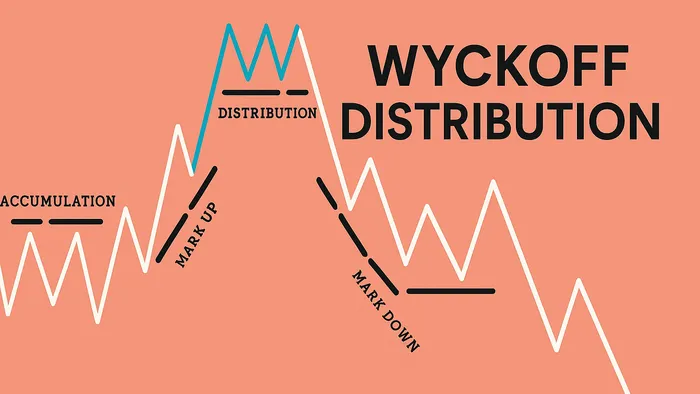

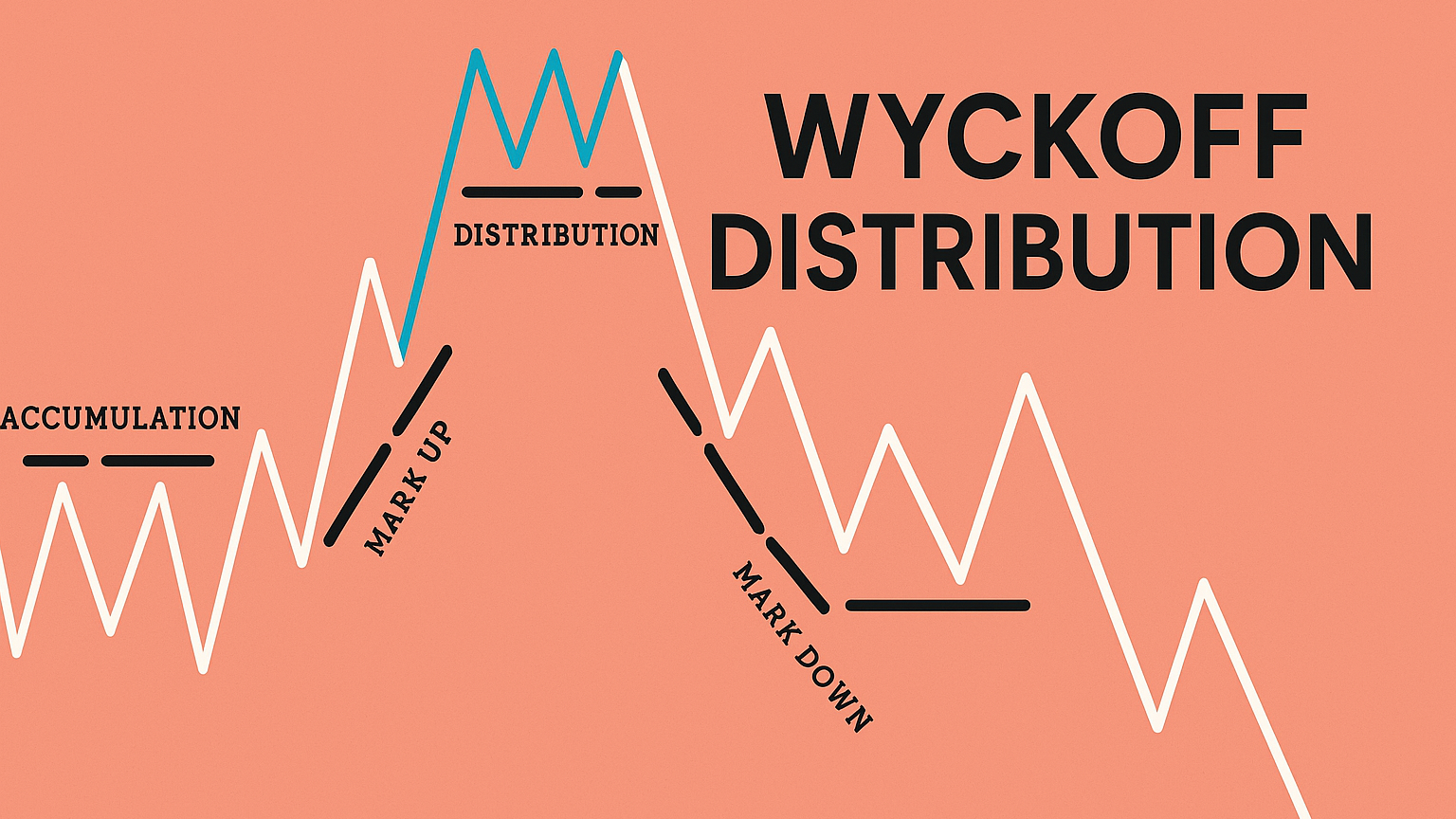

Explore the Wyckoff Distribution pattern to understand market reversals and enhance your trading strategies through key concepts and stages.

