Explore how a trading platform visualizes market data to enhance trading decisions with real-time insights on order flow and liquidity.

Bookmap is a trading platform that turns complex market data into clear visuals, helping traders understand liquidity and order flow in real time. Here's what you need to know:

- What It Does: Visualizes market depth and order flow at 40 FPS, providing both live and historical views of order book positions.

- Key Benefits:

- Spot real-time liquidity zones.

- Make faster, informed trading decisions.

- Analyze true, non-aggregated market depth.

- Main Features:

- Heatmap Visualization: Highlights liquidity with color‑coded signals.

- Volume Bubbles: Shows trade execution points.

- Order Flow Tracking: Tracks behavior of market participants.

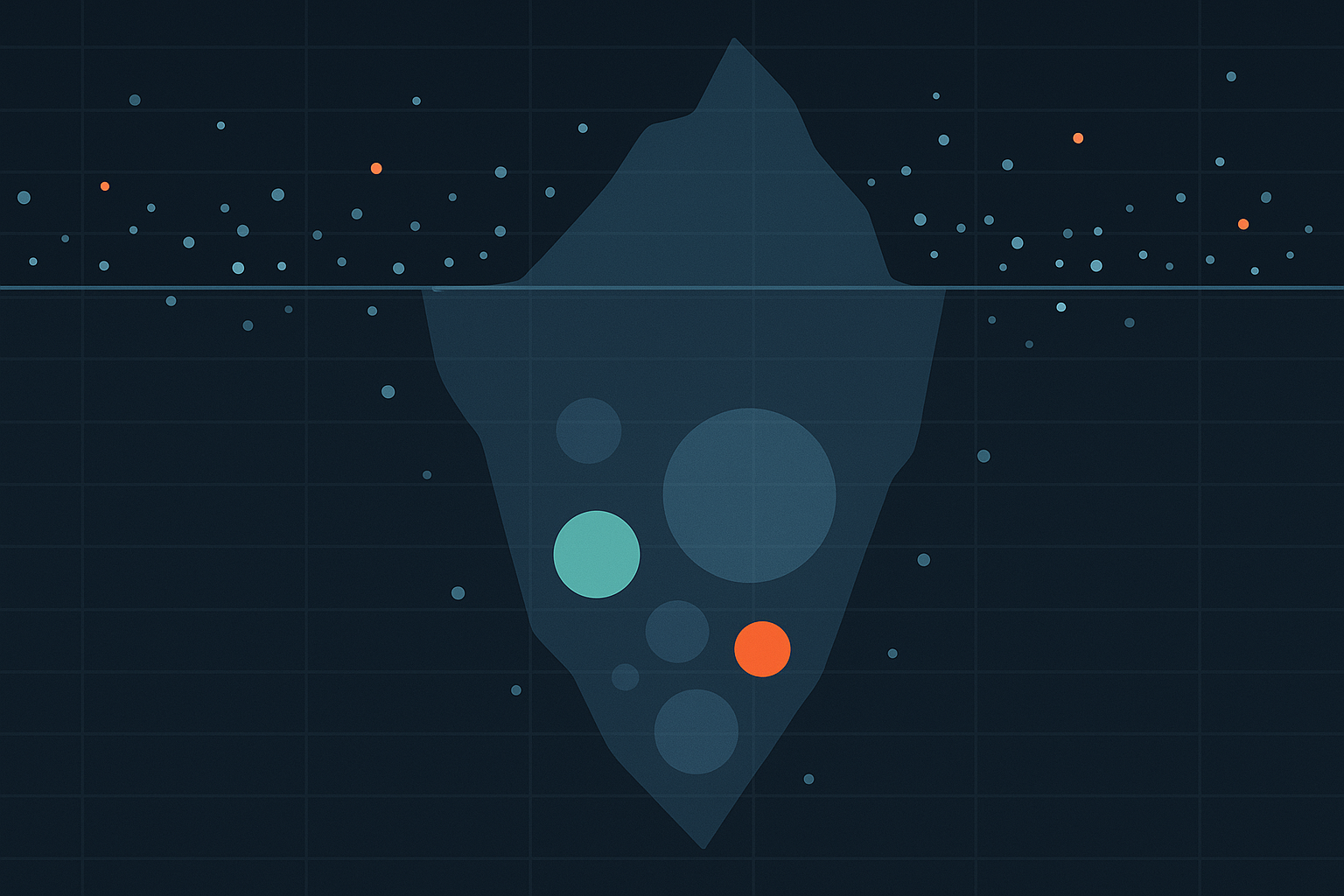

- Large Lot Tracker & Iceberg Detection: Identifies hidden trades and institutional activity.

