Learn how long shadow candlesticks signal market reversals, with key patterns, trading strategies, and verification methods for better trading decisions.

Long shadow candlesticks, one of the free indicators in the LuxAlgo Library, are key signals in trading that point to potential market reversals. They feature shadows (or wicks) at least twice the length of the candlestick body, reflecting strong price rejection. Here's what you need to know:

- Long Upper Shadow: Indicates seller dominance, often seen in uptrends, signaling a potential bearish reversal.

- Long Lower Shadow: Shows buyer strength, typically appearing in downtrends, hinting at a bullish reversal.

- Common Patterns: Hammer (bullish), Shooting Star (bearish), and Dragonfly Doji (bullish near support levels).

- Confirmation Tips: Look for increased trading volume, alignment with support/resistance levels, and confirmation from the next candlestick.

To trade effectively with long shadow candlesticks, always confirm signals, set proper stop losses, and consider market context. These patterns are most reliable when paired with volume analysis and technical levels.

Long Shadows Candlestick

Finding Long Shadow Patterns

Let's break down how to spot long shadow candlesticks in charts and what they tell us about market movements.

Parts of a Long Shadow

A long shadow candlestick consists of two main parts: the body and the shadow. Here's what to look for:

| Component | Measurement Rule | What It Tells You |

|---|---|---|

| Shadow Length | At least 2× the body size | Indicates strong price rejection |

| Body Size | Small compared to shadow | Shows price consolidation near open/close |

| Opposite Shadow | Very small or absent | Highlights a clear directional bias |

How to Spot Them on Charts

To identify long shadow patterns, look for candlesticks with a small body and an extended shadow. For example, on a daily chart, a candlestick with a 10-pip body and a shadow exceeding 25 pips is a clear sign of a long shadow.

Key Pattern Types

Here are the three main types of long shadow candlestick patterns to watch for:

- Hammer: Found in downtrends, this bullish reversal pattern features a long lower shadow (at least twice the body size) and a close near the high of the period.

- Shooting Star: This bearish pattern appears at market peaks. It has a small body and a long upper shadow (at least twice the body size), signaling strong selling pressure.

- Dragonfly Doji: Occurs when the open and close prices are almost identical, forming a tiny body with a long lower shadow. This pattern suggests strong buying support.

To confirm these patterns, always consider the market context, such as nearby support or resistance levels and trading volume. These factors can strengthen the reliability of the signals.

