Explore how deep learning revolutionizes algorithmic trading through enhanced predictions, risk management, and sentiment analysis.

Deep learning is transforming algorithmic trading by enabling real-time decisions, improving predictions, and analyzing market sentiment. Here's what you need to know:

- What is Deep Learning? It uses neural networks to process large, unstructured financial data, identifying patterns without human input.

- Why it Matters: Deep learning enhances trading by automating decisions, handling complex data, and adapting to market changes.

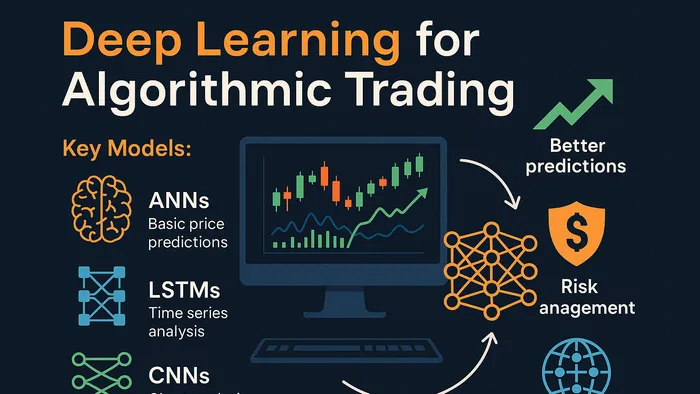

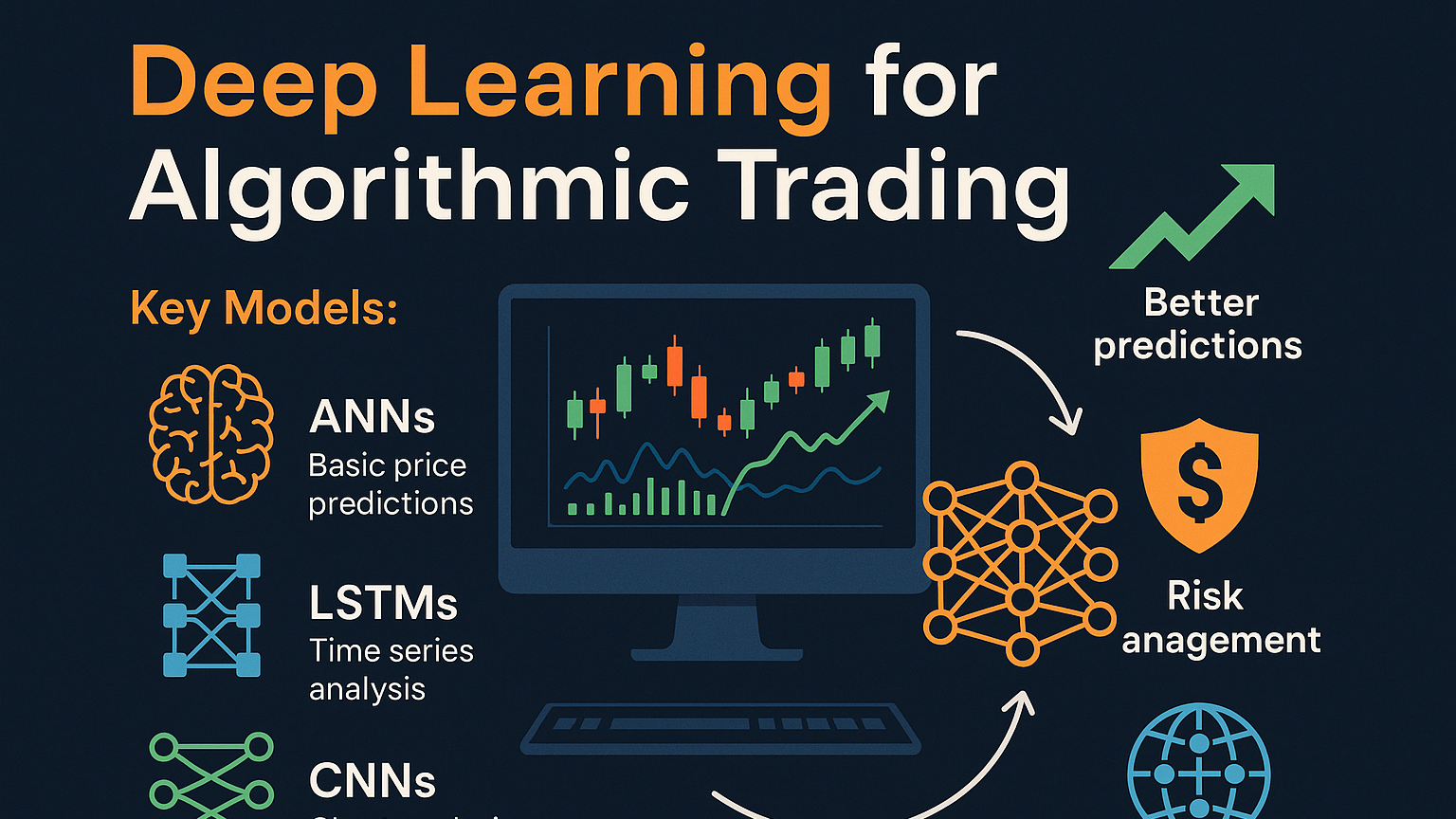

- Key Models:

- ANNs: Basic price predictions.

- LSTMs: Time series analysis with up to 93% accuracy.

- CNNs: Chart analysis for trends and signals.

- Benefits:

- Better price and trend forecasts.

- Advanced risk and portfolio management.

- Real-time sentiment analysis from news and social media.

Quick Comparison

| Aspect | Traditional Trading | Deep Learning Trading |

|---|---|---|

| Decision Making | Rule-based, static | Learns and adapts |

| Data Processing | Structured only | Structured + unstructured |

| Speed | Human-dependent | Real-time processing |

| Pattern Recognition | Manual | Automated |

| Adaptability | Manual updates | Self-adjusting |

Deep learning is reshaping trading systems, offering tools to improve ROI, manage risks, and analyze markets more effectively. Ready to build your trading strategy? Start with clean data, choose the right model, and test thoroughly.

Algorithmic Trading and Price Prediction using Python Neural Network Models

Main Deep Learning Models for Trading

