Explore the significance of shaved candlesticks in trading, their patterns, and how to effectively use them for better market analysis.

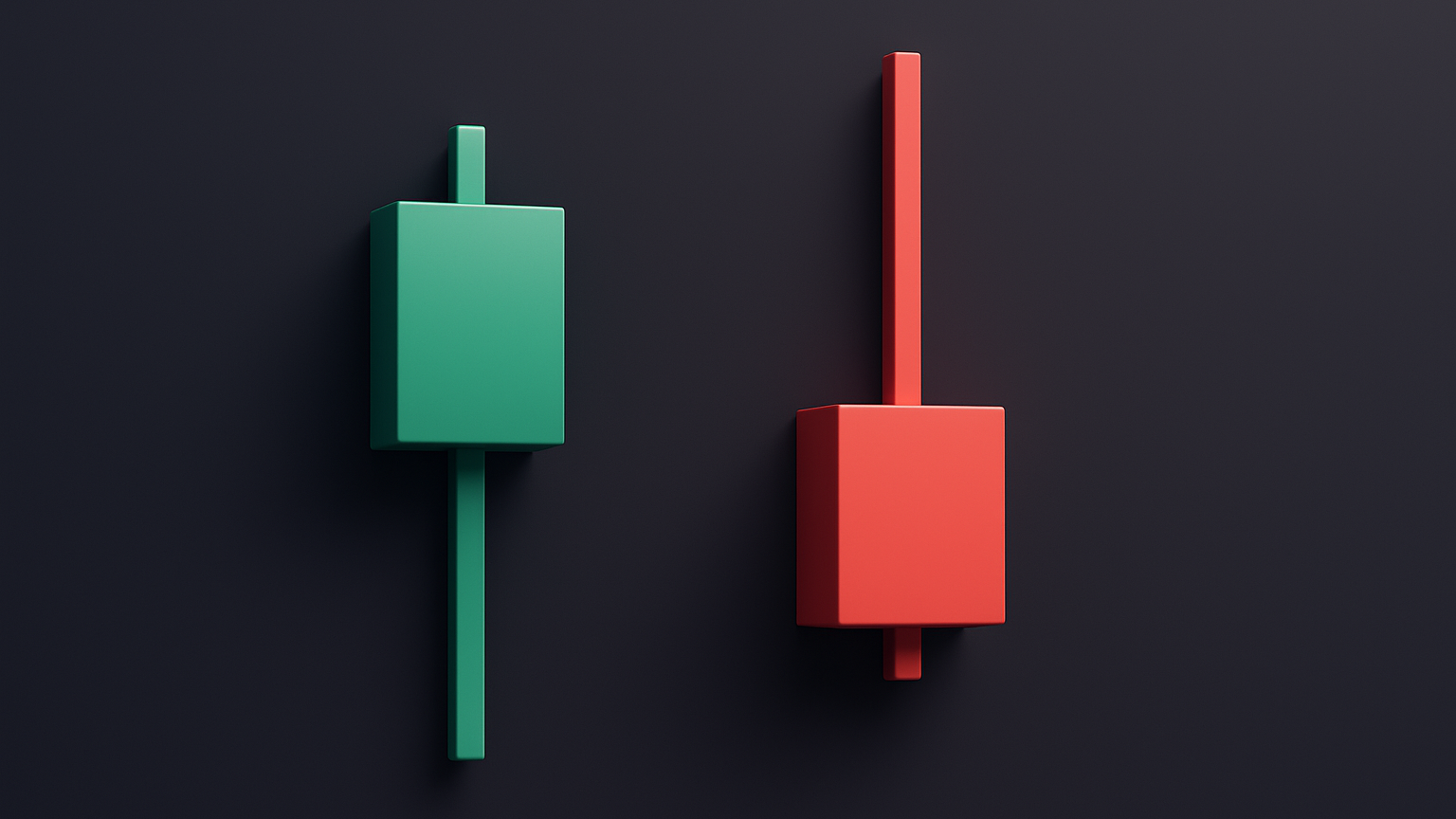

Shaved candlesticks are powerful trading signals that show strong market momentum. They have no upper or lower shadows (or sometimes neither), indicating that buyers or sellers were fully in control. Here's a quick breakdown:

- Shaved Top: No upper shadow, signals strong buying.

