Understand the key differences between breaker blocks and order blocks to enhance your trading strategy and make informed decisions in various market conditions.

Want to improve your trading strategy? Start by understanding the difference between breaker blocks and order blocks.

- Order Blocks: Areas of high institutional buying or selling activity, acting as strong support or resistance zones. Best for trend continuation strategies in stable, trending markets.

- Breaker Blocks: Form when order blocks fail, signaling market structure shifts or reversals. Ideal for volatile markets with sharp price movements.

Quick Comparison

| Aspect | Order Blocks | Breaker Blocks |

|---|---|---|

| Formation | Institutional accumulation, distribution | Failed order blocks after structural breaks |

| Purpose | Support trend continuation | Signal reversals or price shifts |

| Market Role | Entry and exit points based on institutional interest | Highlight market structure changes |

| Best Conditions | Trending markets with clear direction | Volatile markets with sharp reversals |

| Reliability | Consistent in stable trends | Dependable when aligned with trends |

| Stop Loss Placement | Just outside the order block zone | Just outside the breaker block zone |

Key Takeaway: Use order blocks to follow institutional activity in trending markets. Turn to breaker blocks for spotting reversals in volatile conditions. Both concepts help traders make informed decisions, but their effectiveness depends on the market environment and your trading style.

Order Block Simplified — Smart Money Course

What Are Breaker Blocks and Order Blocks

Understanding breaker blocks and order blocks is key for traders aiming to identify market patterns and adapt their strategies effectively. In LuxAlgo language, these are price action concepts you can study in the documentation and explore with indicators available on TradingView.

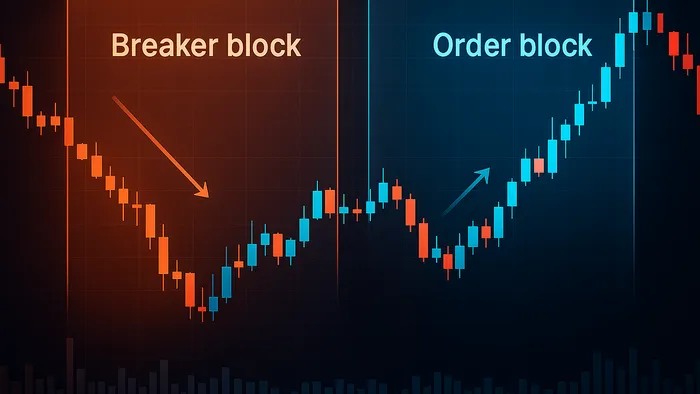

What Are Breaker Blocks?

Breaker blocks form when an order block fails to maintain its position, signaling a change in the market structure.

These zones often appear after a liquidity sweep or a major structural break, marking areas where earlier institutional interest fades as market dynamics shift. A bullish breaker block emerges from a failed bearish order block and often acts as support. A bearish breaker block stems from a failed bullish order block and often serves as resistance. These areas can also function as zones for liquidity rebalancing. For traders, higher timeframe breaker blocks, such as daily or weekly, tend to be more dependable and offer stronger signals.

In contrast to breaker blocks, order blocks represent zones where institutional activity remains active and consistent.

What Are Order Blocks?

Order blocks highlight areas on a chart where significant institutional buying or selling occurs. A bullish order block signals concentrated buy orders, while a bearish order block reflects heavy sell orders. When price revisits these zones, it often reacts predictably due to ongoing institutional interest.

These blocks are relevant across various markets, including stocks, crypto, forex, and futures. They work especially well with high volume assets like the S&P 500, Bitcoin, and Ethereum, as volatility can make order block formations clearer. Higher timeframes, such as daily or weekly charts, make these zones more visible and reliable for trading decisions.

Key Differences Comparison Table

| Aspect | Order Blocks | Breaker Blocks |

|---|---|---|

| Formation | Areas of institutional accumulation, distribution | Failed order blocks after structural breaks |

| Primary Purpose | Support trend continuation | Signal potential reversals or price shifts |

| Market Role | Provide entry and exit points based on institutional interest | Highlight market structure changes and reversals |

| Best Market Conditions | Trending markets with clear directional bias | Volatile markets with sharp reversals |

| Reliability | Consistent in stable trending conditions | More dependable when aligned with the overall trend |

| Trading Focus | Follow institutional activity | Take advantage of failed institutional levels |

How Breaker Blocks and Order Blocks Form

Breaker blocks and order blocks develop in distinct ways. Grasping how these zones form can help you identify their development early and use them effectively in trading strategies.

