Boost your trading performance with this comprehensive trade journaling platform that automates tracking and offers AI-driven insights.

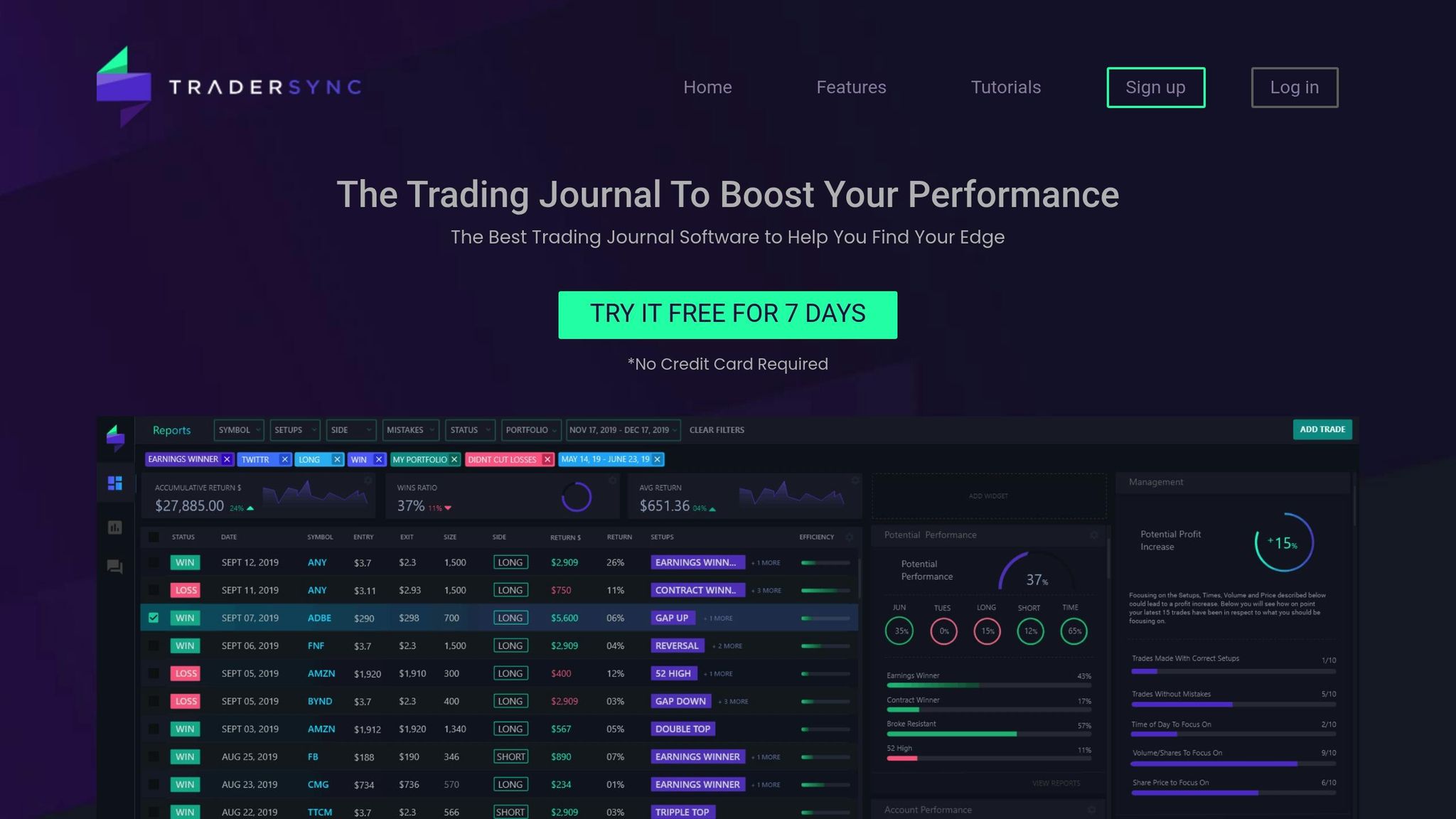

Tradersync is a trade‑journaling platform designed for U.S. traders to log, analyze, and improve their performance. It automates trade tracking by connecting with 900+ brokers, supports multiple asset classes (stocks, options, forex, futures, crypto), and provides actionable insights through AI‑powered analytics. Key features include customizable reports, a strategy checker, market‑replay tools, and risk‑management tracking. Tradersync also aids with tax reporting by maintaining detailed trade records.