Quick Comparison Table

| Feature | Description | Trading Benefit |

|---|---|---|

| Heatmap Visualization | Real‑time liquidity view | Spot support/resistance levels |

| Volume Bubbles | Highlights trade sizes and locations | Understand market activity |

| Order Flow Analysis | Tracks order flow at 40 FPS | Detect sentiment shifts quickly |

| Large Lot Tracker | Identifies significant orders | Track institutional actions |

| Iceberg Detection | Exposes hidden liquidity | Spot market manipulation |

Bookmap is ideal for scalping, day trading, and swing trading, offering tools to detect support/resistance, track market manipulation, and analyze order flow. Start with the free Digital plan or explore advanced options for deeper insights.

Liquidity Heatmap Trading 101: Beginner’s Guide

Understanding Bookmap Heatmaps

Bookmap turns order book data into real-time visuals, making it easier to understand market depth. This approach offers a clear view of trading activity.

Reading Heatmap Data

Bookmap uses color‑coded signals to represent market liquidity. Here's what the colors mean:

- Red and Orange: Indicate high liquidity, often marking potential support or resistance levels.

- Blue and Green: Show low liquidity, which could signal breakout zones.

- Darker Shades: Represent fewer orders, pointing to weaker price levels.

| Color | Liquidity Level | Trading Implication |

|---|---|---|

| Red/Orange | High liquidity | Potential support/resistance |

| Blue/Green | Low liquidity | Possible breakout zones |

| Dark shades | Fewer orders | Weaker price levels |

Order Flow and Liquidity Analysis

The heatmap updates in real time, reflecting changes in the order book. Volume dots overlay these visuals, with green dots showing aggressive buyers (bid aggressors) and red dots showing aggressive sellers (ask aggressors).

To analyze order flow effectively:

- Follow Color Changes: Shifts in intensity help identify support and resistance levels.

- Pay Attention to Volume Dots: Larger green or red dots can highlight aggressive buying or selling at specific prices.

- Examine Order Book Depth: Use raw market data to assess true liquidity levels.

Using Real-Time Market Depth

The Liquidity Marker add-on helps you spot significant changes in market depth. It offers two modes—Liquidity Markers and Max Liquidity Levels—which are particularly useful in fast‑moving markets.

For better real‑time analysis:

- Adjust Thresholds: Tailor settings to match your trading instrument and market conditions.

- Look for Absorption Zones: Areas where large orders are absorbed, often signaling potential support or resistance.

- Spot Algorithmic Activity: Use DOM Pro to identify patterns of liquidity concentration that suggest algorithmic trading.

Bookmap Tools and Indicators

Volume and Order Flow Tools

Bookmap's volume and order flow tools take real‑time market depth visuals to the next level, offering a detailed look at market behavior. The platform refreshes at an impressive 40 frames per second, ensuring precise tracking of market activity.

Here are some key tools:

-

Cumulative Volume Delta (CVD): Tracks the difference between buying and selling volumes. Traders can use CVD to:

- Identify support and resistance levels.

- Spot divergences that might signal potential reversals.

- Cross‑check signals against volume histograms for confirmation.

-

Volume Dots: Visually represents trade executions:

- Green dots indicate aggressive buying.

- Red dots highlight aggressive selling.

- The size of the dots reflects the trade volume.

Additionally, Bookmap provides insights into institutional activity, making it easier to spot large orders and hidden trades.

Large Order Detection

Bookmap employs sophisticated algorithms to uncover institutional trading activity through tools like the Large Lot Tracker and Iceberg Detection systems.

| Detection Feature | Function | Threshold Requirements |

|---|---|---|

| Large Lot Tracker | Identifies significant orders | 20% of total order size at a price level |

| Iceberg Detection | Exposes hidden liquidity | 10% of the largest pending orders bar |

| Native Algorithm | Requires MBO data for accuracy | Most precise detection |

| Resistance Algorithm | Works with lower‑quality data | Alternative detection method |

Iceberg orders are identified by analyzing discrepancies between pending orders and actual transactions at specific price points. Traders can monitor volume spikes, price changes, and mismatches in orders, then use historical replays to evaluate how these large orders impact the market.