Formation of Breaker Blocks

Breaker blocks are born when existing order blocks fail. This process begins with price breaking through a support or resistance level, then reversing to invalidate the breakout. The result is a disruption in the market structure, creating a new zone of interest.

These setups often occur in volatile markets prone to liquidity hunts and false breakouts. For instance, a bearish breaker block can form when a bullish order block fails during an uptrend, while a bullish breaker block can appear when a bearish order block fails during a downtrend. A hallmark of breaker blocks is a retest of the failed zone, which confirms that the prior support or resistance level has flipped and now functions in the opposite role.

"Breaker Blocks often align with the overall trend, signaling potential reversals or significant price shifts." - Michael J Huddleston

The formation of breaker blocks is different from the accumulation patterns that define order blocks.

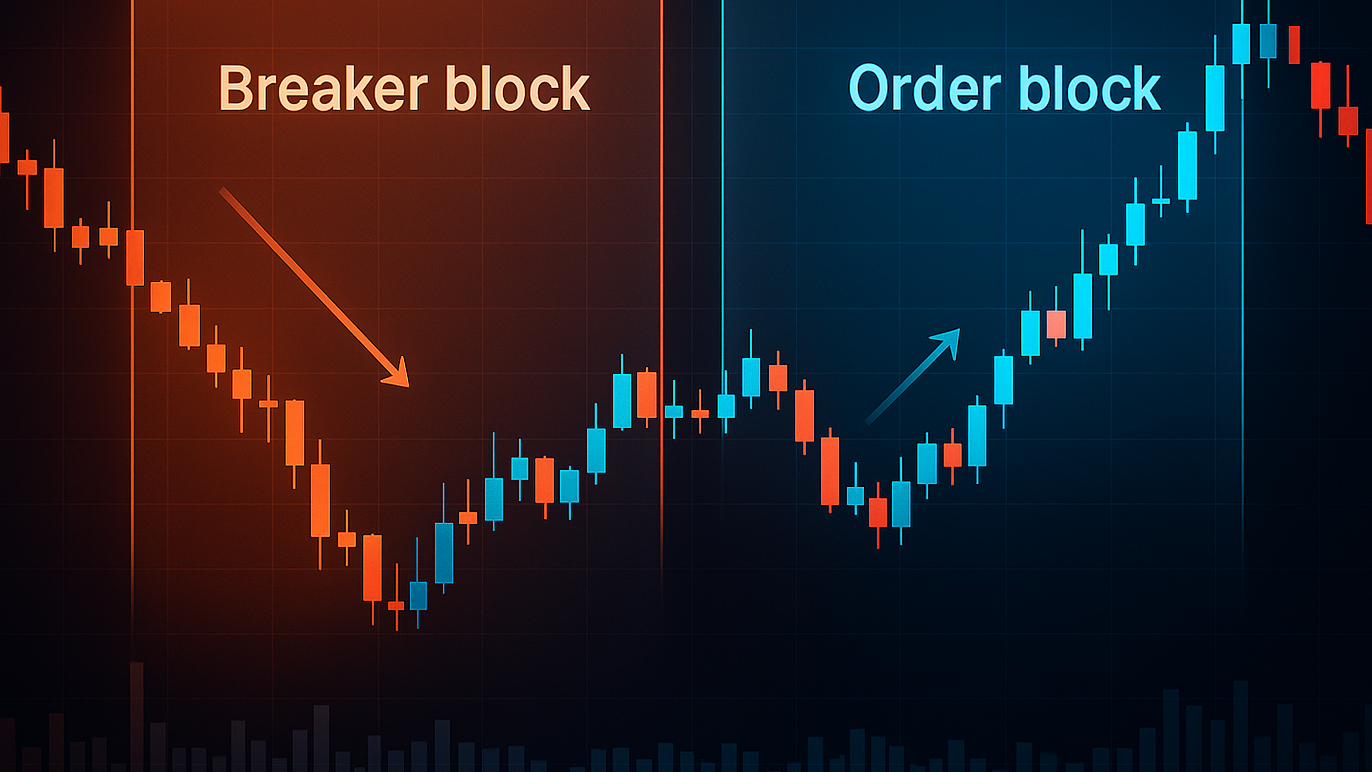

Formation of Order Blocks

Order blocks emerge during periods of institutional accumulation or distribution. These zones represent areas where large orders are placed, often at pivotal moments that set new highs or lows.