Key Features:

- Automated Trade Tracking: Sync with brokers to import trades automatically.

- Analytics and Reporting: Identify patterns, track performance, and refine strategies.

- Risk Management: Tools to monitor stop‑losses and adherence to trading rules.

- AI‑Powered Insights: Highlight strengths, weaknesses, and trading biases.

- U.S.‑Focused Design: Uses $ currency, MM/DD/YYYY format, and aligns with U.S. market hours.

Pricing:

- Pro: $29.95/month (basic journaling tools).

- Premium: $49.95/month (adds AI assistant and strategy checker).

- Elite: $79.95/month (includes market replay and advanced AI insights).

A 7‑day free trial is available for new users. Tradersync stands out as a robust platform for traders seeking data‑driven decision‑making and improved performance.

Main Features of Tradersync

Automated Trade Tracking

Tradersync simplifies trade management by connecting with 900+ brokers to upload your history and record future trades [1][2]. Transfer years of data in minutes [3], eliminating manual entry and reducing errors.

The platform supports stocks, options, forex, futures, and crypto [1][2], catering to varied U.S. trader needs. Link multiple accounts for a unified view [4].

By automating these processes, Tradersync saves hours of manual work, keeping your journal updated while you focus on strategy development.

Analytics and Reporting

Once data is uploaded, analytics tools transform raw numbers into insights. The engine organizes complex data into clear sections [5], and the NextGen Journal delivers reports up to 10× faster [6].

Reports pinpoint which setups work and which don’t [1]. For instance, a “Day Breakout” may excel on Tuesday mornings [5].

| Day | Return | Profit Factor |

|---|---|---|

| Monday | $44,532 | 1.5 |

| Tuesday | $20,000 | 3.2 |

| Wednesday | $10,000 | 1.2 |

| Thursday | $13,000 | 1.3 |

| Friday | ‑$22,000 | ‑1.8 |

Bookmark favorite reports to revisit key metrics [6].

Risk Management and Feedback Tools

Tradersync tracks stop‑loss adherence [3], and its Strategy Checker monitors rule consistency [7]. For a “Gap and Go” setup you might pair market‑structure analysis with price targets; Tradersync highlights where you follow or deviate from the plan.

Advanced AI generates clear feedback [3], helping you learn and adjust [4].

How Tradersync and LuxAlgo Work Together

From Idea to Logged Results

Whether you are experimenting with fresh ideas or refining a proven edge, LuxAlgo provides the missing link between creative strategy design and long‑term performance measurement. Start by asking the AI Backtesting Assistant to craft a strategy or select one from its database of 6 million+ concepts. Mix and match conditions from the Signals & Overlays, Price Action Concepts, and Oscillator Matrix toolkits directly on TradingView. The assistant returns Pine‑Script‑ready code plus a full equity‑curve report you can export to TraderSync, where each live trade is logged automatically and measured against the theoretical results.

Iterate further by running bulk chart scans with LuxAlgo Screeners, then zoom into anomalies with high‑resolution indicators such as S&O Alpha Prime, PAC Wick Heatmap, and OSC Energy. Finally, compare months of real‑world journaling against simulation data in this LuxAlgo research article. Over time, this loop of AI‑assisted design and disciplined logging builds a robust dataset that helps prevent strategy decay and boosts confidence.

Automation for Active Traders

Active traders appreciate automation: faster imports, P&L calculations, automatic charting, and batch tagging [9][3].

