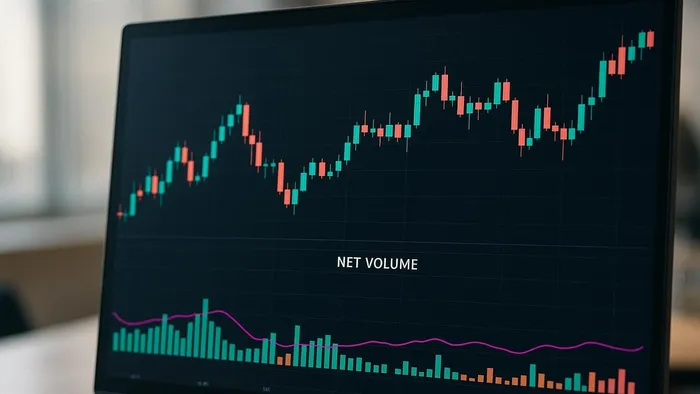

Understand the Net Volume Indicator to gauge market sentiment and refine your trading strategies by analyzing buying and selling pressure.

The Net Volume Indicator helps traders determine if buyers or sellers are dominating a market by subtracting downtick volume from uptick volume. Positive readings suggest buying pressure, while negative readings indicate selling pressure. This provides clarity beyond standard volume analysis by revealing market sentiment and the strength behind price movements.

Key takeaways:

- Formula: Net Volume = Uptick Volume - Downtick Volume.

- Positive Net Volume: Indicates stronger buying activity (bullish signal).

- Negative Net Volume: Reflects stronger selling activity (bearish signal).

- Applications: Confirms trends, spots reversals, and validates breakouts.

- Example: In a 15-minute period, Apple Inc. had +1,300 Net Volume, showing buyers dominated.

For deeper insights, combine Net Volume with technical tools like moving averages, RSI, or Bollinger Bands to refine trading strategies. Platforms like LuxAlgo provide tools on TradingView to simplify Net Volume analysis, automate calculations, and offer real-time signals.

How to Calculate the Net Volume Indicator

Grasping how the Net Volume Indicator is calculated allows traders to better understand its reliability and apply it with confidence. This method examines price movements and their corresponding volumes to assess market direction.

The Calculation Process

Start by categorizing each trade as either an uptick (price increases) or a downtick (price decreases). Trades where the price remains unchanged are usually excluded or follow the trend of the previous trade.

The formula is simple:

Net Volume = Uptick Volume - Downtick Volume

For a given time period (e.g., 1-minute, 5-minute, daily), add up the volumes of all upticks and subtract the volumes of all downticks. A positive result points to net buying, while a negative result suggests net selling.

Most platforms rely on the tick rule to classify trades: if the current price is higher than the previous one, it's an uptick; if lower, it's a downtick. Alternatively, some systems use the bid-ask rule, where trades at or above the ask price are considered buying, and trades at or below the bid price are considered selling (SEC Alternative Uptick Rule; see also bid–ask spread for context).

Now, let’s explore the factors that can influence the accuracy of this calculation.

Key Parameters to Consider

Several factors can impact how accurate and useful Net Volume calculations are:

- Timeframe Selection: Shorter timeframes provide detailed insights but can be noisier, while longer timeframes offer smoother, more generalized signals.

- Data Quality: High-frequency trading and algorithmic activity can create numerous small ticks that may distort results. Traders often filter out trades below a certain volume threshold to focus on significant market activity.

- Price Source: Using the actual trade price is essential to correctly determine the tick direction.

- Market Hours: Pre-market and after-hours trading tend to have lower volumes and wider spreads, which can skew Net Volume readings. Many traders focus on regular trading hours (9:30 AM to 4:00 PM ET for U.S. stocks) for more consistent signals (NYSE trading hours).

