Explore top alternatives to a popular stock screening tool, comparing features, pricing, and best use cases for various trading styles.

- MarketSmith is popular but costs $149.95/month, leading many to explore alternatives.

- We compare FINVIZ, Stock Rover, TradingView, Trade Ideas, and LuxAlgo to help you choose the right platform.

Key Comparison Factors:

- Filters: Fundamental and technical criteria for screening

- Real-time Data: Speed and accuracy of updates

- Interface: Ease of use and customization

- Price: Monthly costs and value offered

- Market Coverage: Number of assets and exchanges included

Quick Comparison Table:

| Platform | Best For | Price Range | Key Features |

|---|---|---|---|

| FINVIZ | Swing Trading | $0 – $39.50 | Fundamental filters, top gainers/losers, RSI |

| Stock Rover | Long-term Investing | $0 – $27.99 | 600+ metrics, portfolio tools, dividend analysis |

| TradingView | Global Market Coverage | $0 – $239.00 | Advanced charting, 14 K+ stocks, social tools |

| Trade Ideas | Day Trading | $0 – $254.00 | AI-driven insights, real-time alerts |

| LuxAlgo | Technical Indicators | $39.99 – $59.99 | Pattern recognition, AI backtesting, institutional-grade insights |

Best Picks by Trading Style:

- Day Traders: Trade Ideas for AI-driven real-time scanning

- Swing Traders: FINVIZ for detailed filters and alerts

- Technical Analysts: TradingView for advanced charting and indicators

- Long-term Investors: Stock Rover for in-depth financial analysis

- Advanced Traders: LuxAlgo for AI insights and pattern recognition

Each platform has strengths tailored to specific trading needs. Dive into the article for detailed comparisons and features.