The Wyckoff Distribution pattern is a critical concept in understanding market reversals and institutional trading behavior. It highlights how large players, or "smart money", sell off their holdings before a market downturn. Here's what you need to know:

- What It Is: A market phase where institutional investors distribute (sell) their assets to retail traders, often signaling a price decline.

- Why It Matters: Helps traders identify market tops, avoid risks, and refine trade timing.

- Key Concepts:

- Supply vs. Demand: Large institutions offload holdings, increasing supply and pushing prices down.

- Effort vs. Result: High trading volume with limited price movement signals strong selling pressure.

- 5 Stages: From the end of an uptrend to a clear price decline, these stages outline the distribution process.

Quick Tip: Use volume analysis and resistance tests to validate patterns and optimize your strategies. Many traders also leverage the LuxAlgo Library of free indicators to complement Wyckoff analysis.

Understanding this pattern can protect your investments and improve decision‑making during volatile market phases. Read more trading insights on the LuxAlgo blog.

Main Concepts of Wyckoff Theory

Supply and Demand

Wyckoff's theory revolves around the balance between supply and demand. During a distribution phase, large institutions gradually sell off their holdings, increasing the market's supply. When supply surpasses demand, prices tend to drop. Traders who prefer an automated approach to price action often use the Price Action Concepts toolkit to visualize these supply‑demand shifts.

| Market Condition | Supply vs. Demand | Price Action |

|---|---|---|

| Buying Climax | Demand peaks | Sharp price increase with high trading volume |

| Preliminary Supply | Supply emerges | Early signs of price weakness |

| Secondary Test | Supply dominates | Failed rallies with lower trading volume |

Cause and Effect

This principle explains how price targets are formed during distribution phases. The "cause" builds up during horizontal price ranges, while the resulting price movement — the "effect" — is determined by the size of this accumulation or distribution.

"…all the fluctuations in the market and in all the various stocks should be studied as if they were the result of one man's operations. Let us call him the Composite Man, who, in theory, sits behind the scenes and manipulates the stocks to your disadvantage if you do not understand the game as he plays it, and to your great profit if you do understand it." – Richard D. Wyckoff

A prolonged distribution phase creates a strong "cause", leading to a significant downward price movement.

Effort vs. Result

This concept examines the link between trading volume (effort) and price movement (result), providing insights into market strength or weakness. Traders frequently rely on real‑time volume overlays from the Signals & Overlays toolkit to gauge this effort‑result dynamic.

| Effort (Volume) | Result (Price) | Distribution Signal |

|---|---|---|

| High Volume | Minor Price Rise | Indicates strong supply is present |

| Declining Volume | Price Stability | Suggests weakening demand |

| Volume Spike | Price Drop | Confirms supply is dominating the market |

When prices fail to rise despite heavy trading volume, it signals that major players are offloading their positions, setting the stage for a potential price decline. These principles form the foundation for the practical 5‑stage process discussed next.

5 Stages of Wyckoff Distribution

Stage 1: End of Uptrend

This stage signals the peak of an uptrend, defined by a Buying Climax (BC) and Preliminary Supply (PSY). For Bitcoin (weekly chart, Q1 2024), the BC occurred at $73,660, highlighting maximum demand before institutional selling began. These patterns align with Wyckoff's idea that supply starts to outweigh demand.

| Stage 1 Signal | Price Action | Volume |

|---|---|---|

| Buying Climax | Sharp price spike | High volume |

| Preliminary Supply | Initial weakness | Above‑average volume |

| Automatic Reaction | Quick decline | Moderate to high volume |

Stage 2: Price Consolidation

At this point, prices move sideways as large players gradually offload their positions. Patterns like the Secondary Test (ST) and Automatic Rally (AR) emerge. For quick multi‑asset scans, consider the PAC Screener, which highlights recent price‑action signals across up to ten tickers. For Bitcoin, the AR established resistance at $60,795. Rallies during this stage often show lower volume, signaling reduced buying interest. This consolidation prepares the market for resistance challenges in the next stage.

Stage 3: Resistance Test

This stage is marked by Last Point of Supply (LPSY) tests, where attempts to rally fail to surpass earlier highs. Bitcoin's Upthrust After Distribution (UTAD) at $71,680 acted as a bull trap, confirming strong selling pressure and reinforcing resistance levels. Volume‑based confirmation can also be monitored via indicator overlays in the Signals & Overlays settings or through the S&O Screener.

Stage 4: Distribution End

The Sign of Weakness (SOW) defines the end of the distribution phase. For Bitcoin, the SOW at $54,344 highlighted seller dominance through:

- Increased selling volume during price drops

- Rallies failing to break resistance

- Breakdown below key support levels

- A deteriorating price structure

Momentum and money‑flow deterioration can be cross‑checked with the Oscillator Matrix toolkit.