Example Calculation

Let’s break this down with an example using Apple Inc. (AAPL). Consider the following trades:

- Trade 1: 500 shares at $150.25 (uptick from $150.20)

- Trade 2: 1,200 shares at $150.15 (downtick from $150.25)

- Trade 3: 800 shares at $150.30 (uptick from $150.15)

- Trade 4: 300 shares at $150.25 (downtick from $150.30)

- Trade 5: 1,500 shares at $150.35 (uptick from $150.25)

Now, categorize and total the volumes:

- Uptick Volume: 500 + 800 + 1,500 = 2,800 shares

- Downtick Volume: 1,200 + 300 = 1,500 shares

The Net Volume is:

Net Volume = 2,800 - 1,500 = +1,300 shares

This positive Net Volume of +1,300 shares indicates that buying pressure outweighed selling pressure during this 15-minute period. On a chart, this would show up as a positive (often green) bar below the price action, signaling bullish sentiment.

Net Volume also accounts for about 30.2% of the total volume (1,300 out of 4,300 shares).

Repeating this calculation for each time period creates a series of positive and negative bars. These bars collectively form the Net Volume Indicator, with larger absolute values reflecting stronger market direction during that interval. This data helps traders interpret market sentiment and make informed decisions.

How to Use the Net Volume Indicator in Trading

The Net Volume Indicator can be a powerful way to refine trading decisions and timing across various market conditions.

Using Net Volume to Confirm Trends

Strong market trends often show a clear alignment between price movement and Net Volume readings. When prices rise alongside positive Net Volume, it indicates genuine buying interest is driving the momentum. On the other hand, falling prices paired with negative Net Volume suggest authentic selling pressure.

For example, imagine a stock breaking above a key resistance level at $50.00 and maintaining positive Net Volume readings for several consecutive periods. This scenario suggests institutional investors are likely supporting the breakout. However, if the same breakout occurs with negative or declining Net Volume, it may indicate a lack of conviction behind the move, increasing the likelihood of a reversal.

The magnitude of Net Volume readings also matters. A stock gaining 5% in a day with a Net Volume of +2,500 shares demonstrates stronger market participation and conviction than one with only +200 shares. Larger readings reflect broader involvement, which adds weight to the trend confirmation.

These patterns naturally lead to spotting divergences, which can signal potential trend reversals.

Spotting Reversals and Divergences

Divergences between price and Net Volume are key indicators of potential trend changes. These occur when price moves in one direction, but Net Volume either moves in the opposite direction or fails to confirm the price action.

A bearish divergence happens when prices hit new highs, but Net Volume doesn’t follow suit or turns negative. This suggests fading buying enthusiasm, signaling that selling pressure might soon dominate.

In contrast, bullish divergences occur when prices drop to new lows, but Net Volume either becomes less negative or turns positive. This shift indicates that selling pressure is easing and buyers may be stepping in, often preceding a price rebound.

The most reliable divergences develop over multiple time periods. A single period of divergence might just be market noise, but divergences lasting 3–5 periods often point to meaningful shifts in sentiment.

Another nuance is hidden divergences, which can signal trend continuation. For instance, in an uptrend, prices may form higher lows while Net Volume records lower lows. Similarly, in a downtrend, prices may form lower highs while Net Volume shows higher highs. These patterns suggest the current trend is likely to persist.

Confirming Breakouts

The Net Volume Indicator is also invaluable for validating breakouts, helping traders distinguish between genuine and false moves. When a stock breaks above resistance or below support, the accompanying Net Volume reading can reveal whether the move has institutional support or is merely driven by short-term retail activity.

For a successful breakout, Net Volume should exceed the average of the last 10–20 periods. For example, if a stock typically shows Net Volume between −500 and +500 shares, a breakout with a reading of +1,800 shares signals significant new interest.

Timing is critical—strong Net Volume should align with the breakout itself, not show up several periods later. Late-arriving volume often indicates retail traders chasing the move, rather than institutional investors positioning early.

Failed breakouts often feature weak or contradictory Net Volume. For instance, if a stock breaks above $75.00 resistance but shows a Net Volume of −800 shares, it suggests the breakout lacks support and may reverse within 1–3 trading sessions.

To strengthen breakout analysis, consider the relative strength of Net Volume compared to recent periods and look for confirmation across multiple timeframes. For example, a breakout supported by positive Net Volume on both 5-minute and 15-minute charts carries more weight than one confirmed on just a single timeframe. This approach helps filter out short-lived spikes in activity and identifies more reliable opportunities.

Reading Net Volume for Market Sentiment

Net Volume readings provide a clear lens into market sentiment and institutional activity by showing whether buying or selling pressure is in control.

