A very common question asked by new traders or investors when it comes to technical analysis always seems to be this. "What is the best timeframe for trading?"

A very common question asked by new traders or investors when it comes to technical analysis always seems to be this. "What is the best timeframe for trading?" It's seen many times on almost every trading strategy video we release and asked multiples times a day in our Discord group. Let's break down the answer so everyone knows.

Intro

To put it simply, there is no "best" timeframe for trading. It simply doesn't exist.

The truth is, you should never trade one timeframe itself and you should be doing top-down analysis.

This is where you start with the higher timeframes such as the 1D or 4H charts to get a sense of important levels and the overall trend.

Then you can work your way down to timeframes that will be more relevant for where you are looking to enter trades.

It always will depend on how much availability you have at the screen.

It doesn't matter if you're typically placing trades on the 15-minute chart, you should always be aware of the higher timeframe trend.

Examples

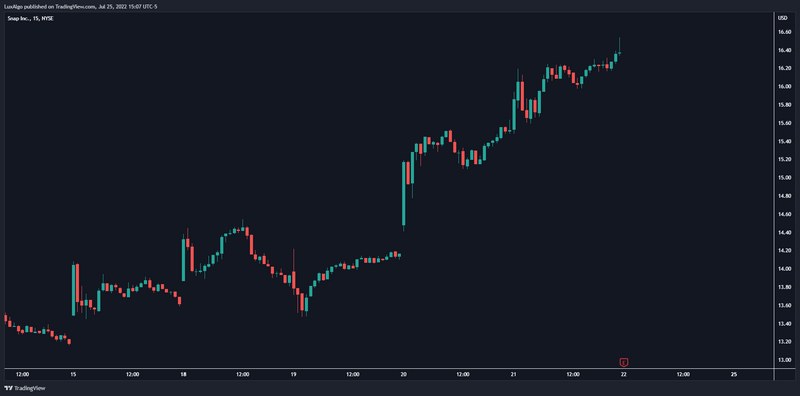

Here's a perfect example.

On the 15-minute timeframe here the market is clearly in an uptrend...

...but by zooming out to the daily chart and marking up some basic levels, you can see we were actually reaching a major resistance point.

By limiting your analysis to one single dimension, you are setting yourself up for unexpected moves to occur in the market.

By practicing top-down analysis to generally be aware of the higher timeframe trend & important levels, you are increasing your chances of creating better trading plans.

Useful Tips

Use this as a 'heads up' before considering there may be a "better" timeframe to use than another before making a mistake.

It is definitely true to acknowledge that lower timeframes like the 1-minute chart or even 5 minute-chart can be considered "unhealthy" to trade primarily based off of.

The reason for this is not only because of the importance of top-down analysis... but also, because of liquidity issues & trading fees.

Overtrading is a horrible thing and is a big reason why many traders lose money even with a decent win rate.

It's less stressful to trade on higher timeframes like the 30-minute chart or above too.

By focusing more on these higher timeframes, you will need to be more disciplined as a trader and instill more patience in your trades.

Considering the common downfall of overtrading & other risks associated with trading lower timeframes, this is a good thing.

In our next post we will cover more about trading psychology. Hope you enjoyed this read.