Forward-Backward Exponential Oscillator

Mar 5, 2025

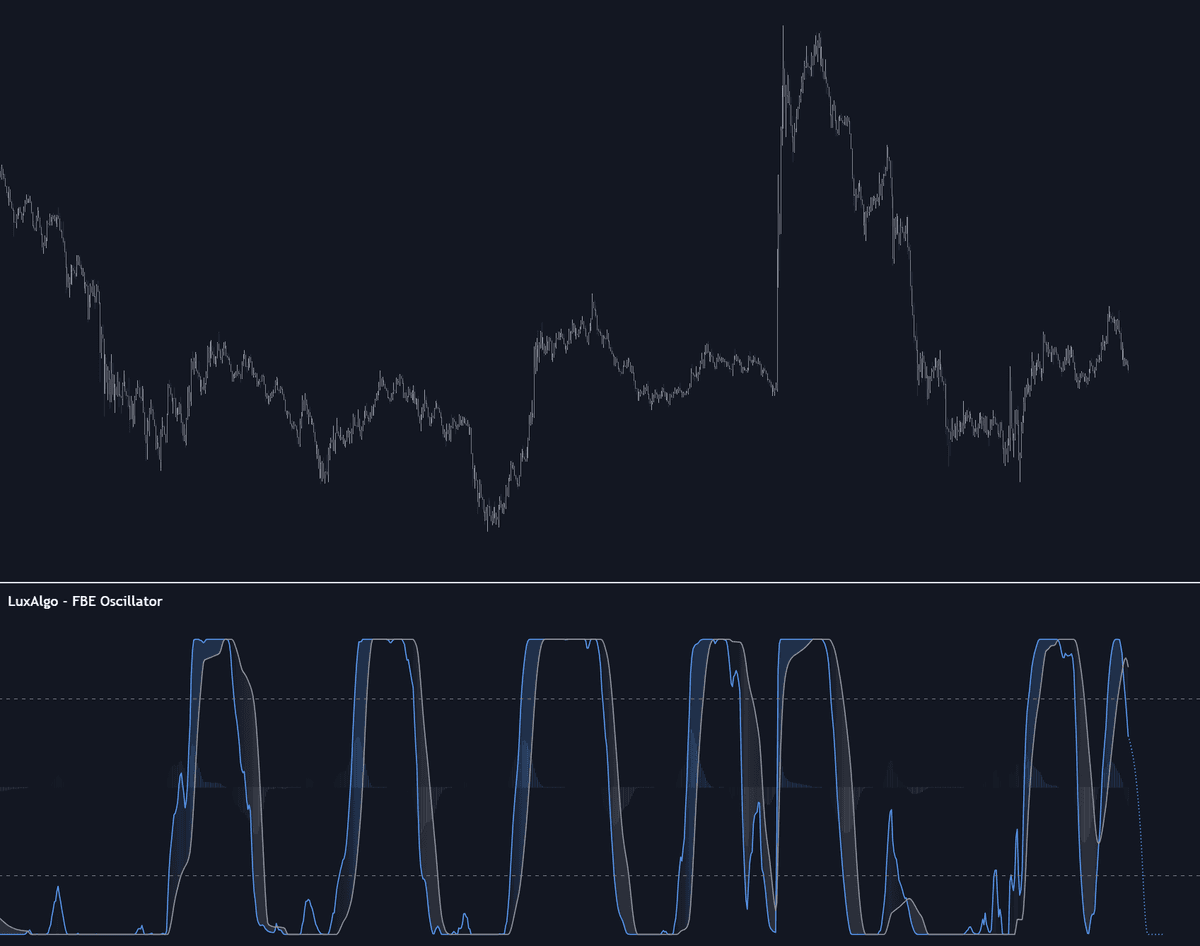

The Forward-Backward Exponential Oscillator is a powerful, normalized trading indicator designed to detect directional shifts in market momentum utilizing a unique "Forward-Backward Filtering" calculation method specifically crafted for Exponential Moving Averages (EMAs). This innovative technique delivers a smoothed, normalized price representation while significantly reducing lag and enhancing accuracy.

How to Trade the Forward-Backward Exponential Oscillator?