Positive vs. Negative Net Volume

Positive Net Volume indicates that buying pressure is stronger than selling pressure during a specific timeframe. Consistent positive readings suggest bullish sentiment, showing that investors are willing to pay higher prices to secure positions. For example, a Net Volume reading of +50,000 shares carries much more weight than +500 shares, especially when compared to a stock’s typical volume. If Apple’s usual Net Volume fluctuates between −10,000 and +10,000 shares, a sudden spike to +45,000 shares signals an unusual surge in buying interest, which could drive prices higher.

On the other hand, Negative Net Volume shows that selling pressure is dominant, with more shares trading at or below the bid price. This often reflects investors eager to exit positions, even at lower prices to ensure execution. Sustained negative readings often accompany or precede price declines.

The size and consistency of these readings matter. A quick spike in Net Volume might signal a temporary imbalance, but persistent trends over time point to deeper shifts in market sentiment.

Periods of neutral or low Net Volume often occur when the market lacks direction, leading traders to wait for clearer signals before making significant moves.

Net Volume Changes and Trend Exhaustion

Net Volume often reveals momentum shifts before they appear in price action. For instance, during an uptrend, if positive Net Volume readings start to decline, it could indicate that buying enthusiasm is fading, even if prices continue to rise. This divergence is often a precursor to trend reversals or pullbacks.

Take Microsoft, for example. If it maintains an uptrend with Net Volume readings between +25,000 and +30,000 shares, but those readings drop to +15,000, +8,000, and eventually +3,000 shares while prices still climb, it signals weakening buying pressure.

Trend exhaustion becomes evident when Net Volume shifts from strongly positive to neutral or negative while prices remain near their highs. This suggests sellers are gaining confidence while buyers hesitate. During such phases, institutional investors often start reducing their positions, setting the stage for potential price declines.

The pace of change in Net Volume adds another layer of insight. A gradual decrease in buying pressure might indicate a healthy pullback within an uptrend, while a sharp shift from strongly positive to strongly negative often signals a dramatic reversal.

Volume spikes during trend shifts also carry weight. Extreme changes in Net Volume—whether positive or negative—at turning points hint at stronger conviction behind the new direction. For example, a shift from +5,000 to −20,000 Net Volume suggests a more decisive move than a drop from +5,000 to −2,000.

To refine these signals further, combining Net Volume with other technical tools can provide a more complete picture.

Combining Net Volume with Other Indicators

Net Volume alone reveals the tug-of-war between buyers and sellers, but pairing it with other indicators enhances its effectiveness. For instance, moving averages help define the broader trend. A stock trading above its 50-day moving average with positive Net Volume confirms bullish momentum, while positive Net Volume below key moving averages might indicate a temporary bounce rather than a true reversal.

Support and resistance levels become more meaningful when analyzed alongside Net Volume. A stock nearing resistance with increasing positive Net Volume has a higher chance of breaking out, while approaching support with growing negative Net Volume often signals a breakdown.

| Scenario | Net Volume | Price Trend | MA Context | Interpretation |

|---|---|---|---|---|

| Strong Bullish | +15,000+ | Rising | Above 50-day MA | High likelihood of continued uptrend |

| Weak Bullish | +2,000–5,000 | Slowly rising | Near 50-day MA | Optimism, but confirmation needed |

| Strong Bearish | −15,000+ | Falling | Below 50-day MA | High likelihood of continued downtrend |

| Potential Reversal | Negative | At support | Below 50-day MA | Watch for bounce or further breakdown |

The Relative Strength Index (RSI) pairs well with Net Volume for spotting opportunities. When RSI signals oversold conditions (below 30) and Net Volume turns positive, it often marks a solid buying opportunity. Similarly, overbought RSI levels (above 70) combined with declining positive Net Volume hint at potential selling opportunities.

Bollinger Bands also complement Net Volume analysis. When prices approach the upper band with increasing positive Net Volume, it signals strong momentum behind the move. Conversely, prices nearing the lower band with growing negative Net Volume often confirm breakdown scenarios.

The key to effective analysis lies in finding alignment among multiple indicators. While a single indicator can give false signals, when Net Volume, price action, and other tools point in the same direction, the likelihood of accurate predictions and successful trades increases significantly.