Compliance and Localization

Tradersync tailors charting to U.S. equities and follows standard currency/date formatting [3].

"TraderSync goes above and beyond the typical trading journal. The platform is well‑designed, provides quality data and AI insights, and offers ongoing hands‑on customer support." (David Rodeck) [2]

User Experience and Accessibility

User Interface

Tradersync’s sleek design scores a 4.8 TrustScore from 226 reviews [11] and is praised for clarity [2].

Multi‑Device Support

The platform runs on iOS, Android, Mac, Windows, and via WebCatalog wrappers [12].

Customization and Community Resources

Choose Classic or Snapshot dashboards and hide widgets to focus on key metrics [8].

| Tag Type | Purpose & Benefit |

|---|---|

| Strategy Tags | Identify best‑performing setups |

| Market Condition Tags | Gauge results in varying volatility |

| Custom Fields | Align metrics with your style |

Pricing and Plans

Pricing Tiers and Features

Tradersync offers three plans. Pro is $29.95 monthly, Premium $49.95, Elite $79.95. Annual billing drops costs to $22.46, $37.46, and $59.96 [14]. Elite unlocks a Risk‑Management resource, market replay, and AI‑driven insights after 100 trades [2].

Plan Comparison Table

| Plan | Monthly | Annual | Annual Savings | Key Features |

|---|---|---|---|---|

| Pro | $29.95 | $22.46 | $89.85 | Journaling, import, detailed reports |

| Premium | $49.95 | $37.46 | $149.85 | Pro plus AI assistant, Strategy Checker, sector reports |

| Elite | $79.95 | $59.96 | $239.85 | Premium plus Trading‑Plan tool, replay, AI insights |

Payment and Billing Details

Pay by credit card monthly or annually [16]. A 7‑day Elite‑level trial requires no card [15], and annual billing saves 25 percent [14].

Conclusion

Main Takeaways

Tradersync elevates U.S. traders through automated imports, AI analytics, and flexible pricing, while LuxAlgo accelerates strategy creation. Together they form an end‑to‑end workflow: design, test, execute, and log.

Final Thoughts on Tradersync

By combining LuxAlgo’s AI Backtesting capabilities with disciplined journaling in Tradersync, traders gain a continuous improvement loop that sharpens execution and confidence over time.

TraderSync Review – The Ultimate Trading Journal for 2024 – Elevate Your Trading Log

FAQs

How can Tradersync's AI analytics help me become a better trader?

Tradersync turns data into practical insights, helping you spot winning patterns and avoid frequent mistakes. Over 10 reports reveal trends and offer feedback to refine strategies.

What are the key differences between the Pro, Premium, and Elite plans?

Pro ($29.95) covers basics, Premium ($49.95) adds deeper analytics, and Elite ($79.95) unlocks AI insights and market‑replay tools.

How does TraderSync protect user data?

TraderSync collects only essential details, uses advanced encryption during data transfer and storage, limits third‑party sharing to broker integrations, and continuously monitors system security.

References

- Tradersync Official Website

- Tradersync Features

- NextGen Journal

- Tradersync Reports

- Strategy Checker

- Software Updates

- Dashboard Customization

- Pricing Page

- Purchase Plan Support

- Free Trial Support

- User Reviews

- TradeThePool Review

- StockBrokers.com Review

- BullishBears Review

- WebCatalog App

- WebCatalog Platform

- DayTrading.com Review

- TraderSync Overview Video

- LuxAlgo Stop‑Loss Monitor

- AI Backtesting Strategy Fetching

- Market‑Structure Intrabar Indicator

- LuxAlgo AI‑Technology Articles

- AI Backtesting Assistant

- Signals & Overlays Toolkit

- Price Action Concepts Toolkit

- Oscillator Matrix Toolkit

- LuxAlgo Screeners

- S&O Alpha Prime Indicator

- PAC Wick Heatmap Indicator

- OSC Energy Indicator

- Trading Journals vs Backtesting

- Risk‑Management Resource

- AI‑Driven Trading Insights