- Shaved Bottom: No lower shadow, signals strong selling.

- Key Use: Best used near support or resistance levels to predict potential breakouts or reversals.

- Confirmation: Always wait for 1–2 subsequent candles or use tools like RSI or MACD to validate signals.

Why They Matter:

- Trend Indicators: Help identify market direction and momentum.

- Reliable Patterns: Combine with other tools to improve accuracy.

- Risk Management: Use stop-losses just beyond the candlestick's extreme.

Shaved candlesticks are simple yet effective signals for traders when paired with broader market analysis and technical indicators. Let’s explore how to use them effectively.

Reading Shaved Candlestick Signals

Bullish and Bearish Signals

Shaved candlesticks highlight strong market sentiment. A bullish shaved top—with a long body and no upper shadow—shows aggressive buying as prices close near their peak. Conversely, a bearish shaved bottom, featuring a long body without a lower shadow, indicates dominant selling pressure.

| Signal Type | Best Trading Context |

|---|---|

| Shaved Top | At the end of a downtrend or during an uptrend |

| Shaved Bottom | At the end of an uptrend or during a bearish phase |

These signals provide valuable clues about market direction and sentiment.

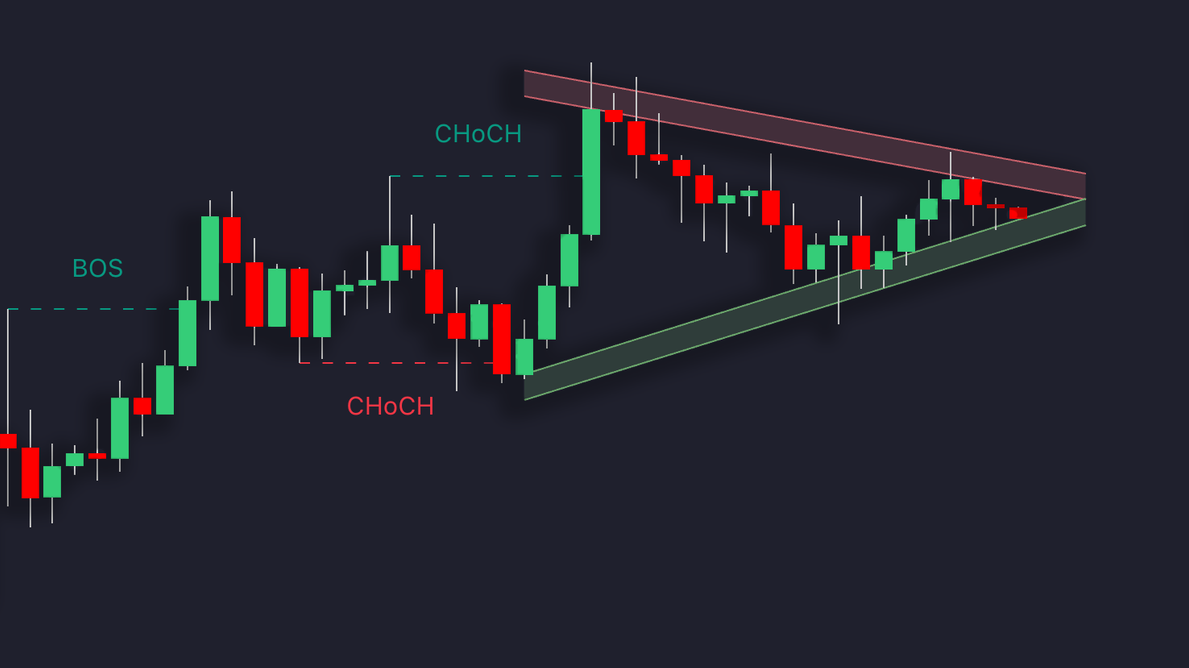

Trend Signals

Beyond individual signals, shaved candlesticks can also help identify broader market trends. To analyze these patterns effectively:

- Compare the candlestick's body size to nearby candles.