The oscillator comprises two series of values that are derived by normalizing the sum of each EMA's change over a user-defined lookback period (length). It includes one less reactive value calculated forward (depicted in grey) and another more reactive value recalculated backward for each bar (depicted in blue). This "Forward-Backward" method makes the oscillator more responsive than traditional double-smoothed EMA calculations.

The interplay between these two values, known as the Forward Value and Backward Value, serves as a tool to identify shifts in market momentum over time. In essence, when the Forward Value surpasses the Backward Value, it suggests an upward price movement. Conversely, if the Forward Value falls below the Backward Value, it suggests a downward price movement. The difference between these values is illustrated through a histogram centered at the 50 mark on the oscillator.

Future Projections and Market Anticipation

Anticipating market movements becomes more insightful with this oscillator as it projects estimated future values of the forward value line in front of the current plotted line. This projection visualizes the data utilized in creating the Forward Value, aiding traders in making more informed decisions.

Length & Smoothing: Customizing the Oscillator for Optimal Trading Strategy

- Smoothing Input: This adjusts the length of the EMAs under analysis.

- Length Input: Determines the lookback period for summing changes from the EMAs.

Using varying input sizes alters the oscillator's behavior and provides different insights:

- A larger length input results in more gradual, slower oscillator responses because it considers a broader lookback window.

- Higher smoothing settings produce smoother EMAs, hence a more refined, less noisy oscillator response.

Note: The projection length is contingent on the "length" input. For an extended projection, increase the length accordingly.

Understanding the Mechanism: Forward-Backward Filtering

Forward-backward filtering, when applied to linear time-invariant (LTI) filters, yields a zero-phase shift filter response. This appears to shift a typical causal filter response rightward, achieving effectively zero lag. The filtering process involves first computing forward over a data sequence, akin to conventional moving averages, and then recalculating backward, using the previous output as input, hence doubling the filter application.

This capability is notably advantageous for achieving zero-lag response in EMAs, although the method is prone to repainting. Nonetheless, this oscillator displays only the normalized sum of changes from the forward-backward EMA, ensuring no repainting in its final output.

Useful Settings for Tailored Analysis

- Length: Adjust the lookback period for the oscillator's calculations.

- Smoothing: Modify the back-end EMA calculations' smoothness.

- Source: Adjust the source input for the indicator to fit specific trading needs.

Frequently Asked Questions (FAQ)

How do I access the Forward-Backward Exponential Oscillator?

You can get access to the Forward-Backward Exponential Oscillator on the LuxAlgo Library for charting platforms like TradingView, MetaTrader (MT4/MT5), and NinjaTrader for free.

What market conditions are best suited for using this oscillator? The Forward-Backward Exponential Oscillator is most effective in identifying shifts in momentum, making it suitable for volatile or trending markets.

Can the oscillator settings be adjusted for different trading strategies? Yes, traders can customize the Length and Smoothing settings of the oscillator to better suit various trading strategies and styles.

Trading & investing are risky and many will lose money in connection with trading and investing activities. All content on this site is not intended to, and should not be, construed as financial advice. Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Past performance does not guarantee future results.

Hypothetical or Simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, including, but not limited to, lack of liquidity. Simulated trading programs in general are designed with the benefit of hindsight, and are based on historical information. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

As a provider of technical analysis tools and strategies, we do not have access to the personal trading accounts or brokerage statements of our customers. As a result, we have no reason to believe our customers perform better or worse than traders as a whole based on any content, tool, or platform feature we provide.

Charts used on this site are by TradingView in which the majority of our technical indicators are built on. TradingView® is a registered trademark of TradingView, Inc. www.TradingView.comTradingView® has no affiliation with the owner, developer, or provider of the Services described herein.

Market data is provided by CBOE, CME Group, BarChart, CoinAPI. CBOE BZX real-time US equities data is licensed from CBOE and provided through BarChart. Real-time futures data is licensed from CME Group and provided through BarChart. Select cryptocurrency data, including major coins, is provided through CoinAPI. All data is provided “as is” and should be verified independently for trading purposes.

This does not represent our full Disclaimer. Please read our full disclaimer.

© 2025 LuxAlgo Global, LLC.