Deep learning has reshaped algorithmic trading by enabling advanced market analysis and prediction tools. Various neural network architectures are used to tackle different aspects of financial data. Here’s a closer look at three prominent models and how they contribute to trading.

Basic Neural Networks

Artificial Neural Networks (ANNs) serve as the starting point for many trading systems due to their simple structure and ease of use. They are particularly effective at tasks like pattern recognition and regression, making them suitable for basic price predictions.

| Feature | Capability | Best Use Case |

|---|---|---|

| Data Processing | Works with diverse data | General market analysis |

| Implementation | Simple, fully connected | Entry-level trading systems |

| Training Speed | Quick with basic datasets | Rapid evaluations |

| Memory Handling | Limited retention | Short-term predictions |

This model provides a solid foundation for straightforward trading strategies.

LSTM Networks for Time Series

Long Short-Term Memory (LSTM) networks are a go-to choice for time series analysis in trading. They excel at capturing long-term dependencies, uncovering patterns in historical financial data, and predicting trends. For example, one study demonstrated that an LSTM network could achieve up to 87.86% accuracy in stock market forecasts.

Key strengths of LSTMs include:

- Handling sequential market data effectively

- Identifying long-term price trends

- Adapting to changing market conditions

- Delivering better results than traditional statistical models for forecasting

Next, let’s explore how CNNs add another layer of capability by focusing on visual market data.

