Explore the top proprietary trading firms for 2025, offering substantial funding, profit splits, and scaling options for traders.

Looking to trade with significant capital in 2025? Here's a quick breakdown of the top proprietary trading firms offering the highest account sizes, profit splits, and scaling opportunities for traders:

Prop Firm Challenge Strategies That Help You Pass in 2025

Passing a prop firm challenge is less about finding “more trades” and more about executing a repeatable plan that respects the firm’s rules (daily loss limit, max drawdown, minimum trading days, and news restrictions). That’s why many traders look for strategies that have already demonstrated consistency across prior market conditions—not just ideas that look good in hindsight.

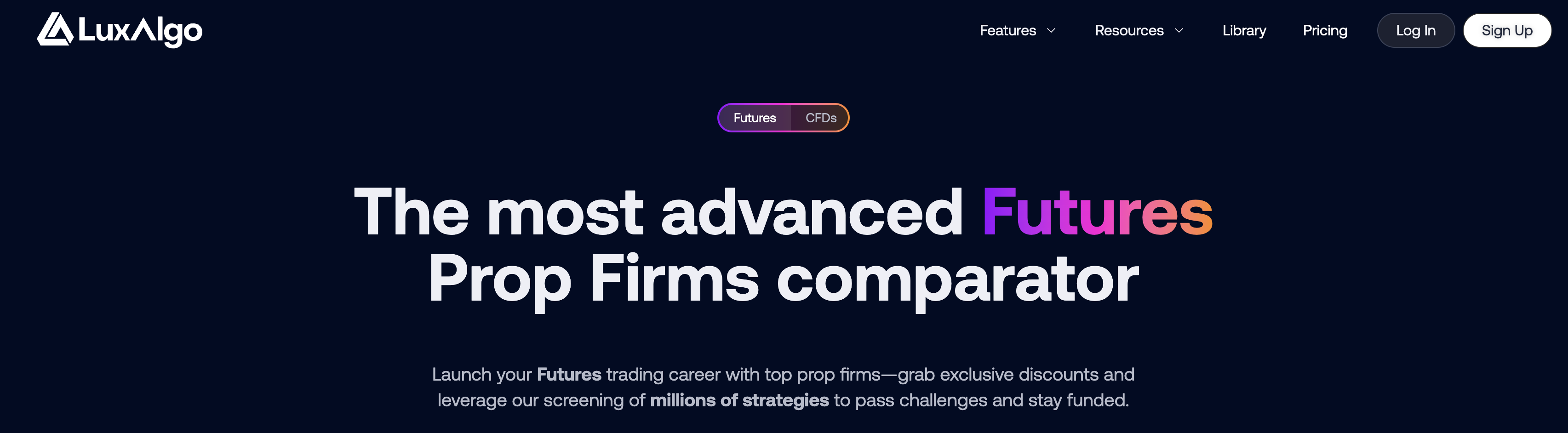

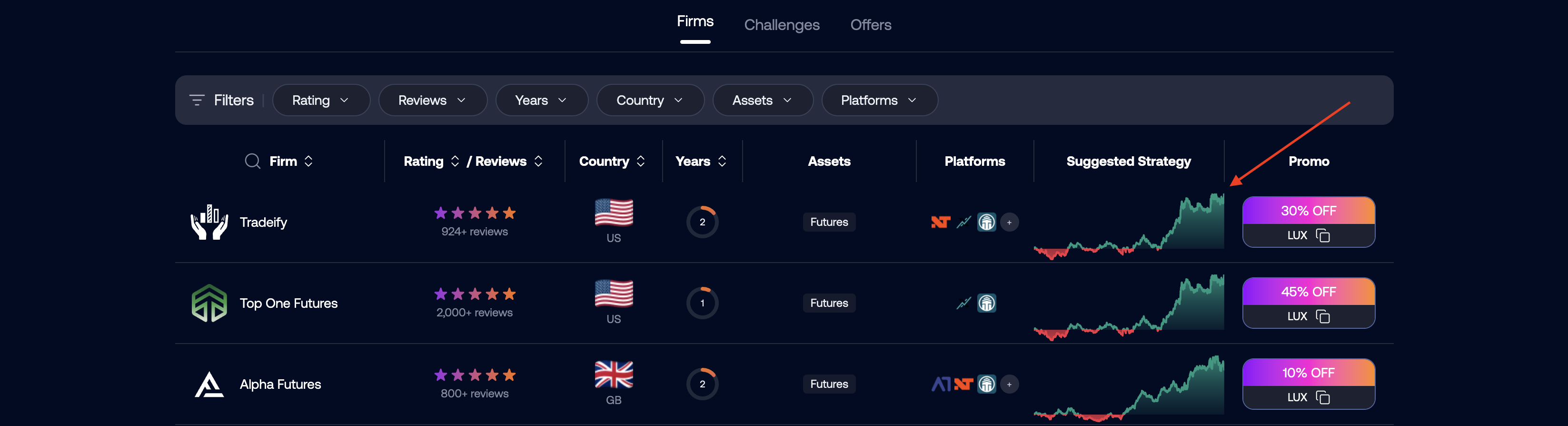

On LuxAlgo, you can quickly access ready-to-use prop firm strategies on the LuxAlgo Prop Firms portal. The goal is simple: help you trade challenges with frameworks that are built to survive strict risk rules. These strategies are designed to be practical for challenge conditions because they:

- Have proven to work in the past across historical market environments (multiple regimes, volatility cycles, and trend conditions).

- Would have passed historical challenges under comparable rule constraints, based on prior performance behavior and risk profiles.

- Have a higher probability of passing current challenges by focusing on repeatability, risk containment, and rule-aware execution rather than chasing high variance outcomes.

Inside the LuxAlgo prop firm strategies page, you can navigate directly to the firm you’re considering and access strategies that align with the most common evaluation constraints. Instead of manually searching for setups and stitching together rules, you can use the portal to quickly find strategy options, compare firms, and get straight to implementation—especially useful if you’re managing multiple evaluations or switching between CFD and futures prop programs.