Using LuxAlgo Tools for Net Volume Analysis

Once you’ve got a handle on how to calculate and interpret Net Volume, the next step is putting that knowledge to work. LuxAlgo provides tools on TradingView that simplify these calculations and turn them into practical insights. By combining the basics of Net Volume with these capabilities, traders can streamline their analysis and make more informed decisions.

LuxAlgo Indicators for Real-Time Analysis

LuxAlgo’s Price Action Concepts (PAC) toolkit is a powerful resource for identifying institutional activity within Net Volume patterns. For example, its order blocks highlight areas where institutional accumulation might be happening during volume spikes. If a large-cap stock shows a surge in Net Volume near an order block, traders can use this insight to determine whether it reflects genuine institutional buying or just short-term retail activity.

The Signals & Overlays (S&O) toolkit adds another layer by offering multiple signal algorithms to validate volume-based insights. Its overlay visualizations are particularly helpful for spotting Net Volume divergences alongside other technical indicators. For instance, during an uptrend, if a stock sees a sharp drop in Net Volume, the trend signals from the S&O toolkit can help traders decide if it’s just a healthy consolidation or the start of a reversal.

The Oscillator Matrix (OSC) focuses on real-time divergence detection and trend confirmation. When a stock approaches resistance with a noticeable increase in Net Volume, the OSC toolkit’s momentum indicators can confirm whether the breakout is likely to hold.

Additionally, the Custom Alert Creator ensures traders stay on top of critical market moves by allowing them to set alerts for specific volume thresholds. This means you won’t miss key shifts, even during busy market hours.

AI Backtesting and Optimization

While real-time analysis is essential, refining your strategy over time is just as important. LuxAlgo’s AI Backtesting Assistant automates the process of testing different volume thresholds and parameters across various assets and timeframes.

The platform’s optimization engine helps traders fine-tune their Net Volume settings based on their trading style. For example, a swing trader focusing on large-cap stocks might find that higher volume readings, when paired with PAC signals, offer a better balance between risk and reward. Meanwhile, a day trader might prefer lower thresholds combined with faster confirmation signals for quicker decision-making.

One standout feature is the AI assistant’s ability to adapt to changing market conditions. As volatility and average trading volumes shift, it adjusts Net Volume parameters to ensure strategies remain relevant. The system also tests strategies under different conditions—whether in strong trends or periods of consolidation—and provides performance metrics to help traders understand when their Net Volume approach will work best.

For those on the Ultimate plan, weekly strategy reports and backtests highlight the most effective Net Volume setups across market sectors. This keeps traders informed about where the best opportunities lie, based on current market trends.

Features Comparison Table

| Feature | Premium Plan | Ultimate Plan | Key Net Volume Analysis Benefits |

|---|---|---|---|

| Price Action Concepts Toolkit | ✓ | ✓ | Identifies institutional Net Volume activity using order blocks |

| Signals & Overlays Toolkit | ✓ | ✓ | Confirms Net Volume divergences with multiple signals |

| Oscillator Matrix Toolkit | ✓ | ✓ | Detects divergences and complements Net Volume trends |

| Custom Alert Creator | ✓ | ✓ | Alerts for specific volume thresholds |

| TradingView Screeners | ✓ | ✓ | Filters stocks by volume and Net Volume patterns |

| AI Backtesting Assistant | ✗ | ✓ | Optimizes Net Volume parameters across assets and timeframes |

| Deep Optimization Engine | ✗ | ✓ | Identifies the best volume thresholds for various strategies |

| Weekly Strategy Reports | ✗ | ✓ | Highlights top-performing Net Volume setups across sectors |

| Advanced Backtesters | ✗ | ✓ | Tests strategies under varied market conditions |

The TradingView screeners included in both plans save time by allowing traders to filter stocks based on specific volume criteria. Instead of manually reviewing hundreds of charts, these screeners highlight assets that meet your requirements, making it easier to find high-probability setups.

To support traders further, LuxAlgo offers 24/7 customer service to address any technical questions about using these tools for Net Volume strategies. Plus, an active community forum provides additional insights, with experienced traders sharing their strategies for combining Net Volume analysis with LuxAlgo’s toolkits.

