Explore a revolutionary trading program that offers immediate access to capital with flexible profit sharing and strict risk management.

FundedNext's Stellar Instant program lets traders skip evaluations and begin trading immediately in a real-market simulation environment. As of 2026, Stellar Instant account sizes are $2,000, $5,000, $10,000, and $20,000 with one-time fees of $59, $149, $299, and $599 respectively (swap-free options are typically priced higher). Traders earn a tier-based Performance Reward share that starts at 70% and can rise to 80% as scaling tiers are met, and the program includes performance-based scaling that can expand the account toward a higher capital ceiling over time. A single 6% trailing maximum loss limit applies and there is no daily loss cap.

Updated FundedNext Review Has Arrived

FundedNext Stellar Instant Funding Plans

The Stellar Instant model is tailored for traders who want to bypass traditional evaluations and start trading a funded-style account right away—an approach commonly associated with proprietary trading programs. The plan provides immediate activation, on demand Performance Rewards, and performance based scaling designed for traders who can manage risk under a trailing drawdown rule.

Account Sizes and Pricing

Four account tiers are available as of 2026: $2,000 (fee $59), $5,000 (fee $149), $10,000 (fee $299), and $20,000 (fee $599). This range lets traders choose a starting balance that matches their position sizing, risk tolerance, and growth goals while keeping entry costs relatively predictable with a one-time purchase rather than a monthly subscription.

Profit Sharing and Growth Potential

Stellar Instant uses a tier-based Performance Reward structure rather than a flat split: traders typically begin at 70% (Tier 1–2) and can increase to 80% from higher tiers onward as account scaling milestones are met. This means disciplined performance is rewarded over time, with the reward share improving automatically as traders progress through the scaling ladder.

Risk Management and Trading Rules

Stellar Instant enforces a single 6% trailing maximum loss limit and does not apply a separate daily loss limit. This gives traders more intraday flexibility, but it also means risk must be controlled around equity highs because the trailing threshold can tighten after profits are made. A practical way to keep the account stable is to understand drawdown as a peak-to-trough decline and to avoid sharp equity swings that can trigger the trailing breach. Prohibited practices still include exploitative arbitrage behavior, latency abuse, and cross-account hedging that violates fairness rules.

| Feature | Stellar Instant Details (2026) |

|---|---|

| Account Sizes | $2,000 to $20,000 |

| Fees | $59 to $599 |

| Performance Reward Share | 70% to 80% (tier-based) |

| Maximum Loss (Trailing) | 6% |

| Daily Loss Limit | None |

| On-Demand Reward Eligibility | 5% account growth (alternative cycle-based option may apply below 5%) |

| Minimum Trading Days | None |

| Refundable Fee | No (one-time purchase) |

Platform Options and Trading Flexibility

As of 2026, FundedNext lists MetaTrader 4 and MetaTrader 5 as the supported platforms for Stellar Instant accounts. MetaTrader 5 is available via the official platform ecosystem (MetaTrader 5). If you have seen cTrader offered in other prop environments, treat that as plan- or region-dependent elsewhere—Stellar Instant’s official platform support is centered on MT4/MT5 for consistency and execution parity across accounts.

Account Management and Compliance

Know Your Client (KYC) verification is required before the first Performance Reward withdrawal, and FundedNext may enforce additional restrictions if platform stability or rule integrity is threatened. In practice, this means traders should keep account ownership details consistent and avoid behavior that can be flagged as copying across unrelated accounts or attempting to exploit execution conditions.

The Stellar Instant model marks a shift from traditional challenge structures: a higher up front cost but immediate access to trading, no minimum trading day requirement, a single trailing loss rule, and flexible Performance Reward options that include an on-demand path once key growth thresholds are met.

LuxAlgo Trading Tools

LuxAlgo provides traders with advanced technical analysis features that can help meet the strict risk requirements of programs like Stellar Instant. By combining advanced technical analysis with AI driven backtesting, LuxAlgo offers a structured approach for navigating tight trailing drawdown rules, and traders can also explore the free LuxAlgo Library to build a workflow before upgrading.

Core Trading Toolkits

The core capabilities center on three TradingView toolkits: Price Action Concepts, Signals & Overlays, and Oscillator Matrix. Together they support structured decision-making by surfacing market structure, liquidity context, and momentum or money-flow conditions that traders can translate into tighter, rule-compliant execution.

| Module | Function | Trading Advantage |

|---|---|---|

| Market Structure Labels | Detects swing BOS and CHoCH in real time | Identifies trend shifts with clear structure context |

| Automatic Order Blocks | Highlights bullish and bearish zones with mitigation tags | Helps frame entries, invalidation points, and stop placement |

| Liquidity Levels | Maps equal highs and lows plus higher timeframe liquidity | Targets likely stop clusters and liquidity pools |

| Fair Value Gap Scanner | Flags imbalances that may be revisited | Refines retracement entries and reduces chasing |

| Premium or Discount Zones | Shows relative value within the current range | Avoids buying peaks or selling troughs in mean reversion setups |