7 Best Stock Screeners in 2024 [It’s Not Yahoo! Finance]

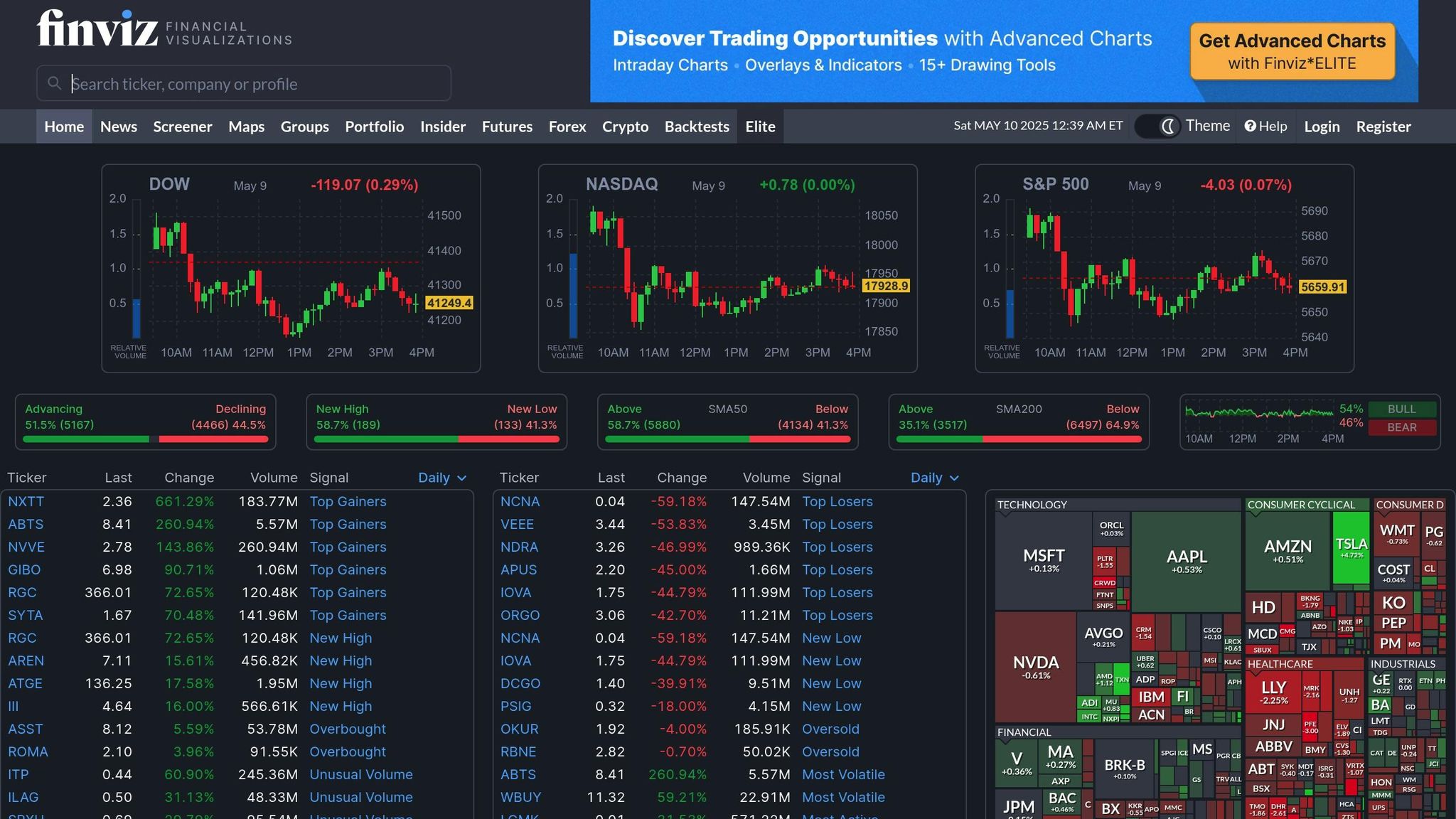

1. FINVIZ Stock Screener

FINVIZ stands out as a popular choice for swing traders, thanks to its extensive filtering options and user-friendly interface. With nearly 20 million monthly users, the platform offers both free and premium tools for market analysis.

The screener covers stocks listed on major U.S. exchanges, including NASDAQ, NYSE, and AMEX. Its filtering options span several categories, allowing traders to fine-tune their searches:

| Filter Category | Metrics |

|---|---|

| Fundamental Analysis | P/E, PEG, P/B, EPS Growth, ROE, Debt/Equity |

| Technical Indicators | RSI, Moving Averages, Volume, Beta, ATR |

| Market Signals | Top Gainers/Losers, Unusual Volume, Overbought/Oversold |

| Ownership Data | Insider/Institutional Holdings, Short Float |

For those seeking more advanced features, FINVIZ Elite is available at $24.96 per month (billed annually at $299.50). The premium version enhances the experience with tools designed for deeper analysis and real-time data:

- Real-time intraday updates

- Advanced charting options

- Backtesting functionality

- Correlation analysis tools

- Ad-free browsing

"If you’re on the fence about whether or not you should pay for the premium version of FINVIZ, then you shouldn’t upgrade." – Lincoln Olson, Head of Content, WallStreetZen

FINVIZ also allows users to save filter presets and pulls financial news from top-tier outlets like Bloomberg and The Wall Street Journal, making it easier to make informed trading decisions.

However, the free version does have its limits, particularly for day traders. Data updates are delayed, and the backtesting feature lacks the ability to scan historical data. Despite these drawbacks, most investors find the free version sufficient for basic screening and analysis.

With its detailed output, multiple viewing options, and instant updates, FINVIZ is a solid tool for swing traders focusing on both technical and fundamental factors. It’s a reliable option for those evaluating different stock-screening platforms.

2. Stock Rover Platform

Stock Rover tracks a massive database of 8 500 stocks, 4 000 ETFs, and 40 000 mutual funds. It’s packed with tools for in-depth fundamental analysis and real-time screening, making it a go-to platform for investors who want detailed insights.