- Wait for confirmation in the next 1–2 periods.

- Pay attention to patterns forming near key support or resistance levels.

For example, a bullish shaved top near a support level may indicate strong buying pressure and a potential reversal. Recognizing these trends helps traders align with market momentum and improve timing.

Price Momentum Signals

The lack of shadows in shaved candlesticks offers a clear view of price momentum. A longer body compared to nearby candles signals stronger momentum, while the absence of shadows reflects decisive control by buyers or sellers.

To confirm the signal, check subsequent candles and use momentum indicators like RSI or MACD. Place stop-losses just beyond the candle's extreme to manage risk.

The best momentum signals occur when shaved candlesticks align with broader market trends and other technical tools. This combination helps filter out false signals and pinpoint high-probability trading opportunities.

Shaved Candlestick Explained

Common Patterns and Success Rates

Let's delve into candlestick patterns, focusing on their common forms and how they perform based on success metrics.

1‑Candle Patterns

The Marubozu is a single‑candle pattern with a long body and no shadows. Its success rate ranges between 65–70% when paired with other technical indicators. These single‑candle setups are straightforward to spot, but their meaning shifts depending on the market context and timeframe. Here's a breakdown:

| Timeframe | Average Gain | Success Rate | Market Exposure |

|---|---|---|---|

| Daily | 0.43% | 73% | 20% |

| Weekly | 0.70% | 73% | 24% |

| Monthly | 3.10% | N/A | N/A |

Multiple‑Candle Patterns

Patterns involving multiple candlesticks—especially those with shaved candlesticks—tend to be more reliable than single‑candle setups. Two key examples include:

- Island Reversals: These occur when a shaved candlestick is isolated by gaps, signaling a potential reversal.

- Kicker Patterns: A sharp two‑candle formation that often marks a trend change.

Such patterns generally offer higher reliability and measurable success rates.

Pattern Success Rates

Research indicates that candlestick patterns are particularly effective in the U.S. stock market.

"A revolutionary concept developed by Greg Morris in 1991, called candle pattern filtering, provides a simple method to improve the overall reliability of candle patterns. While the short‑term trend of the market must be identified before a candle pattern can exist, the determination of overbought and oversold markets using traditional technical analysis will enhance a candle pattern's predictive ability."

- John Murphy

For better accuracy, traders should focus on higher timeframes—such as 1‑hour or longer—where patterns are less affected by market noise. For instance, the Three Outside Up pattern successfully predicted a bullish reversal in Bitcoin's price in 2024.

To maximize results, combine these patterns with momentum indicators and maintain disciplined risk‑management strategies.

Trading Methods with Shaved Candlesticks

This section builds on earlier candlestick signal analyses by outlining practical trading strategies.

Trade Entry and Exit Rules

Trading with shaved candlesticks requires clear entry and exit guidelines. It's recommended to wait for one or two candles to confirm the signal before making a move.

| Signal Type | Entry Condition | Exit Strategy | Stop‑Loss Placement |

|---|---|---|---|

| Shaved Top | After confirmation candle | At reversal signs or profit target | Below the pattern's low |

| Shaved Bottom | After confirmation candle | At reversal signs or profit target | Above the pattern's high |

| Multiple Shaved | After the second confirmation | Based on trend strength | Outside the pattern's range |

This setup allows traders to incorporate additional technical tools into their approach.

Using Other Technical Tools

Pairing shaved candlestick signals with other indicators can improve accuracy. Steve Nison's research highlights how oscillators can validate candlestick patterns. Here are a few tools to consider:

- RSI (Relative Strength Index): Look for divergences or oversold conditions (below 30) to spot potential reversals.

- MACD (Moving Average Convergence/Divergence): Use to confirm the momentum's direction.

- Moving Averages: These help identify the broader trend, providing context for shaved candlestick signals.