Another advantage: when promotions are available, users can often stack meaningful savings by accessing high discounts (as high as possible when relevant) through the portal’s firm pages and offer placements—helping reduce evaluation costs while keeping you focused on execution quality.

Suggested Strategies

If you want a faster starting point, head to the LuxAlgo Prop Firms portal, choose your firm, then review the suggested strategies designed around challenge-style risk limits. From there, pick a style that fits your temperament (trend-following, mean reversion, structure-based entries, or rule-driven confirmations), and focus on consistency and drawdown control—two of the biggest determinants of whether you pass.

- Goat Funded Trader: Start with up to $200,000, scale to $800,000, with an 80%-100% profit split.

- DNA Funded: Access $200,000 accounts, scale to $600,000, with an 80%-90% profit split.

- FTMO prop firm challenge: Manage up to $400,000 (scaling to $2,000,000), offering 80%-90% splits. (Official site)

- The5ers prop firm scaling program: Begin with $20,000, scale to $4,000,000, with profit splits up to 100%. (Official site)

- FundingPips prop firm evaluation: Scale from $200,000 to $2,000,000, offering 60%-100% splits. (Official site)

- Apex Trader Funding futures prop firm: Trade futures with accounts up to $300,000, scaling to $25,000+ profits at 100%, then 90%. (Official site)

- FundedNext: Start with $300,000, scale to $4,000,000, offering 60%-95% splits.

- Topstep: Focused on futures, offers accounts up to $150,000 with 100% profit on the first $10,000, then 90%.

- MyFundedFX: Start with $300,000, scale to $600,000, with up to 92.75% splits.