Once sellers take control in this phase, the market transitions into a prolonged decline.

Stage 5: Price Decline

This is the phase of a clear downtrend. Bitcoin's LPSY 2 at $65,105 indicated further price drops, confirming the completion of distribution. Look for signs like lower volumes on rallies and higher volumes during declines, which suggest the market is now firmly in a bearish trend. Traders often keep an eye on divergences via the OSC Screener to gauge when the trend might exhaust.

"The Wyckoff Distribution model offers a comprehensive framework for understanding how major market players distribute their holdings before a significant downturn." – ArShevelev, TradingView

The Wyckoff Method: Understanding Distribution Patterns

Trading with Wyckoff Distribution

Once the stages of the Wyckoff Distribution are identified, traders can use these principles to develop actionable strategies.

Recognizing Key Chart Patterns

Spotting the Wyckoff Distribution pattern requires careful analysis of price movements and volume trends. Here’s what to look for:

- Initial Resistance Zone: Pay attention to sharp price surges with high volume followed by quick reversals, indicating growing selling pressure.

- Trading Range Formation: Notice price consolidating between support and resistance levels, accompanied by rising volume, lower highs, and increased volatility.

- Distribution Confirmation: Watch for failed breakouts, stronger selling volume, and a breakdown below support levels that confirm the pattern.

Timing Your Trades: Entry and Exit

In this phase, traders often take short positions when resistance tests fail or after a confirmed breakdown. Place stop‑loss orders above recent swing highs or the breakdown level to manage risk. Adjust these rules as needed to align with changing market conditions. Following this structured approach, from pattern recognition to trade execution, can help safeguard your strategy against market reversals. For strategy automation, refer to the AI Backtesting Assistant docs.

Risk Management and Strategy Validation

Even a well‑identified Wyckoff Distribution can produce false signals if risk parameters are ignored. Consider the following:

- Position Sizing: Limit exposure to a fixed percentage of account equity when shorting after a UTAD.

- Confirmation Windows: Require a close below support on higher‑timeframe candles before committing fully.

- Equity Curve Review: Use the complimentary backtesters (e.g., S&O Backtester) to simulate drawdowns. The AI Backtesting platform can generate equity curves and walk‑forward metrics within seconds.

Problem Solving and Advanced Methods

Spotting False Patterns

Identifying real Wyckoff Distribution patterns amid false signals requires careful analysis and multiple confirmations. Genuine patterns often show increased volume during breakdowns.

Key indicators to watch for:

- Lower highs paired with stronger selling pressure

- Failed rallies that reinforce resistance levels

- A clear link between price and volume, where down moves are accompanied by higher volume compared to up moves

"Schematics are not meant as exact replicas to the way that the range will play out. Schematics are used to give a loose structure, it is up to you as the chartist to interpret and analyse the price action." – ColdBloodedShiller

Conclusion

Main Points

The Wyckoff Distribution pattern helps traders understand market reversals by examining volume, price movements, and market structure. This approach highlights the key phases of distribution that may indicate a potential shift in trends.

Key takeaways include:

- Focus on supply and demand imbalances that lead to distribution

- Use volume analysis to confirm breakdowns

- Recognize the role of institutional actions and "smart money"

- Combine traditional technical analysis with AI Backtesting on the LuxAlgo platform

"According to Wyckoff's rules, a price trend never repeats itself exactly and trends must be studied in context with past behavior." – Investopedia

Steps to Improve Pattern Recognition

-

Study and Practice

Review historical charts to spot distribution phases. Use LuxAlgo tools as confluence before executing trades. If you are new to LuxAlgo, follow the setup guide to connect your TradingView account. -

Enhance Analysis

Focus on volume‑price relationships and validate signals with multiple indicators. Explore articles like Top 10 Algo Trading Strategies for 2025 for additional context. -

Create a Trading Plan

Draft a plan with clear entry and exit points, along with stop‑loss levels. Regularly evaluate your strategy with backtesting. For pricing details, see the LuxAlgo plans, and review best practices in strategy development.

"The Wyckoff Method is used by investors and traders to determine market trends, select investments, and time the placement of trades. It can help them identify the times at which big players are accumulating (or distributing) positions in a security." – Investopedia

References

- LuxAlgo Library

- LuxAlgo Blog

- Price Action Concepts Toolkit Docs

- Signals & Overlays Toolkit Docs

- Indicator Overlay Docs

- PAC Screener Docs

- S&O Screener Docs

- Oscillator Matrix Toolkit Docs

- OSC Screener Docs

- AI Backtesting Assistant Docs

- AI Backtesting Platform

- Getting Started Guide

- Top 10 Algo Trading Strategies for 2025

- LuxAlgo Pricing

- Best Practices in Algo Trading Strategy Development

- Investopedia: Making Money the Wyckoff Way

- Investopedia: Wyckoff Distribution

- TradingView: Wyckoff Ideas

- Investopedia: Volume