Bullish order blocks are identified during a downward price movement, marking the area where the last bearish candle occurs before a significant upward move. In contrast, bearish order blocks appear during an upward price movement, characterized by the last bullish candle before a notable downward shift.

Three common elements are necessary for order block formation: a liquidity sweep indicating institutional activity, an imbalance in price where the market moves rapidly and leaves behind untraded zones, and the area remaining unfilled. These blocks typically form in trending markets, particularly near price extremes, and are often associated with elevated trading volume and large orders.

Formation Differences Comparison Table

| Formation Aspect | Order Blocks | Breaker Blocks |

|---|---|---|

| Origin | Institutional order placement | Failure of existing order blocks |

| Market Conditions | Trending markets with clear direction | Volatile markets with structure breaks |

| Formation Trigger | Accumulation, distribution before moves | Liquidity hunts and false breakouts |

| Key Candle or Zone | Last opposing candle before momentum | Support or resistance break with retest |

| Volume Characteristics | High volume and larger trades | Often traps reactive traders |

| Retest Behavior | Often remains untraded initially | Price retraces to failed zone |

| Structural Role | Can establish new highs and lows | Signals market structure shifts |

Trading Applications — When to Use Each Concept

Knowing when and how to use breaker blocks and order blocks can make a difference in outcomes. Breaker blocks are best suited for reversal scenarios, order blocks excel in trend continuation setups.

Using Breaker Blocks in Reversal Strategies

Breaker blocks are useful for spotting market reversals. They are failed order blocks that indicate a shift in structure, signaling potential opportunities for traders who can identify these changes.

To trade breaker blocks effectively, first recognize a market structure shift. This involves spotting breaks in previous highs or lows. After identifying a potential breaker block, wait for confirmation within the zone before entering a trade.

For instance, consider a USOil chart where a bullish order block failed and turned into a bearish breaker block. A sell position can be considered after confirmation, with a stop loss above the retest zone and a target risk–reward of at least 3:1.

Risk management is critical when trading breaker blocks. Place your stop loss just outside the breaker block zone, as these setups can be volatile. To improve your approach, combine breaker blocks with other techniques like candlestick patterns or momentum indicators such as RSI. This can provide stronger confirmation.

Using Order Blocks in Trend Continuation Strategies

Order blocks are effective in trending markets. These zones represent key areas where significant orders have been placed, making them ideal for strategies that align with the prevailing trend.

In an uptrend, focus on bullish order blocks that act as areas of demand. In a downtrend, look for bearish order blocks that serve as supply. To validate an order block, ensure it has triggered a liquidity sweep, shows a clear price imbalance, and remains untouched by recent price action.

For confirmation, check that the order block helped break a recent high or low, caused a sharp move away from the zone, and remains untested. Using higher timeframes like H4 or Daily can help identify zones that institutions are more likely to respect.

Wait for a retest with telltale rejection wicks before entering. Place your stop loss just outside the order block zone and aim for at least a 2:1 reward to risk. You can add confirmation with volume analysis or other context.

Trading Applications Comparison Table

| Application Aspect | Order Blocks | Breaker Blocks |

|---|---|---|

| Primary Use | Trend continuation strategies | Reversal trading strategies |

| Market Alignment | Following institutional flow | Capitalizing on structure shifts |

| Best Market Conditions | Strong trending environments | Volatile markets with breakouts |

| Entry Confirmation | Rejection wicks, reversal patterns | Candlestick patterns, market character shifts |

| Risk Reward Target | Minimum 2:1 | Minimum 2:1, preferably 3:1 |

| Stop Loss Placement | Just outside the order block zone | Just outside the breaker block zone |

| Confluence Factors | Volume, trend context | Other indicators, chart patterns |

| Timeframe Preference | H4 and Daily charts | Multiple timeframes for confirmation |

How to Identify Breaker Blocks and Order Blocks on Charts

To identify breaker blocks and order blocks, focus on specific chart behaviors. This section links chart formations to actionable trading insights.

Key Indicators for Breaker Blocks

Breaker blocks emerge when order blocks fail, creating noticeable shifts on your charts. The primary signal is a failed order block, price breaks through a support or resistance zone that was functioning as an order block, then retests from the other side.