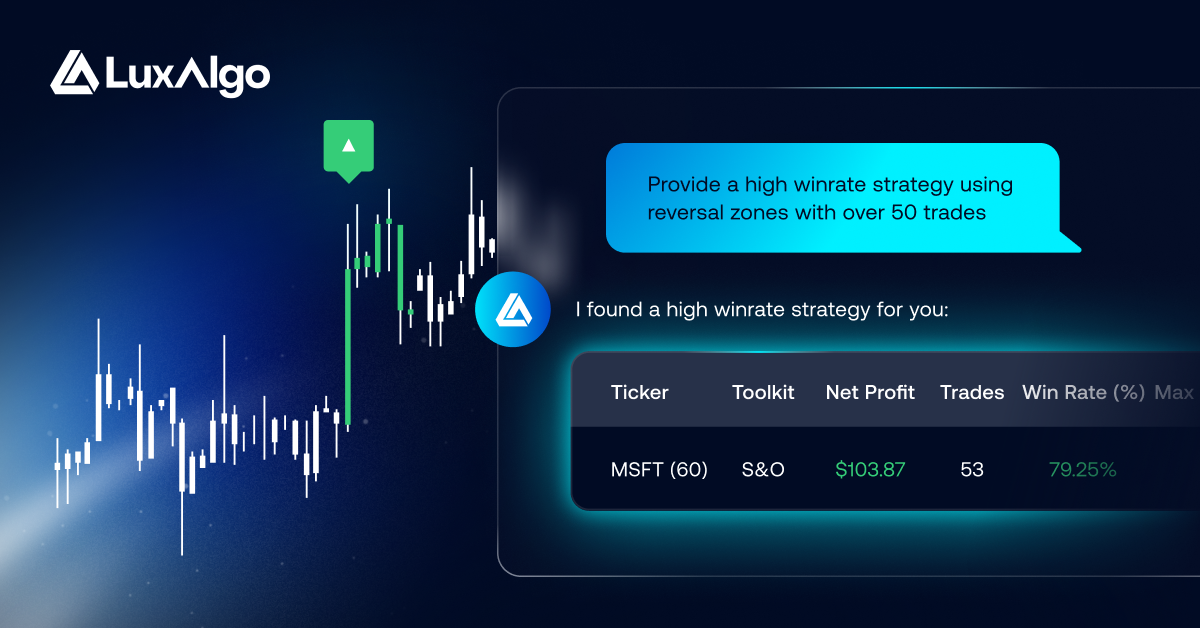

AI Powered Backtesting Platform

LuxAlgo's AI Backtesting Assistant delivers performance metrics—such as win rate, drawdown, and profit factor—that help traders align strategy behavior with Stellar Instant’s 6% trailing loss rule. For implementation details, supported workflows, and how the agent evaluates strategies, the AI Backtesting Assistant documentation provides the most accurate reference.

Strategy Development and Optimization

The optimization workflow helps fine tune strategy parameters efficiently so traders can validate risk settings, entry/exit logic, and frequency constraints before risking a live prop-style account. For traders operating under a trailing drawdown, this is especially useful because reducing volatility and avoiding clustered losses can be just as important as improving raw win rate.

Pricing and Platform Access

- Free Plan, $0 lifetime access, includes hundreds of tools across 5+ platforms via the LuxAlgo Library.

- Premium, $39.99/month, includes advanced signals, alerts, and oscillator tools on TradingView.

- Ultimate, $59.99/month, includes the AI Backtesting platform.

For the most current plan details and inclusions, see LuxAlgo pricing.

Integration with Trading Platforms

LuxAlgo integrates with TradingView, MetaTrader, and NinjaTrader, making it easier to take a tested concept from chart analysis into execution. Traders who want to scan multiple markets for setups can also use the PAC Screener and OSC Screener to track conditions across watchlists and reduce the chance of forcing trades under a trailing risk ceiling.

Pros and Cons

FundedNext Stellar Instant Analysis

Stellar Instant removes the evaluation phase and offers flexible Performance Reward options, including on-demand withdrawals once 5% account growth is achieved. Account sizes now begin as low as $2,000, expanding accessibility for traders who want a smaller starting point, while the 6% trailing maximum loss limit still requires disciplined risk control. Unlike many challenge programs, there is no daily loss limit and no minimum trading day requirement, which can benefit traders who prefer selective execution over forced activity.