The Strength Level Indicator highlights hidden orders after they are executed but does not predict future hidden orders. This tool is particularly useful for tracking institutional order flow and spotting potential market manipulation.

Trading Strategies with Bookmap

Finding Support and Resistance

Bookmap's heatmap makes it easier to spot key support and resistance levels. Support often shows up as clusters of large buy Volume Dots, dark blue zones, and areas with consistent liquidity. On the flip side, resistance is marked by concentrated sell Volume Dots, bright red zones, and repeated large sell orders.

Detecting Market Manipulation

Bookmap's tools can help you spot manipulation tactics like spoofing and layering. Spoofing involves placing and canceling orders quickly, while layering uses multiple orders at various price levels. Hidden liquidity is another red flag, often revealed by volume spikes without corresponding visible orders. Keep an eye on sudden large orders that disappear, fast cancellations, or gaps between displayed and executed trades.

| Manipulation Type | Visual Indicators | Suggested Actions |

|---|---|---|

| Spoofing | Rapid order placement and cancellation | Watch for sudden changes in order book depth |

| Layering | Multiple orders at various price levels | Track how long orders stay in place |

| Hidden Orders | Volume spikes without visible orders | Examine changes in the bid‑ask spread |

A high‑profile example of spoofing occurred in 2020 when JPMorgan Chase & Co. agreed to a settlement over their activities in the precious metals markets. This highlights the importance of tools like Bookmap for identifying unusual trading behavior.

Order Flow Trading Methods

Bookmap's Volume Bubbles highlight areas with intense trading activity. For instance, during Bitcoin's price movements, large buy Volume Dots clustering around $40,000 suggested institutional support. Here are a few approaches you can use:

- Scalping: Take advantage of temporary support or resistance created by large bid/ask orders.

- Day Trading: Focus on areas with high trading volume and activity.

- Swing Trading: Use cumulative volume delta to confirm broader trends.

Next, we’ll dive into how to set up and configure Bookmap to make the most of these strategies.

Setup and Configuration

Data Feed Setup

To use Bookmap effectively, connect it to your preferred market data providers and trading platforms. The connection options vary depending on your subscription level. For futures trading, BookmapData CME offers access to CME, CBOT, NYMEX, and COMEX exchanges for $79 per month. You can also choose individual exchange access starting at $34, with a 50% discount for the first month.

Quick setup steps:

- Open Connections > Configure

- Select your platform and input login credentials

- Activate the connection

- Subscribe to the instruments you want to trade

If you're trading cryptocurrencies, Bookmap integrates with platforms like Binance, Coinbase, and Kraken through its Digital subscription. This includes real-time data and trading features. Note that some platforms, such as HitBTC and Kraken (spot), only allow market data viewing.

Chart and Tool Settings

Bookmap's visual interface is highly customizable, allowing you to fine‑tune the display to suit your trading style. Access these options using the "Configure Visible Components" and "Studies Configuration" icons.

Heatmap Configuration:

- Adjust color maps to highlight key liquidity levels

- Set upper and lower cutoffs for identifying large order sizes

- Enable vertical smoothing to improve clarity when zoomed out

Market Depth Display:

- Configure aggregated market depth views

- Customize the number of visible price levels

- Set parameters for resetting depth when prices go out of range

API Trading Setup

Automating trades in Bookmap involves configuring exchange adapters and API credentials. Here's how to set it up:

- Install the necessary adapters and enter your API credentials under Settings > Manage plugins.

- Enable trading features in the Trading Configuration Panel.

Security Reminder: API keys and secrets remain secure and are not shared with Bookmap's servers.

The Trading Configuration Panel (TCP) allows you to manage:

- Order size settings

- Stop order configurations

- Automatic bracket orders

Bookmap currently supports API trading with several cryptocurrency exchanges, including Binance (Spot & Futures), BitMEX, and Kraken (Spot & Futures). Keep an eye on the Bookmap forum for updates, as some adapters are still in alpha testing.