Watch for areas where former support becomes resistance, bearish breaker, or where previous resistance turns into support, bullish breaker. This role reversal indicates a breaker block.

Candlestick patterns are helpful for confirmation. Look for decisive movements that breach order block zones and quickly reverse.

A breaker block is often confirmed when a retest fails and shows clear rejection, for example long wicks or reversal patterns.

While breaker blocks are validated by failed tests and reversals, order blocks are identified through consolidation and engulfing patterns.

Key Indicators for Order Blocks

Order blocks are zones of consolidation or areas where sudden price movements suggest large orders. They serve as potential support or resistance levels.

Engulfing patterns are a reliable signal of order block formation. These occur when a larger candlestick completely engulfs the body of the previous one, which can point to concentrated activity. The earlier candlestick often marks the origin of the order block.

Bullish order blocks typically form with the last bearish candle in a downtrend before a sharp upward move. Bearish order blocks often appear with the last bullish candle before a significant drop. These origin candles highlight where activity preceded a major price shift.

"Professionals always buy during downtrends and sell during uptrends." - Tom Williams, creator of the VSA approach

Using higher timeframes, such as H4 or Daily charts, can improve the reliability of order block zones.

Identification Criteria Comparison Table

| Identification Aspect | Order Blocks | Breaker Blocks |

|---|---|---|

| Primary Visual Signal | Consolidation followed by breakout | Failed order block with role reversal |

| Candlestick Patterns | Engulfing patterns at origin | Sharp rejection after failed breakout |

| Market Structure | Swing points with quick reversals | Structural breaks and invalidations |

| Formation Context | Accumulation, distribution phases | Order block failure and sentiment shift |

| Confirmation Method | Impulse move away from zone | Retest failure and rejection |

| Timeframe Preference | H4 and Daily for reliability | Multiple timeframes for validation |

| Role in Market | Acts as support or resistance | Flipped support becomes resistance, or vice versa |

When to Use Breaker Blocks vs Order Blocks

Choosing between breaker blocks and order blocks depends on market dynamics, your approach, and risk tolerance. Below is a breakdown of when each concept works best and how they align with different trading styles.

Breaker Blocks for Volatile Markets

Breaker blocks can shine in fast moving conditions, especially after stop hunts.

"At its core, a breaker block is a failed order block that marks a pivotal shift in market structure and liquidity." - Maverick Currencies

In volatile scenarios, breaker blocks can help confirm continuation setups after breakouts. For example, on the EUR/USD daily chart, a support level at 1.0750 may be breached and later retested as resistance. This can create a bearish breaker block and a short opportunity.

These patterns can suit traders who prefer active management. Avoid relying on breaker blocks in low volume or sideways markets where structure is unclear. For best results, identify significant structure shifts on daily or 4 hour charts, then drop to shorter timeframes for precise entries.

Order Blocks for Trending Markets

Order blocks often work best in steady trends. They form around institutional activity, creating repeatable areas of demand or supply. They can also act as reversal zones in trends, signaling potential turning points before larger moves.

They are useful for traders who prefer a measured approach. However, they may not perform well in range bound or consolidating markets where conflicting interests can weaken reliability.

Strategic Selection Comparison Table

| Selection Criteria | Breaker Blocks | Order Blocks |

|---|---|---|

| Best Market Conditions | Volatile, trending, post breakout | Established trends, accumulation |

| Trader Experience Level | Experienced, advanced analysis skills | All levels, beginner friendly |

| Risk Tolerance | Higher risk, quick decisions | Lower risk, measured approach |

| Trading Style | Day trading, scalping | Swing trading, position trading |

| Time Commitment | Active monitoring required | More relaxed approach possible |

| Psychological Profile | Comfortable with rapid changes | Prefers steady, repeatable patterns |

| Entry Timing | Post failure confirmation | Trend direction alignment |

Your choice often depends on your trading personality and market context. Test both in a demo account to see which aligns with your style. Many traders blend the two, using order blocks to map the broader trend and breaker blocks for precision entries after structural breaks.

LuxAlgo Price Action Concepts — Detecting Order Blocks and Breaker Blocks

The LuxAlgo Price Action Concepts toolkit on TradingView provides automated detection of both order blocks and breaker blocks, allowing traders to visualize these key zones in real time without manual chart marking. By combining institutional-level logic with precise market structure analysis, this toolkit highlights high-probability trading areas directly on the chart.