- Funded Trading Plus prop firm payouts: Begin with $200,000, scale to $2,500,000, offering 80%-100% splits. (Official site)

Quick Comparison Table

| Prop Firm | Max Account Size | Profit Split | Scaling Potential | Key Features |

|---|---|---|---|---|

| Goat Funded Trader | $800,000 | 80%-100% | $800,000 | Wide instrument variety |

| DNA Funded | $600,000 | 80%-90% | $600,000 | Regulated broker, leverage limits |

| FTMO prop firm | $2,000,000 | 80%-90% | $2,000,000 | Strong reputation, scaling plan |

| The5ers prop firm | $4,000,000 | 50%-100% | $4,000,000 | 8-level scaling system |

| FundingPips prop firm | $2,000,000 | 60%-100% | $2,000,000 | Flexible payout options |

| Apex Trader Funding futures prop firm | $300,000 | 90%-100% | Unlimited profits | Focused on futures |

| FundedNext | $4,000,000 | 60%-95% | $4,000,000 | No time limits, diverse programs |

| Topstep | $150,000 | 100% first $10k | Futures-specific | Focused on CME futures |

| MyFundedFX | $600,000 | 80%-92.75% | $600,000 | Forex-focused, flexible tools |

| Funded Trading Plus prop firm | $2,500,000 | 80%-100% | $2,500,000 | Fast payouts, progressive splits |

Choose the firm that aligns with your trading style, capital needs, and profit-sharing preferences. These firms offer substantial funding, flexible scaling, and diverse trading instruments to help you succeed in 2025.

Best 10 Prop Trading Firms of April 2025!

1. Goat Funded Trader

Goat Funded Trader markets a high-volume prop offering across multiple regions. As with any prop evaluation, confirm the rules that affect risk limits (daily drawdown, max drawdown, news restrictions) before purchasing an account. For a general primer on how proprietary trading works, see Investopedia’s overview of proprietary trading.

Maximum Account Size

With account funding options starting at $5,000 and going up to $200,000, Goat Funded Trader provides traders with a solid foundation to begin or expand their trading journey. What sets them apart is their scaling program, which allows accounts to grow to a maximum of $800,000.

Profit Split Percentage

Goat Funded Trader advertises an 80% profit split on standard account types, with options that can change the split depending on the checkout add-ons and account model. Always verify whether the split applies to all payouts or only after certain milestones (and whether there are caps or buffers).

Trading Instrument Diversity

Instrument coverage varies by program and platform. Before committing, confirm which symbols are available on your specific account type and whether the firm restricts certain products during major news events.

For those interested in starting, challenge fees begin at $15 for a $2,000 account and go up to $398 for a $100,000 challenge.

2. DNA Funded

DNA Funded was listed as the top prop firm for 2025 in a CBS News roundup, citing its challenge variety and options for US traders [1].

Maximum Account Size

DNA Funded advertises funded accounts ranging from $5,000 to $200,000, with scaling/portfolio allocation approaches that can increase total exposure by managing multiple accounts (subject to the firm’s limits and terms).

Profit Split Percentage

Traders typically start around an 80% profit split, with higher splits available via optional add-ons. When comparing plans, look beyond the headline split and confirm any payout caps, payout cadence, and minimum trading-day requirements.

Trading Instrument Diversity

DNA Funded promotes access to hundreds of instruments across major markets, but exact availability depends on the platform and account type. Validate symbol lists and trading conditions (spreads/commissions) before selecting an evaluation.

To help traders manage risk effectively, DNA Funded applies specific leverage limits based on the asset class and challenge type:

| Asset Class | Leverage |

|---|---|

| Forex (1 Phase & Rapid) | 1:30 |

| Forex (2 Phase) | 1:50 |

| Commodities, Indices, Stocks | 1:10 |

| Cryptocurrency | 1:2 |

This structured leverage system helps traders align position sizing with prop risk limits, especially when daily drawdown rules are tight.

3. FTMO prop firm challenge rules

FTMO is one of the most recognized names in prop trading, known for its structured scaling strategy. It offers traders the opportunity to manage up to $400,000 in capital, often split across multiple accounts. For those pursuing systematic, rules-based approaches, many traders validate ideas first using the AI Backtesting Assistant’s strategy discovery workflow. If you want to review FTMO directly, here’s the official FTMO site.