Here’s a breakdown of its screening capabilities:

| Feature Category | Capabilities |

|---|---|

| Stock Metrics | Over 600 indicators covering price, operations, and financials |

| ETF Metrics | Nearly 250 specialized filters |

| Pre-built Screeners | 140+ templates based on specific strategies |

| Custom Formulas | Advanced filtering with historical data (Premium Plus) |

| Financial Analysis | Piotroski F-Score for evaluating financial strength (9-point scale) |

The Premium version adds weighted-criteria ranking and real-time screening. It also includes powerful portfolio-management tools such as:

- Rebalancing recommendations delivered straight to your inbox

- Custom screens tapping into 700+ factors

- Detailed research reports for deeper insights

- Side-by-side screener comparisons for easy evaluation

"Stock Rover is like a computer operating system. The more you use it and play with it the more powerful it becomes." – Donald E. L. Johnson

The platform also excels in dividend analysis and options research. Its ability to evaluate momentum, technicals, and historical trends appeals to CAN SLIM investors.

Although the free plan offers basic screening, most serious investors gravitate toward the Premium tiers. To help users explore its full potential, Stock Rover provides a two-week free trial of the Premium Plus plan.

A standout feature is the Screener Snapshot Facility, which tracks performance over time. With access to nearly 1 000 metrics for portfolio and watchlist customization, investors can tailor their approach to fit specific strategies.

3. TradingView Scanner

TradingView’s scanner combines a user-friendly interface with powerful tools, screening across stocks, crypto, forex, and commodities.

| Feature Category | Capabilities |

|---|---|

| Screening Scope | Stocks, Crypto, Forex, Commodities |

| Display Options | Table view, Grid charts |

| Custom Templates | Save, copy, rename, export |

| Alert System | Real-time notifications, multi-timeframe monitoring |

| Technical Tools | Pine Script customization, multiple indicators |

The scanner offers flexible filtering options across different timeframes such as 15-minute, 1-hour, and 4-hour. A notable highlight is the Multiple Indicators Screener, which can scan up to 100 items at once, displaying results in batches of 10 for better performance.

TradingView also shines with its social-network features, enabling users to share templates, exchange strategies, and tap community-driven insights.

Scores across key areas:

- Overall: 4.4 / 5

- Features: 4.9 / 5

- Design: 4.9 / 5

- Support: 4.1 / 5

For traders, the scanner is particularly useful for identifying patterns like inside bars, trend-line breaks, and volume spikes across exchanges. Premium plans unlock advanced filtering tools and real-time alerts.

4. Trade Ideas Platform

Trade Ideas elevates market analysis with AI-powered automation. Established in 2002, it offers real-time scanning and advanced AI-driven insights.

| Feature Category | Capabilities |

|---|---|

| Real-Time Scanning | Live market analysis with instant alerts |

| AI Integration | TradeWave technology for automated signals |

| Alert System | Customizable, multi-timeframe alerts |

| Trading Support | Entry and exit signals |

| Automation Level | Fully automated trading options |

The AI processes fundamental, technical, and social data overnight, producing strategies with success rates above 60 percent. A second-generation AI, “Money Machine”, tailored for momentum trading, is slated for early 2025.

"Real-Time AI Optimization Adapting to Every Single Market Move."

– Trade Ideas

Pricing: Standard $99/month, Premium $188/month, Professional from $5 500/year.

User rating stands at 4.7 / 5. Beginners may find the learning curve steep, but free one-on-one sessions and tutorials ease onboarding. Built-in scans, alert windows, and multi-timeframe visualizations appeal to experienced traders.

