and time-weighted positions |

These order types work with the platform's group management system, which can execute trades across up to 200 accounts simultaneously. This feature is useful for professional traders handling multiple accounts or offering signal services.

Communication and Integration

Alertatron enhances usability with communication tools. It can capture high-resolution chart snapshots at key moments and share them via Telegram, Discord, Slack, email, or custom webhooks.

Its flexible command syntax allows continuous custom trade sequences triggered by TradingView alerts or bot signals. Additionally, the platform supports percentage-based trading, automatically scaling positions based on account balance.

For testing strategies and managing risk, Alertatron integrates with testnet exchanges like Deribit and BitMEX.

Pricing

Alertatron offers pricing plans that typically start around $59/month, with higher tiers (e.g., $199/month) offering larger daily alert limits and added features. Annual subscriptions often include discounts.

2. LuxAlgo Features

LuxAlgo focuses on technical analysis, providing exclusive toolkits on TradingView and an AI Backtesting Assistant that helps traders refine and evaluate strategies. Unlike Alertatron, which emphasizes trade execution, LuxAlgo offers in-depth insights into market structure, trends, and patterns.

Advanced Toolkits

LuxAlgo’s capabilities are organized into three toolkits (all available via invite‑only scripts on TradingView):

| Toolkit | Purpose | Key Features |

|---|---|---|

| Price Action Concepts (PAC) | Automates price action | Market structure, patterns, volumetric order blocks |

| Signals & Overlays (S&O) | Generates signals & overlays | Signal modes, dynamic overlays |

| Oscillator Matrix (OSC) | Trend & momentum analysis | Real‑time divergence, money‑flow, confluence |

Screening and Strategy Development

Beyond chart indicators, LuxAlgo provides PAC Screener, S&O Screener, and OSC Screener on TradingView to surface opportunities quickly. Its AI Backtesting documentation explains how the AI agent evaluates strategies and retrieves results.

- Analyze toolkit combinations for confluence.

- Test strategies in different market conditions using S&O Backtester and PAC Backtester.

- Measure performance metrics (e.g., win rate, drawdown) to guide decisions. For a walk‑through, see our AI Backtesting breakdown.

Platform Integration

LuxAlgo works with TradingView via invite‑only scripts. It also integrates with TradersPost, enabling traders to connect to multiple brokers and automate execution if desired.

Pricing Structure

LuxAlgo offers three plans:

| Plan | Monthly Cost | Features Included |

|---|---|---|

| Free | $0 | Access to the Library (free indicators) with a free LuxAlgo account |

| Premium | $39.99 | All TradingView toolkits (PAC, S&O, OSC) + screeners |

| Ultimate | $59.99 | Includes the AI Backtesting platform |

All plans include ongoing updates. Premium and Ultimate are designed for advanced analysis and optimization, while Free provides lifetime access to basic resources.

3. TradingView Features

TradingView serves as the backbone for many automation workflows, thanks to its powerful alert system and broad integrations. These features provide a strong base for automation‑focused solutions.

Alert System for Automation

TradingView's alert system can generate entry/exit signals and risk‑management triggers that connect to external executors. See the official overview of TradingView alerts for more.

Integration Options

TradingView supports a variety of integrations, enabling traders to connect with exchanges, automation tools, and communication platforms:

| Integration Type | Features | Supported Platforms |

|---|---|---|

| Exchange Connection | Alert‑driven trading | Bybit, Binance, OKX |

| Third‑Party Tools | Strategy automation | Alertatron, Coinrule |

| Communication Platforms | Signal sharing | Telegram, Discord, Slack |

Tools for Technical Analysis

- Build custom indicators to generate precise signals.

- Create and test strategy templates to fine‑tune trading methods.

- Set alerts to track multiple assets and identify market opportunities.

Platform Constraints

While TradingView excels in alerts and analysis, it does not handle trade execution. Traders must rely on third‑party services like Alertatron to carry out trades. This setup highlights the complementary relationship between TradingView and specialized execution tools.

Tool Strengths and Weaknesses

This section breaks down the strengths and weaknesses of each platform, focusing on where each one shines and the trade‑offs to consider.

Execution and Integration Capabilities

Each platform offers distinct features that cover different parts of a trading workflow:

| Feature | Alertatron | LuxAlgo | TradingView |

|---|---|---|---|

| Execution | Direct automation | Requires third‑party execution | Alert generation only |

| Integrations | Multiple channels | TradingView + brokers via partners | Broad third‑party support |

| Features | Advanced orders, trailing stops | AI Backtesting, toolkits | Charting tools |

| Pricing | $59–$199/month | $0–$59.99/month | Free and premium tiers |

Platform Advantages and Limitations

Alertatron

- Executes trades in ~1 second.

- Supports group management for up to 200 clients.

- Includes automated chart capture.

- Supports spot and derivatives where the connected exchange provides them.

- Interface prioritizes function over form.

LuxAlgo

- Provides an extensive set of TradingView tools across PAC, S&O, and OSC.

- Offers AI Backtesting for strategy creation and optimization.

- Backed by an active user community.

- Relies on third‑party services for trade execution.

TradingView

- Features advanced charting tools and a reliable alert system.

- Supports integration with multiple third‑party platforms.

- Does not support direct trade execution.

Complementary Capabilities

These platforms work well together. TradingView excels at analysis, LuxAlgo refines strategy development (including market structure and Fibonacci workflows), and Alertatron handles trade execution. The trade‑off is managing multiple subscriptions and integrations.

Summary and Recommendations

Based on the strengths and limitations outlined earlier, here are practical suggestions focused on execution speed, analytical tools, and budget.

Day Traders & Algorithmic Traders

For traders who need lightning‑fast order execution, Alertatron is a strong choice. Its sub‑second execution fits automated strategies across multiple exchanges. Plans commonly range from $59 to $199 per month.

Technical Analysis Specialists

If your focus is on refining technical strategies, LuxAlgo stands out with advanced toolkits and an AI Backtesting platform. Plans span $39.99 to $59.99 per month, with a Free tier for basic access.

Budget‑Friendly Setup

For a cost‑conscious approach, start with Alertatron's Starter plan at ~$59/month. Pair it with TradingView's free charting tools to save on initial costs. As your activity grows, consider LuxAlgo Premium at $39.99/month for all toolkits and screeners, or upgrade to Ultimate at $59.99/month to use the AI Backtesting platform.

References

LuxAlgo Resources (15)

- LuxAlgo — Official Site

- AI Backtesting Assistant — Main Page

- AI Backtesting — Introduction (Docs)

- Signals & Overlays — Introduction

- Oscillator Matrix — Introduction

- Price Action Concepts — Introduction

- Volumetric Order Blocks (Docs)

- Market Structure (Docs)

- Fibonacci (Docs)

- Backtester (S&O) — Introduction

- Backtester (PAC) — Introduction

- S&O Screener — Introduction

- PAC Screener — Introduction

- OSC Screener — Introduction

- Introducing LuxAlgo’s AI Backtesting Assistant (Blog)

External Resources

- Alertatron — Official Site

- TradingView — Official Site

- TradingView Alerts — Official Guide

- Trailing Stop — Investopedia

- Stop‑Loss vs Take‑Profit — Investopedia

- Binance — Exchange

- Bybit — Exchange

- BitMEX — Exchange

- Bitfinex — Exchange

- Deribit — Exchange

- Bitget — Exchange

- TradersPost — Brokerage Automation

- Invite‑Only Scripts — TradingView Support