CNN Models for Chart Analysis

Convolutional Neural Networks (CNNs) are ideal for analyzing visual market data, such as candlestick charts and technical indicator plots. A standout example is Ashwin Siripurapu's research, which transformed 30-minute price windows into RGB images and used a CNN to predict 5-minute price movements.

| CNN Application | Purpose | Advantage |

|---|---|---|

| Candlestick Analysis | Recognizing patterns | Automated chart reading |

| Heat Map Processing | Gauging market sentiment | Identifying complex trends |

| Technical Indicators | Spotting trends | Generating real-time signals |

Deep Learning Uses in Trading

Price and Trend Prediction

Deep learning has significantly improved the accuracy of price forecasting in algorithmic trading. For example, some LSTM models have achieved prediction accuracy rates of over 93% for major stock indices, outperforming traditional technical analysis methods. A study on the Vietnamese stock market also showed that LSTM models, combined with technical indicators, consistently identified regional market patterns.

| Model Type | Accuracy | Best Use Case |

|---|---|---|

| LSTM + Technical Indicators | 93% | Stock Index Prediction |

| Multimodal (Price + Text) | 89.93% | Complex Market Analysis |

| XG-Boost | Outperformed ARIMA/LSTM | Short-term Forecasting |

In addition to price forecasting, deep learning plays a key role in improving risk management and overall market analysis.

Risk and Portfolio Management

Deep learning algorithms are highly effective in portfolio optimization and risk assessment, thanks to their advanced pattern recognition capabilities. Models optimized with genetic algorithms have been shown to outperform market returns by as much as 20%. Another notable application involved combining reinforcement learning with traditional ensemble methods, which led to a 15% increase in cumulative returns.

Market Sentiment Analysis

Adding another layer to trading strategies, sentiment analysis allows traders to gauge market mood by analyzing data from social media and news. For instance, a CNN-LSTM model used to analyze Reddit headlines from 2008 to 2016 achieved 69% accuracy for Tesla and 64% for Apple. This kind of analysis enables traders to detect sentiment shifts in real time, often before price movements occur, and adjust their portfolios accordingly.

"When investors learn new information about a company, it can make them want to buy or sell its stocks."

William Haight, expert in finance and market behavior

Building Deep Learning Trading Systems

Data Preparation

Getting your data ready is a crucial step when developing deep learning trading systems. Financial data demands special handling to ensure models perform effectively.

Key steps for preparing data include:

- Cleaning the data: Remove outliers and address missing values.

- Scaling and encoding: Standardize and encode data for compatibility with deep learning models.

- Creating technical indicators: Generate features like moving averages or RSI to capture market patterns.

- Handling non-stationarity: Use techniques like detrending or differencing to stabilize the data.

"Financial markets are like roller coasters, full of trends, cycles, and volatility clustering. To keep your models from getting dizzy, use smart techniques like detrending, differencing, or fractional differentiation."

Shahaf Wagner, applied AI and ML researcher

For time series data, maintaining the sequence of events is key. Unlike other machine learning tasks, financial data benefits from specialized splitting methods:

- Rolling Window: Ideal for short-term forecasting, adjusting to recent trends.

- Expanding Window: Keeps historical data intact, making it useful for long-term analysis.

- Walk-forward: Simulates real-world trading conditions, essential for live testing.

Model Creation and Training

With clean and structured data, the next step is building a robust trading model. This involves choosing the right architecture and fine-tuning the training process. Key factors to consider:

- Model architecture: Select a structure suited to your trading objectives, such as LSTMs for sequential data or CNNs for feature extraction.

- Hyperparameter tuning: Adjust parameters like learning rate, batch size, and dropout to improve performance and reduce overfitting risks.

- Validation: Use strong cross-validation methods to ensure the model generalizes well to unseen data.

Testing and Deployment

Testing is where theory meets reality. Rigorous testing ensures your model can handle live market conditions. This process typically includes backtesting, paper trading, and live testing. Research indicates that trading systems need at least 100-200 trades to achieve stability.

Deployment happens in three stages:

- Pre-deployment Testing: Conduct backtesting and validate the system under various market scenarios.