Incorporating these tools with disciplined risk management can lead to more precise trades.

Risk Control Methods

Effective risk management is crucial. Limit the risk per trade to a fixed percentage of your account. Here are some practical steps:

- Place stop‑losses slightly below the low of a Shaved Top for long trades.

- Set stops just above the high of a Shaved Bottom for short trades.

- Avoid placing stops at round numbers to reduce the risk of stop‑hunting.

For example, if an RSI indicator shows oversold conditions alongside a shaved bottom candlestick, the chances of a successful trade increase significantly.

Trading Mistakes to Watch For

Reading Errors

Misreading shaved candlesticks is a common pitfall for traders. Many mistakenly treat them as absolute signals, leading to poor decisions.

Here are some frequent reading mistakes and how to avoid them:

| Error Type | Impact | Prevention Strategy |

|---|---|---|

| False Breakouts | Premature trades and losses | Wait for confirmation from the next candle |

| Misidentifying Patterns | Faulty trading decisions | Analyze patterns on higher timeframes |

| Signal Timing | Bad entry or exit points | Use volume and momentum indicators |

Relying too heavily on a single indicator often stems from these misinterpretations, as explored in the next section.

Over‑Dependence on Single Patterns

Basing decisions on just one pattern without further validation can lead to costly errors. Dr. Alexander Elder highlights the importance of understanding candlestick dynamics:

"The main advantage of a candlestick chart is its focus on the struggle between amateurs who control openings and professionals who control closings".

To improve accuracy, combine candlestick patterns with tools like momentum indicators, support/resistance levels, and volume analysis. Steve Nison's research shows that patterns become much more reliable when paired with other technical indicators.

Ignoring the broader market context can also skew trading decisions, making it crucial to assess the bigger picture.

Missing Market Context

Overlooking overall market conditions reduces the reliability of trading signals. This mistake can undermine strategies related to trend signals and risk management. Key factors to consider include:

- Trend Direction: A bullish signal is less trustworthy during a strong downtrend.

- Market Volatility: High volatility calls for wider stop losses and more cautious pattern analysis.

- Volume Analysis: Genuine breakouts are often accompanied by a noticeable rise in volume.

As Edwin Lefèvre wisely noted:

"Easy profits in the stock market are the bait on the hook that catches the mug."

Traders should ensure signals align with broader trends and occur near critical levels. This holistic approach reduces the chances of errors and improves decision‑making.

Conclusion

Main Points Review

Shaved candlesticks can be a valuable signal in technical analysis, especially when they appear at key support or resistance levels. Their reliability improves when confirmed by subsequent price movements and other technical indicators.

To trade effectively using shaved candlesticks, focus on these three principles:

| Principle | How It Helps |

|---|---|

| Pattern Recognition | Helps filter out false signals |

| Signal Confirmation | Enhances timing for trade entries |

| Risk Management | Minimizes potential losses |

These principles form a solid foundation for building a strong trading strategy.

"Each candlestick is a simple, yet powerful tool to understand what's happening in the market"

Keep these insights in mind as you apply this method to your trades.

Getting Started

To incorporate shaved candlestick analysis into your routine, follow a structured approach. Focus on recognizing patterns within clear trends. Reliable signals are more likely when shaved candlesticks align with other technical tools.

- Start by analyzing larger timeframes to identify clear trends.

- Place stop‑loss orders slightly beyond the candlestick's extremes.

- Use volume analysis and momentum indicators to confirm signals.

Achieving consistent results requires combining shaved candlestick signals with other technical tools and maintaining disciplined risk management.

References

- Investopedia: Relative Strength Index (RSI)

- Wikipedia: Moving Average Convergence/Divergence (MACD)

- LuxAlgo Library – Candlestick Structure Indicator

- LuxAlgo Library – Reversal Candlestick Structure Indicator

- LuxAlgo Library – Dynamic Support & Resistance Indicator

- LuxAlgo Documentation – Oscillator Matrix Reversal Signals

- LiteFinance – Marubozu Candlestick Pattern

- Strike.money – Three Outside Up Pattern