LuxAlgo Tools Assessment

LuxAlgo’s AI driven backtesting and real time analytics help traders respect a trailing loss rule by testing strategy stability and reducing the likelihood of sharp equity swings. To better understand how LuxAlgo structures its exclusive tools on TradingView, the LuxAlgo features overview and the Getting Started documentation provide clear step-by-step orientation.

| Aspect | FundedNext Stellar Instant (2026) | Toolkits Overview (LuxAlgo) |

|---|---|---|

| Advantages | Immediate activation, no daily loss cap, no minimum trading days, on-demand rewards at 5% growth, multiple account sizes (2K to 20K) | Advanced analysis on TradingView, structured market context, workflow support for disciplined execution |

| Drawbacks | 6% trailing loss limit, one-time purchase cost, tier progression required to improve reward share | Learning curve, subscription cost for Premium/Ultimate, requires practice to apply rules consistently |

| Best For | Traders ready to operate under a strict trailing risk model | Traders refining entries, exits, and risk discipline with structured analysis |

| Risk Level | High (strict trailing loss rule) | Lower (testing, refinement, and decision support) |

| Cost Structure | One-time account fee | Monthly subscription |

Combined Usage Considerations

Using LuxAlgo to pre test strategies helps ensure the 6% trailing limit is respected before risking Stellar Instant capital. The combination suits traders who value disciplined, data driven approaches—especially when entries are tied to objective structure shifts, liquidity zones, and momentum confirmation rather than impulsive execution during volatile swings.

Conclusion

FundedNext's Stellar Instant program continues evolving in 2026 by maintaining the instant-activation structure while expanding accessibility through a lower $2,000 tier. Traders can choose from $2,000, $5,000, $10,000, and $20,000 starting balances, and Performance Reward share increases from 70% toward 80% as scaling tiers are met. The trade off is a strict 6% trailing maximum loss limit, but there is no daily loss cap and no minimum trading day requirement, which favors traders who prefer careful, selective execution.

LuxAlgo’s exclusive tools on TradingView complement this setup by helping traders model strategies that stay within a trailing threshold. At $39.99/month for Premium or $59.99/month for Ultimate (which includes AI Backtesting), the platform can be cost effective compared with the opportunity value of operating a rule-compliant funded account—especially when traders use structured rules for sizing, stops, and trade frequency to reduce equity volatility.

For traders ready to bypass evaluations and trade immediately, the synergy of FundedNext’s Stellar Instant and LuxAlgo’s analytics can provide a disciplined pathway to growth—where consistent execution and drawdown control matter just as much as finding profitable entries.

FAQs

What makes FundedNext's Stellar Instant program a better choice compared to traditional prop trading models?

Stellar Instant offers immediate activation without an evaluation, flexible Performance Reward options including on-demand eligibility once 5% account growth is achieved, and account sizes starting at $2,000. The model removes common restrictions like daily loss caps and minimum trading day requirements, but it still enforces a strict 6% trailing maximum loss limit, making disciplined risk control essential.

How do LuxAlgo’s AI tools help traders meet FundedNext's risk management rules for Stellar Instant?

LuxAlgo’s indicators and AI Backtesting Assistant let traders simulate strategies under drawdown constraints, optimize stop placement, and stress test parameter changes before applying them to a trailing-loss environment. This reduces the chance of strategy volatility causing a breach and helps traders refine entry criteria so trades are taken only when conditions match a repeatable edge.

How can traders maximize profits while staying within FundedNext's 6% trailing loss limit in Stellar Instant?

Use position sizing that keeps risk per trade low, place stops at invalidation points rather than arbitrary distances, avoid revenge trading after drawdowns, and reduce exposure after equity highs so the trailing threshold is less likely to be hit by routine volatility. Monitoring equity behavior and keeping losses shallow protects the account while creating room for consistent compounding and tier progression.

References

LuxAlgo Resources

- Advanced Technical Analysis (LuxAlgo Blog)

- LuxAlgo Library

- Price Action Concepts (TradingView Toolkit)

- Signals & Overlays (TradingView Toolkit)

- Oscillator Matrix (TradingView Toolkit)

- Liquidity Levels (Library Indicator)

- Fair Value Gap Scanner (Library Indicator)

- AI Backtesting Assistant

- AI Backtesting Assistant Documentation

- LuxAlgo Pricing

- PAC Screener (TradingView)

- OSC Screener (TradingView)

- LuxAlgo Features Overview

- Toolkits Overview

- Getting Started Documentation

External Resources

- FundedNext (Official Site)

- FundedNext – Stellar Instant

- Stellar Instant Pricing Table (FundedNext Help Center)

- Stellar Instant Loss Limits (FundedNext Help Center)

- Performance Reward Eligibility (FundedNext Help Center)

- Minimum Trading Days (FundedNext Help Center)

- Performance Reward Share Tiers (FundedNext Help Center)

- Supported Platforms for Stellar Instant (FundedNext Help Center)

- FundedNext Stellar Instant (YouTube Video)

- Proprietary Trading (Investopedia)

- Drawdown (Investopedia)

- Know Your Client (KYC) (Investopedia)

- MetaTrader 5 (Official Site)