Reading Long Shadow Signals

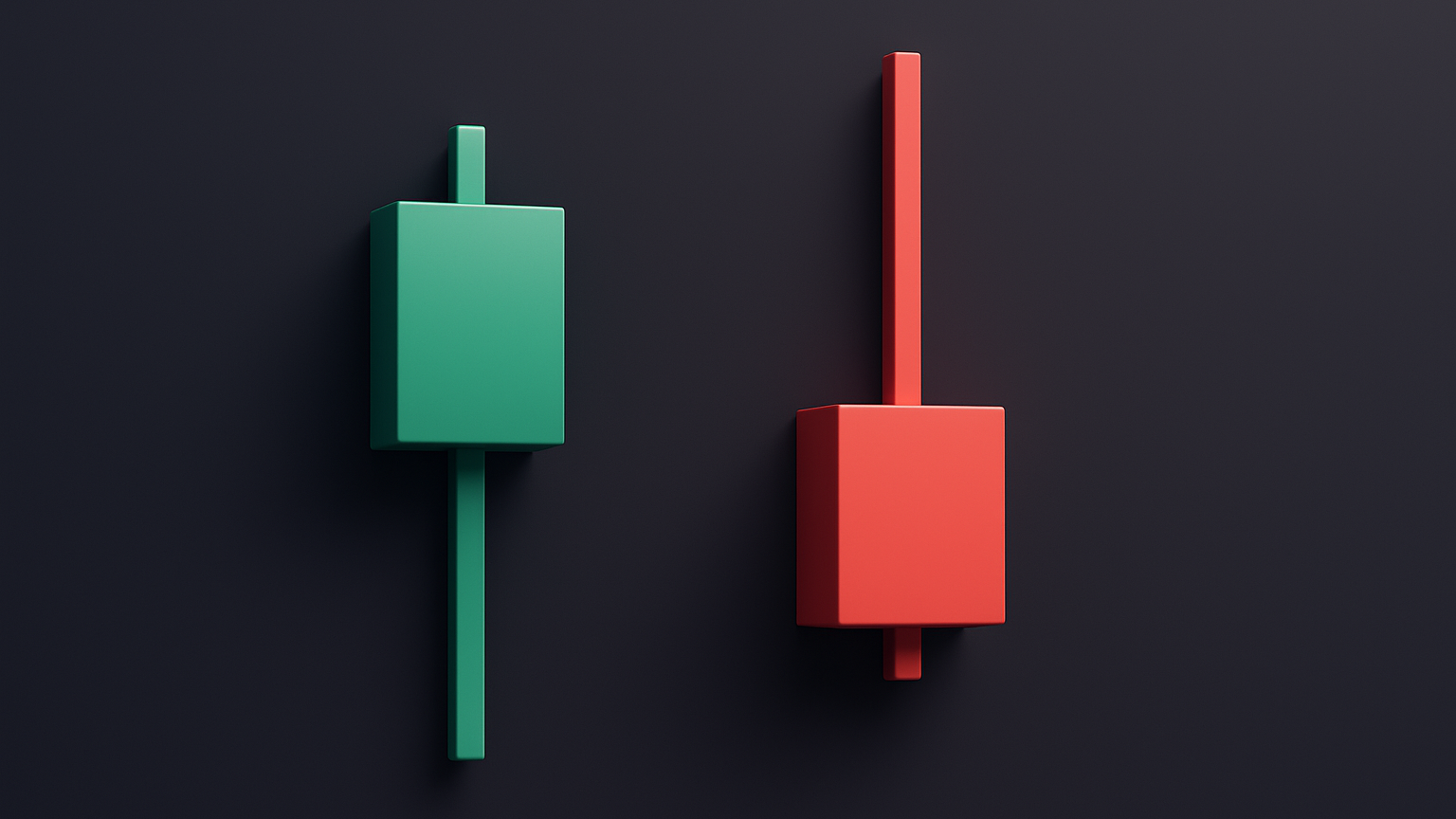

Up vs Down Signals

Long shadow candlesticks provide clues about market direction based on shadow placement:

| Shadow Type | Position | Market Signal | Trading Implication |

|---|---|---|---|

| Upper Shadow | Above body | Sellers dominated | Possible reversal during an uptrend |

| Lower Shadow | Below body | Buyers dominated | Possible reversal during a downtrend |

For accurate interpretation, ensure the shadow is at least twice the length of the candlestick body (a 2:1 shadow-to-body ratio).

Market Trend Impact

The broader market trend adds context to these signals. In an uptrend, a long upper shadow suggests buyers are losing momentum as sellers push prices lower. Conversely, in a downtrend, a long lower shadow near support may indicate growing buying pressure, hinting at a potential reversal.

Signal Verification

Strengthen your analysis by verifying signals through multiple factors: high trading volume, confirmation from the next candlestick, and alignment with key support or resistance levels.

The Reversal Candlestick Structure indicator, available in the LuxAlgo Library, can help fine-tune your evaluation by:

- Identifying reversal patterns at critical points

- Filtering patterns using data from a stochastic oscillator

- Displaying a dashboard with reliability percentages for detected patterns

Trading with Long Shadows

Entry and Exit Rules

When trading long shadow candlesticks, focus on identifying potential reversals rather than short-term price changes.

- For bullish trades: Look for long lower shadows during a downtrend. These should align with rising volume and appear near key support levels.

- For bearish trades: Seek out long upper shadows in an uptrend. Confirm these with high trading volume and resistance level breaches.

Stop Loss Guidelines

Setting a stop loss correctly is essential to control risk when trading long shadow patterns:

| Pattern Type | Stop Loss Placement | Reasoning |

|---|---|---|

| Bullish Lower Shadow | Below the candlestick's low | A break below this level invalidates the reversal signal. |

| Bearish Upper Shadow | Above the candlestick's high | A move above this level negates the bearish signal. |

Risk Control Methods

Keep your risk in check by following these practices:

- Position Sizing: Limit your risk to 1-2% of your account per trade, based on how far the stop loss is set.

- Volume Confirmation: Higher trading volume strengthens the likelihood of a reversal.

- Pattern Validation: Wait for the next candlestick to confirm the pattern before acting.

To increase accuracy, pair these methods with a broader market analysis. This includes examining support and resistance levels and understanding the overall market trend. A thorough and disciplined approach ensures better validation of long shadow signals before risking your capital.

Trading Examples

Chart Examples

Here's an example: Imagine a stock in a downtrend that forms a candlestick with a long lower shadow near a support level. At the same time, there's a noticeable spike in volume. The next candlestick confirms a reversal signal.

| Pattern Element | Market Indication | Trading Action |

|---|---|---|

| Long Lower Shadow | Buyers stepping in | Watch for confirmation |

| Increased Volume | Strong buying interest | Assess reversal potential |

| Support Level Contact | Price finding a base | Plan your entry point |

Trade Setup Guide

- Look for a candlestick with a shadow that's at least twice the size of its body.

- Check for a volume spike to confirm market activity.

- Ensure the pattern coincides with key technical levels like support or resistance.

In the example above, the alignment of the pattern, volume, and technical levels created a clear trading opportunity.

Common Mistakes

When trading long shadow patterns, steer clear of these errors:

- Don't get distracted by small, insignificant candlestick movements; focus on clear, noticeable patterns.

- Never analyze the pattern in isolation—always consider nearby support and resistance levels.

- Wait for confirmation from the next candlestick or other indicators before making your move. Jumping in too early can lead to unnecessary losses.

Summary

Main Points Review

Long shadow candlesticks can reveal shifts in market sentiment and hint at potential price direction changes. These candlesticks are defined by a wick that's at least twice the size of the body, showing strong price rejection at specific levels. The placement of the shadow is key—a long upper shadow in an uptrend often suggests sellers are stepping in, while a long lower shadow in a downtrend may point to buyers gaining strength.

| Shadow Type | Market Context | Signal Indication |

|---|---|---|

| Long Upper | Uptrend | Possible trend reversal as sellers take control |

| Long Lower | Downtrend | Potential bullish reversal as buyers push prices higher |

Getting Started

Now that you understand the key signals, here’s how to integrate them into your trading plan:

- Spot the Patterns: Look for candlesticks with shadows that are at least twice the length of the body.

- Analyze the Context: Always factor in the current market trend and critical technical levels.

- Check the Volume: Increased trading volume can confirm the strength of the signal.

Trading with long shadows requires patience and clear confirmation. Practice identifying these patterns on a demo account to sharpen your skills without financial risk. Pay special attention to how these candlesticks behave around support and resistance levels, as signals in these areas are often more dependable.