FTMO’s scaling plan can increase account size over time to a maximum initial balance of $2,000,000, with eligible traders receiving a 25% balance increase and a 90% reward rate under the Scaling Plan rules [13].

Profit Split Percentage

Under the standard plan, traders receive an 80% reward rate. If they meet Scaling Plan conditions, FTMO states the reward rate becomes 90% and the account balance can be increased by 25% at scale-up [13].

Trading Instrument Diversity

FTMO provides access to markets across forex, indices, commodities, stocks, and cryptocurrencies, and publishes a dedicated symbol/specs page for spreads and contract details [16].

4. The5ers prop firm scaling system

The5ers stands out with a structured scaling system that promotes long-term growth across multiple levels. Public review platforms show large volumes of user feedback; for example, The5ers has an active listing on Trustpilot [17]. For direct program details, visit the official The5ers site.

Maximum Account Size

The5ers offers multiple pathways for traders to grow their accounts significantly. Depending on the program, traders start at different levels, but the scaling framework is designed to increase account size after performance milestones are met.

| Program Level | Account Balance | Milestone Target | Next Level |

|---|---|---|---|

| Evaluation Trader LV 1 | $20,000 | $2,000 profit | LV 2 |

| Funded Trader LV 2 | $40,000 | $4,000 profit | LV 3 |

| Funded Trader LV 3 | $80,000 | $8,000 profit | LV 4 |

| Funded Trader LV 4 | $160,000 | $16,000 profit | LV 5 |

| Funded Trader LV 5 | $320,000 | $32,000 profit | LV 6 |

| Funded Trader LV 6 | $640,000 | $64,000 profit | LV 7 |

| Funded Trader LV 7 | $1,280,000 | $128,000 profit | LV 8 |

| Funded Trader LV 8 | $4,000,000 | Maximum level | N/A |

Profit Split Percentage

Profit splits vary by program and level. When comparing The5ers plans to other prop firms, confirm whether the split changes after each scale-up, and whether the firm applies consistency rules (e.g., daily profit caps) that can affect payout timing.

Regular payouts are part of the structure, and some programs include performance bonuses depending on milestones and account levels.

Trading Instrument Diversity

Instrument availability depends on platform and program. Always verify what you can trade (and the leverage by asset class), because these parameters materially change position sizing under drawdown rules.

5. FundingPips prop firm evaluation rules

FundingPips offers multiple evaluation models aimed at different trading styles. Like any prop firm, it’s worth comparing evaluation rules that can be “silent deal-breakers” (news restrictions, max lot size, minimum trading days). FundingPips also maintains a public Trustpilot listing with a large review count [21]. For direct details, visit the official FundingPips site.

Maximum Account Size

FundingPips funds accounts across several tiers, with scaling systems that can increase the total allocation after performance criteria are met. Always verify whether the scaling is automatic, requires applying, or depends on payout history.

| Account Model | $5K | $10K | $25K | $50K | $100K |

|---|---|---|---|---|---|

| Instant | $69 | $99 | $199 | $299 | $499 |

| One-Step | $59 | $99 | $199 | $299 | $499 |

| Two-Step | $36 | $66 | $156 | $266 | $470 |

| Pro | $29 | $55 | $109 | $199 | $259 |

Profit Split Percentage

FundingPips offers different splits depending on payout cadence and program. When comparing splits, treat “higher split” as only one variable—payout conditions and risk limits often matter more than a 5–10% difference.

Payout Speed and Structure

Payout speed varies by program. If fast payouts are a priority, verify (1) the minimum number of trading days, (2) whether a buffer must be built above the max loss limit, and (3) whether profits are subject to consistency rules.

Trading Instrument Diversity

FundingPips supports major CFD categories such as forex, indices, commodities, and cryptocurrencies—enough coverage for most multi-market strategies.

