Learn how window patterns reveal market sentiment and enhance trading strategies through effective analysis and risk management.

Window patterns are key price gaps between trading periods that reveal market sentiment and signal potential trend continuations. They come in two types:

- Rising Windows – bullish gaps indicating upward trends.

- Falling Windows – bearish gaps signaling downward trends.

Why They Matter

- Trend Confirmation – window patterns often align with ongoing trends.

- Risk Management – use windows to set stop-loss levels.

- Volume Validation – high trading volume strengthens pattern reliability.

How to Trade Them

- Identify the Gap – ensure no overlap between the previous and current candle.

- Confirm With Volume – look for above-average trading activity.

- Combine With Indicators – use RSI, moving averages, or Fibonacci levels for better accuracy.

- Set Entries & Exits

- Rising Window: enter above the gap; target Fibonacci resistance levels.

- Falling Window: enter below the gap; target Fibonacci support levels.

Quick Comparison of Window Patterns

| Pattern | Market Context | Volume Role | Stop-Loss Placement |

|---|---|---|---|

| Rising Window | Uptrend | Confirms bullish trend | Below the gap |

| Falling Window | Downtrend | Confirms bearish trend | Above the gap |

Mastering window patterns involves combining technical tools, analyzing volume, and understanding market trends for precise trading setups.

Falling Windows Patterns

Window Pattern Types

Window patterns highlight market movements through specific price gaps, often pointing to trend continuations or shifts in sentiment.

Rising Windows

Rising windows are bullish patterns seen in uptrends. They occur when there's a gap between the high of the first candle and the low of the second candle. Analysis of S&P 500 stocks from 1995 – 2015 shows that rising windows appeared in 5.73 % of candlestick patterns—36,612 occurrences out of 2,236,421 candlesticks analyzed. These patterns successfully predict trend continuation 75 % of the time.

“The rising window is a fancy name for a price gap in an upward price trend.” – Thomas Bulkowski

Key characteristics of rising windows:

| Feature | Description | Trading Implication |

|---|---|---|

| Gap Duration | Average 79 days; median 11 days | Helps plan holding time |

| Volume Profile | Higher volume strengthens the pattern | Use volume as confirmation |

| Support Level | Acts as price support | Potential stop-loss zone |

| Pattern Context | Forms during established uptrends | Confirms bullish continuation |

Now let’s explore falling windows and their role in down-trend strategies.

Falling Windows

Falling windows are the bearish counterpart to rising windows. These patterns appear in downtrends when the second candle’s high is below the first candle’s low, reflecting ongoing selling pressure and signaling a likely continuation of the downtrend.

Comparing gap positions:

| Window Type | Gap Position | Market Context |

|---|---|---|

| Falling Window | Between the first candle’s low and the second candle’s high | Downtrends |

| Rising Window | Between the first candle’s high and the second candle’s low | Uptrends |

Pattern Elements

Successful window-pattern trading focuses on:

- Candlestick positioning – where the gap forms relative to the trend.

- Volume changes – spikes can confirm the pattern.

- Key price levels – use windows to guide entries and exits.

Pattern Recognition Methods

Spotting window patterns involves a structured process that combines visual observation, technical tools, and volume analysis.

Pattern Detection Steps

| Step | Action | Verification Point |

|---|---|---|

| Chart Setup | Use multi-time-frame charts (e.g., 4-hour and daily) | Look for clear candlestick formations |

| Trend Analysis | Draw trendlines connecting peaks and troughs | Confirm trend direction |

| Gap Identification | Find price gaps between candles | Ensure no overlap between highs and lows |

| Volume Check | See if volume exceeds the 20-day average | Confirm above-average activity |