Conclusion

The Net Volume Indicator is a valuable resource for gauging market sentiment by analyzing the tug-of-war between buying and selling pressure. Unlike traditional volume metrics, it calculates the difference between up-volume and down-volume, providing a clearer picture of which side is in control[1].

Here’s how it works: during each period, volume is categorized as buying when prices rise and selling when they fall. The net volume is simply the up-volume minus the down-volume[1]. This straightforward calculation makes it an essential tool for traders looking to integrate volume analysis into their strategies.

Traders rely on the Net Volume Indicator to confirm trends, detect potential reversals through divergences, and validate breakouts[1]. For example, if prices are climbing and net volume remains consistently positive, it signals strong buying interest. On the other hand, rising prices coupled with negative net volume might hint at a rally lacking widespread support, suggesting it could be short-lived. Positive readings highlight buying strength, while negative ones warn of potential trend exhaustion[1].

To maximize its effectiveness, the indicator is often paired with other technical tools. Divergences between price movement and net volume can act as early warnings of momentum shifts, while additional tools like moving averages or RSI provide further confirmation.

LuxAlgo turns these principles into practice by providing toolkits that identify institutional activity, validate volume-based signals, and pinpoint key divergences in real time. The AI Backtesting Assistant further enhances this process by fine-tuning Net Volume parameters across different market scenarios, helping traders refine their strategies with the backing of historical data.

For traders in the U.S. dealing with dollar-denominated assets, these capabilities integrate seamlessly into existing workflows. Features like real-time alerts, customizable thresholds, and robust backtesting allow traders to shift their focus from manual calculations to execution. This streamlined approach supports more consistent, data-driven decision-making, empowering traders to navigate the markets with greater confidence.

FAQs

What makes the Net Volume Indicator different from traditional volume analysis when assessing market sentiment?

The Net Volume Indicator takes a different approach to volume analysis by zeroing in on the difference between uptick volume (buying activity) and downtick volume (selling activity). This method gives a sharper view of market dynamics, highlighting whether buyers or sellers are in control. It's an effective way to gauge market sentiment with more precision.

On the other hand, traditional volume analysis simply measures the total trading volume, without breaking it down into buying and selling components. While this gives a general sense of market activity, it doesn't reveal the balance of power between buyers and sellers. For traders aiming to spot shifts in sentiment, the Net Volume Indicator offers a more focused and practical perspective.

How can I effectively combine the Net Volume Indicator with other tools to enhance my trading strategy?

To make the most of the Net Volume Indicator, it’s a good idea to pair it with other technical analysis tools. This combination can help confirm signals and lead to better trading decisions. For instance, you can use it alongside support and resistance levels, trendlines, or chart patterns to validate potential price movements.

Another effective approach is to combine the Net Volume Indicator with tools like VWAP (Volume Weighted Average Price) or candlestick patterns. Pay attention to moments where significant shifts in net volume align with price trends—these can reveal important clues about market sentiment. Using multiple tools together ensures you get a clearer picture and allows for more confident decision-making.

How can traders ensure accurate Net Volume calculations despite high-frequency and algorithmic trading activity?

To calculate Net Volume accurately in markets influenced by high-frequency trading (HFT) and algorithmic activity, traders can turn to advanced tools designed to filter out distortions caused by these factors. These tools can spot patterns like rapid order entries and irregular trade volumes, helping traders identify and exclude trades that don't reflect typical market behavior.

On top of that, machine learning models can play a key role in separating meaningful trading signals from the noise created by algorithm-driven activity. By working with cleaner and more dependable data, traders are better equipped to make informed decisions while preserving the accuracy of their Net Volume calculations.

References

LuxAlgo Resources

- Net Volume Indicator

- Volume Delta Candles

- Volumetric Toolkit

- Market Sentiment (Technicals)

- Understanding Moving Averages

- Bollinger Bands Breakout Oscillator

- AI Backtesting Assistant

- OSC Reversal Signals

- Trading Sessions

- Price Action Concepts (PAC)

- Volume Forecasting

- Oscillator Matrix (OSC)

- Adaptive Momentum Oscillator

- Custom Alert Creator – Readymade Scripts

- Reversal Spotting Made Easy