6. Apex Trader Funding futures prop firm challenge

Apex Trader Funding is a well-known option for futures evaluations. If you’re comparing futures props, it helps to understand how futures contracts work (tick size, margin, and contract specs), because they can dramatically change risk compared to CFDs. For the firm’s official details, see Apex Trader Funding’s official site.

Maximum Account Size

Account sizes range from $25,000 to $300,000. The flagship $300,000 account is one of the larger retail futures evaluation tiers.

| Account Size | Monthly Fee (Rithmic) | Monthly Fee (Tradovate) | Contracts | Profit Target | Trailing Threshold |

|---|---|---|---|---|---|

| $25,000 | $147 | $167 | 4 (40 micros) | $1,500 | $1,500 |

| $50,000 | $167 | $187 | 10 (100 micros) | $3,000 | $2,500 |

| $100,000 | $207 | $227 | 14 (140 micros) | $6,000 | $3,000 |

| $150,000 | $297 | $317 | 17 (170 micros) | $9,000 | $5,000 |

| $250,000 | $517 | $537 | 27 (270 micros) | $15,000 | $6,500 |

| $300,000 | $657 | $677 | 35 (350 micros) | $20,000 | $7,500 |

| $100,000 (Static) | $137 | $157 | 2 (20 micros) | $2,000 | $0.00 |

Profit Split Percentage

Traders keep 100% of the first $25,000 and 90% thereafter, with no payout cap (confirm your specific account’s payout rules in the firm’s help center).

Payout Speed and Structure

Payout availability depends on evaluation type and account status. Review the firm’s official payout policy before you size up aggressively.

Trading Instrument Diversity

Apex focuses on futures categories (equity index, rates, FX, energy, metals, agriculture), which can be a plus if your edge is built around liquid exchange-traded markets.

7. FundedNext

FundedNext offers several program variants that typically trade off price, rules strictness, and payout cadence. When evaluating, compare the practical constraints: daily loss limit, max loss limit, and whether you can hold trades over the weekend.

Maximum Account Size

Account sizes range from smaller entry tiers up to larger allocations, with scaling plans that can increase total exposure over time if milestones are met.

Profit Split Percentage

Profit splits vary by program and optional add-ons. If you’re optimizing for take-home payout, factor in fees and the payout “unlock” requirements—not just the split percentage.

Trading Instrument Diversity

FundedNext typically includes major CFD categories such as forex, indices, commodities, and crypto. Confirm the exact symbols and leverage by program.

8. Topstep

Topstep focuses on exchange-traded futures. The firm’s help center details payout mechanics and the “Maximum Loss Limit” behavior, which matters a lot for drawdown management [42].

Maximum Account Size

Trading Combine accounts come in $50k, $100k, and $150k sizes.

Profit Split Percentage

Topstep states traders keep 100% of the first $10,000 in payouts, then 90% thereafter (per the official payout FAQs) [42].

Trading Instrument Diversity

Topstep’s product list is centered on CME Group futures (indices, rates, FX, energy, metals, agriculture), depending on the rules for the account type you’re trading.

9. MyFundedFX

MyFundedFX is often positioned as forex-centric, with program details varying by platform and region. If you’re choosing it specifically for scaling, confirm the cadence, eligibility, and whether scaling depends on payouts or calendar time.

Maximum Account Size

Traders may see multiple max-allocation numbers advertised depending on whether accounts are aggregated, scaled, or split across programs. Validate the firm’s official program terms before comparing it to other providers on “headline capital.”

Profit Split Percentage

Profit splits vary by plan and add-ons. Compare the split alongside fees and payout eligibility rules.

Trading Instrument Diversity

Instrument lists typically include major CFDs (indices, commodities, and crypto) in addition to forex—confirm the symbol list and leverage per program.