Detection Software

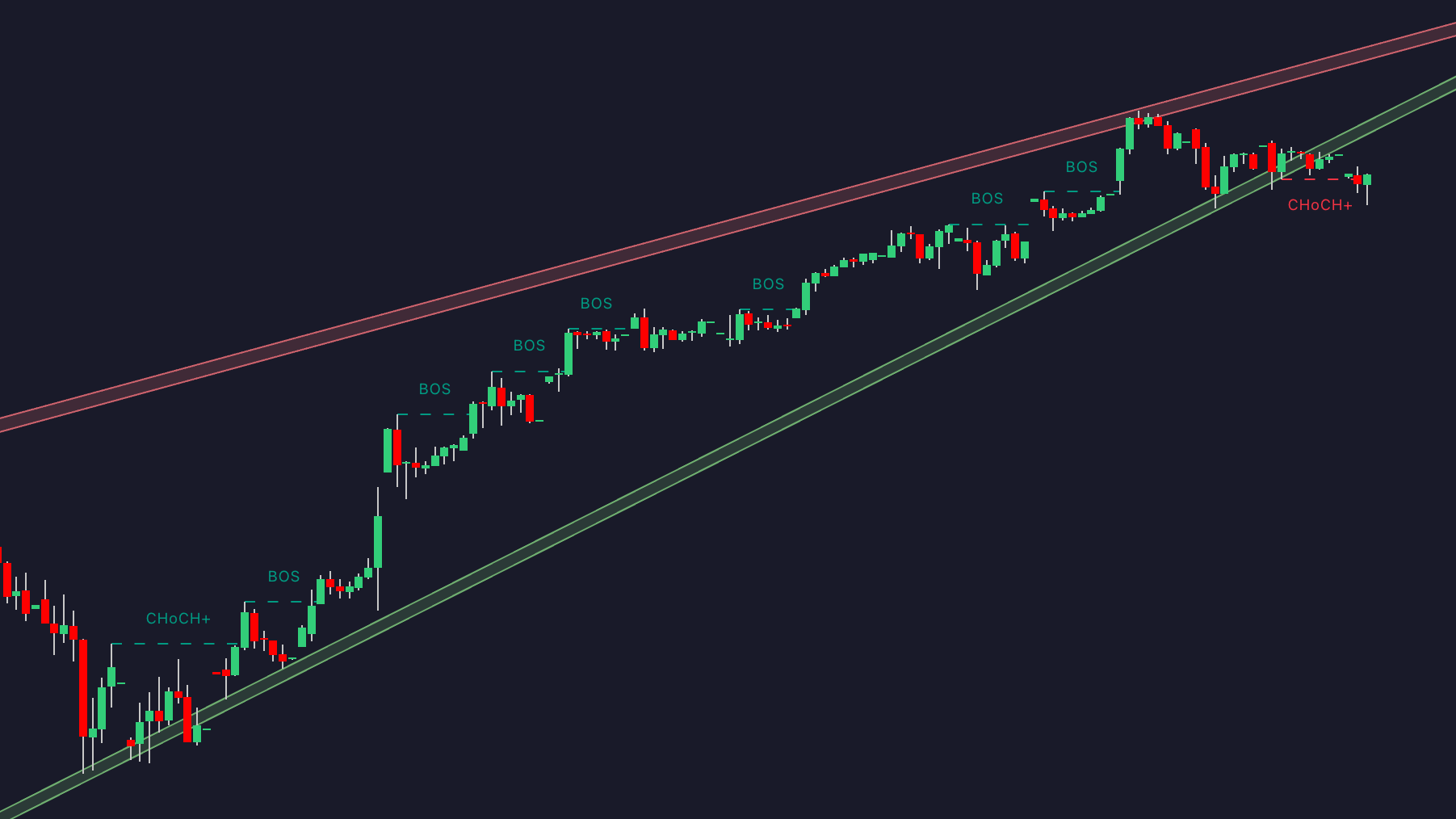

Automated tools streamline pattern recognition. On TradingView, LuxAlgo’s Price Action Concepts (PAC) toolkit offers:

- Real-time pattern identification across multiple time frames

- Customizable gap-detection parameters

- Scanning of multiple tickers simultaneously

- Seamless TradingView integration

Pairing software with volume analysis helps validate patterns before trading.