- Implementation: Integrate the model into your trading setup, including automation and risk management features.

- Post-deployment Monitoring: Keep an eye on key metrics like win rate, drawdown, and Sharpe ratio. Adjust the system as needed to maintain performance.

Each step builds on the last, creating a system ready to tackle the complexities of financial markets.

Problems and Future of AI Trading

Current Challenges

Deep learning in trading comes with its fair share of challenges. Financial data is often messy, riddled with noise, inconsistencies, and outliers, which requires extensive cleaning and preparation before it can be used effectively. On top of that, training large-scale models with millions of parameters demands high-performance hardware like GPUs or TPUs, which drives up operational costs.

Security is another pressing issue. FBI data from 2021 revealed 847,367 fraud complaints, resulting in $6.9 billion in losses. This highlights the critical need for secure AI trading systems. These challenges are pushing the industry to explore new solutions.

New AI Trading Methods

AI trading is evolving quickly, with recent advancements reshaping the landscape. One standout is reinforcement learning (RL), which allows trading strategies to continuously adjust and improve in response to market changes. This approach addresses issues like noisy data and high computational demands.

Here’s how some major players in the financial world are using AI:

| Institution | AI Implementation | Impact |

|---|---|---|

| Renaissance Technologies | Advanced mathematical models | Improved price movement predictions |

| Citadel Securities | High-frequency trading AI | Real-time risk management |

| Bloomberg | News analytics platform | Instant analysis of financial news |

| JPMorgan Chase | AI monitoring system | Ensures compliance with regulations |

The generative AI market is projected to hit $667.96 billion by 2030, growing at a 47.5% annual rate from 2023. As these technologies advance, regulators are working to keep up with the potential risks.

Trading Rules and Laws

Regulations are evolving to tackle the complexities of AI-driven trading. The Commodity Futures Trading Commission (CFTC) has issued guidelines for regulated entities, emphasizing the importance of thorough risk assessments and frequent policy reviews.

Key regulatory goals include:

- Protecting consumers from fraud, discrimination, and privacy risks linked to AI

- Maintaining strong, regularly updated risk assessment frameworks

- Ensuring transparency, accountability, and proper oversight in the market

Financial institutions are also expected to implement strict oversight measures, such as frequent audits of AI models and ensuring decision-making processes are transparent, especially in high-frequency trading scenarios.

Conclusion

Main Points

Deep learning is transforming algorithmic trading, which once made up over 70% of U.S. stock volumes, by improving price predictions and risk management.

Here’s how deep learning stands out compared to traditional trading methods:

| Aspect | Traditional Trading | Deep Learning Trading |

|---|---|---|

| Performance | Influenced by human emotion | Consistent, emotion-free decisions |

| Efficiency | Relies on manual analysis | Processes vast data in real time |

| Returns | Matches market averages | Potential for returns exceeding 260% annually |

"Deep learning algorithms not only help traders discover trading signals in noisy financial data but also help them design effective features of their models, greatly enhancing the efficiency and effectiveness of their algorithmic trading systems."

Deepak Kanungo

These benefits highlight why deep learning is becoming a go-to approach for modern traders.

Getting Started

To bring deep learning into your trading strategy, start with trusted data providers like Alpha Vantage, Quandl, or IEX Cloud. Make sure to clean and standardize your data thoroughly before diving into model development.

Key steps to begin:

- Gather historical price data, trading volumes, and economic indicators from reliable sources.

- Create technical indicators such as moving averages and RSI.

- Choose models that align with your trading goals.

Using advanced models like LSTMs and CNNs, you can turn theoretical concepts into practical trading systems. Start with paper trading to test your strategies in a risk-free environment. Frameworks like TensorFlow and PyTorch provide powerful tools to build your first deep learning-based system. It’s also a good idea to assemble a team skilled in data science and machine learning.

Stay updated on developments like Explainable AI (XAI) and Federated Learning, which are set to tackle challenges around transparency and data privacy, shaping the future of algorithmic trading.