10. Funded Trading Plus prop firm program

Funded Trading Plus is a popular option for traders prioritizing payout cadence and multiple account structures. The firm also has a public Trustpilot listing with user feedback that can help you sanity-check support quality and payout experiences [53]. For direct program details, visit the official Funded Trading Plus site.

Maximum Account Size

Start between $5,000 and $200,000, with scaling programs that can increase allocation when milestones are met.

Profit Split Percentage

Progressive splits move upward as traders hit profit milestones. When comparing “progressive” models, verify whether the higher split applies immediately after a milestone or only after a payout cycle.

Trading Instrument Diversity

Markets typically include FX majors & minors, exotics, metals, commodities, indices, and crypto. Confirm whether any symbols are restricted during news windows.

Quick Comparison Table

Picking the right prop firm is easier when you can compare the details side by side. Below is a summary covering maximum account sizes, profit splits, payout schedules, and standout features.

| Prop Firm | Max Account Size | Profit Split | Payout Speed | Key Features |

|---|---|---|---|---|

| Goat Funded Trader | Up to $200k | 80%-90% | Bi-weekly | Multiple evaluations, flexible rules |

| DNA Funded | $5k - $200k | 80%-90% | 14-day (7-day add-on) | Broad instrument coverage, add-on flexibility |

| FTMO prop firm | Up to $200k | 80%-90% | Bi-weekly | Structured scaling plan; position sizing support via Risk Management Tool |

| The5ers prop firm | $5k - $250k (up to $4m scaling) | 80%-90% | Bi-weekly | Multi-level scaling framework |

| FundingPips prop firm | Up to $200k | 80%-90% | Bi-weekly | Multiple evaluation models |

| Apex Trader Funding futures prop firm | Up to $300k | 90%-100% | Weekly | Futures-focused evaluations |

| FundedNext | Up to $300k (scaling available) | 80%-90% | Bi-weekly | Diverse program types |

| Topstep | $50k - $150k | 100% first $10k then 90% | Varies | Exchange-traded futures specialist |

| MyFundedFX | Up to $600k | 80%-90% | Bi-weekly | Forex-centric programs |

| Funded Trading Plus prop firm | $5k - $200k (scaling available) | 80%-90% | 3, 5, or 7 days | Fast payout options |

What the Numbers Mean

Many firms cap initial funding around $200k, but scaling can materially change long-term opportunity. When comparing scaling promises, look for the exact eligibility conditions: required payout count, required return, and time windows (e.g., quarterly).

Why Payout Speed Matters

While bi-weekly is common, faster payouts can be helpful for cash-flow, but only if the firm’s rules don’t force “over-trading” to qualify. Pay special attention to minimum trading days and consistency rules.

The Real Deal on Profit Splits

Splits may look similar but differ in structure. For example, Topstep’s “100% of the first $10k” is defined in their payout policy documentation Topstep Payout FAQs.

How LuxAlgo Helps You Pass Prop Firm Challenges

Prop firm challenges require sharp timing, disciplined risk management, and consistent execution of high-probability setups. LuxAlgo provides indicators and analytics on TradingView that help you build a repeatable decision process—especially when you’re trading under strict max drawdown rules.

If you’re deciding which LuxAlgo plan fits your workflow (Free vs Premium vs Ultimate), the quickest summary is on the Pricing page. For free indicators specifically, the LuxAlgo Library is the starting point.

Price Action Concepts (PAC): Master Market Structure

The Price Action Concepts toolkit focuses on structure and liquidity concepts (e.g., order blocks, imbalances, and premium/discount zones). In evaluations, this can reduce decision fatigue by standardizing how you map structure, where you define invalidation, and what you consider “clean” liquidity.

To go deeper on the mechanics, LuxAlgo’s docs explain Premium & Discount zones and how the toolkit highlights market structure in real time.

If you prefer to see the script listing on TradingView, PAC is available here: LuxAlgo® - Price Action Concepts™ (TradingView).