LuxAlgo Price Action Concepts Pattern Detection

LuxAlgo provides the Price Action Concepts toolkit on TradingView—an exclusive set of tools that automatically highlights rising & falling window gaps, break-of-structure events, liquidity zones, and dozens of other price-action signals in real time. Key benefits include:

- Instant on-chart call-outs—no manual scanning required.

- Adjustable sensitivity—fine-tune pattern detection for any timeframe or instrument.

- Built-in alerts—get notified the moment new windows or structural shifts appear.

- Multi-time-frame dashboard—view high-level market structure at a glance while drilling into lower-time-frame entries.

Whether you’re a newcomer or an experienced trader, the PAC toolkit delivers actionable insights that turn raw candlesticks into trade-ready information—directly inside TradingView.

Volume Analysis

Volume confirms market participation. A few scenarios:

| Volume Scenario | Pattern Implication |

|---|---|

| Above-average volume | Confirms strong trading activity |

| Below-average volume | Suggests a weaker pattern |

| Volume spike at gap | Signals high market participation |

Trading With Window Patterns

Trade Entry and Exit

Confirm the pattern with the close of the second candle. Fibonacci retracements guide entries and exits:

| Pattern Type | Entry Strategy | Exit Strategy |

|---|---|---|

| Rising Window | Enter above the window high once confirmed | Target the 23.6 % Fibonacci level |

| Falling Window | Enter short below the window low once confirmed | Target the next Fibonacci level |

Risk Control

| Risk Element | Management Strategy | Rationale |

|---|---|---|

| Stop-Loss Placement | Set just outside the window range | Limits losses if the pattern fails |

| Pattern Validity | Confirm with above-average volume | Ensures pattern strength |

Pattern Confirmation

| Confirmation Factor | Key Indicator | Action Point |

|---|---|---|

| Technical Indicators | RSI and MACD convergence | Confirms trend direction |

| Fibonacci Integration | Price action at key levels | Enter above the 38.2 % level for rising windows |

| Pattern Structure | Gap size and candle positioning | Ensures clean window formation |

Advanced Pattern Trading

Multiple-Time-Frame Strategy

| Time-Frame Level | Purpose | Key Focus |

|---|---|---|

| Higher (Daily/Weekly) | Assess trend direction | Spot support/resistance and major patterns |

| Intermediate (4 h) | Confirm patterns | Align volume with the trend |

| Lower (1 h/15 min) | Fine-tune entries | Pinpoint exact entry & exit |

Strategy Testing

LuxAlgo’s AI Backtesting Assistant lets traders test window-pattern strategies under various market conditions. Key components include:

| Component | Implementation | Outcome |

|---|---|---|

| Pattern Recognition | Automated detection | Validates success rates |

| Risk Parameters | Optimized stop-loss levels | Improves risk-to-reward ratios |

| Volume Analysis | Correlates trade volume | Boosts confidence in reliability |

Trend-Trading Integration

Combine volume and confirmation metrics with broader trend analysis. For example, on a Tesla chart, a Falling Window began with a bearish pin bar, followed by a gap down and a bearish marubozu. In contrast, Alphabet Inc. (GOOGL) showed a Rising Window on 29 Apr 2021 after strong earnings, creating a solid trading opportunity.

Main Takeaways

| Component | How to Apply | Why It Matters |

|---|---|---|

| Pattern Recognition | Spot visual gaps between candlesticks | Foundation of the setup |

| Volume Analysis | Confirm activity during gap formation | Validates strength |

| Risk Control | Place stop-loss orders strategically | Protects capital |

| Market Context | Trade with the broader trend | Improves success rate |

Getting Started

Begin with reliable tools and practice accounts. Platforms like TradingView (rated 4.6 / 5 by users) offer free candlestick recognition—ideal for newcomers.

- Use demo accounts to build confidence.

- Trade during high-volume sessions for clearer signals.

- Set stop-loss orders just outside the window range.

Indicators such as LuxAlgo’s Rising & Falling Window Signals work on TradingView, NinjaTrader, and MetaTrader and help manage support and resistance zones. Combined with disciplined risk management and continuous learning, they support long-term trading success.