5. LuxAlgo Screening Capabilities

LuxAlgo provides a sophisticated set of screening capabilities, packed with technical indicators and pattern-recognition features, all seamlessly integrated into TradingView.

| Feature Category | Capabilities |

|---|---|

| Pattern Recognition | Automatically identifies harmonic patterns and Elliott-Wave structures |

| Volume Analysis | Tracks institutional trading activity and visualizes order flow |

| Market Regime | Real-time classification: trending, ranging, volatile |

| Alert System | Sends multi-timeframe pattern alerts |

| Backtesting | Validates strategies using AI and Monte Carlo simulations |

The Premium plan costs $39.99 per month, unlocking 30+ proprietary indicators, including Smart Money Concepts. Advanced tiers add API connectivity and deeper backtesting.

LuxAlgo’s quantitative approach scans multiple timeframes to flag statistical anomalies, momentum shifts, and volatility trends.

- Real-time market-condition classification

- Order-flow insights

- Sector-correlation filters

- Statistical-anomaly detection

With a 4.7 / 5 rating from 850+ TradingView reviews, LuxAlgo is widely trusted. Institutional clients receive tailored solutions, including dedicated support and custom indicator development to suit specific trading strategies.

Direct Comparison Results

Testing and feedback collected through February 2025 highlight the key strengths of each stock-screener:

| Feature Category | FINVIZ | Stock Rover | TradingView | Trade Ideas | LuxAlgo |

|---|---|---|---|---|---|

| Coverage | 8 500+ stocks & ETFs | U.S.-focused | 150+ exchanges, 50+ countries | U.S.-focused | Global markets |

| Real-time Data | Limited | Yes | Yes | Yes (Premium) | Yes |

| Charting Tools | Basic | Intermediate | Advanced | Intermediate | Advanced |

| AI Integration | No | Basic | Limited | Advanced | Yes |

TradingView stands out for global coverage and community-driven insights. FINVIZ suits beginners focusing on fundamentals, while Stock Rover excels in deep fundamental screens. Trade Ideas leads in AI-driven day-trading scans. LuxAlgo blends advanced technical analysis with AI insights for multi-timeframe, institutional-style trading.

Recommendations by Trading Style

Day Traders & Scalpers

Trade Ideas offers real-time AI scanning, perfect for split-second decisions.

Swing Traders

FINVIZ provides robust filters, up-to-date data, reliable backtesting tools, and timely alerts.

Technical Analysts

TradingView delivers exceptional charting tools, diverse indicators, and global-market access.

Long-Term Investors

Stock Rover supplies in-depth research tools, historical data, and comprehensive portfolio tracking.

Institutional-Style Traders

LuxAlgo integrates advanced technical analysis and AI-driven insights within TradingView, ideal for sophisticated strategies.

FAQs

What should I look for when selecting a stock-screening platform?

When choosing a stock-screening platform, align it with your trading style – day trading, swing trading, or long-term investing. Look for a broad range of screening criteria, reliable real-time data, and, if you test strategies, robust backtesting tools. An intuitive interface and multi-exchange coverage round out the ideal choice.

How does AI integration improve the performance of stock-screening tools like LuxAlgo?

AI transforms stock-screening by delivering real-time analysis and uncovering patterns that may escape human eyes. LuxAlgo adapts dynamically to shifting market conditions, providing precise, timely signals that help traders keep pace with fast-moving markets.

What factors should traders consider when choosing a stock-screening platform based on their trading style?

Traders weigh how well a platform supports their strategies and goals. Swing traders value detailed filters, real-time data, and customizable alerts. Those focused on global markets prioritize multi-exchange access, intuitive charting, and community resources. Evaluate each platform’s strengths to find the best fit.

References

- LuxAlgo Homepage

- Multi-Chart Widget Indicator

- Backtesters Alerts Documentation

- PAC Screener Filtering Guide

- Understanding Moving Averages Blog

- S&O Screener Elements

- OSC Screener Filtering Docs

- Alert System – Backtesting Docs

- Trend Lines Indicator

- PAC Exits – Backtesting System

- Signals & Overlays Indicator Overlay Docs

- Elliott Wave Indicator

- Volumetric Toolkit Indicator

- Setup Alerts Guide

- Fetching Strategies – AI Backtesting Assistant