For order blocks, the tool identifies areas of accumulation and distribution and distinguishes between bullish and bearish zones. For breaker blocks, it pinpoints failed order blocks that have flipped their role, marking potential reversal or continuation setups depending on market context.

Traders can adjust detection sensitivity, timeframe filters, and visualization styles to suit their strategies. This flexibility makes the Price Action Concepts toolkit valuable for both scalpers seeking intraday precision and swing traders looking for higher timeframe confirmation. When paired with other LuxAlgo features — such as volume analysis, oscillator tools, or AI Backtesting — it becomes a powerful way to validate trade ideas and improve decision-making.

You can learn more about LuxAlgo's Price Action Concepts toolkit and how it detects order and breaker blocks in the official documentation.

Conclusion — Using Breaker Blocks and Order Blocks Effectively

Grasping the distinctions between breaker blocks and order blocks can sharpen decisions and align them with the behavior of larger market participants.

Order blocks highlight areas of concentrated buying or selling, useful in trending markets. Breaker blocks indicate reversals after failed order blocks, especially in volatile conditions. High volatility can also reduce the reliability of both concepts, so confirmation and risk controls matter.

Match the concept to the current environment. Use order blocks to capitalize on clear trends and institutional activity. Turn to breaker blocks when you notice structural breaks that can offer precise entry points during fast moving shifts.

Risk management should remain a top priority. Place stop losses just beyond the identified zone and keep per trade risk modest, for example 1 to 2 percent. For added confidence, combine these concepts with other techniques, like moving averages or Fibonacci retracements, to confirm signals.

Before committing capital, practice both in a simulator to find what fits your style.

FAQs

What is the best way for traders to spot breaker blocks and order blocks across different timeframes?

Traders aiming to identify breaker blocks can watch for a previous bearish order block that is invalidated when a bullish close occurs above it. This can hint at a potential reversal. A surge in trading volume may accompany the break, which supports the signal. On shorter timeframes, like 15 minute or hourly charts, these patterns can be less reliable, so combining them with confirmation tools can help.

For order blocks, pay attention to zones where price consolidates before a decisive move. A bullish order block acts as a support area, while a bearish order block functions as resistance. Monitoring reactions to these levels across timeframes can help spot reversals or confirm trend continuations. Patience and close analysis of price action are crucial for incorporating these concepts effectively.

What are the most effective ways to combine breaker blocks and order blocks with other technical indicators?

Combining breaker blocks and order blocks with other techniques can sharpen strategies. For instance, aligning them with moving averages can help confirm trends. When a breaker block forms near a longer term moving average, it can signal a strong continuation or reversal zone.

Another technique is using momentum or volume reads to fine tune timing as price interacts with breaker or order blocks. Multi timeframe analysis also helps, for example identifying a bullish order block on a daily chart and then finding a confirming pattern on a lower timeframe.

What are the key differences between breaker blocks and order blocks in trending and volatile markets?

Breaker blocks and order blocks serve different purposes based on market behavior. In trending markets, breaker blocks can help confirm continuation zones after a breakout. These areas can act as support or resistance, which helps identify where price may either reverse or maintain the trend.

In volatile markets, order blocks can highlight zones of intense buying or selling. When price approaches these zones, sharp movements can occur, which helps traders anticipate significant shifts.

References

LuxAlgo Resources

- LuxAlgo Docs — Market Structures

- LuxAlgo Blog — Reversal Spotting Made Easy

- LuxAlgo Library — Liquidity Sweeps

- LuxAlgo Library — Order Breaker Blocks

- LuxAlgo Library — Market Structure Breakers

- LuxAlgo Library — Dynamic Order Blocks

- LuxAlgo Blog — ICT Immediate Rebalance

- LuxAlgo Library — Breakouts with Tests and Retests

- LuxAlgo Docs — AI Backtesting Assistant: Fetching Strategies

- LuxAlgo Docs — Order Blocks

- LuxAlgo Docs — Imbalances

- LuxAlgo Docs — Oscillator Matrix: Reversal Signals

- LuxAlgo Library — Candlestick Structure

- LuxAlgo Library — Volumetric Toolkit

- LuxAlgo Blog — Moving Averages Guide