Signals & Overlays (S&O): Reliable Confirmation

The Signals & Overlays toolkit provides confirmation and contrarian signals alongside overlays that help with trend context and trade management. If you’re exploring how to combine confirmation vs contrarian conditions, this guide is a useful reference: Mastering Contrarian and Confirmation Signals.

Docs overview (features and configuration): Signals & Overlays introduction. TradingView script listing: LuxAlgo® - Signals & Overlays™ (TradingView).

Built-in Alerts: Stay Ahead of Opportunities

Custom alerts let you define precise conditions via the Alert Creator templates in LuxAlgo’s docs, so you can trigger notifications only when your full checklist is met: Alert Creator templates.

TradingView Integration: Streamlined Workflow

Because LuxAlgo runs directly on TradingView charts, it’s easier to keep analysis and execution consistent—especially when you’re managing multiple evaluations or rotating between markets.

AI Backtesting Assistant: Refine Before You Trade

Before risking evaluation capital, validate ideas across multiple market regimes using LuxAlgo’s AI Backtesting Assistant. If you want the long-form walkthrough, start here: Introducing LuxAlgo’s AI Backtesting Assistant. For platform docs and best practices (including how strategy retrieval works), see AI Backtesting Assistant documentation.

Community Support: Insights and Motivation

An active Discord server can help with accountability and process refinement during evaluations—just make sure you’re following your own risk rules rather than copying trades.

Simplifying Success in Prop Firm Challenges

By standardizing analysis, enabling precise alerts, and supporting structured strategy validation, LuxAlgo helps you stay focused on execution and risk control—the core constraints in most prop firm challenges.

Conclusion

As we move into 2025, prop trading offers opportunities for disciplined traders—but outcomes are highly sensitive to rules, risk limits, and execution quality. Prioritize firms whose drawdown and payout rules fit your style, and build a repeatable analysis workflow that keeps you consistent under pressure [62].

References

LuxAlgo

- Traditional Proprietary Trading: An Insider’s Guide

- LuxAlgo Prop Firms Portal (Prop Firm Strategies)

- FTMO (LuxAlgo Prop Firm Page)

- The5ers (LuxAlgo Prop Firm Page)

- FundingPips (LuxAlgo Prop Firm Page)

- Apex Trader Funding (LuxAlgo Prop Firm Page)

- Funded Trading Plus (LuxAlgo Prop Firm Page)

- Prop Firms Portal Cover Image (Section Cover)

- Prop Firms Portal Cover Image (Suggested Strategies)

- AI Backtesting Assistant: Fetching Strategies

- Risk Management Tool

- Pricing & Features

- LuxAlgo Library

- Price Action Concepts

- PAC Docs: Premium & Discount Zones

- PAC Docs: Market Structure

- PAC on TradingView

- Signals & Overlays

- Mastering Contrarian and Confirmation Signals

- S&O Docs: Introduction

- Signals & Overlays on TradingView

- Alert Creator Templates (Ready-Made Scripts)

- AI Backtesting Assistant (Main Page)

- Introducing LuxAlgo’s AI Backtesting Assistant

- AI Backtesting Assistant Docs: Introduction

External Resources

- Investopedia: Proprietary Trading

- TradingView

- CME Group: Introduction to Futures

- Nasdaq: How Prop Trading Firms Work

- Goat Funded Trader (Official Site)

- DNA Funded (Official Site)

- CBS News: Best Prop Firms for US Traders in 2025

- FTMO (Official Site)

- FTMO: Reward Growth & Scaling Plan

- FTMO: Symbols & Trading Conditions

- The5ers (Official Site)

- Trustpilot: The5ers Reviews

- FundingPips (Official Site)

- Trustpilot: FundingPips Reviews

- Apex Trader Funding (Official Site)

- FundedNext (Official Site)

- Topstep (Official Site)

- Topstep Help Center: Payout FAQs

- MyFundedFX (App Store Listing)

- Funded Trading Plus (Official Site)

- Trustpilot: Funded Trading Plus Reviews

- YouTube Embed: Best 10 Prop Trading Firms of April 2025