Bookmap vs. Other Platforms

Platform Comparison

Bookmap's heatmap visualization refreshes 125 times per second, providing smooth, real‑time updates that help traders spot market sentiment and liquidity zones quickly.

| Feature | Bookmap | Jigsaw Trading | NinjaTrader | Sierra Chart |

|---|---|---|---|---|

| Core Technology | Java architecture | Native Windows | Native Windows | Native Windows |

| Heatmap Quality | Clear, 125 FPS | Limited definition | Basic | Basic |

| Education | Two skill levels | Targeted training | Video guides, webinars | ’entretienSetup videos only |

| Analytics | Basic | Advanced (Journalytix) | Limited | Limited |

| News Feed | Real‑time (extra cost) | Real‑time (extra cost) | Data service dependent | Not available |

| Self‑Tuning Tools | No | Yes | No | No |

Key Features That Set Bookmap Apart

- DOM Integration: Combines traditional DOM with historical heatmap data for deeper insights.

- Enhanced Footprint Charts: Adds detailed liquidity data to standard footprint functionality.

- Volume Profile Integration: Provides a more detailed view of liquidity compared to basic volume profiles.

Architecture and Community Support

While Bookmap uses Java architecture, which may impact performance on some systems, it doesn't compromise on delivering market insights. Competitors like Jigsaw, NinjaTrader, and Sierra Chart rely on native Windows technology.

Community support also varies. Bookmap and Jigsaw provide active chat rooms for peer interaction, while NinjaTrader and Sierra Chart stick to traditional user forums, which can make the learning process slower.

Tips for Using Bookmap

Best Settings Guide

To get the most out of Bookmap, tailor your settings to match your trading style. For scalping, prioritize high refresh rates, one‑click trading, and keep chart indicators to a minimum. Swing traders should focus on extended historical depth, volume dots, and multiple timeframe views for a broader market perspective.

| Trading Style | Recommended Settings | Additional Requirements |

|---|---|---|

| Scalping | High refresh rate, one‑click trading, minimal chart indicators | Low‑latency internet, low commission broker, tight spreads |

| Swing Trading | Extended historical depth, volume dots, multiple timeframe views | Higher chart timeframes, supply/demand indicators, pattern recognition |

Common Mistakes to Avoid

To improve your trading strategy, steer clear of these common errors:

-

Misinterpreting Liquidity Zones

Not all liquidity is created equal. Here's how to differentiate between genuine liquidity and temporary activity:Aspect Genuine Liquidity Temporary Activity Order Consistency Sustained levels Brief concentrations Book Depth Multiple price levels Single‑level spikes Market Response Predictable reactions Limited impact - Ignoring Market Context

Many traders focus solely on liquidity zones during morning trading sessions but fail to account for upcoming economic reports or significant market events. - Weak Strategy Development

Relying only on heatmap analysis isn't enough. Combine it with traditional indicators, test your approach in simulator mode, and regularly update your analysis. Always stick to strict risk management principles.

Learning Materials

Bookmap provides a wealth of resources to help you master the platform. The Learning Center offers over 100 free videos and daily live events. Their YouTube channel, which has 49.5K subscribers, also provides regular market updates and insights.

Start your learning journey with:

- The Free Digital package

- Foundational courses for beginners

- Advanced feature tutorials

- Hands‑on practice sessions

For more technical details, the platform’s knowledge base is an excellent resource. These materials will deepen your understanding of Bookmap’s heatmap and liquidity tools, enhancing your trading skills.

Conclusion

Main Features and Benefits

Bookmap offers detailed market insights by refreshing data every 30 milliseconds. Its standout features provide a deeper understanding of market activity:

| Feature | Trading Benefit | Effect on Decisions |

|---|---|---|

| Heatmap Visualization | Analyzes the order book in real time | Pinpoints key support and resistance levels |

| Volume Bubbles | Tracks trade size and location | Gives a clearer view of market activity |

| Order Flow Analysis | Updates 40 times per second | Detects early changes in market sentiment |

| Large Lot Tracker | Highlights large trades | Sheds light on major market players' actions |

How to Get Started

- Choose Your Plan

Start with the free Digital plan or upgrade to the Global plan for $39/month. - Learn the Core Tools

Dive into features like heatmap visualization, volume bubbles, and order flow tracking. These tools are essential for understanding market structure and predicting price movements. - Enhance Your Strategy

Combine Bookmap's specialized indicators (e.g., Iceberg, Large Lot Tracker) with traditional trading methods to identify high‑probability setups and manage risk effectively.

Consistent practice is key to mastering Bookmap. Its real‑time updates and detailed visualizations give you an edge in analyzing and responding to market conditions.